Ragweed Pollen Allergy Treatment Market Size, Share, Growth & Forecast 2034

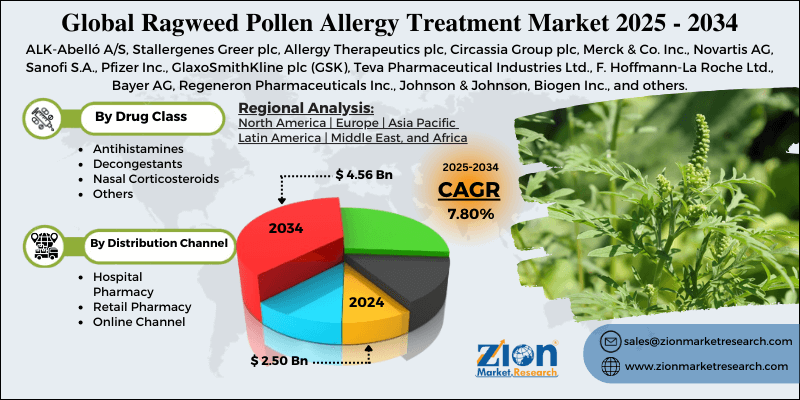

Ragweed Pollen Allergy Treatment Market By Drug Class (Antihistamines, Decongestants, Nasal Corticosteroids, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Channel), and By Region - Global, and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

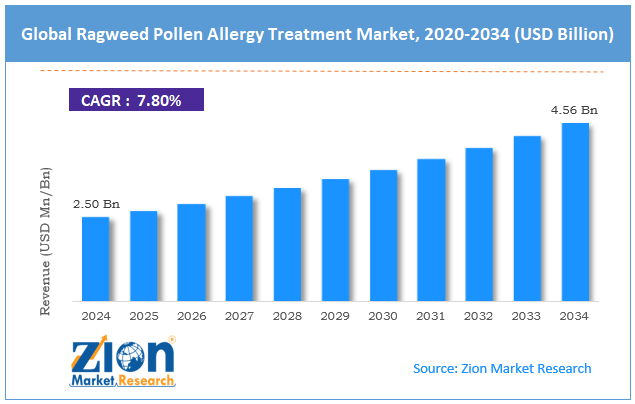

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.50 Billion | USD 4.56 Billion | 7.80% | 2024 |

Ragweed Pollen Allergy Treatment Industry Perspective:

The global ragweed pollen allergy treatment market size was approximately USD 2.50 billion in 2024 and is projected to reach around USD 4.56 billion by 2034, with a compound annual growth rate (CAGR) of approximately 7.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global ragweed pollen allergy treatment market is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2025-2034)

- In terms of revenue, the global ragweed pollen allergy treatment market size was valued at around USD 2.50 billion in 2024 and is projected to reach USD 4.56 billion by 2034.

- The ragweed pollen allergy treatment market is projected to grow significantly due to rising awareness about allergic rhinitis and asthma, the growth of pharmaceutical R&D in allergy therapeutics, and increasing global healthcare expenditure.

- Based on drug class, the antihistamines segment is expected to lead the market, while the nasal corticosteroids segment is expected to grow considerably.

- Based on the distribution channel, the retail pharmacy segment is expected to lead the market compared to the online channel segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Ragweed Pollen Allergy Treatment Market: Overview

Ragweed pollen allergy treatment emphasizes managing symptoms caused by exposure to ragweed pollen, a key seasonal allergen that triggers allergic rhinitis and hay fever. Treatment options comprise decongestants, OTC and prescription antihistamines, and corticosteroid nasal spray to lessen sneezing, congestion, and a runny nose. The global ragweed pollen allergy treatment market is projected to witness substantial growth, driven by the increasing incidence of allergic rhinitis, extended allergy seasons, climate change, and advancements in immunotherapy. Ragweed pollen is one of the most common allergens affecting millions worldwide. In the United States alone, ragweed season affects nearly 23 million individuals annually. Rising cases of allergic rhinitis and hay fever are propelling the demand for effective treatment solutions.

Moreover, warmer temperatures and increasing CO2 levels are extending pollen seasons and increasing pollen concentrations. According to studies, the ragweed pollen season has lengthened by nearly 27 days in North America over the past three decades, primarily driving the need for effective treatments. Furthermore, progressing sublingual immunotherapy (SLIT) tablets and enhanced allergy shots are gaining prominence because of long-term efficacy and patient compliance. This is fueling the growth in prescription-based treatment domains.

Although drivers exist, the global market is challenged by factors such as the high cost of advanced treatments, side effects of medicines, and competition from generic drugs. Immunotherapies and biologics are more expensive than OTC medicines, restricting their adoption in the middle and low-income economies. Likewise, antihistamines may cause drowsiness, while corticosteroid sprays have long-term adverse effects. These issues restrict compliance and industry penetration. Additionally, the availability of low-cost generic antihistamines decreases revenue opportunities for branded drug manufacturers.

Even so, the global ragweed pollen allergy treatment industry is well-positioned due to the integration of digital health and telemedicine, precision and personalized medicine, and the surging adoption of sublingual immunotherapy. Digital allergy management platforms and virtual consultations are enhancing diagnosis and treatment access, mainly in remote regions. Similarly, biomarker-based therapies and generic profiling offer key opportunities for patient-specific and targeted allergy treatments. SLIT tablets offer convenience over allergy shots, increasing popularity among patients. This segment is projected to expand speedily.

Ragweed Pollen Allergy Treatment Market: Growth Drivers

How is the demand for immunotherapy treatments boosting the ragweed pollen allergy treatment market?

Immunotherapy has progressed as a transformative force in the treatment of ragweed allergies. Sublingual immunotherapy (SLIT) and subcutaneous immunotherapy (SCIT) are primarily prescribed due to their long-term effectiveness in reducing sensitivity to allergens. The U.S. FDA accepted Ragwitek (Merck & Co.) for ragweed pollen-induced allergic rhinitis, and the latest clinical trials have presented a 70% reduction in symptom scores among patients using SLIT tablets.

Moreover, European economies are driving the adoption of immunotherapy through favorable reimbursement policies, which in turn is promoting treatment adoption and fueling the global market.

Growth of pharmaceutical R&D in allergy treatments fuels the market growth

Pharmaceutical companies are ramping up research and development for allergy therapeutics, fueling advancements in the global ragweed pollen allergy treatment market. Merck, Stallergenes Greer, and ALK-Abelló are highly investing in next-generation biologics aimed at long-term allergy relief. Recent clinical trials are discovering monoclonal antibodies that target IgE pathways, with promising results showing a reduction in allergy flare-ups. News from 2024 highlighted that ALK-Abelló secured regulatory clearance to expand its allergy tablet portfolio in Asia, indicating a rise in the developing economies and intensifying competition among major drugmakers.

Ragweed Pollen Allergy Treatment Market: Restraints

How are safety concerns and side effects of allergy treatments hindering the progress of the ragweed pollen allergy treatment market?

One key restraint is the occurrence of adverse effects related to biologic treatments and immunotherapy. While effective, therapies like subcutaneous immunotherapy and Ragwitek may cause ill effects, including swelling, throat irritation, and anaphylaxis (in rare cases). The U.S. FDA issued a 2023 safety update reminding doctors to use epinephrine auto-injectors along with immunotherapy to alleviate risks. According to the Journal of Allergy and Clinical Immunology, approximately 8% of patients discontinue immunotherapy because of adverse effects. These safety concerns deter patients from initiating or continuing treatment, thereby slowing overall adoption rates worldwide.

Ragweed Pollen Allergy Treatment Market: Opportunities

How does the development of personalized allergy treatments offer favorable conditions for the development of the ragweed pollen allergy treatment market?

The move towards personalized medicine is unveiling opportunities for tailored allergy therapies. Biomarker-based approaches and genetic testing methods allow physicians to tailor immunotherapy regimens, enhancing efficiency. According to a 2023 NIH-funded study, personalized immunotherapy decreased relapse rates by 40% to standard treatment. Companies are now investing in precision allergy diagnostics, comprising microarray-based assays that identify specific allergen sensitivities. This trend complies with the worldwide healthcare industry’s inclination towards individualized solutions, offering prospects for premium-priced therapies and high patient satisfaction, boosting the growth of the ragweed pollen allergy treatment industry.

Ragweed Pollen Allergy Treatment Market: Challenges

Patient non-adherence to long-term treatments restricts the market growth

Non-adherence is still a key challenge in immunotherapy treatments, which need long-term commitment. According to the Journal of Allergy and Clinical Immunology in 2022, nearly 50% of patients discontinue sublingual immunotherapy within the first year of treatment. The key reasons include side effects, inconvenience, and symptom relief, which can lead to premature discontinuation. This highlights treatment efficiency and decreases lifetime revenue potential for producers. Sustaining patient engagement is, therefore, a key barrier to achieving consistent industry development.

Ragweed Pollen Allergy Treatment Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ragweed Pollen Allergy Treatment Market |

| Market Size in 2024 | USD 2.50 Billion |

| Market Forecast in 2034 | USD 4.56 Billion |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 214 |

| Key Companies Covered | ALK-Abelló A/S, Stallergenes Greer plc, Allergy Therapeutics plc, Circassia Group plc, Merck & Co. Inc., Novartis AG, Sanofi S.A., Pfizer Inc., GlaxoSmithKline plc (GSK), Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd., Bayer AG, Regeneron Pharmaceuticals Inc., Johnson & Johnson, Biogen Inc., and others. |

| Segments Covered | By Drug Class, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ragweed Pollen Allergy Treatment Market: Segmentation

The global ragweed pollen allergy treatment market is segmented based on drug class, distribution channel, and region.

Based on drug class, the global ragweed pollen allergy treatment industry is segmented into antihistamines, decongestants, nasal corticosteroids, and others. The antihistamine segment has captured a significant market share, as it is the first-line option for managing symptoms such as itching, runny nose, sneezing, and watery eyes. Their availability in prescription and OTC formats increases their accessibility. Non-drowsy and fast-acting formulations also fuel consumer preference, reinforcing their dominant position worldwide.

On the other hand, nasal corticosteroids are the second-leading segment due to their effectiveness in controlling congestion and nasal infections. Unlike antihistamines, they offer long-term relief during longer pollen seasons, making them suitable for continuous use. Rising physician recommendations and enhanced compliance with once-daily sprays have driven the global adoption of these products.

Based on distribution channel, the global ragweed pollen allergy treatment market is segmented into hospital pharmacies, retail pharmacies, and online channels. The retail pharmacy segment held a dominating share in the market since it is the primary point of access for both OTC and prescription pollen allergy treatments. Consumers prefer retail outlets for their convenience, professional pharmacist guidance, and immediate availability. The robust presence of retail pharmacy chains in suburban and urban regions also fuels the segmental dominance. Seasonal demand during ragweed pollen outbreaks also leads to elevated sales volumes, even though these outlets, compared to other channels.

Conversely, the online channel segment holds a second-leading rank due to the growth of e-commerce and telehealth services. Patients majorly prefer online platforms for doorstep delivery, convenience, and competitive prices. Rising digital adoption and the trend towards contactless healthcare are also augmenting the segmental prominence.

Ragweed Pollen Allergy Treatment Market: Regional Analysis

What gives North America a competitive edge in the global Ragweed Pollen Allergy Treatment Market?

North America is likely to maintain its leadership in the ragweed pollen allergy treatment market due to the high prevalence of ragweed allergies, an extended ragweed pollen season, and high healthcare expenditure and access. North America, particularly Canada and the United States, reports the highest number of cases of ragweed pollen allergies worldwide. According to the American College of Allergy, Asthma & Immunology, nearly 23 million Americans report ragweed-associated hay fever every year. This large patient pool directly affects surge demand for treatment options in the region.

Additionally, climate change has significantly extended the ragweed pollen season in North America compared to other areas. According to studies, pollen seasons in Canada and parts of the U.S. Midwest have extended by nearly 27 days over the past three decades. More extended exposure periods result in higher reliance on prescription and OTC allergy treatments.

Furthermore, the United States leads the world in healthcare spending, surpassing USD 3,000 billion in 2023. This promises greater access to advanced therapies like prescription nasal corticosteroids, immunotherapy, and biologics. Insurance coverage also supports the broader adoption of high-cost treatments in developing nations.

Europe continues to secure the second-highest share in the ragweed pollen allergy treatment industry owing to the rising prevalence of ragweed pollen allergies, expanding ragweed distribution, and strong healthcare spending and infrastructure. Ragweed pollen allergies are increasing in Europe, particularly in the Eastern and Central regions, including France, Italy, and Hungary.

According to the studies, nearly 33 million Europeans suffer from ragweed-induced allergic rhinitis yearly. This growing patient pool contributed to the steady demand for pharmaceutical treatments and immunotherapies. Due to climate change and cross-border pollen transport, ragweed has expanded from localized hotspots to broader regions across Europe.

According to reports, ragweed pollen exposure has increased by 70% in certain parts of Europe over the past two decades. This growth propels increased adoption of therapeutic and preventive solutions. Additionally, Europe benefits from robust healthcare systems, with economies such as France, Germany, and the United Kingdom heavily investing in allergy treatment and diagnosis. The region's healthcare expenditure reached more than EUR 1.5 trillion in 2023, promising access to advanced therapies and prescription drugs. Reimbursement policies also support the adoption of treatment in high-cost regions.

Ragweed Pollen Allergy Treatment Market: Competitive Analysis

The leading players in the global ragweed pollen allergy treatment market are:

- ALK-Abelló A/S

- Stallergenes Greer plc

- Allergy Therapeutics plc

- Circassia Group plc

- Merck & Co. Inc.

- Novartis AG

- Sanofi S.A.

- Pfizer Inc.

- GlaxoSmithKline plc (GSK)

- Teva Pharmaceutical Industries Ltd.

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Regeneron Pharmaceuticals Inc.

- Johnson & Johnson

- Biogen Inc.

Ragweed Pollen Allergy Treatment Market: Key Market Trends

Rising demand for immunotherapy:

Sublingual immunotherapy and allergy shots are gaining prominence as patients seek long-term solutions beyond symptom relief. Unlike antihistamines, these treatments address the root cause of allergies by desensitizing the immune system. This move is driving higher adoption, particularly in developed regions such as Europe and North America.

Innovation in precision therapies and biologics:

Pharmaceutical companies are heavily investing in monoclonal antibodies, aiming to target IgE and other immune-related trials. These therapies are specially designed for severe allergy sufferers who respond poorly to conventional drugs. Precision medicine methods are transforming the next wave of advancement in allergy management.

The global ragweed pollen allergy treatment market is segmented as follows:

By Drug Class

- Antihistamines

- Decongestants

- Nasal Corticosteroids

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Channel

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ragweed pollen allergy treatment emphasizes managing symptoms caused by exposure to ragweed pollen, a key seasonal allergen that triggers allergic rhinitis and hay fever. Treatment options comprise decongestants, OTC and prescription antihistamines, and corticosteroid nasal spray to lessen sneezing, congestion, and a runny nose.

The global ragweed pollen allergy treatment market is projected to grow due to the surging prevalence of ragweed pollen allergies worldwide, growing urbanization and environmental pollution levels, and supportive government healthcare initiatives.

According to study, the global ragweed pollen allergy treatment market size was worth around USD 2.50 billion in 2024 and is predicted to grow to around USD 4.56 billion by 2034.

The CAGR value of the ragweed pollen allergy treatment market is expected to be approximately 7.80% from 2025 to 2034.

Antihistamines are expected to dominate the ragweed pollen allergy treatment market by 2034 due to their widespread accessibility and use.

Increasing environmental factors, like extended pollen seasons due to climate change and stringent drug approval regulations, are affecting the growth of the ragweed pollen allergy treatment market.

Rising healthcare spending, economic growth in emerging markets, and increasing disposable incomes are expected to positively impact the ragweed pollen allergy treatment market in the years to come.

North America is expected to lead the global ragweed pollen allergy treatment market during the forecast period.

The key players profiled in the global ragweed pollen allergy treatment market include ALK-Abelló A/S, Stallergenes Greer plc, Allergy Therapeutics plc, Circassia Group plc, Merck & Co., Inc., Novartis AG, Sanofi S.A., Pfizer Inc., GlaxoSmithKline plc (GSK), Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd., Bayer AG, Regeneron Pharmaceuticals, Inc., Johnson & Johnson, and Biogen Inc.

The report examines key aspects of the ragweed pollen allergy treatment market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed