Global Protective Packaging Market Size, Share, Growth Analysis Report - Forecast 2034

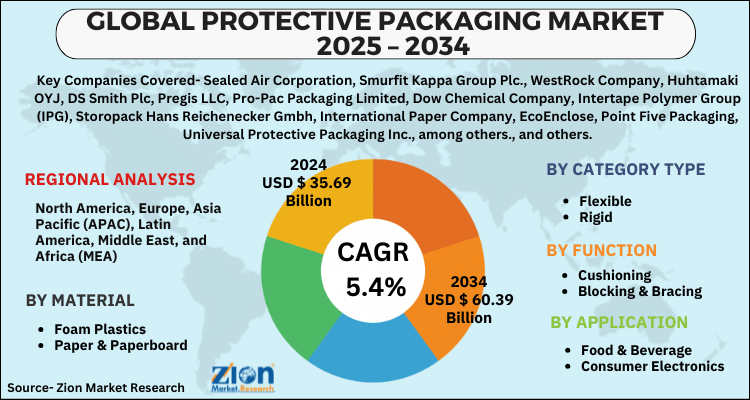

Protective Packaging Market By Material (Foam Plastics, Paper & Paperboard, and Others), By Category Type (Flexible, Rigid, and Foam), Function (Cushioning, Blocking & Bracing, Void Fill, and Others), Application (Food & Beverage, Consumer Electronics, Household Appliances, Automotive, Industrial Goods, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

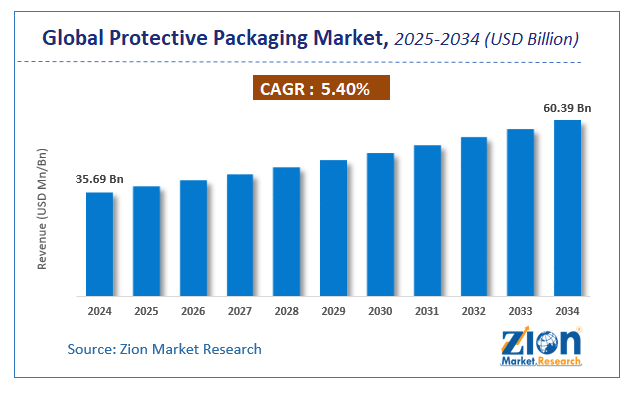

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35.69 Billion | USD 60.39 Billion | 5.4% | 2024 |

Protective Packaging Market: Industry Perspective

The global protective packaging market size was worth around USD 35.69 Billion in 2024 and is predicted to grow to around USD 60.39 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034. The report analyzes the global protective packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the protective packaging industry.

Protective Packaging Market: Overview

Protective packaging is materials designed to shield and safeguard a product from damage or destruction during shipment or storage. Protective packaging can be manufactured out of any material, including but not restricted to plastic, cardboard, metal, and other materials. Protective packaging is often used as the primary element of a product's packaging or as a supplementary type of package supply. It serves a variety of purposes, but all kinds of protective packaging have the same goal, to ensure that a product arrives in perfect condition and free of damage or other issues.

Protective packaging is designed and constructed to safeguard the goods from atmospheric, electrostatic, magnetic, vibration, or any other kind of damage. The protective packaging consists of packaging materials, storage containers, spacers, liners, and others. Protective packaging safeguards industrial & machinery products and other items from getting damaged. The protective factors may include electrical insulation, thermal insulation, fireproofing, vapor protection, vibration dampening, weather resistance, and others. Most of the vendors in the food & beverages, textiles, automotive, pharmaceuticals, and electronics industries use such packaging to transport goods to a destination in a safe condition.

The booming e-commerce market is the major factor in increasing the demand for the protective packaging market. Moreover, the rising trend of online shopping is also considered to be a strong factor in boosting the e-commerce market which positively tends to influence market growth. In addition to this, the increase in investments in R&D activities is anticipated to drive market growth owing to the increase in the use of recyclable materials. Furthermore, the rising adoption of protective packaging in the electronics and food & beverages sectors to protect during transportation will considerably drive the global protective packaging market growth during the forecast period. Nonetheless, an increase in the cost of raw materials is estimated to obstruct the market growth during the forecast timeline.

Key Insights

- As per the analysis shared by our research analyst, the global protective packaging market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- Regarding revenue, the global protective packaging market size was valued at around USD 35.69 Billion in 2024 and is projected to reach USD 60.39 Billion by 2034.

- The protective packaging market is projected to grow at a significant rate due to growth of e-commerce, increasing demand for damage-free transportation of goods, and a rising focus on sustainable packaging solutions.

- Based on Material, the Foam Plastics segment is expected to lead the global market.

- On the basis of Category Type, the Flexible segment is growing at a high rate and will continue to dominate the global market.

- Based on the Function, the Cushioning segment is projected to swipe the largest market share.

- By Application, the Food & Beverage segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Protective Packaging Market: Growth Drivers

The booming E-commerce industry may fuel the growth of the market.

The e-commerce business is one of the fastest-growing sectors in the world as more and more people choose to purchase online. This is due to the ease and wide range of product availability. According to the US Department of Commerce, the e-commerce business in the US has grown 17% per year over the last couple of years. Similarly, rapidly developing digital platforms in Asian countries support the E-commerce sector's growth. Major E-commerce companies operating in emerging countries such as India, China, and Japan serve millions of customers.

Protective packaging materials are used by large e-commerce firms like Alibaba, Amazon, and Flipkart to protect the contents from harm during shipment and delivery. With such huge demand from the E-commerce sector, the market is expected to grow significantly over the forecast period.

Protective Packaging Market: Restraints

Strict rules related to packaging materials may hinder the growth of the market.

Packaging trash is harmful to the environment since it takes decades for it to degrade. Governments all across the globe are tackling this problem by enacting tough regulations that the packaging sector must follow. Governments in Europe, for example, have taken a variety of steps to address packaging waste and recycling difficulties. Governments in developing countries have grown increasingly concerned about environmental protection, and initiatives are being taken to encourage sustainable packaging.

As a result of these rules prohibiting enterprises from getting raw materials from organizations that do not comply with environmental regulations, the cost of raw materials will rise, further increasing the operating expenses. As profits drop, this has an impact on overall protective packaging revenues.

Protective Packaging Market: Opportunities

An increase in international trade globally will provide better growth opportunities for the market.

In emerging nations, construction and industrialization are growing at a rapid pace. Construction and chemical sector items are seeing an increase in demand as a result of this. As a result, international commerce is increasing to meet this need. The worldwide protective packaging industry is being driven by two key factors: technological advancements, which have lowered transportation costs, and greater trade & capital market liberalization, which has enhanced export and import activity.

Companies are also shipping their products to other nations as a result of globalization, which is boosting the need for protective packaging to preserve items from harm across long distances.

Protective Packaging Market: Challenges

Issues with efficiency and sustainability pose major challenges to the growth of the market.

Overboxing and inefficient use of space due to a lack of configurable boxing options can result in excess air being transported. More items may be carried in a single load with more efficient box and container space, lowering greenhouse gas emissions from needless excess transportation and weight. This system-wide management is aided by open communication among manufacturers, vendors, distributors, and brands, which lowers transportation costs.

While volume and weight minimization are essential sustainability factors for protective packaging and sourcing, end-of-life is also equally crucial. Responsibly sourced renewable resources and recycled materials are examples of commodities with beneficial sourcing attributes. Favorable packaging is characterized as recyclable, reusable, or biodegradable after its life cycle.

Protective Packaging Market: Segmentation

The global protective packaging market is categorized into material, category type, function, application, and region.

Based on material, the market is bifurcated into foam plastics, paper & paperboard, and others. The foam plastics segment dominates the protective packaging market due to its high-performance cushioning and protective capabilities, making it essential for shipping fragile and high-value products. However, the Paper & Paperboard segment is experiencing significant growth, driven by increasing sustainability efforts and regulatory support for eco-friendly packaging.

On the basis of Category Type, the global protective packaging market is bifurcated into Flexible, Rigid, and Foam.

By Function, the global protective packaging market is split into Cushioning, Blocking & Bracing, Void Fill, and Others.

In terms of Application, the global protective packaging market is categorized into Food & Beverage, Consumer Electronics, Household Appliances, Automotive, Industrial Goods, and Others.

Protective Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Protective Packaging Market |

| Market Size in 2024 | USD 35.69 Billion |

| Market Forecast in 2034 | USD 60.39 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 258 |

| Key Companies Covered | Sealed Air Corporation, Smurfit Kappa Group Plc., WestRock Company, Huhtamaki OYJ, DS Smith Plc, Pregis LLC, Pro-Pac Packaging Limited, Dow Chemical Company, Intertape Polymer Group (IPG), Storopack Hans Reichenecker Gmbh, International Paper Company, EcoEnclose, Point Five Packaging, Universal Protective Packaging Inc., among others., and others. |

| Segments Covered | By Material, By Category Type, By Function, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Protective Packaging Market: Regional Analysis

Asia Pacific to rule the global market with a considerable revenue generation

The Asia Pacific is the largest revenue generator in the global protective packaging market. This is due to increasing industrialization in China and India. China is the global production house and industries in these countries supply millions of goods worldwide. Due to such factors, China contributes a major share of the regional market. India on the other hand has great potential for the expansion of the market.

Key factors such as booming industrialization, rising internet penetration, expanding manufacturing activities, rising disposable income, rising consumption levels, and increasing e-retail sales will drive the market in India during the projected period.

Recent Developments

- In January 2020, Sealed Air Corporation introduced a new variant of its bubble wrap packaging that contains at least 90 percent recycled material. This form of bubble wrap brand packaging is made using recycled content taken from industrial waste materials which would otherwise wind up in landfills.

Protective Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the protective packaging market on a global and regional basis.

The global protective packaging market is dominated by players like:

- Sealed Air Corporation

- Smurfit Kappa Group Plc.

- WestRock Company

- Huhtamaki OYJ

- DS Smith Plc

- Pregis LLC

- Pro-Pac Packaging Limited

- Dow Chemical Company

- Intertape Polymer Group (IPG)

- Storopack Hans Reichenecker Gmbh

- International Paper Company

- EcoEnclose

- Point Five Packaging

- Universal Protective Packaging Inc.

- among others.

The global protective packaging market is segmented as follows;

By Material

- Foam Plastics

- Paper & Paperboard

- and Others

By Category Type

- Flexible

- Rigid

- and Foam

By Function

- Cushioning

- Blocking & Bracing

- Void Fill

- and Others

By Application

- Food & Beverage

- Consumer Electronics

- Household Appliances

- Automotive

- Industrial Goods

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Protective packaging refers to materials and solutions used to safeguard products from damage during storage, handling, and transportation. It includes items like bubble wrap, foam, airbags, and corrugated boxes that protect against shock, vibration, moisture, and contamination.

The Global protective packaging market is expected to grow due to increasing demand for e-commerce and logistics, rising focus on product safety during transportation, growing adoption of sustainable and biodegradable materials, and advancements in lightweight and cost-effective packaging solutions.

According to a study, the Global protective packaging market size was worth around USD 35.69 Billion in 2024 and is expected to reach USD 60.39 Billion by 2034.

The Global protective packaging market is expected to grow at a CAGR of 5.4% during the forecast period.

Asia-Pacific is expected to dominate the protective packaging market over the forecast period.

Leading players in the Global protective packaging market include Sealed Air Corporation, Smurfit Kappa Group Plc., WestRock Company, Huhtamaki OYJ, DS Smith Plc, Pregis LLC, Pro-Pac Packaging Limited, Dow Chemical Company, Intertape Polymer Group (IPG), Storopack Hans Reichenecker Gmbh, International Paper Company, EcoEnclose, Point Five Packaging, Universal Protective Packaging Inc., among others., among others.

The report explores crucial aspects of the protective packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed