Global Power Rental Market Size, Share, Growth Analysis Report - Forecast 2034

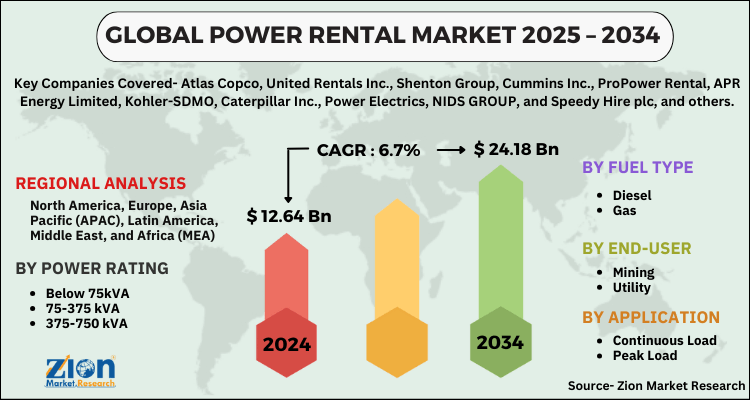

Power Rental Market By Power Rating (Below 75kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA), By Fuel Type (Diesel, Gas, and Others), End-User (Mining, Utility, Construction, Manufacturing, and Oil & Gas), Application (Continuous Load, Peak Load, and Standby Load), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

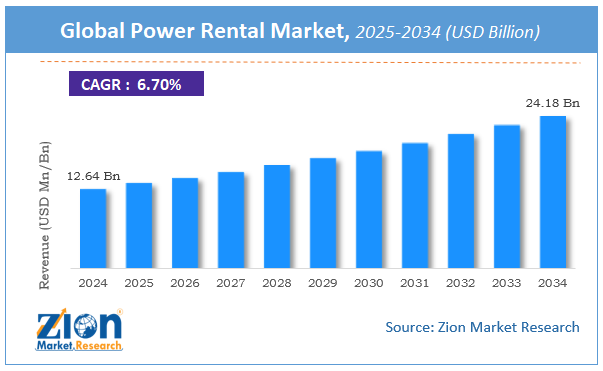

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.64 Billion | USD 24.18 Billion | 6.7% | 2024 |

Global Power Rental Market Overview:

The global power rental market size was worth around USD 12.64 Billion in 2024 and is predicted to grow to around USD 24.18 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.7% between 2025 and 2034. The report analyzes the global power rental market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the power rental industry.

Power Rental Market: Outlook

Power rental, which is also referred to as providing power on hire, has massive benefits in comparison to power equipment purchase. Power generators on lease prove beneficial over purchased ones as former provide susceptibility in requirement of power ratings along with carrying low maintenance & deployment charges. Apart from this, power rental can be easily availed within a short notice and have low initial costs. Energy producing firms prefer getting power generators on lease due to lack of access to strong grid infrastructure, temporary power needs, and high cost on maintaining current power supply equipment.

Reportedly, power on rent is preferred by firms established in regions either having poor power grid infrastructure facility or whose grid infrastructure is in phase of development. For instance, Asian and Latin American countries prefer power rental. Additionally, mining sector is largest consumer of power rental. Power rental is preferred due to constant outage as a result of load shedding and need of extra power due to heavy power load.

Key Insights

- As per the analysis shared by our research analyst, the global power rental market is estimated to grow annually at a CAGR of around 6.7% over the forecast period (2025-2034).

- Regarding revenue, the global power rental market size was valued at around USD 12.64 Billion in 2024 and is projected to reach USD 24.18 Billion by 2034.

- The power rental market is projected to grow at a significant rate due to rising need for temporary power solutions in industrial and emergency applications.

- Based on Power Rating, the Below 75kVA segment is expected to lead the global market.

- On the basis of Fuel Type, the Diesel segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Mining segment is projected to swipe the largest market share.

- By Application, the Continuous Load segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Power Rental Market: Growth Drivers

Humungous requirement for electrification and incessant supply of electricity will boost global market trends. Apart from this, unexpected power failures and load shedding has resulted in massive need of power, thereby widening the scope of power rental business. In addition to this, mining sector requires high power rating generator for carrying out digging operations and hence miners prefer power rental for fulfilling their daily but temporary electricity demand. Furthermore, power grid issues, natural disasters, and sudden failure of power producing device will pave a way for rise in use of power rentals. These abovementioned factors will contribute remarkably towards earnings of power rental industry.

Moreover, massive need for reliable power backup in industrial and commercial sectors will enhance use of power rental systems, thereby catalyzing market growth. Nonetheless, strict environmental legislations pertaining to GHG emissions & noise control can restrict expansion of power rental market.

Power Rental Market: segmentarion

The global power rental market is segmented based on power rating, fuel type, end-user, application, and region.

Based on Power Rating, the global power rental market is divided into Below 75kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA.

On the basis of Fuel Type, the global power rental market is bifurcated into Diesel, Gas, and Others.

By End-User, the global power rental market is split into Mining, Utility, Construction, Manufacturing, and Oil & Gas.

In terms of Application, the global power rental market is categorized into Continuous Load, Peak Load, and Standby Load.

Continuous Load was largest application segment with 45.56% of the global revenue and is expected to show a significant rise in light of the increasing demand from various sectors such as oil & gas, mining and construction and others. These sectors require a continuous supply of power by renting power equipment as the operational activities of these sectors usually take place far off from the power grid which in turn is expected to drive the demand for the power rental market. Peak shaving is another leading application segment owing to rising awareness among energy-intensive industries in order to control the charged over high energy demand during peak hours. Standby power was accounted for over 20% share of the total market and is anticipated to show moderate growth in the years to come owing to various regulations implemented by EPA and Greenpeace which are expected to minimize standby power consumption.

Power Rental Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Power Rental Market |

| Market Size in 2024 | USD 12.64 Billion |

| Market Forecast in 2034 | USD 24.18 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 166 |

| Key Companies Covered | Atlas Copco, United Rentals Inc., Shenton Group, Cummins Inc., ProPower Rental, APR Energy Limited, Kohler-SDMO, Caterpillar Inc., Power Electrics, NIDS GROUP, and Speedy Hire plc, and others. |

| Segments Covered | By Power Rating, By Fuel Type, By End-User, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Power Rental Market: Regional Analysis

The Middle East and African Market To Register Fastest Growth Over Forecasting Timeline

Growth of power rental market in the Middle East and Africa over forecasting years can be attributed to a massive surge in ongoing construction ventures in countries such as UAE and Saudi Arabia. Furthermore, thriving oil & gas sector in region is projected to create new growth avenues for power rental industry in the Middle East and Africa. Low access to power grid and rise in mining activities in African regions has resulted in huge demand for power rental in sub-continent. Huge need of power for oil & gas explorations from reservoirs has culminated into massive use of power rental in Africa, thereby driving regional market trends.

Power Rental Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the power rental market on a global and regional basis.

The global power rental market is dominated by players like:

- Atlas Copco

- United Rentals Inc.

- Shenton Group

- Cummins Inc.

- ProPower Rental

- APR Energy Limited

- Kohler-SDMO

- Caterpillar Inc.

- Power Electrics

- NIDS GROUP

- and Speedy Hire plc

The global power rental market is segmented as follows:

By Power Rating

- Below 75kVA

- 75-375 kVA

- 375-750 kVA

- and Above 750 kVA

By Fuel Type

- Diesel

- Gas

- and Others

By End-User

- Mining

- Utility

- Construction

- Manufacturing

- and Oil & Gas

By Application

- Continuous Load

- Peak Load

- and Standby Load

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Power rental refers to the temporary use of power generation equipment, such as generators or power plants, provided by a rental company. It is commonly used during emergencies, planned outages, construction projects, or events that need short-term electricity supply.

The global power rental market is expected to grow due to rising demand for temporary power solutions, increasing construction and industrial activities, and the need for emergency power backup.

According to a study, the global power rental market size was worth around USD 12.64 Billion in 2024 and is expected to reach USD 24.18 Billion by 2034.

The global power rental market is expected to grow at a CAGR of 6.7% during the forecast period.

North America is expected to dominate the power rental market over the forecast period.

Leading players in the global power rental market include Atlas Copco, United Rentals Inc., Shenton Group, Cummins Inc., ProPower Rental, APR Energy Limited, Kohler-SDMO, Caterpillar Inc., Power Electrics, NIDS GROUP, and Speedy Hire plc, among others.

The report explores crucial aspects of the power rental market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed