Polyisoprene Rubber Market Size, Share, Trends, Growth and Forecast 2034

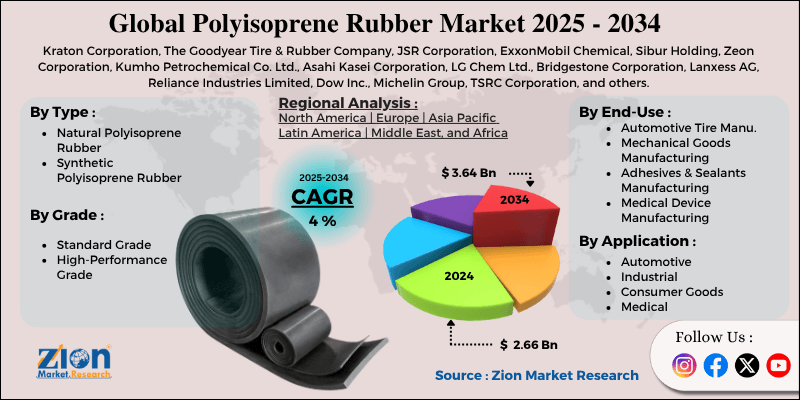

Polyisoprene Rubber Market By Type (Natural Polyisoprene Rubber, Synthetic Polyisoprene Rubber), By Grade (Standard Grade, High-Performance Grade), By Application (Automotive, Industrial, Consumer Goods, Medical), By End-Use (Automotive Tire Manufacturing, Mechanical Goods Manufacturing, Adhesives and Sealants Manufacturing, Medical Device Manufacturing), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

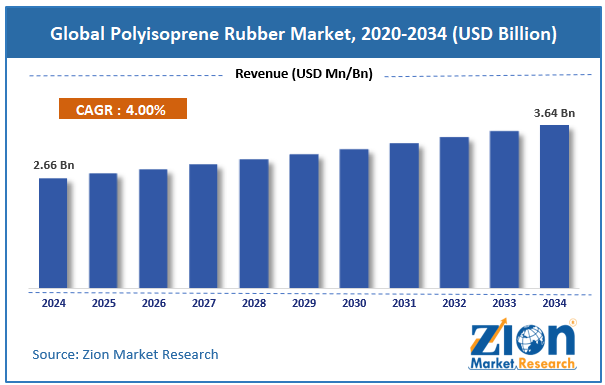

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.66 Billion | USD 3.64 Billion | 4% | 2024 |

Polyisoprene Rubber Industry Perspective:

The global polyisoprene rubber market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 3.64 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4% between 2025 and 2034.

Polyisoprene Rubber Market: Overview

Polyisoprene is a synthetic elastomer that imitates the characteristics of natural rubber, with excellent resilience, flexibility, and tensile strength. It is primarily used in applications requiring high-performance rubber materials, such as automotive parts, medical devices, adhesives, and footwear.

The key drivers of the polyisoprene rubber market include growing demand in medical applications, consistent supply, and quality that surpasses that of natural rubber, as well as surged investments in rubber manufacturing. The growing preference for synthetic polyisoprene over natural rubber in catheters, surgical gloves, and other medical devices is driving industry growth.

Polyisoprene offers enhanced purity and removes latex-associated allergies. The global medical gloves industry is expected to surpass $19 billion in the coming years, thereby driving demand. Polyisoprene is synthetically produced, offering reliable properties and a stable supply. This increases its preference for precision-critical and industrial applications.

Stability in the supply chain also helps manufacturers mitigate risks associated with regional or climate disturbances. Key operating players are investing in modernized production technologies and expanding their facilities for polyisoprene. These investments lower production costs and enhance rubber performance.

However, the global market is restricted by volatility in the prices of raw materials and growing competition from natural rubber and other alternatives. Polyisoprene production is dependent on petrochemical feedstock, such as isoprene, which is subject to variations in crude oil costs. Unexpected cost hikes impact profit margins and pricing strategies.

Moreover, natural rubber is highly demanded in applications where cost outweighs performance. Additionally, other synthetic rubbers compete with polyisoprene in various sectors. Hence, polyisoprene’s niche attraction restricts its industry share more than these materials.

Nonetheless, the global polyisoprene rubber industry is projected to experience significant growth over the coming years, driven by the development of bio-polyisoprene and its increasing adoption in advanced electronics. Research and development on bio-polyisoprene, made from renewable feedstocks such as biomass or sugarcane, is gaining traction. Leading companies, such as DuPont and Goodyear, are exploring green alternatives. Successful commercialization may shift the industry towards ecological rubber.

Moreover, the insulating and flexible characteristics of polyisoprene increase its suitability for use in flexible devices and wearable electronics. With the global wearable devices market surpassing USD 60 billion, the demand for polyisoprene is expected to increase substantially for niche electronic applications.

Key Insights:

- As per the analysis shared by our research analyst, the global polyisoprene rubber market is estimated to grow annually at a CAGR of around 4% over the forecast period (2025-2034)

- In terms of revenue, the global polyisoprene rubber market size was valued at around USD 2.66 billion in 2024 and is projected to reach USD 3.64 billion by 2034.

- The polyisoprene rubber market is projected to grow significantly due to heavy demand in the automotive sector, supportive regulations for synthetic substitutes, and the expansion of industrial manufacturing.

- Based on type, the natural polyisoprene rubber segment is expected to lead the market, while the synthetic polyisoprene rubber segment is expected to grow considerably.

- Based on grade, the standard grade segment dominates the market, while the high-performance grade segment is expected to progress considerably.

- Based on application, the automotive is the largest segment, while the medical segment is projected to witness substantial revenue growth over the forecast period.

- Based on end-use, the automotive tire manufacturing segment is expected to lead the market, surpassing the medical device manufacturing segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Polyisoprene Rubber Market: Growth Drivers

Expansion in industrial products and mechanical goods boosts market growth

Polyisoprene rubber is broadly used in seals, vibration dampers, hoses, and belts because of its exceptional fatigue resistance and resilience. The growth in material handling equipment and manufacturing automation has strengthened the demand for durable elastomers.

Brands such as Hutchinson and Continental AG are increasingly utilizing synthetic rubbers in a wide range of sealing and shock-absorbing applications. These advancements are vital for maintaining uptime in heavy-duty operations, mainly in mining and construction. These factors notably impact the growth of the polyisoprene rubber market.

The shift towards synthetic alternatives considerably fuels the market growth

Environmental concerns and volatility in natural rubber pricing are prompting industries to adopt synthetic alternatives, such as polyisoprene. The production of synthetic polyisoprene is also growing, sustainable, and efficient.

Remarkably, in February 2024, Goodyear successfully tested a synthetic rubber obtained from bio-based feedstock in tires, denoting a shift towards environmentally friendly polyisoprene. This trend supports global sustainability objectives and helps manufacturers meet the increasing regulatory standards for lifecycle emissions and material traceability.

Polyisoprene Rubber Market: Restraints

High production costs of synthetic polyisoprene hamper the market progress

Synthetic polyisoprene, despite being chemically similar to natural rubber, is expensive due to its high production costs, which stem from the need for petrochemical feedstocks such as isoprene monomers and complex polymerization methods.

Reasonably, synthetic polyisoprene costs 30% more than natural rubber, limiting its use primarily to regulated and high-performance applications, such as baby bottle nipples and medical gloves.

ExxonMobil reported a 12 percent year-over-year rise in the cost of its synthetic rubber products due to feedstock and energy price hikes in April 2025.

Polyisoprene Rubber Market: Opportunities

Growing opportunities in 3D printing and additive manufacturing positively impact market growth

The use of elastomer-compatible 3D printing has opened up new avenues for polyisoprene-based materials. Isoprene rubber's resilience and elastic properties increase its suitability for customized grips, wearable medical devices, and seals manufactured through additive methods.

Researchers at MIT's Department of Materials Science developed a printable polyisoprene resin for medical prosthetics in 2024. This offers avenues for on-demand personalized medical manufacturing.

Startups in the sporting and orthopedic goods space are also discovering isoprene rubber for customized products that require rubber-like stretchability. This technology may notably increase the reach of isoprene rubber in high-value and niche markets, thus impacting the progress of the polyisoprene rubber industry.

Polyisoprene Rubber Market: Challenges

Reliance on restricted raw material sources restricts the growth of the market

Natural polyisoprene is primarily harvested from the Hevea brasiliensis tree, a native of Southeast Asia. This monoculture-based reliance makes the industry vulnerable to diseases such as leaf blight, labor constraints, and climate-related issues.

An outbreak of Pestalotiopsis fungal disease in Indonesian rubber farms risked nearly 100,000 hectares, causing significant disturbances to the supply chain in the rubber glove industry in January 2025.

Polyisoprene Rubber Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyisoprene Rubber Market |

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2034 | USD 3.64 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 214 |

| Key Companies Covered | Kraton Corporation, The Goodyear Tire & Rubber Company, JSR Corporation, ExxonMobil Chemical, Sibur Holding, Zeon Corporation, Kumho Petrochemical Co. Ltd., Asahi Kasei Corporation, LG Chem Ltd., Bridgestone Corporation, Lanxess AG, Reliance Industries Limited, Dow Inc., Michelin Group, TSRC Corporation, and others. |

| Segments Covered | By Type, By Grade, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyisoprene Rubber Market: Segmentation

The global polyisoprene rubber market is segmented based on type, grade, application, end-use, and region.

Based on type, the global polyisoprene rubber industry is divided into natural polyisoprene rubber and synthetic polyisoprene rubber. The natural polyisoprene rubber segment held a significant market share due to its abundance, established supply chain, and low cost. Obtained from the latex of Hevea brasiliensis trees, natural polyisoprene rubber is largely used in automotive tires, adhesives, industrial applications, and footwear. Its exceptional elasticity, mechanical strength, and biodegradability make it a broadly accepted material.

Natural rubber is primarily preferred in developing countries, where accessibility and affordability are key considerations for this material. Despite the rising competition from synthetics, its cost advantage and eco-friendly nature continue to lead to its industry dominance.

Based on application, the global polyisoprene rubber market is segmented into automotive, industrial, consumer goods, and medical. The automotive sector is the leading segment, impacted by tire manufacturing. Polyisoprene is largely used in tire treads, inner liners, and sidewalls due to its brilliant resilience, elasticity, and abrasion resistance.

As global vehicle production increases, primarily in developing regions, the demand for high-performance rubber compounds also rises. Polyisoprene’s ability to enhance road grip and improve fuel efficiency reinforces its role in next-generation automotive parts. The industry's growth and scale potential are the reasons for its leading application segment.

Based on end-use, the global market is segmented as automotive tire manufacturing, mechanical goods manufacturing, adhesives and sealants manufacturing, and medical device manufacturing. The automotive tire manufacturing segment holds a prominent share, registering the maximum volume demand.

Both synthetic and natural polyisoprene are widely used in inner liners, sidewalls, and tire treads due to their optimal elasticity, wear resistance, and tensile strength, thus fueling the segment's prominence.

In addition, producers are highly preferring synthetic polyisoprene to meet regulatory requirements and performance consistency. With over 1.5 billion units of tires produced globally (yearly), the segment is the backbone of polyisoprene rubber demand.

By grade, the market is segregated into standard grade and high-performance grade.

Polyisoprene Rubber Market: Regional Analysis

North America to witness significant growth over the forecast period

North America held a dominant share of the global polyisoprene rubber market due to the strong presence of the automotive and tire sectors, as well as the improved medical device and healthcare industries, and the increased adoption of synthetic alternatives.

North America boasts a robust automotive industry, with the United States producing over 10 million units annually. This has a remarkably significant impact on the incessant demand for polyisoprene rubber in automotive components and tire manufacturing. The region's focus on replacement market and performance tires strengthens its dominance.

Additionally, the United States leads the global healthcare industry, spending over $4.5 trillion in 2024, with stringent regulations that support the use of high-purity synthetic materials. The said rubber is widely used in medical gloves, thereby increasing its usage in medical applications.

Moreover, North American producers are increasingly opting for synthetic polyisoprene due to its safety, consistency, and superior performance. This addresses the growing concerns over latex allergies, particularly in food-grade and healthcare products. The region's stringent regulatory compliance improves the demand for non-toxic and hypoallergenic materials.

Europe is expected to make notable progress in the polyisoprene rubber industry, following North America, due to its high-quality manufacturing standards, established automotive industry, and significant demand in both consumer and industrial sectors. The European industry prioritizes eco-friendly and high-quality materials, continuously enforcing ISO and REACH regulations.

Synthetic polyisoprene suits are perfect due to their recyclability and purity. Regional producers are investing in bio-based isoprene research and studies to meet the goals of the Green Deal and sustainability.

In addition, Europe is home to prominent vehicle manufacturers, including Renault, BMW, and Volkswagen, with overall production exceeding 15 million units in 2024. Polyisoprene is broadly used in seals, tires, and vibration-absorbing components for aftermarket and OEM applications. Constant innovation in premium vehicles and electric vehicles (EVs) supports the demand for advanced rubber.

Moreover, industrial machinery, consumer goods, and footwear are the main polyisoprene applications gaining prominence in the region. The growing demand for durable, elastic, and safe materials in consumer electronics and sporting goods is fueling the use. The region's progressing e-commerce industry also backs distribution in different applications.

Polyisoprene Rubber Market: Competitive Analysis

The leading players in the global polyisoprene rubber market are:

- Kraton Corporation

- The Goodyear Tire & Rubber Company

- JSR Corporation

- ExxonMobil Chemical

- Sibur Holding

- Zeon Corporation

- Kumho Petrochemical Co. Ltd.

- Asahi Kasei Corporation

- LG Chem Ltd.

- Bridgestone Corporation

- Lanxess AG

- Reliance Industries Limited

- Dow Inc.

- Michelin Group

- TSRC Corporation

Polyisoprene Rubber Market: Key Market Trends

Move towards latex-free medical products:

There is a strong inclination towards latex-free materials in the healthcare industry to avoid allergic reactions. Synthetic polyisoprene, being consistent and hypoallergenic in purity, is taking over natural rubber latex in catheters, gloves, and tubing. This trend is fueled by the growing patient safety awareness and strict regulations.

Progress of bio-based polyisoprene:

Research and development are focusing on the production of polyisoprene from renewable sources, including genetically modified organisms and biomass. Prominent companies like Genencor and Goodyear have discovered bio-isoprene as a means to decrease their reliance on petrochemicals. This complies with the global sustainability objectives and creates enduring growth opportunities.

The global polyisoprene rubber market is segmented as follows:

By Type

- Natural Polyisoprene Rubber

- Synthetic Polyisoprene Rubber

By Grade

- Standard Grade

- High-Performance Grade

By Application

- Automotive

- Industrial

- Consumer Goods

- Medical

By End-Use

- Automotive Tire Manufacturing

- Mechanical Goods Manufacturing

- Adhesives and Sealants Manufacturing

- Medical Device Manufacturing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polyisoprene is a synthetic elastomer that imitates the characteristics of natural rubber, with excellent resilience, flexibility, and tensile strength. It is mainly used in applications needing high-performing rubber materials like automotive parts, medical devices, adhesives, and footwear.

The global polyisoprene rubber market is projected to grow due to surging demand for environmentally friendly alternatives, mounting demand in sports goods and footwear, and escalating demand in medical applications.

According to study, the global polyisoprene rubber market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 3.64 billion by 2034.

The CAGR value of the polyisoprene rubber market is expected to be around 4% during 2025-2034.

North America is expected to lead the global polyisoprene rubber market during the forecast period.

The key players profiled in the global polyisoprene rubber market include Kraton Corporation, The Goodyear Tire & Rubber Company, JSR Corporation, ExxonMobil Chemical, Sibur Holding, Zeon Corporation, Kumho Petrochemical Co., Ltd., Asahi Kasei Corporation, LG Chem Ltd., Bridgestone Corporation, Lanxess AG, Reliance Industries Limited, Dow Inc., Michelin Group, and TSRC Corporation.

The report examines key aspects of the polyisoprene rubber market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed