Respiratory Devices Market Size, Share, Growth Analysis, Forecast Report 2024-2032

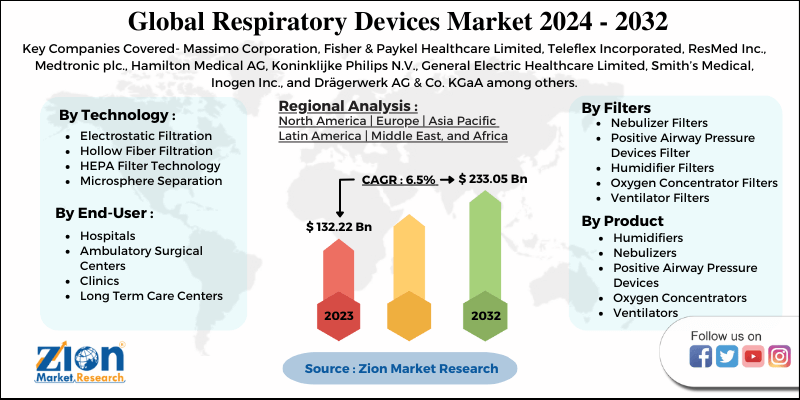

Respiratory Devices Market By Product (Humidifiers, Nebulizers, Gas Analyzers, Positive Airway Pressure Devices, Oxygen Concentrators, Ventilators, Gas Analyzers, Capnographs) By Technology (Electrostatic Filtration, Hollow Fiber Filtration, High Efficiency Particulate Air (HEPA) Filter Technology, Microsphere Separation) By Filters (Nebulizer Filters, Positive Airway Pressure Devices Filter, Humidifier Filters, Oxygen Concentrator Filters, Ventilator Filters) By End-User (Hospitals, Ambulatory Surgical Centers, Clinics, Long Term Care Centers): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

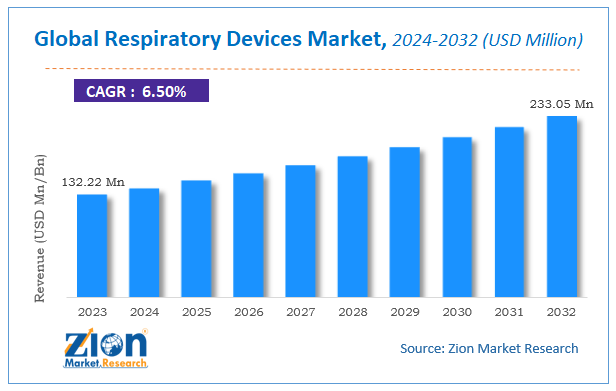

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 132.22 Million | USD 233.05 Million | 6.5% | 2023 |

Respiratory Devices Market Insights

Zion Market Research has published a report on the global Respiratory Devices Market, estimating its value at USD 132.22 Million in 2023, with projections indicating that it will reach USD 233.05 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.5% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Respiratory Devices Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Respiratory Devices Market: Overview

Respiratory devices are medical devices that help patients suffering from breathing trouble. Fibrosis, asthma, Chronic Obstructive Pulmonary Disease (COPD), and Acute Respiratory Distress Syndrome (ARDS) are all managed and treated with these devices.

In recent years, the worldwide Respiratory Devices market has been converting purchaser possibilities due to the growing occurrence of breathing illnesses along with chronic obstructive pulmonary ailment (COPD), allergies, and sleep apnea is a primary motive force. Technological advancements in respiratory gadgets, along with transportable and smart devices, contribute to improved patient results and compliance.

Additionally, the market is characterized by means of the presence of key gamers supplying a huge range of respiratory care devices. Moreover, the shift in the direction of home-based healthcare and the development of innovative devices for remote patient monitoring are emerging traits. Regulatory tasks and requirements for breathing care devices play an essential function in shaping the marketplace panorama. Regional variations in the superiority of respiratory diseases, healthcare infrastructure, and economic elements have an impact on market dynamics. North America and Europe have nicely-hooked up healthcare systems, even as Asia-Pacific shows vast growth ability because of increasing healthcare expenditure and focus.

Global Respiratory Devices Market: Growth Factors

The increasing number of respiratory diseases has prompted manufacturers of respiratory devices to experiment with new designs. Asthma and COPD patients have been searching for more precise drug delivery, which has resulted in a rise in the adoption of respiratory devices. Governments with favourable reimbursement programmes promote the production and sales of respiratory devices.

According to the WHO, COPD is a chronic health problem and one of the leading causes of death worldwide. Technologically advanced medical devices and successful medications have become essential to manage COPD and other respiratory disorders. For example, in 2016, the United Nations introduced Sustainable Development Goals (SDGs) to enhance living standards across the globe. Similarly, the Forum of International Respiratory Societies (FIRS) was established to resolve the rising burden of respiratory diseases. These activities play an important role in growing the demand for respiratory devices.

Several new medicines have been approved for the treatment of COPD and other respiratory conditions, such as asthma, over the last decade. As the number of products in pipeline increases, the market will have more scope for expansion, particularly as the demand for respiratory devices has increased since the outbreak of COVID-19. The pandemic crisis has prompted pharmaceutical companies to move quickly to approve drugs and introduce new products. The COVID-19 has resulted in respiratory device manufacturing partnerships between healthcare and non-healthcare industries. To cater to the increasing demand, manufacturers are ramping up production of respiratory devices, contributing towards the growth of market.

Multifunctional polymer composites R&D is expected to provide lucrative growth opportunities for players in the global respiratory system market. For example, in February 2020, researchers from the National Research Institute in Poland, announced the production of a multifunctional polymer composite made of polyethylene terephthalate and polypropylene for filtering respiratory protective devices.

Global Respiratory Devices Market: Segmentation

The positive airway pressure (PAP) devices module held the largest share in 2O20 and is predicted to maintain its dominance in the near future. PAP devices have greater accuracy and ease of use, which are the primary reasons for the segment's supremacy. By maintaining airway passages clear, PAP devices minimise daytime sleepiness. It can also help with other sleep apnea-related health issues including hypertension, heart disease, diabetes, and stroke.

On the basis of end-users, hospitals have retained their market leadership among end users, owing to their greater patient footprint. Hospitals are predicted to have a strong demand for respiratory devices in the forecast period. The outbreak of COVID-19 and other pandemics has been instrumental in driving the segment's development. Several COVID-19 patients, for example, have mild to severe respiratory disease, necessitating the use of respiratory devices to administer medical treatment, thereby strengthening the segment’s growth in the upcoming years.

Respiratory Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Respiratory Devices Market |

| Market Size in 2023 | USD 132.22 Million |

| Market Forecast in 2032 | USD 233.05 Million |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 110 |

| Key Companies Covered | Massimo Corporation, Fisher & Paykel Healthcare Limited, Teleflex Incorporated, ResMed Inc., Medtronic plc., Hamilton Medical AG, Koninklijke Philips N.V., General Electric Healthcare Limited, Smith’s Medical, Inogen Inc., and Drägerwerk AG & Co. KGaA among others |

| Segments Covered | By Product, By Technology, By Filters, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Respiratory Devices Market: Regional Analysis

By Geography, the respiratory devices market is segmented into North America, Europe, Latin America, Asia Pacific, and Middle East and Africa.

In 2020, North America dominated the respiratory care devices market, followed by Europe and Asia Pacific. The United States continues to be one of the world's largest markets for medical devices, making it a lucrative market for manufacturers of respiratory devices. The medical devices market in the United States is predicted to account for 40% of the global market in 2017, according to SelectUSA. It's expected to reach USD 203 billion by 2023. Retail spending for durable medical supplies in the United States reached USD 54.4 billion in 2017, according to the Centers for Medicare & Medicaid Services (CMS). It is expected to increase in the coming years, which is reflective of the extraordinary potential for expansion that it will bring to companies in the field of respiratory devices.

Favorable health policies, combined with high per capita health spending, have created a favourable climate for the adoption of respiratory devices in the United States The involvement of leading players such as Medtronic plc. and ResMed Inc. is also promoting development in the country. The strategies pursued by these businesses include product releases and expansion plans, which will help to support the overall expansion in the country.

Respiratory devices are expected to become more widely used in hospitals and healthcare facilities across the United Kingdom. The demand for respiratory devices is expected to rise due to various initiatives taken by government organizations, such as the European Academy of Allergy and Clinical Immunology, to raise awareness about COPD and other respiratory diseases like asthma. These factors are likely to boost market demand in the country.

The Asia-Pacific market is projected to expand at the fastest rate during the forecast period due to the existence of a large pool of respiratory patients, an increase in healthcare expenditure, and the rapid development of healthcare infrastructure. The growing middle-class population, rising per capita income, and an increase in the prevalence of tobacco smoking are also certain factors driving market growth in the region. Asia Pacific is now becoming a medical tourism center and is considered to be one of the fastest-growing markets for medical devices and procedures. Low infrastructure and treatment expenses and the emergence of highly educated doctors have driven medical tourists to Asia Pacific, especially in India and China.

Global Respiratory Devices Market: Competitive Players

Some of the leading players in the global market inlcude

- Massimo Corporation

- Fisher & Paykel Healthcare Limited

- Teleflex Incorporated

- ResMed Inc.

- Medtronic plc.

- Hamilton Medical AG

- Koninklijke Philips N.V.

- General Electric Healthcare Limited

- Smith’s Medical

- Inogen Inc.

- Drägerwerk AG & Co. KGaA

The report segment of global respiratory devices market are as follows:

By Product Segment Analysis

- Humidifiers

- Heated Humidifiers

- Integrated Humidifiers

- Passover Humidifiers

- Built-In Humidifiers

- Stand-Alone Humidifiers

- Nebulizers

- Compressor-Based Nebulizers

- Piston Based Handheld Nebulizer

- Ultrasonic Nebulizer

- Positive Airway Pressure Devices

- Continuous Positive Airway Pressure Devices

- Auto-Titrating Positive Airway Pressure Devices

- Bi-Level Positive Airway Pressure Devices

- Oxygen Concentrators

- Fixed Oxygen Concentrators

- Portable Oxygen Concentrators

- Ventilators

- Adult Ventilators

- Neonatal Ventilators

- Gas Analyzers

- Capnographs

By Technology Segment Analysis

- Electrostatic Filtration

- Hollow Fiber Filtration

- HEPA Filter Technology

- Microsphere Separation

By Filters Segment Analysis

- Nebulizer Filters

- Inlet Filter

- Cabinet Filter

- Replacement Filter

- Positive Airway Pressure Devices Filter

- Ultra Fine Foam Inlet Filters

- Acrylic & Polypropylene Fiber Filters

- Polyester Non-Woven Fiber Filters

- Humidifier Filters

- Wick Filters

- Mineral Absorption Pads

- Permanent Cleanable Filters

- Demineralization Cartridges

- Oxygen Concentrator Filters

- HEPA Filter

- Bacterial Filter

- Cabinet Filter

- Inlet Filter

- Pre-Inlet Filter

- Micro Disk Filter

- Hollow-Membrane Filter

- Felt Intake Filter

- Ventilator Filters

- Mechanical Filters

- Electrostatic Filters

By End-User Segment Analysis

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Long Term Care Centers

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The increasing number of respiratory diseases has prompted manufacturers of respiratory devices to experiment with new designs. Asthma and COPD patients have been searching for more precise drug delivery, which has resulted in a rise in the adoption of respiratory devices. Governments with favourable reimbursement programmes promote the production and sales of respiratory devices. According to the WHO, COPD is a chronic health problem and one of the leading causes of death worldwide. Technologically advanced medical devices and successful medications have become essential to manage COPD and other respiratory disorders. For example, in 2016, the United Nations introduced Sustainable Development Goals (SDGs) to enhance living standards across the globe. Similarly, the Forum of International Respiratory Societies (FIRS) was established to resolve the rising burden of respiratory diseases. These activities play an important role in growing the demand for respiratory devices.

Respiratory Devices Market market size valued at US$ 132.22 Million in 2023, set to reach US$ 233.05 Million by 2032 at a CAGR of about 6.5% from 2024 to 2032.

In 2020, North America dominated the respiratory care devices market, followed by Europe and Asia Pacific. The United States continues to be one of the world's largest markets for medical devices, making it a lucrative market for manufacturers of respiratory devices. The medical devices market in the United States is predicted to account for 40% of the global market in 2017, according to SelectUSA. It's expected to reach USD 203 billion by 2023. Retail spending for durable medical supplies in the United States reached USD 54.4 billion in 2017, according to the Centers for Medicare & Medicaid Services (CMS). It is expected to increase in the coming years, which is reflective of the extraordinary potential for expansion that it will bring to companies in the field of respiratory devices. Favorable health policies, combined with high per capita health spending, have created a favourable climate for the adoption of respiratory devices in the United States The involvement of leading players such as Medtronic plc. and ResMed Inc. is also promoting development in the country. The strategies pursued by these businesses include product releases and expansion plans, which will help to support the overall expansion in the country.

The major players in the global respiratory devices market include Massimo Corporation, Fisher & Paykel Healthcare Limited, Teleflex Incorporated, ResMed Inc., Medtronic plc., Hamilton Medical AG, Koninklijke Philips N.V., General Electric Healthcare Limited, Smith’s Medical, Inogen Inc., and Drägerwerk AG & Co. KGaA among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed