Global Philippines Warehousing Market Size, Share, Growth Analysis Report - Forecast 2034

Philippines Warehousing Market By Type (General Warehousing, Container Freight, Cold Storage, Agriculture, Others), By End User (Food and Beverages, Chemicals and Materials, Electronics, Pharmaceutical, Consumer Durables, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

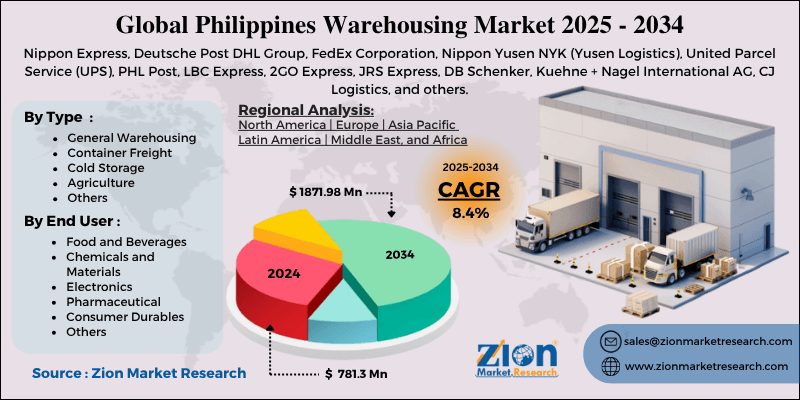

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 781.3 Million | USD 1871.98 Million | 8.4% | 2024 |

Philippines Warehousing Market: Industry Perspective

The global philippines warehousing market size was worth around USD 781.3 Million in 2024 and is predicted to grow to around USD 1871.98 Million by 2034 with a compound annual growth rate (CAGR) of roughly 8.4% between 2025 and 2034. The report analyzes the global philippines warehousing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the philippines warehousing industry.

Philippines Warehousing Market: Overview

The act of purchasing products from a manufacturer and holding them in a warehouse until satisfying orders is known as warehousing. Before distribution, any products must be organized and managed as part of the warehousing process. Companies can keep their products in a warehouse, a storage unit, or, in the case of small firms, in the basement or garage of a residential property.

Key Insights

- As per the analysis shared by our research analyst, the global philippines warehousing market is estimated to grow annually at a CAGR of around 8.4% over the forecast period (2025-2034).

- Regarding revenue, the global philippines warehousing market size was valued at around USD 781.3 Million in 2024 and is projected to reach USD 1871.98 Million by 2034.

- The philippines warehousing market is projected to grow at a significant rate due to rising e-commerce growth, increasing demand for cold storage, expansion of manufacturing and logistics sectors, and government infrastructure investments.

- Based on Type, the General Warehousing segment is expected to lead the global market.

- On the basis of End User, the Food and Beverages segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Philippines Warehousing Market: Growth Drivers

Growth in e-commerce drives market growth

The Lazada Group predicts that the Philippine e-commerce sector will expand more quickly than its regional rivals. Despite the global economic downturn and rising costs, Lazada anticipates that e-commerce will grow "a lot higher" in the Philippines and the rest of Southeast Asia over the next five to ten years as these nations recover from the epidemic. In recent years, the Philippines' e-commerce market has grown. Because of the pandemic, e-commerce in the nation increased as people stayed at home out of fear of coming into contact with disease-carrying agents. This trend will persist given the rise in new online shoppers and the number of online merchants in the nation. The Department of Trade and Industry reports that there were 1,700 online merchants in the Philippines in March 2020 and 93,318 in January 2021. Thus, this is expected to drive the Philippines warehousing market growth over the forecast period.

Philippines Warehousing Market: Restraints

High initial costs hinder market growth

For the establishment of a fully functional warehouse (cold warehouse) unit, the cold-storage warehouses require several investments connected to refrigeration systems, racking systems, security systems, pelleting capacity, refrigerated vehicles, etc. These numerous needs result in a very hefty initial investment. Manufacturers are reluctant to engage in this industry, even after expecting excellent returns in the future. The Philippines warehousing industry may suffer as a result of the expensive initial set cost.

Philippines Warehousing Market: Opportunities

Rising demand for frozen and convenience food offers a lucrative opportunity for market growth

Growing millennial consumption of frozen meals like nuggets, fries, and patties has been a major market growth driver. The country's working population is converting to frozen meals and snacks. Due to their busy lifestyles, customers are looking for replacements that are quick to prepare and convenient to eat at any time. More people than ever are eating frozen and convenience foods, which increases the need for the storage facilities needed to keep these goods' quality and shelf life. Additionally, the industry's growing need for these goods will drive up demand for warehouse space. Thus, the growing demand for frozen and convenience food is expected to offer a lucrative opportunity for Philippines warehousing market growth.

Philippines Warehousing Market: Challenges

Lack of infrastructure poses a major challenge to market growth

The Philippines warehousing industry’s infrastructural facilities do not meet the most modern requirements. Just two of the several issues organizations face are inadequate storage options and frequent power interruptions. Additionally, many vehicles lack the tools needed to retain perishables at the proper temperatures for last-mile deliveries. Sometimes, the production efficiency of the farms might be decreased by their remote locations. With these inadequate infrastructural facilities, the market's expansion might be impeded.

Philippines Warehousing Market: Segmentation

The Philippines Warehousing Market is segmented based on type, end-user, and region.

Based on the Type, the Philippines warehouse market is bifurcated into general warehousing, container freight, cold storage, agriculture, and others. The cold storage segment is expected to hold a significant market share over the forecast period. The growing food sector in the Philippines, which produces both frozen and processed goods, is one of the main factors driving the cold storage market. Demand for premium frozen goods rises as customer preferences change. Furthermore, to maintain the quality of agricultural and fisheries products for export markets, cold storage facilities are crucial. Many perishable products are exported from the Philippines, therefore having reliable cold storage is essential to upholding global standards. Thereby, driving the market growth.

Based on the End User, the Philippines Warehousing industry is bifurcated into food & beverages, chemicals and materials, electronics, pharmaceuticals, consumer durables, and others. The food & beverage’s segment is expected to dominate the market over the forecast period. The Philippines has a diverse food and beverage industry, covering various segments such as fresh produce, processed foods, dairy products, beverages (including alcoholic and non-alcoholic), and snacks. Each of these segments requires specific storage and handling conditions. Therefore, this propels the segment expansion.

Philippines Warehousing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Philippines Warehousing Market |

| Market Size in 2024 | USD 781.3 Million |

| Market Forecast in 2034 | USD 1871.98 Million |

| Growth Rate | CAGR of 8.4% |

| Number of Pages | 218 |

| Key Companies Covered | Nippon Express, Deutsche Post DHL Group, FedEx Corporation, Nippon Yusen NYK (Yusen Logistics), United Parcel Service (UPS), PHL Post, LBC Express, 2GO Express, JRS Express, DB Schenker, Kuehne + Nagel International AG, CJ Logistics, and others. |

| Segments Covered | By Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Philippines Warehousing Market: Region Analysis

Cebu is expected to capture a significant market share over the forecast period

Cebu is expected to capture a significant market share over the forecast period. As a key hub for trade and business within the Visayas area and a gateway to other regions of the Philippines, Cebu is an island strategically placed in the country's center. It is a desirable site for distribution and storage operations due to its advantageous position. Moreover, there are industrial and economic zones in the area, such as the Mactan Economic Zone and the Cebu Light Industrial Park, which support and incentivize manufacturing and warehousing businesses. These areas are intended to draw investors and companies. Furthermore, the Philippines' e-commerce boom is having an impact on Cebu's warehouse sector as well. Businesses need effective storage solutions to keep up with the growing number of online buyers and the need for prompt deliveries. Thus, this is expected to drive the Philippines warehousing market growth in the area.

Philippines Warehousing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the philippines warehousing market on a global and regional basis.

The global philippines warehousing market is dominated by players like:

- Nippon Express

- Deutsche Post DHL Group

- FedEx Corporation

- Nippon Yusen NYK (Yusen Logistics)

- United Parcel Service (UPS)

- PHL Post

- LBC Express

- 2GO Express

- JRS Express

- DB Schenker

- Kuehne + Nagel International AG

- CJ Logistics

The global philippines warehousing market is segmented as follows;

By Type

- General Warehousing

- Container Freight

- Cold Storage

- Agriculture

- Others

By End User

- Food and Beverages

- Chemicals and Materials

- Electronics

- Pharmaceutical

- Consumer Durables

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The act of purchasing products from a manufacturer and holding them in a warehouse until satisfying orders is known as warehousing. Before distribution, any products must be organized and managed as part of the warehousing process. Companies can keep their products in a warehouse, a storage unit, or, in the case of small firms, in the basement or garage of a residential property.

The global philippines warehousing market is expected to grow due to increasing domestic consumption and international trade, government initiatives in infrastructure development, growing manufacturing sector, and the adoption of advanced warehousing technologies for supply chain optimization.

According to a study, the global philippines warehousing market size was worth around USD 781.3 Million in 2024 and is expected to reach USD 1871.98 Million by 2034.

The global philippines warehousing market is expected to grow at a CAGR of 8.4% during the forecast period.

Asia-Pacific is expected to dominate the philippines warehousing market over the forecast period.

Leading players in the global philippines warehousing market include Nippon Express, Deutsche Post DHL Group, FedEx Corporation, Nippon Yusen NYK (Yusen Logistics), United Parcel Service (UPS), PHL Post, LBC Express, 2GO Express, JRS Express, DB Schenker, Kuehne + Nagel International AG, CJ Logistics, among others.

The report explores crucial aspects of the philippines warehousing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed