Global Mining Drilling Services Market Size, Share, Growth Analysis Report - Forecast 2034

Mining Drilling Services Market By Type (Surface Mining, Underground Mining), By Application (Metal, Coal, Minerals, Quarry), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

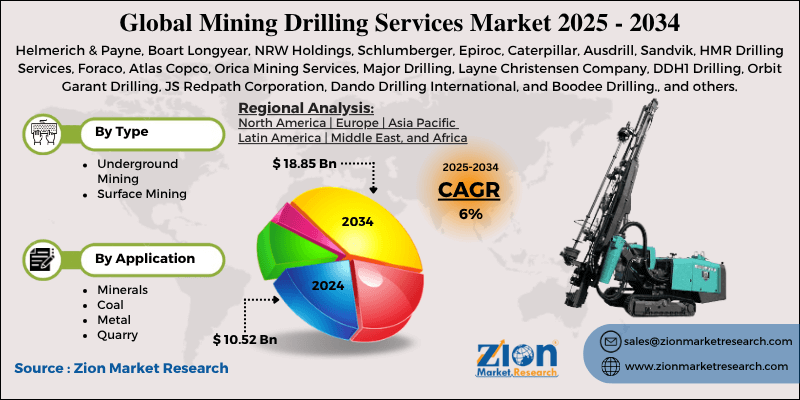

| USD 10.52 Billion | USD 18.85 Billion | 6% | 2024 |

Mining Drilling Services Market: Industry Perspective

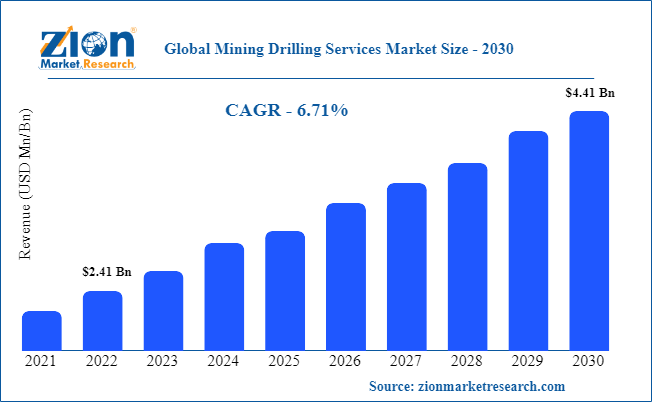

The global mining drilling services market size was worth around USD 10.52 Billion in 2024 and is predicted to grow to around USD 18.85 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6% between 2025 and 2034. The report analyzes the global mining drilling services market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the mining drilling services industry.

The report analyzes the global mining drilling services market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the mining drilling services market.

Mining Drilling Services Market: Overview

The mining drilling services industry is a segment of the larger ministry sector that deals with services related to drilling activities with the intention to extract ores and minerals from the earth. It includes services like production drilling, exploration drilling, environmental drilling, directional drilling, and geotechnical drilling. These activities are essential for the successful operation of the mining sector since it provides assistance in identifying mineral resources along with their extraction process. The industry is highly competitive with a wide range of businesses operating at different junctions of the mining process. Each business sub-segment has different roles to play and services to offer required to meet the dynamic demands of the mining industry. Several factors are expected to drive industry growth during the forecast period but it may also face certain intense restrictions and limitations.

Key Insights

- As per the analysis shared by our research analyst, the global mining drilling services market is estimated to grow annually at a CAGR of around 6% over the forecast period (2025-2034).

- Regarding revenue, the global mining drilling services market size was valued at around USD 10.52 Billion in 2024 and is projected to reach USD 18.85 Billion by 2034.

- The mining drilling services market is projected to grow at a significant rate due to rising mineral exploration activities, increased investments in mining infrastructure, and technological advancements in drilling.

- Based on Type, the Surface Mining segment is expected to lead the global market.

- On the basis of Application, the Metal segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Africa is predicted to dominate the global market during the forecast period.

Mining Drilling Services Market: Dynamics

Key Growth Drivers:

Rising global demand for minerals and metals to support industrialization, infrastructure projects, and the energy transition is a primary driver for mining drilling services, as higher commodity prices and exploration budgets push operators to increase drilling activity. Technological advancements—such as automated drilling rigs, real-time data analytics, directional/horizontal drilling, and improved rock-penetration tools—boost drilling efficiency, reduce downtime, and lower per-meter costs, encouraging greater service uptake. Growing investments in exploration for critical minerals (e.g., lithium, cobalt, rare earths) and deeper/remote deposits also expand demand for specialized drilling services. Finally, the push toward safer, more environmentally responsible operations (including precision drilling that reduces waste and footprint) motivates miners to contract advanced drilling providers.

Restraints:

High capital and operational costs associated with advanced drilling equipment and skilled personnel limit adoption, especially among smaller miners and in low-margin projects. Volatility in commodity prices leads to cyclical drilling budgets—when prices fall, exploration and development slow sharply—creating demand uncertainty for service providers. Regulatory hurdles, permitting delays, and stricter environmental compliance requirements can postpone or cancel drilling programs, increasing project timelines and costs. Additionally, remote-site logistics, poor infrastructure, and political instability in some mineral-rich regions raise operational risks and constrain market expansion.

Opportunities:

There is strong opportunity in niche services for critical- and battery-metal exploration as global electrification accelerates; specialized drilling for lithium, nickel, and rare earths commands premium rates. Digitalization and IoT-enabled fleets create scope for value-added services—remote monitoring, predictive maintenance, and data-driven consulting—that boost margins and client stickiness. Expansion into underexplored regions (with improving geopolitical stability) and de-risking politically sensitive projects through joint ventures offer growth avenues. Additionally, offering integrated end-to-end solutions (exploration, drilling, sampling, and data interpretation) and greener drilling technologies (lower emissions rigs, efficient fuel use) open new contracts with ESG-focused mining companies.

Challenges:

Recruiting and retaining skilled drill operators, geotechnical experts, and data scientists is an ongoing challenge as the industry competes with other resource sectors and automation changes workforce needs. Integrating new digital technologies with legacy fleets and ensuring cybersecurity for connected drilling operations can be complex and costly. Environmental and social license pressures—community opposition, stricter remediation obligations, and higher reclamation costs—can delay projects and increase liability for service firms. Finally, intense competition and pressure to offer low-cost bundled services compress margins, making it difficult for smaller or less technologically advanced providers to compete.

Mining Drilling Services Market: Segmentation

The global mining drilling services market is segmented based on application, type, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on application, the global market segments are minerals, coal, metal, and quarry. In 2024, the industry witnessed the highest growth in the minerals segment and it is expected to continue its dominance followed by metal and coal. Services used in this segment require the use of specialized techniques and equipment since minerals are extracted from the earth’s core. Most of the drilling processes include the creation of wells or boreholes in the ground from where the minerals are extracted. The type of drilling technique used depends on the mineral being targeted and the geographical condition of the area surrounding it. In 2023, Saudi Arabia generated more than 5.8 metric tons of gold.

Based on type, the global market segments are underground mining and surface mining. The industry witnessed the highest CAGR in the surface mining segment in 2024. As observed by the US Geological Survey, around 74% of the mining activities conducted worldwide are surface-based whereas 26% are underground mining activities. Surface mining deals with the removal of surface soil and vegetation allowing access to the minerals stored beneath. This type of mining is conducted to extract gold deposits, copper, iron ore, and coal.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Mining Drilling Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mining Drilling Services Market |

| Market Size in 2024 | USD 10.52 Billion |

| Market Forecast in 2034 | USD 18.85 Billion |

| Growth Rate | CAGR of 6% |

| Number of Pages | 222 |

| Key Companies Covered | Helmerich & Payne, Boart Longyear, NRW Holdings, Schlumberger, Epiroc, Caterpillar, Ausdrill, Sandvik, HMR Drilling Services, Foraco, Atlas Copco, Orica Mining Services, Major Drilling, Layne Christensen Company, DDH1 Drilling, Orbit Garant Drilling, JS Redpath Corporation, Dando Drilling International, and Boodee Drilling., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mining Drilling Services Market: Regional Analysis

Asia-Pacific to dominate the market growth

The global mining drilling services market is anticipated to witness the highest growth in Asia-Pacific mainly owing to the exhaustive mining activities conducted in several parts of the region. Australia is home to one of the largest service providers in the industry. NRW Holdings has a world reputation for being honored with several multi-billion dollar assignments across blasting and drilling segments. In addition to this, the mining exports of the country currently account for 75% of the global market share and are an essential segment of Australia’s economic growth.

North America is also registering a significant CAGR in the last few years due to immense exploration activities conducted by the US and Canadian governments for natural gas and different types of minerals. Increasing investment in the segment is a crucial growth propeller.

Mining Drilling Services Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the mining drilling services market on a global and regional basis.

The global mining drilling services market is led by players like:

- Helmerich & Payne

- Boart Longyear

- NRW Holdings

- Schlumberger

- Epiroc

- Caterpillar

- Ausdrill

- Sandvik

- HMR Drilling Services

- Foraco

- Atlas Copco

- Orica Mining Services

- Major Drilling

- Layne Christensen Company

- DDH1 Drilling

- Orbit Garant Drilling

- JS Redpath Corporation

- Dando Drilling International

- Boodee Drilling.

The global mining drilling services market is segmented as follows:

By Application

- Minerals

- Coal

- Metal

- Quarry

By Type

- Underground Mining

- Surface Mining

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The industry is a segment of the larger ministry sector that deals with services related to drilling activities with the intention to extract ores and minerals from the earth.

The global mining drilling services market is expected to grow due to rising mineral exploration activities, increased investments in mining infrastructure, and technological advancements in drilling.

According to a study, the global mining drilling services market size was worth around USD 10.52 Billion in 2024 and is expected to reach USD 18.85 Billion by 2034.

The global mining drilling services market is expected to grow at a CAGR of 6% during the forecast period.

Africa is expected to dominate the mining drilling services market over the forecast period.

Leading players in the global mining drilling services market include Helmerich & Payne, Boart Longyear, NRW Holdings, Schlumberger, Epiroc, Caterpillar, Ausdrill, Sandvik, HMR Drilling Services, Foraco, Atlas Copco, Orica Mining Services, Major Drilling, Layne Christensen Company, DDH1 Drilling, Orbit Garant Drilling, JS Redpath Corporation, Dando Drilling International, and Boodee Drilling., among others.

The report explores crucial aspects of the mining drilling services market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed