Polyphenylene Sulfide Market Size, Share, Trends, Growth 2032

Polyphenylene Sulfide Market By Application (Aerospace, Electrical & Electronics, Coatings, Automotive, Filter Bags, Industrial, and Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

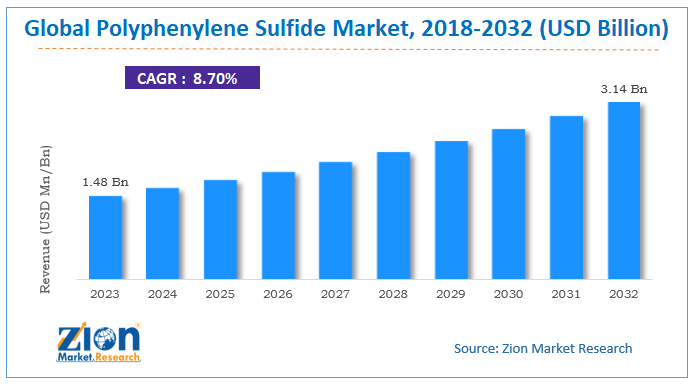

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.48 Billion | USD 3.14 Billion | 8.70% | 2023 |

Polyphenylene Sulfide Market: Overview

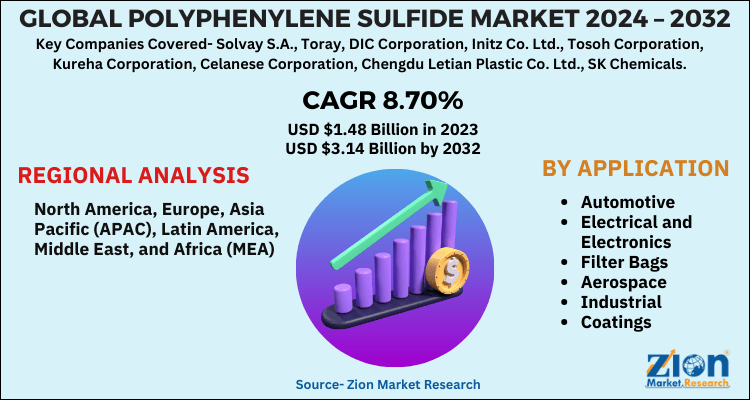

The global polyphenylene sulfide market size was evaluated at $1.48 billion in 2023 and is slated to hit $3.14 billion by the end of 2032 with a CAGR of nearly 8.70% between 2024 and 2032.

The complete study covers the key drivers and restraints for the polyphenylene sulfide market. It also provides the impact of the market within the forecast period. Furthermore, the study also includes the opportunities accessible within the polyphenylene sulfide market on a global level.

Polyphenylene Sulfide Market: Growth Factors

Polyphenylene sulfide or PPS is an organic polymer that contains sulfide elements. It has excellent properties, such as chemical resistance, high-temperature resistance, dimensional stability, flowability, etc. Polyphenylene sulfide is filled with fillers and fibers to overcome its inherent brittleness.

The global polyphenylene sulfide market is likely to grow considerably over the estimated timeframe, owing to the rapidly expanding automobile industry across the globe. Polyphenylene sulfide is widely used in automobiles, owing to its high-temperature resistance characteristics. This polymer also exhibits high flame and fuel resistance, which makes it suitable for various automobile parts. Moreover, the rising demand for filter bags in dust chamber filters and coal boilers is likely to further fuel the polyphenylene sulfide market in the future.

However, the availability of substitutes, such as PEEK (polyether ether ketone) and PEI (polyetherimide), and the fluctuating prices of raw materials of polyphenylene sulfide might hamper the polyphenylene sulfide market growth on a global scale. Conversely, the growing focus on the production of bio-based engineering plastics is projected to offer lucrative growth opportunities for the polyphenylene sulfide market players in the future.

In order to offer the users of this report, a comprehensive view of the polyphenylene sulfide market, we have enclosed a detailed value chain analysis. To know the competitive landscape within the market, an analysis of Porter’s Five Forces model for the market has additionally been enclosed. The study includes a market attractiveness analysis, wherein all the segments are benchmarked supported their market size, growth rate, and general attractiveness.

The study also includes the market share of the key participants operating in the polyphenylene sulfide market globally. Besides, the report covers the strategic development together with acquisitions & mergers, agreements, partnerships, collaborations, and joint ventures, and regional growth of key players within the market on a regional basis.

Polyphenylene Sulfide Market: Segmentation

The study provides a crucial view of the polyphenylene sulfide market by segmenting the market based on application and region. By application, the global polyphenylene sulfide market includes aerospace, electrical and electronics, coatings, automotive, filter bags, industrial, and others.

The automotive sector is the largest market contributor and is projected to maintain its dominance in the future as well. In the year 2017, the automotive segment held about 30% share of the global polyphenylene sulfide market. Additionally, the electrical and electronics sector is expected to grow at the fastest rate in the future, owing to the growing demand for electrical components and appliances globally.

Polyphenylene Sulfide Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyphenylene Sulfide Market Research Report |

| Market Size in 2023 | USD 1.48 Billion |

| Market Forecast in 2032 | USD 3.14 Billion |

| Growth Rate | CAGR of 8.70% |

| Number of Pages | 215 |

| Key Companies Covered | Solvay S.A., Toray, DIC Corporation, Initz Co. Ltd., Tosoh Corporation, Kureha Corporation, Celanese Corporation, Chengdu Letian Plastic Co. Ltd., SK Chemicals, Albis Plastic GmbH, and SABIC, among others. |

| Segments Covered | By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyphenylene Sulfide Market: Regional Insights

Additionally, the regional classification includes Europe, North America, Latin America, Asia Pacific, the Middle East and Africa along with the key countries, such as the U.S., Rest of North America, UK, Germany, France, Rest of Europe, China, Japan, India, Rest of Asia Pacific, Brazil, and Rest of Latin America.

The global polyphenylene sulfide market includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2017, the Asia Pacific region held the largest share and is expected to continue its dominance over the next few years as well. The Asia Pacific polyphenylene sulfide market witnessed a high polyphenylene sulfide demand due to the region’s growing automotive industry. China is projected to be the highest regional revenue contributor among all the nations in the region, due to its thriving automobile and electrical industries. China is emerging as one of the major manufacturers of electrical and electronic products. This, in turn, is likely to further propel the polyphenylene sulfide market across the region in the future.

Polyphenylene Sulfide Market: Competitive Space

The global polyphenylene sulfide market profiles key players such as

- Solvay S.A.

- Toray

- DIC Corporation

- Initz Co. Ltd.

- Tosoh Corporation

- Kureha Corporation

- Celanese Corporation

- Chengdu Letian Plastic Co Ltd

- SK Chemicals

- Albis Plastic GmbH

- SABIC

This report segments the global polyphenylene sulfide market into:

Global Polyphenylene Sulfide Market: Application Analysis

- Automotive

- Electrical and Electronics

- Filter Bags

- Aerospace

- Industrial

- Coatings

- Others

Global Polyphenylene Sulfide Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

PPS is a thermoplastic high-performance material distinguished by its exceptional chemical resistance, thermal stability, and mechanical characteristics.

PPS finds extensive applicability in the automotive industry owing to its exceptional mechanical strength and resistance to high temperatures. The automotive sector's increasing emphasis on electric vehicles and lightweight materials to improve fuel economy is anticipated to contribute to a rising demand for PPS.

The global polyphenylene sulfide market size was evaluated at $1.48 billion in 2023 and is slated to hit $3.14 billion by the end of 2032.

The global polyphenylene sulfide market a CAGR of nearly 8.70% between 2024 and 2032.

Additionally, the regional classification includes Europe, North America, Latin America, Asia Pacific, the Middle East and Africa along with the key countries, such as the U.S., Rest of North America, UK, Germany, France, Rest of Europe, China, Japan, India, Rest of Asia Pacific, Brazil, and Rest of Latin America.

Some key manufacturers of the global polyphenylene sulfide market are Solvay S.A., Toray, DIC Corporation, Initz Co. Ltd., Tosoh Corporation, Kureha Corporation, Celanese Corporation, Chengdu Letian Plastic Co. Ltd., SK Chemicals, Albis Plastic GmbH, and SABIC, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed