Photographic And Photocopying Equipment Market Size, Share, Trends, Growth 2034

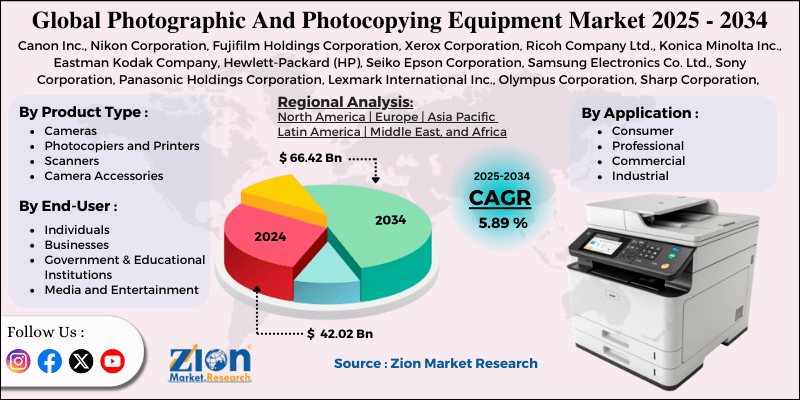

Photographic And Photocopying Equipment Market By Product Type (Cameras, Photocopiers and Printers, Scanners, Camera Accessories, and Others), By Application (Consumer, Professional, Commercial, Industrial), By End-User (Individuals, Businesses, Government and Educational Institutions, Media and Entertainment), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

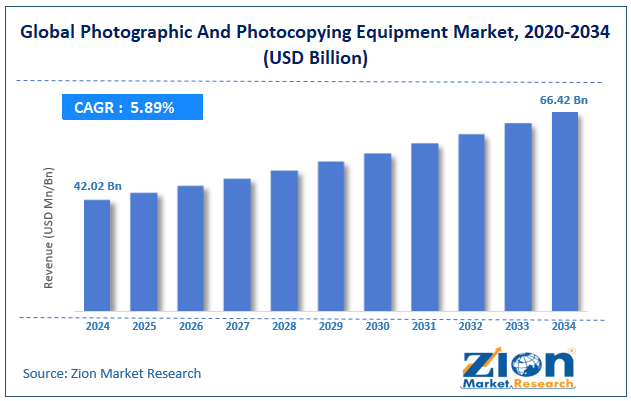

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.02 Billion | USD 66.42 Billion | 5.89% | 2024 |

Photographic And Photocopying Equipment Industry Perspective:

The global photographic and photocopying equipment market size was worth around USD 42.02 billion in 2024 and is predicted to grow to around USD 66.42 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.89% between 2025 and 2034.

Photographic And Photocopying Equipment Market: Overview

The photographic and photocopying equipment includes systems and devices used to capture, process, reproduce, and print documents and images. This comprises film processing machines, cameras, printers, photocopiers, and associated accessories. The demand for printing and photocopying solutions is growing notably with the rising replacement of traditional film with digital imaging. The global photographic and photocopying equipment market is poised for notable growth owing to the surging need for office automation, growing use of security systems and surveillance, and technological improvements in imaging. Educational institutions and corporates are investing in smart photocopying systems and multifunctional printers to reduce operational workload and improve document management.

Moreover, photographic equipment with improved sensors is broadly used in security systems. The rising global focus on private and public security has increased the demand for high-resolution imaging machines. Continuous modernizations, such as mirrorless DSLRs, high-speed scanning solutions, and AI-driven cameras, are fueling the demand. Features like real-time image processing and facial recognition attract modern machines.

Nevertheless, the global market faces limitations due to factors such as smartphone camera disruption and high maintenance and operational costs. High-quality smartphone cameras have significantly slowed consumer demand for digital cameras, especially point-and-shoot models, shrinking a segment of the industry. Moreover, printing and photocopying machines typically incur high maintenance, repair costs, and toner replacement, which can hinder mid-sized and small-sized businesses.

Still, the global photographic and photocopying equipment industry benefits from several favorable factors, including ML and AI integration, the move to cloud-based document management, and eco-friendly products. Embedding artificial intelligence in photographic tools and document imaging offers fresh user segments. The growing demand for storage and cloud printing solutions presents a significant opportunity for scanning and photocopying equipment that enables seamless cloud integration. Additionally, launching ecological cartridges, eco-friendly packaging, and energy-efficient copiers can help meet regulatory needs and cater to the growing demand for green solutions.

Key Insights:

- As per the analysis shared by our research analyst, the global photographic and photocopying equipment market is estimated to grow annually at a CAGR of around 5.89% over the forecast period (2025-2034)

- In terms of revenue, the global photographic and photocopying equipment market size was valued at around USD 42.02 billion in 2024 and is projected to reach USD 66.42 billion by 2034.

- The photographic and photocopying equipment market is projected to grow significantly owing to the growing adoption of multifunctional office equipment, heavy demand for office-home printing solutions, and increasing prominence of mirrorless and instant cameras.

- Based on product type, the photocopiers and printers segment is expected to lead the market, while the cameras segment is expected to grow considerably.

- Based on application, the commercial segment is the dominating segment, while the professional segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the business segment is expected to lead the market compared to the government and educational institutions segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Photographic And Photocopying Equipment Market: Growth Drivers

How is the escalating use of multifunctional photocopying equipment in offices boosting the photographic and photocopying equipment market?

Despite the digital shift, MFPs (multifunctional photocopying equipment) continue to experience demand in government, corporate, and educational sectors. These devices blend copying, scanning, faxing, and printing, offering space-saving and cost-efficiency advantages.

Canon launched its ‘imageRUNNER ADVANCE DX' line, aiming at large enterprises and SMEs in April 2025. These series feature workflow automation and cybersecurity. Such advancements help businesses simplify operations, achieve greater document management efficiency, and reduce operational costs, aiding the resilience of the photographic and photocopying equipment market.

The growth of online education tools and e-learning fuels the market growth

The growth of hybrid learning environments and online education platforms is adding to the rising demand for webcams, affordable photographic tools, and document copiers in academic institutions. Scanners and cameras are vital for preparing digital materials, online exams, tutorials, and lectures.

Leading companies like Brother and Epson have introduced budget-friendly educational equipment bundles that include projectors, wireless printers, and copiers with document camera facilities. This is majorly booming the academic segment in the worldwide market, mainly in Latin America and the Asia Pacific.

Photographic And Photocopying Equipment Market: Restraints

How is the shift to paperless workflows and digital documentation negatively impacting the photographic and photocopying equipment market?

The global inclination towards paperless environments in governmental and corporate sectors is decreasing the need for printing and photocopying equipment. With cloud platforms like Microsoft 365, Adobe Document Cloud, and Google Workspace becoming standard solutions, the need to physically reproduce documents has decreased.

This directly impacts the MFP and copier industry, especially in sectors like legal, finance, and education that were earlier dependent on printed documentation. Even government agencies are shifting to digitized records and e-filing systems, making the long-term demand for this equipment unclear.

Photographic And Photocopying Equipment Market: Opportunities

How is the growth in drone photography and aerial imaging opportunistic to the photographic and photocopying equipment market?

The speedy adoption of drones in aerial imaging, used in agriculture, real estate, disaster management, and cinematography, is propelling the demand for compatible and high-resolution cameras. This offers fresh growth avenues for camera lens image sensors developers and lens makers, driving the photographic and photocopying equipment industry.

Hasselblad and DJI introduced a new line of medium-format camera drones designed for high-end photography and industrial inspections in 2025. The rising demand from recreational users and enterprises offers strong growth for companies producing high-resolution, lightweight, and durable imaging modules.

Photographic And Photocopying Equipment Market: Challenges

Challenges in consumer retention due to fast innovation cycles limit the market growth

With rapid advancements in imaging technologies, companies face a consistent challenge in managing excess inventory, product lifecycle, and customer dissatisfaction due to quick obsolescence. Users expect recurrent upgrades, such as improvements in frame rate, sensor quality, or connectivity, even before they have fully utilized the current models.

Therefore, companies usually end up introducing incremental enhancements that fail to build excitement, while bearing high research and development and marketing costs. This results in weak repeat sales and brand switching in B2B and B2C segments, increasing challenges for consumer retention.

Photographic And Photocopying Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Photographic And Photocopying Equipment Market |

| Market Size in 2024 | USD 42.02 Billion |

| Market Forecast in 2034 | USD 66.42 Billion |

| Growth Rate | CAGR of 5.89% |

| Number of Pages | 212 |

| Key Companies Covered | Canon Inc., Nikon Corporation, Fujifilm Holdings Corporation, Xerox Corporation, Ricoh Company Ltd., Konica Minolta Inc., Eastman Kodak Company, Hewlett-Packard (HP), Seiko Epson Corporation, Samsung Electronics Co. Ltd., Sony Corporation, Panasonic Holdings Corporation, Lexmark International Inc., Olympus Corporation, Sharp Corporation, and others. |

| Segments Covered | By Product Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Photographic And Photocopying Equipment Market: Segmentation

The global photographic and photocopying equipment market is segmented based on product type, application, end-user, and region.

Based on product type, the global photographic and photocopying equipment industry is divided into cameras, photocopiers and printers, scanners, camera accessories, and others. The photocopiers and printers segment registered a maximum market share because of broader use in educational institutions, government organizations, and corporate offices. The demand for multifunctional printers, which incorporate copying, faxing, printing, and scanning, remains high in the emerging and developed nations. The vital role of automation and document handling fuels the segmental dominance.

Based on application, the global photographic and photocopying equipment market is segmented into consumer, professional, commercial, and industrial. The commercial segment holds leadership in the market owing to the vital role that multifunctional printers, photocopiers, and scanners play in daily business operations. Educational institutions, offices, service centers, and government agencies heavily depend on these devices for record keeping, document printing, administrative workflows, and bulk photocopying. The commercial segment holds dominance mainly due to the move towards digital record management, improving efficacy and productivity.

Based on end-user, the global market is segmented as individuals, businesses, government and educational institutions, and media and entertainment. The businesses segment captures a remarkable market share since they extensively use printers, photocopiers, and scanners for regular document processing, reporting, contract printing, and communications. The broader adoption of multifunctional devices in co-working spaces, SMEs, and corporate offices improves productivity, workflow automation, and document security. Businesses also adopt improved imaging tools for design, marketing, and operational use, making them the most convenient and most extensive consumer base in the industry.

Photographic And Photocopying Equipment Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Photographic and Photocopying Equipment Market?

Asia Pacific is projected to maintain its dominant position in the global photographic and photocopying equipment market owing to the presence of key manufacturing hubs, expanding industrial and commercial base, and growing professional and consumer photography base. Asia Pacific holds leadership as it houses major manufacturing companies like Fujifilm, Ricoh, Epson, Sony, and Canon, all based in Japan, South Korea, and China. These nations offer advanced R&D competencies and large-scale production capacities.

According to IDC, more than 60% of the global copier and printer shipments in 2024 were from APAC. The rapid industrialization and growth of corporates and SMEs in India, China, and Southeast Asia have significantly driven the demand for imaging and photocopier systems. Digitalization, office automation, and rising corporate presence have burgeoned the sales of multifunctional printers. In 2024, the region registered for more than 35% of the worldwide MFP demand, as per Statista.

Moreover, APAC houses a broader base of hobbyist and professional photographers, with growing interest boosted by e-commerce and social media. Nations like South Korea, China, and Japan hold leadership in camera consumption and advancements. More than 45% of worldwide digital camera sales were registered from APAC in 2024, according to CIPA.

North America maintains its position as the second-leading region in the global photographic and photocopying equipment industry due to surging demand from industrial and corporate users, growth of home and work office printing, and advanced adoption of content creation and digital imaging. North America experiences robust demand for multifunctional printers, scanners, and copiers in universities, corporate offices, and public institutions. Canadian and the U.S. corporates prioritize cloud integration, productivity, and document security.

In 2024, North America registered approximately 20% of the worldwide office printing equipment sales, according to IDC. The remote and hybrid trend in the region has prompted surging demand for wireless, compact, and smart printing solutions for home offices. Consumers are looking for mobile scanning, printing, and cloud storage compatibility.

Furthermore, North America, especially the United States, has a flourishing industry for digital photography, professional content creation, and vlogging. The demand for mirrorless systems, high-class cameras, and editing hardware continues to fuel the regional dominance.

Photographic And Photocopying Equipment Market: Competitive Analysis

The leading players in the global photographic and photocopying equipment market are:

- Canon Inc.

- Nikon Corporation

- Fujifilm Holdings Corporation

- Xerox Corporation

- Ricoh Company Ltd.

- Konica Minolta Inc.

- Eastman Kodak Company

- Hewlett-Packard (HP)

- Seiko Epson Corporation

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Panasonic Holdings Corporation

- Lexmark International Inc.

- Olympus Corporation

- Sharp Corporation

Photographic And Photocopying Equipment Market: Key Market Trends

Shift toward cloud-connected and smart devices:

There is a surging adoption of smart copiers and printers with cloud integration, wireless connectivity, and mobile printing. These devices improve document security, remote work productivity, and workflow automation. In 2024, more than 48% of new printers sold worldwide supported cloud-driven management systems, according to IDC.

Progress of eco-friendly printing solutions:

Environmental concerns are fueling the demand for energy-saving devices, low-emission printing solutions, and recycled cartridges. Manufacturers are introducing green-certified products to comply with sustainability objectives. In 2024, more than 30% of European printing equipment sales were environmentally certified, according to the European Commission.

The global photographic and photocopying equipment market is segmented as follows:

By Product Type

- Cameras

- Photocopiers and Printers

- Scanners

- Camera Accessories

- Others

By Application

- Consumer

- Professional

- Commercial

- Industrial

By End-User

- Individuals

- Businesses

- Government and Educational Institutions

- Media and Entertainment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The photographic and photocopying equipment includes systems and devices used to capture, process, reproduce, and print documents and images. This comprises film processing machines, cameras, printers, photocopiers, and associated accessories. The demand for printing and photocopying solutions is growing notably with the rising replacement of traditional film with digital imaging.

The global photographic and photocopying equipment market is projected to grow due to the growth of social media and e-commerce sectors, improvements in lenses and image sensors, and the increasing proliferation of content creation and professional photography.

According to study, the global photographic and photocopying equipment market size was worth around USD 42.02 billion in 2024 and is predicted to grow to around USD 66.42 billion by 2034.

The CAGR value of the photographic and photocopying equipment market is expected to be around 5.89% during 2025-2034.

Asia Pacific is expected to lead the global photographic and photocopying equipment market during the forecast period.

The key players profiled in the global photographic and photocopying equipment market include Canon Inc., Nikon Corporation, Fujifilm Holdings Corporation, Xerox Corporation, Ricoh Company, Ltd., Konica Minolta, Inc., Eastman Kodak Company, Hewlett-Packard (HP), Seiko Epson Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Panasonic Holdings Corporation, Lexmark International, Inc., Olympus Corporation, and Sharp Corporation.

The photographic and photocopying equipment market faces challenges from rapid smartphone camera developments, which are reducing demand for traditional cameras. Moreover, declining usage of paper-based photocopying and high equipment costs hinder market growth.

By 2034, the commercial segment is expected to dominate the photographic and photocopying equipment market due to sustained demand from media, advertising, and professional photography sectors. Its reliance on high-performance equipment drives upgrades and consistent investment.

Macroeconomic factors, such as fluctuating exchange rates and inflation, may increase import costs and production, affecting equipment pricing. Furthermore, global economic slowdowns may reduce business and consumer spending on non-essential imaging solutions.

The report examines key aspects of the photographic and photocopying equipment market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

Photographic And Photocopying EquipmentIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisCompetitive AnalysisKey Market TrendsThe global photographic and photocopying equipment market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed