Polycarbonate Market Size, Share, Trends, Growth 2034

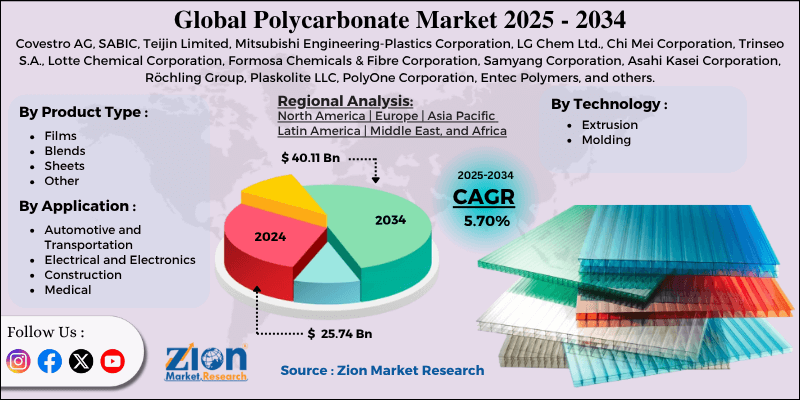

Polycarbonate Market By Product Type (Films Blends, Sheets, and Other), By Technology (Extrusion, Molding), By Application (Automotive and Transportation, Electrical and Electronics, Construction, Medical, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

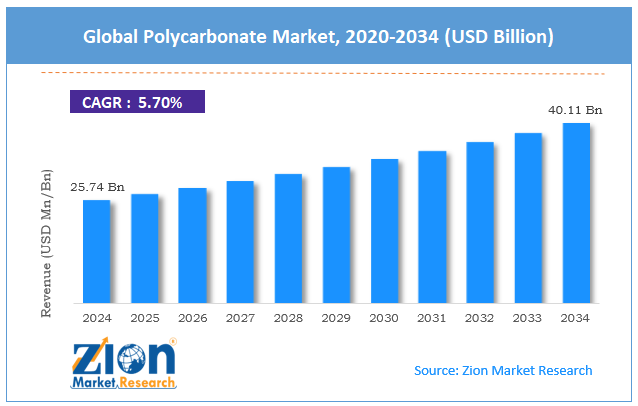

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.74 Billion | USD 40.11 Billion | 5.70% | 2024 |

Polycarbonate Industry Perspective:

The global polycarbonate market size was worth around USD 25.74 billion in 2024 and is predicted to grow to around USD 40.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.70% between 2025 and 2034.

Polycarbonate Market: Overview

Polycarbonate is a lightweight, strong, and transparent thermoplastic known for its excellent optical clarity and high impact resistance. It is widely used in various sectors, including electronic components, eyewear lenses, automotive parts, packaging, and construction materials, due to its heat resistance and durability. Polycarbonate is in high demand for consumer products and industrial manufacturing due to its ability to be easily thermoformed and molded.

The global polycarbonate market is driven by the increasing demand from the automotive industry, rising medical applications, and advancements in manufacturing technology. The automotive market uses polycarbonate in windows, lighting systems, and interior trims due to its impact resistance and lightweight properties. This material enhanced fuel safety and efficiency.

The growing inclination towards electric vehicles is driving the adoption of this material. Polycarbonate offers transparency, high strength, and sterilizability in medical devices, increasing its suitability for housings, IV components, and surgical instruments. Healthcare spending has increased globally since the COVID-19 pandemic. This creates a heavy demand for high-performing plastic materials.

Moreover, fresh developments in extrusion, injection molding, and compounding have reduced prices and improved the quality of polycarbonate parts. Precision and automation in production have optimized scalability. These solutions also facilitate the development of speedy prototypes for various industries.

However, despite advancements, the global market is restrained by fluctuations in the prices of raw materials and challenges in recycling. The production of polycarbonate depends on phosgene and BPA, which are obtained from crude oil. Variations in oil prices directly influence the production costs. This offers uncertainties in revenue margins for the producers.

In addition, unlike HDPE and PET, polycarbonate is not widely reused due to its contamination issues and complex structure. Mechanical recycling degrades the quality. The lack of recycling infrastructure hinders efforts to achieve ecological compliance.

Nonetheless, the global polycarbonate industry is expected to experience substantial growth due to the increasing use of recycled and bio-based polycarbonate, as well as applications in optical and solar energy.

Sustainable modernizations, such as BPA-free substitutes and CO2-based polycarbonate, are commercially feasible. These materials align with the ESG objectives of multinational companies. Investment in these domains may offer significant opportunities.

Also, polycarbonate's UV resistance and clarity make it the best choice for optical films and solar panel covers. As the number of renewable energy projects increases, the demand for these materials is also expected to rise.

Key Insights:

- As per the analysis shared by our research analyst, the global polycarbonate market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034)

- In terms of revenue, the global polycarbonate market size was valued at around USD 25.74 billion in 2024 and is projected to reach USD 40.11 billion by 2034.

- The polycarbonate market is projected to grow significantly due to the increasing demand from the electrical and electronics sector, advancements in manufacturing processes, and a shift towards lightweight materials.

- Based on product type, the sheets segment is expected to lead the market, while the film blends segment is expected to grow considerably.

- Based on technology, the molding is the dominant segment, while the extrusion segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the electrical and electronics segment is expected to lead the market compared to the automotive and transportation segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Polycarbonate Market: Growth Drivers

Recyclable material innovations and sustainability push fuel market growth

Polycarbonate manufacturers are actively focusing on recycling, sustainability, and circular economy initiatives. The advanced polycarbonate grades are produced with recycled or bio-based feedstock, appealing to industries pressurized to decrease carbon emissions.

LG Chem introduced its eco-polycarbonate line, made with PCR (post-consumer recycled) plastics, in November 2023 to meet the demand from the appliance-making and electronics sectors, which prioritize ESG objectives. This inclination towards green manufacturing is a leading driver in the polycarbonate market, particularly in Europe, where regulations are accelerating the adoption of sustainability.

Technological improvements in aerospace and optical applications spur market growth

Polycarbonate is a highly demanded material in safety glasses, optical lenses, shielding components, and aircraft canopies because of its optical-grade precision, impact resistance, and exceptional clarity. The defense and aerospace industries are largely adopting polycarbonate because of its durable and lightweight nature.

Airbus and Boeing are integrating polycarbonate for cockpit instrumentation and interior cabin panels. NASA announced novel spacecraft modules with polycarbonate-enabled shielding for micro-meteoroid protection in early 2025, showcasing the material's high-performance applications.

Polycarbonate Market: Restraints

Easy accessibility of cost-effective alternatives negatively impacts market progress

While polycarbonate offers brilliant clarity and impact resistance, it faces competition from less expensive alternatives such as PET, PMMA, and glass in many applications. These materials are typically required when optical cost and quality are crucial or mechanical stress is minimal.

LG Display shifted a portion of its mobile screen protective covers to a PMMA-PET mixture in 2024 to reduce costs and enhance scratch resistance. This trend, primarily in price-sensitive regions such as Africa and Southeast Asia, is negatively impacting demand for polycarbonate in low-end applications.

Polycarbonate Market: Opportunities

Green building boom in developing markets is a key opportunity for market growth

Polycarbonate panels and sheets are highly demanded for canopies, transparent roofing, solar energy applications, and facades in sustainable buildings and infrastructure. The material’s thermal insulation, UV resistance, and lightweight nature increase its suitability for agricultural greenhouses, daylighting systems, and energy-efficient structures. This significantly impacts the demand for material, fueling the global polycarbonate industry.

India's Smart Cities Mission has added $10 billion to green infrastructure projects, primarily fueling demand for polycarbonate in architectural applications. Producers like Bayer AG and Trinseo are expanding their product lines in these areas, focusing on energy-saving applications and multi-layer PC sheets.

Polycarbonate Market: Challenges

Supply chain disruptions and geopolitical instability limit market growth

The polycarbonate supply chain is more sensitive to geopolitical stresses, trade wars, and logistical barriers, particularly in the APAC region, which affects global production. Any disturbance in feedstock supply, such as phosgene or BPA, or changes in import/export routes, may significantly affect pricing and availability on a global scale.

In 2023 and 2024, shipping congestion at port shutdowns and the Panama Canal, as well as in China, disrupted the export of resin, leading to 15% price hikes and delays in Europe and the United States.

Polycarbonate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polycarbonate Market |

| Market Size in 2024 | USD 25.74 Billion |

| Market Forecast in 2034 | USD 40.11 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 212 |

| Key Companies Covered | Covestro AG, SABIC, Teijin Limited, Mitsubishi Engineering-Plastics Corporation, LG Chem Ltd., Chi Mei Corporation, Trinseo S.A., Lotte Chemical Corporation, Formosa Chemicals & Fibre Corporation, Samyang Corporation, Asahi Kasei Corporation, Röchling Group, Plaskolite LLC, PolyOne Corporation, Entec Polymers, and others. |

| Segments Covered | By Product Type, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polycarbonate Market: Segmentation

The global polycarbonate market is segmented based on product type, technology, application, and region.

Based on product type, the global polycarbonate industry is divided into films, blends, sheets, and others. The 'polycarbonate sheets' segment held a leading position among others due to their transparency, high strength, and weather resistance. They are broadly used in automotive glazing, construction, industrial safety panels, and security barriers. Their thermal insulation and UV resistance enhance their suitability for use in energy-efficient constructions.

Speedy urbanization in the Middle East and Asia Pacific regions propels strong demand. Additionally, low-weight polycarbonate sheets reduce installation costs and transportation, making them more appealing for broad adoption in agricultural greenhouses and infrastructure. Advances in corrugated and multiwall sheets also aid their increasing utility.

Based on technology, the global polycarbonate market is segmented into extrusion and molding. The molding technology segment holds a dominating share of the market. It is broadly used in electronic housings, automotive components, consumer goods, and medical devices due to its efficiency, precision, and ability to produce diverse shapes.

The process aids high-volume production without compromising quality, which is vital for mass-market products. The growth of miniaturized electronics and lightweight automotive parts continues to drive demand for molded polycarbonate parts. Additionally, advancements in molding solutions, such as micro-injection and mini-shot molding, are expanding their application range across various sectors.

Based on application, the global market is segmented into automotive and transportation, electrical and electronics, construction, medical, and others. The electrical and electronics segment captured a maximum market share fueled by polycarbonate's outstanding heat resistance, dimensional stability, and electrical insulation. It is broadly used in laptop casings, battery enclosures, smartphone housings, switches, LED lighting systems, and connectors.

With the growing production of consumer electronics, the industry remains a key driver of polycarbonate demand. Additionally, the miniaturization of electronic devices and the surging demand for high-performance thermoplastics in IoT-based products and 5G infrastructure are fueling segmental growth.

Polycarbonate Market: Regional Analysis

North America to witness significant growth over the forecast period

North America holds a leading share of the global polycarbonate market among other regions, driven by strong demand from the automotive industry, significant investments in medical devices and healthcare, and an increasing number of construction projects.

North America, especially the United States, is home to leading automotive manufacturers such as Tesla, Ford, and GM, which widely utilize polycarbonate for lightweight components.

The U.S. alone produced over 10 million automotive units in 2023, demanding durable and impact-resistant components. The rising focus on electric vehicles also fuels demand for aerodynamic and battery enclosure parts.

Moreover, the United States leads in medical device manufacturing, with healthcare spending of over 16.8% of the GDP. Polycarbonate is broadly used in sterilizable containers, IV components, diagnostic centers, and surgical tools.

The region's post-pandemic focus on health systems and the aging population is expected to maintain consistent growth in polycarbonate for medical uses. Also, polycarbonate is heavily used in wall cladding, glazing, and roofing in energy-efficient buildings.

With current investments in public works and smart infrastructure, the demand for thermally insulated and durable materials is amplifying. Polycarbonate's UV resistance and lightweight nature make it an ideal choice for these applications.

The Asia Pacific is the second-largest region in the polycarbonate industry, driven by the rapidly progressing consumer electronics and electronics industries, infrastructure development, and urbanization, as well as cost benefits and large-scale manufacturing.

The Asia Pacific, mainly comprising South Korea, China, and Japan, is a global center for electronics manufacturing, producing over 60 percent of the world's consumer electronics. Polycarbonate is extensively used in laptop shells, LED lights, smartphone housings, and chargers. The regional industry benefits from large-scale export operations and strong domestic demand.

Additionally, significant infrastructure investments in countries such as Indonesia, China, and India drive demand for polycarbonate panels and sheets in roofing, noise barriers, and skylights. APAC also benefits from low labor and production costs, making it a global hub for polycarbonate fabrication and processing.

China contributed over 30 percent of the global polycarbonate production, with leading companies such as Mitsubishi Chemical and Teijin expanding their geographic scope. This competitive edge boosts its supply chain and export dominance.

Polycarbonate Market: Competitive Analysis

The key players profiled in the global polycarbonate market include:

- Covestro AG

- SABIC

- Teijin Limited

- Mitsubishi Engineering-Plastics Corporation

- LG Chem Ltd.

- Chi Mei Corporation

- Trinseo S.A.

- Lotte Chemical Corporation

- Formosa Chemicals & Fibre Corporation

- Samyang Corporation

- Asahi Kasei Corporation

- Röchling Group

- Plaskolite LLC

- PolyOne Corporation

- Entec Polymers

Polycarbonate Market: Key Market Trends

Growing use of bio-based and recycled polycarbonate:

Sustainability is a key priority, resulting in the development of renewable and recycled polycarbonate grades. Firms like SABIC and Covestro are launching ISCC-approved and bio-certified polycarbonates to decrease carbon footprints. Rising regulatory pressure in North America and Europe is driving the green transition in these industries.

Expansion of polycarbonate sheets in construction & building:

The demand for corrugated and multiwall polycarbonate sheets is rising in skylights, facades, protective barriers, and greenhouses. These sheets offer optimal light transmission, impact resistance, and UV protection, which are vital for modern architectural projects. Infrastructure spending in developing economies, such as those in Southeast Asia and India, is driving this progress.

The global polycarbonate market is segmented as follows:

By Product Type

- Films

- Blends

- Sheets

- Other

By Technology

- Extrusion

- Molding

By Application

- Automotive and Transportation

- Electrical and Electronics

- Construction

- Medical

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polycarbonate is a lightweight, strong, and transparent thermoplastic known for its excellent optical clarity and high impact resistance. It is widely used in various sectors, including electronic components, eyewear lenses, automotive parts, packaging, and construction materials, due to its heat resistance and durability.

The global polycarbonate market is projected to grow due to the expansion of the construction industry, increasing recycling and sustainability initiatives, and its extensive use in medical devices.

According to study, the global polycarbonate market size was worth around USD 25.74 billion in 2024 and is predicted to grow to around USD 40.11 billion by 2034.

The CAGR value of the polycarbonate market is expected to be around 5.70% during 2025-2034.

North America is expected to lead the global polycarbonate market during the forecast period.

The key players profiled in the global polycarbonate market include Covestro AG, SABIC, Teijin Limited, Mitsubishi Engineering-Plastics Corporation, LG Chem Ltd., Chi Mei Corporation, Trinseo S.A., Lotte Chemical Corporation, Formosa Chemicals & Fibre Corporation, Samyang Corporation, Asahi Kasei Corporation, Röchling Group, Plaskolite LLC, PolyOne Corporation, and Entec Polymers.

The report examines key aspects of the polycarbonate market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed