Real Estate Crowdfunding Market Size, Share, Growth, and Forecast Report 2032

Real Estate Crowdfunding Market Size - By Investors (Individual Investors and Institutional Investors) and By Property Type (Residential and Commercial): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

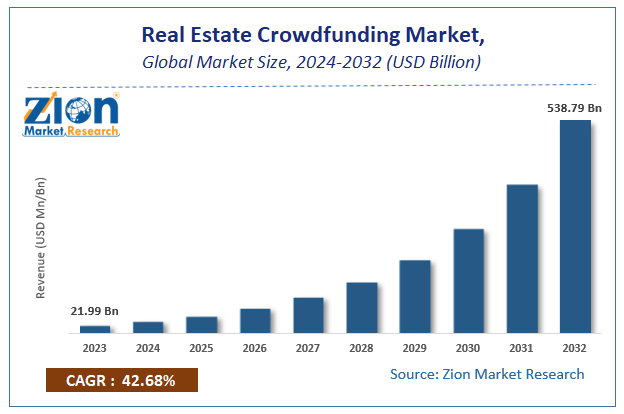

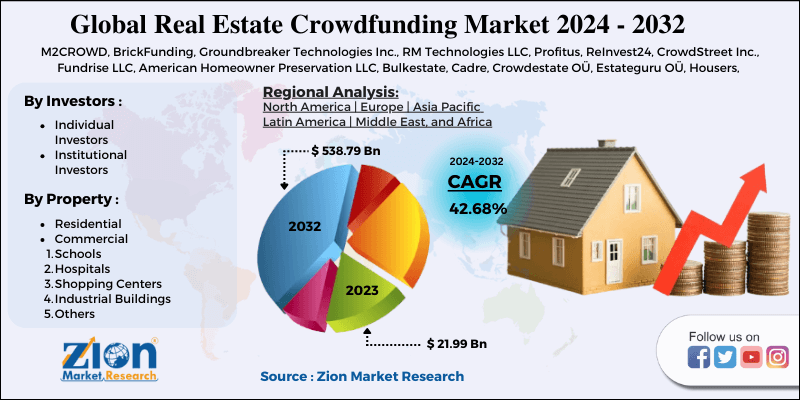

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.99 Billion | USD 538.79 Billion | 42.68% | 2023 |

Real Estate Crowdfunding Market Insights

According to a report from Zion Market Research, the global real estate crowdfunding market was valued at USD 21.99 Billion in 2023 and is projected to hit USD 538.79 Billion by 2032, with a compound annual growth rate (CAGR) of 42.68% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the real estate crowdfunding industry over the next decade.

Real Estate Crowdfunding Market Size

The report offers a valuation and analysis of the Real Estate Crowdfunding market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data for 2018 and 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

Real Estate Crowdfunding Market Overview

Crowdfunding is the practice of project funding by raising a small proportion of currency from a large section of the population through the web. Apparently, crowdfunding is a kind of crowdsourcing and it accrued nearly USD 33.1 billion in 2015. Furthermore, the real estate sector has been a key driver of the crowdfunding business. In addition to this, a large number of money is spent on the construction of real assets such as malls and apartments. Real estate crowdfunding business utilizes social networking sites such as LinkedIn, Facebook, and Twitter for attracting a plethora of investors.

Furthermore, real estate crowdfunding is the digital tool for gathering capital to finance mortgages procured by the real estate industry. For the record, real estate crowdfunding activities have gained popularity due to large-scale promotional activities carried out by RealCrowd, RealtyMogul, IndieGoGo, Kickstarter, CrowdStreet, Fundraise, and American Homeowner Preservation firms.

Market Growth Dynamics

Massive construction activities witnessed in commercial and residential sectors will propel the expansion of the real estate crowdfunding industry over the years ahead. With the emergence of the e-commerce industry and the rise in the demand for online real estate crowdfunding activities, the market for real estate crowdfunding is likely to gain traction over the ensuing years. In addition to this, real estate crowdfunding helps in choosing specific assets that help in fulfilling particular investment plans. Apart from this, online real estate crowdfunding has emerged as a cost-efficient platform for investors to fund real estate assets. Nevertheless, low liquidity is likely to have an adverse impact on the expansion of the real estate crowdfunding market over the assessment timeline.

Moreover, the humungous need for private funding and commercial real estate activities will proliferate the market demand in the years ahead. The surge in real estate crowdfunding sponsors will translate into escalating growth of the real estate crowdfunding industry over the years to come.

Market Analysis

Crowdfunding for real estate transactions is an investing strategy that is still relatively new but has seen significant growth in popularity over the past few years. It is a method of financing real estate projects that involves collecting funds from a large number of investors, typically through the use of an Internet platform. The following is a breakdown of the regional trends seen in the crowdfunding market for real estate:

The real estate crowdfunding market in North America is one of the largest in the world, with the United States of America being the most prominent player. The high level of investment in the real estate sector, the significant number of certified investors, and favorable government rules are driving the market.

Europe: Another one of the world's most important markets for real estate crowdfunding in Europe. The strong demand for property investments, an increasing number of platforms, and favorable legal frameworks are the primary factors driving this market. The most important consumer markets in the region include nations such as the United Kingdom, France, and Germany.

The real estate crowdfunding market in Asia-Pacific is expanding at a rapid rate, with nations like China, Australia, and Japan being the region's main marketplaces. The increasing number of high-net-worth individuals, expanding urbanization, and favorable policies implemented by the government are the primary factors driving the expansion of the market.

Middle East and Africa: The crowdfunding industry for real estate in the Middle East and Africa is still in its infancy but is developing at a rapid rate. The market is being driven by factors such as increased demand for property investments, an increasing number of platforms, and favorable laws from the government.

In general, it is anticipated that the worldwide market for real estate crowdfunding will continue rising, leading to the development of new platforms and the expansion of the offerings provided by existing platforms. Nonetheless, there are dangers associated with participating in the market, including the possibility of fraud, a lack of liquidity, and the unpredictability of regulatory policies. As a result of this, prospective investors in real estate crowdfunding projects should proceed with extreme caution and undertake extensive research before making any investments.

European Real Estate Crowdfunding Market To Expand Leaps & Bounds By 2032

The expansion of the market in the continent over the assessment period can be attributed to low entry barriers in the real estate industry. Additionally, the requirements for investing in the real estate industry in European countries are not as strict as in the U.S.

Real Estate Crowdfunding Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Real Estate Crowdfunding Market |

| Market Size in 2023 | USD 21.99 Billion |

| Market Forecast in 2032 | USD 538.79 Billion |

| Growth Rate | CAGR of 42.68% |

| Number of Pages | 110 |

| Key Companies Covered | M2CROWD, BrickFunding, Groundbreaker Technologies Inc., RM Technologies LLC, Profitus, ReInvest24, CrowdStreet Inc., Fundrise LLC, American Homeowner Preservation LLC, Bulkestate, Cadre, Crowdestate OÜ, Estateguru OÜ, Housers, REALCROWD INC., Square Meter SAPI de CV. |

| Segments Covered | By Investors, By Property Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Market Players & Competitive Landscape

Key participants profiled in the report include

- M2CROWD

- BrickFunding

- Groundbreaker Technologies Inc.

- RM Technologies LLC

- Profitus

- ReInvest24

- CrowdStreet Inc.

- Fundrise LLC

- American Homeowner Preservation LLC

- Bulkestate

- Cadre

- Crowdestate OÜ

- Estateguru OÜ

- Housers

- REALCROWD INC.

- Square Meter SAPI de CV.

This report segments the Real Estate Crowdfunding market as follows:

By Investors Segment Analysis

- Individual Investors

- Institutional Investors

By Property Type Segment Analysis

- Residential

- Commercial

- Schools

- Hospitals

- Shopping Centers

- Industrial Buildings

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Massive construction activities witnessed in commercial and residential sectors will propel the expansion of real estate crowdfunding industry over the years ahead. With emergence of e-commerce industry and rise in the demand for online real estate crowdfunding activities, the market for real estate crowdfunding is likely to gain traction over the ensuing years. In addition to this, real estate crowdfunding helps in choosing specific assets that help in fulfilling particular investment plans. Apart from this, online real estate crowdfunding has emerged as cost-efficient platform for the investors to fund the real estate assets. Moreover, humungous need for private funding and commercial real estate activities will proliferate the market demand in the years ahead.

Real Estate Crowdfunding Market size worth at USD 21.99 Billion in 2023 and projected to USD 538.79 Billion by 2032, with a CAGR of around 42.68% between 2024-2032.

Europe is likely to make noteworthy contributions towards overall Real Estate Crowdfunding Market earnings in the coming years. The growth of the market in the region over estimated timespan can be ascribed to low entry barriers in the real estate industry. Additionally, the requirements for investing in the real estate industry in the European countries are not as strict as in the U.S.

The key players profiled in the report include M2CROWD, BrickFunding, Groundbreaker Technologies Inc., RM Technologies LLC, Profitus, ReInvest24, CrowdStreet Inc., Fundrise LLC, American Homeowner Preservation LLC, Bulkestate, Cadre, Crowdestate OÜ, Estateguru OÜ, Housers, REALCROWD INC., and Square Meter SAPI de CV.

The practice of financing real estate projects through the pooling of funds from a large number of investors, generally through the use of an internet platform, is a relatively new method known as real estate crowdfunding. Through the use of this strategy, investors are given the opportunity to participate in real estate projects that were previously exclusively open to affluent investors and institutions.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed