Reclaimed Rubber Market Size, Share, Growth and Forecast 2032

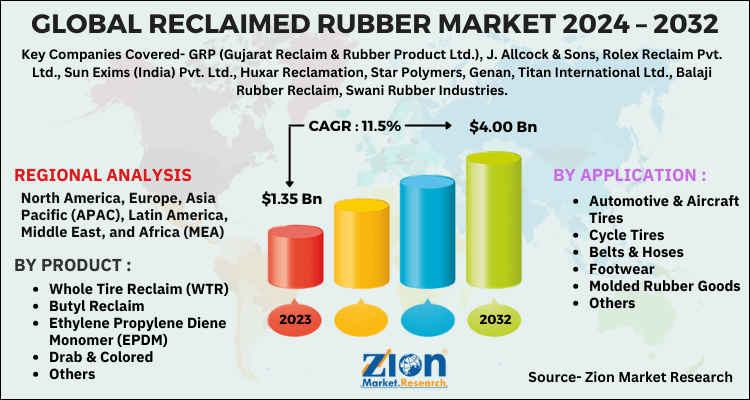

Reclaimed Rubber Market By Product (Whole Tire Reclaim (WTR), Butyl Reclaim, Ethylene Propylene Diene Monomer (EPDM), Drab & Colored, and Others) By Application (Automotive & Aircraft Tires, Cycle Tires, Belts & Hoses, Footwear, Molded Rubber Goods, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

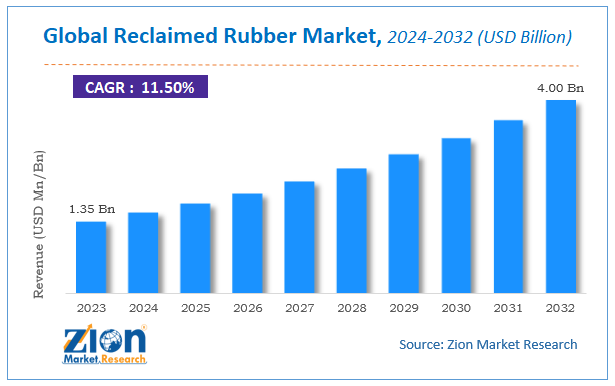

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.35 Billion | USD 4.00 Billion | 11.5% | 2023 |

Reclaimed Rubber Market Insights

According to a report from Zion Market Research, the global Reclaimed Rubber Market was valued at USD 1.35 Billion in 2023 and is projected to hit USD 4.00 Billion by 2032, with a compound annual growth rate (CAGR) of 11.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Reclaimed Rubber Market industry over the next decade.

Reclaimed Rubber Market: Overview

Reclaim rubber used as a substitute for natural & synthetic rubber. Reclaim rubber from a scrap of whole tires; tread peelings, natural rubber tubes used for different applications both for tires and on tires rubber products. Reclaiming or recycling is the widest spread method allowing fractional recycling and use of waste rubber.

The common principle of the most existing methods of reclaiming is the destruction of turgid vulcanized rubber or thermal-oxidative. Reclaim rubber finds an array of application such as automotive and aircraft tires, footwear, cycle tires, molded rubber goods, belts and hoses, retreading.

The significant decrease in the global Reclaimed Rubber market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Reclaimed Rubber Market: Growth Factors

Increasing preference for self-administered pen injectors, Reclaimed Rubber, and auto-injectors is also claimed to bolster the Reclaimed Rubber market. Furthermore, Reclaimed Rubber provide various advantages such as accurate dosing, ease of administration, and lowered risk of contamination. There are various advantages of Reclaimed Rubber in comparison to traditional delivery systems such as accurate dosing, improved safety, reduced risk of contamination, and ease of administration.

These benefits from the groundwork for the success of Reclaimed Rubber and are expected to continue boosting the Reclaimed Rubber market in the years to come. On the other hand, the attendance of optional means of drug delivery and the high price related with the manufacturing of Reclaimed Rubber might hamper the growth of the Reclaimed Rubber market in the coming years.

Reclaimed Rubber Market: Segment Analysis

On the basis of Product, Reclaimed Rubber market has been divided as Whole Tire Reclaim (WTR) and Butyl Reclaim. Whole Tire Reclaim (WTR) segment held the major share in the market. Whole Tire Reclaim was the most popular segment until recently when the introduction of new elastomer-based nitrile and silicon tires corroded its market share.

On the basis of Application, the market is segmented into Automotive & Aircraft Tires, Cycle Tires, and Belts & Hoses. Automotive & Aircraft Tires dominated the Reclaimed Rubber industry in 2020, accounting for almost 44.2% of total Reclaimed Rubber sales.

Reclaimed Rubber Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Reclaimed Rubber Market |

| Market Size in 2023 | USD 1.35 Billion |

| Market Forecast in 2032 | USD 4.00 Billion |

| Growth Rate | CAGR of 11.5% |

| Number of Pages | 174 |

| Key Companies Covered | GRP (Gujarat Reclaim & Rubber Product Ltd.), J. Allcock & Sons, Rolex Reclaim Pvt. Ltd., Sun Exims (India) Pvt. Ltd., Huxar Reclamation, Star Polymers, Genan, Titan International Ltd., Balaji Rubber Reclaim, Swani Rubber Industries |

| Segments Covered | By Type, By end-user And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Reclaimed Rubber Market: Regional Analysis

Asia-Pacific was the largest market for reclaimed rubber in 2020 and is expected to continue being a major market during the forecast period. It accounted for more than 62% share of the total revenue of reclaimed rubber market. The growth in the region is mainly attributed to the growing industrial manufacturing activities. Developed countries are expected to witness growth at below-average rates as compared to other regions across the globe. However, rebounding rubber market coupled with recovery in the automobile sector is expected to drive reclaimed rubber consumption in North America & Europe.

Key Market Players & Competitive Landscape

The major players operating Reclaimed Rubber market are

- GRP (Gujarat Reclaim & Rubber Product Ltd.)

- J. Allcock & Sons

- Rolex Reclaim Pvt. Ltd

- Sun Exims (India) Pvt. Ltd

- Huxar Reclamation

- Star Polymers

- Genan

- Titan International Ltd

- Balaji Rubber Reclaim

- Swani Rubber Industries

- Michelin

The global Reclaimed Rubber Market is segmented as follows:

By Product

- Whole Tire Reclaim (WTR)

- Butyl Reclaim

- Ethylene Propylene Diene Monomer (EPDM)

- Drab & Colored

- Others

By Application

- Automotive & Aircraft Tires

- Cycle Tires

- Belts & Hoses

- Footwear

- Molded Rubber Goods

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Reclaimed Rubber Market was valued at USD 1.35 Billion in 2023 and is projected to hit USD 4.00 Billion by 2032.

According to a report from Zion Market Research, the global Reclaimed Rubber Market a compound annual growth rate (CAGR) of 11.5% during the forecast period 2024-2032.

Some of the key factors driving the global Reclaimed Rubber Market growth are Expanding automotive & aerospace industries in emerging economies.

Asia-Pacific was the largest market for reclaimed rubber in 2016 and is expected to continue being a major market during the forecast period. It accounted for more than 62% share of the total revenue of reclaimed rubber market.

Some of the major players of global Reclaimed Rubber market includes GRP (Gujarat Reclaim & Rubber Product Ltd.), J. Allcock & Sons, Rolex Reclaim Pvt. Ltd., Sun Exims (India) Pvt. Ltd., Huxar Reclamation, Star Polymers, Genan, Titan International Ltd., Balaji Rubber Reclaim, Swani Rubber Industries, and Michelin among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed