Rare Gases Market Size, Share, Trends, Growth 2032

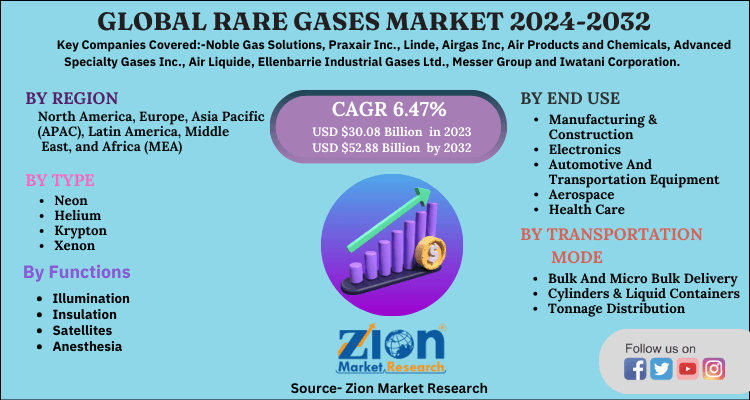

Rare Gases Market By Type (Helium, Neon, Krypton, Xenon And Others) By Functions (Illumination, Insulation, Satellites, Anesthesia And Others), By End User (Manufacturing & Construction, Electronics, Automotive And Transportation Equipment, Aerospace, Health Care), By Transportation Mode (Bulk And Micro Bulk Delivery, Cylinders & Liquid Containers, Tonnage Distribution And Others) And By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

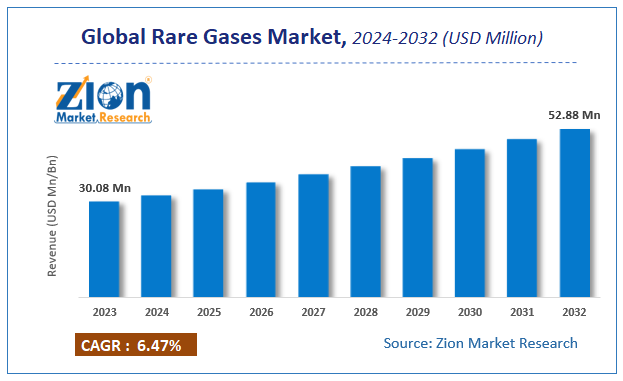

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.08 Million | USD 52.88 Million | 6.47% | 2023 |

Rare Gases Market Insights

According to Zion Market Research, the global Rare Gases Market was worth USD 30.08 Million in 2023. The market is forecast to reach USD 52.88 Million by 2032, growing at a compound annual growth rate (CAGR) of 6.47% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Rare Gases Market industry over the next decade.

Rare gases are the group of gases that include helium, neon, argon, krypton, xenon, and radon, also known as inert noble gases. The gases are stable, inflammable, colorless, non-reactive, and heavy gases, hence known as noble gases. These gases have applications in producing power engines and window insulation. These gases are used as a source of the ion beams to clean, cut, and wield materials due to their high ionization properties. Metallurgical processes, discharge tubes, electric light bulbs, and transistors all use rare gases because of their ability to make an atmosphere that is not reactive.

There is more demand for rare gases on the market because the industries that use them are growing. Demand for rare gases is rising because more people want new building codes that save energy.

Rare Gases Market: COVID-19 Impact Analysis

The rare gases market faced a significant impact due to the outbreak of COVID-19 in the initial phase of the pandemic. The nationwide lockdown across leading countries and halted operations in manufacturing, construction, and electronic industries had negatively impacted the demand for rare gases. The disruptions and supply and distribution chains have resulted in a decline in demand for the rare gases in the electronic, construction, aerospace, transport, and manufacturing industry. The emergence of Covid-19 had provided growth opportunities in the healthcare industry.

The increasing demand from the healthcare industry is driving the demand for noble gases in the Covid-19 pandemic. The increasing investments in the healthcare industry by leading economies across the globe are estimated to bolster the growth opportunities for the rare gases market. This trend of an upsurge in demand from the medical field is leading to the setup of new gas manufacturing facilities by manufacturers to meet the market demand.

Rare Gases Market: Growth Factors

The major factors driving the market growth of rare gases are the increasing demand for rare gases for lightning and laser applications and the exponential rise in demand from the electronic industry. The increasing use of noble gases in industries such as energy-efficient lighting, laser technologies, the semiconductor industry, window insulation, and electronics is driving up demand for rare gases. The non-reactive property of rare gases is increasing the application of rare gases in oxidative and reactive environments in end-user industries.

The rapidly growing urbanization and construction industry are contributing to the higher demand for rare gases. Rising fuel prices are driving up demand for rare gases. In addition to this, the rare gas market is witnessing an upsurge in demand owing to the growing demand for new energy-efficient codes. The growing applications of noble gases in the automotive and transport industries and the healthcare industry are also driving the market demand. The lower labor costs associated with the utilization of rare gases are driving the market demand.

Rare Gases Market: Type Segment Analysis Preview

The Helium segment held a share of around 35.79% in 2020. This is attributable to the high demand for helium in the healthcare industry. The properties of helium, like non-toxic, colorless, odorless, and non-corrosive, are increasing the applications of helium in the medical industry. The property of having the lowest boiling point makes it suitable for application in superconductivity in nuclear magnetic resonance, magnetic resonance imaging, and others. In the medical industry, helium gas is increasingly being used in ophthalmic surgeries, cosmetic surgery, and plasma coagulators. The use of helium in surgery enhances visualization by clearing the blood and other fluids by the gas flow. Also, the helium gas flow eliminates the minute electric fluctuations that create complications in the surgery.

Followed by helium, argon gas holds the largest market share owing to its extensive application in industries. Argon is used as a protective gas in arc welding, a carrier gas in chromatography, a filling mixture for filament lamps, a protective agent in heat treatment industries, and a thermal insulator in multi-pane windows.

Rare Gases Market: End User Industry Segment Analysis Preview

The healthcare industry segment will grow at a CAGR of over 8.7% from 2021 to 2028. This is because doctors are using more rare gases in surgeries and the healthcare industry is getting better at using technology. The rare gases are highly compliant to pharmacopeia standards and hence are increasingly used in the pharmaceutical industry. Helium gas is most in demand in the healthcare industry because it is used to treat asthma flare-ups, post-extubation strider, upper airway obstruction after ophthalmic and cosmetic surgery, and as a plasma coagulator, among other things.

The pharmaceutical and medical industries are focused on patient safety and, hence, they are replacing nitrous oxide with xenon as an anesthetic to reduce the side effect of nausea. The rising applications of noble gases in analytical processes are estimated to drive the growth of the healthcare segment in the forecast period. The electronic industry is the second-largest market shareholder, followed by the healthcare industry, owing to the increasing use of laser gas mixtures in semiconductor devices.

Rare Gases Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rare Gases Market |

| Market Size in 2023 | USD 30.08 Million |

| Market Forecast in 2032 | USD 52.88 Million |

| Growth Rate | CAGR of 6.47% |

| Number of Pages | 188 |

| Key Companies Covered | Noble Gas Solutions, Praxair Inc., Linde, Airgas Inc, Air Products and Chemicals, Advanced Specialty Gases Inc., Air Liquide, Ellenbarrie Industrial Gases Ltd., Messer Group and Iwatani Corporation |

| Segments Covered | By Type, By end-user, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

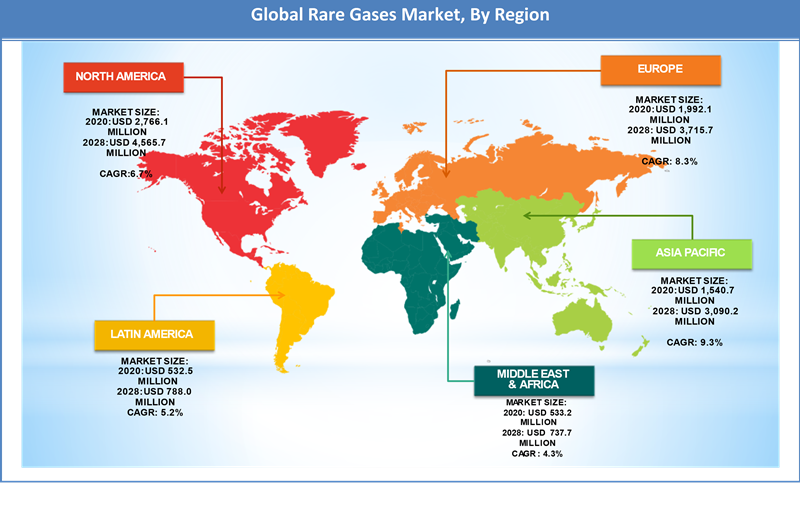

Rare Gases Market: Regional Analysis Preview

The Asia-Pacific region held a share of 20.92% in 2020. This is attributable to the surge in manufacturing activities and industrial Construction in the countries in the region, like China and India. The growth of the construction industry is majorly contributing to the demand for noble gases in the region. The rising investments in the healthcare industry in developing countries like India and China are creating higher demand for noble gases. The wide population base and increasing applications of noble gases in the healthcare industry are driving the market demand for rare gases in this region. China, among other countries, is a leading revenue generator for noble gases owing to well-established rare gas manufacturing set up by major market players. The growing industrialization leading to the growth of industries like electronics, healthcare, automotive, aerospace, and construction is estimated to drive the market demand for rare gases in the forecast period.

The North American region is projected to grow at a CAGR of 6.7% over the forecast period. This surge is due to the rising fuel prices in countries like the U.S. and Canada in the region. The rise in rare gas consumption in technologies like laser and aerospace technology is contributing to the demand for rare gases in the North American region. Growing industrialization is leading to the rapid development of end-user industries and the emergence of new industries associated with electronics and manufacturing. The extensive applications of rare gases in industries like electronics, aerospace, automotive, and construction are creating demand for rare gases in this region. Helium and neon gases are in higher demand in the region due to their applications in the military and aerospace.

Key Market Players & Competitive Landscape

Some of key players in rare gases market are

- Noble Gas Solutions

- Praxair Inc

- Linde

- Airgas Inc

- Air Products and Chemicals

- Advanced Specialty Gases Inc

- Air Liquide

- Ellenbarrie Industrial Gases Ltd

- Messer Group

- Iwatani Corporation

The leading market players are investing in technological advancements for the development of cost-effective gas extraction methodologies. The vendors are focusing on strategies for efficient supply and distribution of rare gases. Rare gas manufacturers are focusing on global business expansion. Manufacturers are establishing manufacturing and storefront facilities across several economies to increase their customer base and strengthen their position in the global and regional markets.

For instance, in May 2021, Noble Gas Solutions established its third shopfront at South Glens Falls. This will aid the extension of the company into the North Country region of New York state. It will assist companies to provide top-notch service in the region.

The global rare gases market is segmented as follows:

By Type

- Neon

- Helium

- Krypton

- Xenon

- Others

By Functions

- Illumination

- Insulation

- Satellites

- Anesthesia

- Others

By End Use

- Manufacturing & Construction

- Electronics

- Automotive And Transportation Equipment

- Aerospace

- Health Care

By Transportation Mode

- Bulk And Micro Bulk Delivery

- Cylinders & Liquid Containers

- Tonnage Distribution

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to Zion Market Research, the global Rare Gases Market was worth USD 30.08 Million in 2023. The market is forecast to reach USD 52.88 Million by 2032.

According to Zion Market Research, the global Rare Gases Market a compound annual growth rate (CAGR) of 6.47% during the forecast period 2024-2032.

Some of the key factors driving the global rare gases market growth are increasing demand for lightning and laser applications of rare gases and exponential rise demand from electronic industry and the growing applications of noble gases in automotive and transport industry and healthcare industry is also driving the market demand.

Asia-Pacific region held a substantial share of the rare gases market in 2020. This is attributable to the surge in manufacturing activities and industrial. Construction in the countries in the region like China and India.

Some of the major companies operating in the rare gases market are Noble Gas Solutions, Praxair Inc., Linde, Airgas Inc, Air Products and Chemicals, Advanced Specialty Gases Inc., Air Liquide, Ellenbarrie Industrial Gases Ltd., Messer Group and Iwatani Corporation

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed