Pyrogen Testing Market Size, Share, Trends and Analysis 2032

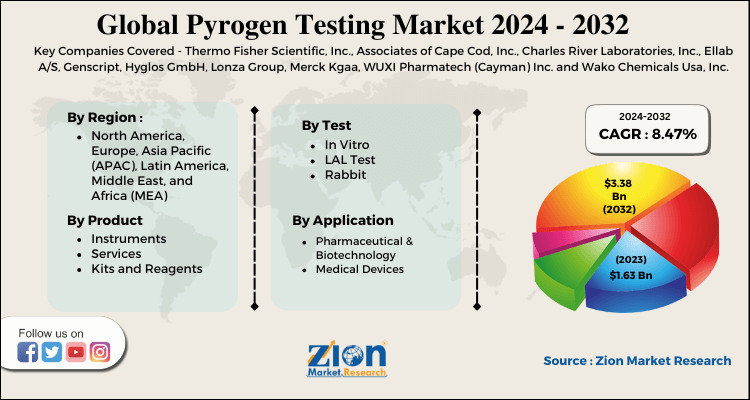

Pyrogen Testing Market By Product (Instruments, Services, and Kits and Reagents), By Test (In Vitro, LAL Test, and Rabbit), By Application (Pharmaceutical & Biotechnology, Medical Devices, and Other): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

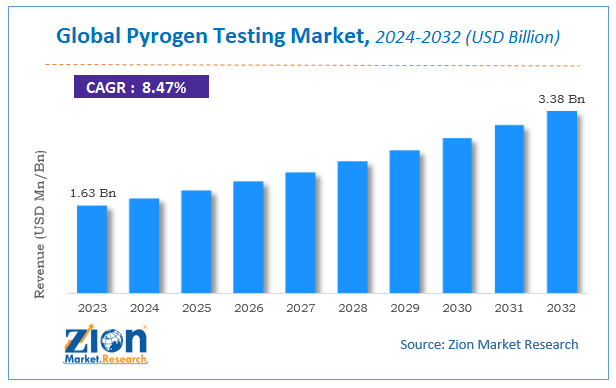

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.63 Billion | USD 3.38 Billion | 8.47% | 2023 |

Pyrogen Testing Market Insights

According to Zion Market Research, the global Pyrogen Testing Market was worth USD 1.63 Billion in 2023. The market is forecast to reach USD 3.38 Billion by 2032, growing at a compound annual growth rate (CAGR) of 8.47% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Pyrogen Testing Market industry over the next decade.

Global Pyrogen Testing Market: Industry Perspective

Pyrogen testing is a critical step in ensuring the safety of parenteral pharmaceutical products and medical devices. It is part of the mandatory release tests to avoid life-threatening fever reactions induced by pyrogenic substances.

The players are focusing aggressively on innovation, as well as on including advanced technologies in their existing products. Over the coming years, they are also expected to take up partnerships and mergers and acquisitions as their key strategy for business development. Citing an instance, in May 2018, MilliporeSigma and Solvias decided to enter into collaboration for providing PyroMat System, an innovative monocyte activation test kit developed by both firms for Pyrogen detection, to customers.

Pyrogen Testing Market: Growth Factors

The introduction of new drugs and the rise in the R&D activities witnessed across pharmaceutical and biotech sectors are anticipated to spur the Pyrogen testing market size over the coming years. Apart from this, massive funding for research & development activities pertaining to drug development along with favorable government policies stimulating the growth of Pharma & biotech industries will further boost the industry trends in the years ahead.

Lack of healthcare amenities and low availability of advanced Pyrogen testing devices, however, is anticipated to obstruct the Pyrogen testing market growth over the forthcoming years. Nevertheless, the increase in the number of outsourcing activities observed across the pharmaceutical sector is projected to generate a profitable roadmap for the Pyrogen testing industry over the ensuing years, normalizing the impact of hindrances on the Pyrogen testing market.

Pyrogen Testing Market: Segment Analysis

On the basis of Product, the global gas market is segmented into Instruments, Services, and Kits and Reagents. The kits and Reagents market segment held the largest market share due to huge demand across the globe.

On the basis of Tests, the Pyrogen Testing market is segmented into In Vitro, LAL tests, and rabbits. The LAL Test segment is estimated to account for the largest Pyrogen Testing market share among all the Tests. This is attributed to the rapid growth in the pharmaceutical and biotechnology industries, increasing demand for medical devices, increasing health standards, rising need for innovative laboratory testing procedures, and the growing drug pipelines.

On the basis of Application, the Pyrogen Testing market is segmented into Pharmaceutical & Biotechnology, Medical Devices, and Others. The pharmaceutical & Biotechnology segment held the largest market share due to huge demand across the globe for the growth of the Pyrogen Testing market.

Pyrogen Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pyrogen Testing Market |

| Market Size in 2023 | USD 1.63 Billion |

| Market Forecast in 2032 | USD 3.38 Billion |

| Growth Rate | CAGR of 8.47% |

| Number of Pages | 180 |

| Key Companies Covered | Thermo Fisher Scientific, Inc., Associates of Cape Cod, Inc., Charles River Laboratories, Inc., Ellab A/S, Genscript, Hyglos GmbH, Lonza Group, Merck Kgaa, WUXI Pharmatech (Cayman) Inc. and Wako Chemicals Usa, Inc. |

| Segments Covered | By Product, By Test, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pyrogen Testing Market: Regional Analysis

North America has been leading the worldwide Pyrogen testing market and is anticipated to continue in the dominant position in the years to come, states the Pyrogen testing market study. The presence of a well-established medical and healthcare infrastructure and skilled healthcare professionals has played a vital role in the dominance of the North America Pyrogen testing market. The high number of market players headquartered in North America is another significant factor that is supporting this regional Pyrogen testing market.

Pyrogen Testing Market: Key Players & Competitive Landscape

The major players operating in the Pyrogen Testing market are

- Thermo Fisher Scientific, Inc

- Associates of Cape Cod, Inc

- Charles River Laboratories, Inc

- Ellab A/S

- Genscript

- Hyglos GmbH

- Lonza Group

- Merck Kgaa

- WUXI Pharmatech (Cayman) Inc

- Wako Chemicals Usa, Inc

The global Pyrogen Testing market is segmented as follows:

By Product

- Instruments

- Services

- Kits and Reagents

By Test

- In Vitro

- LAL Test

- Rabbit

By Application

- Pharmaceutical & Biotechnology

- Medical Devices

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to Zion Market Research, the global Pyrogen Testing Market was worth USD 1.63 Billion in 2023. The market is forecast to reach USD 3.38 Billion by 2032.

According to Zion Market Research, the global Pyrogen Testing Market a compound annual growth rate (CAGR) of 8.47% during the forecast period 2024-2032.

Major driving factors for the growth of Pyrogen Testing market are Introduction of new drugs and rise in the R&D activities witnessed across pharmaceutical and biotech sectors.

North America has been leading the worldwide Pyrogen testing market and is anticipated to continue on the dominant position in the years to come, states the Pyrogen testing market study. The presence of a well-established medical and healthcare infrastructure and skilled healthcare professionals has played a vital role behind the dominance of the North America Pyrogen testing market.

The major players operating in the Pyrogen Testing market are Thermo Fisher Scientific, Inc., Associates of Cape Cod, Inc., Charles River Laboratories, Inc., Ellab A/S, Genscript, Hyglos GmbH, Lonza Group, Merck Kgaa, WUXI Pharmatech (Cayman) Inc. and Wako Chemicals Usa, Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed