Global Pet Insurance Market Size, Share, Growth Analysis Report - Forecast 2034

Pet Insurance Market By Coverage (Accident & Illness, Accident Only, Chronic Conditions, Other Policies), By Animal (Dogs, Cats, Other Animals), Provider (Public, Private), Sales Channel (Direct, Agency, Broker), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.40 Billion | USD 97.12 Billion | 18.1% | 2024 |

Pet Insurance Market: Industry Perspective

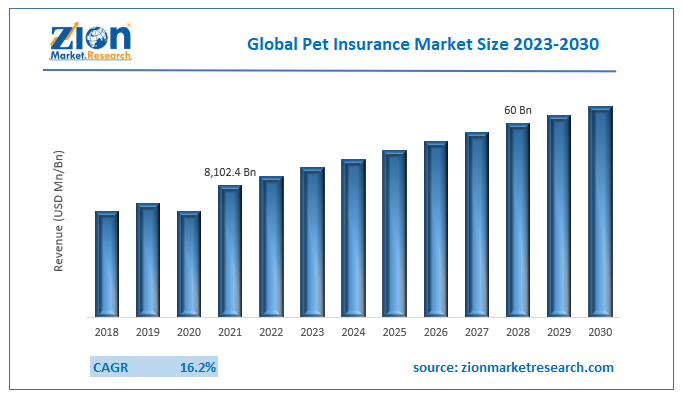

The global pet insurance market size was worth around USD 18.40 Billion in 2024 and is predicted to grow to around USD 97.12 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 18.1% between 2025 and 2034.

The report analyzes the global pet insurance market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pet insurance industry.

Pet Insurance Market: Overview

Pet insurance is a pet owner's coverage that helps lower the costs of costly medical bills. Pet insurance typically pays for treating an insured owner's wounded or sick animal. It is also compensated when the animal dies, goes missing, or is stolen. Pet insurance policies primarily cover dogs, cats, and horses, while coverage for more exotic animals is available. For accident and illness policies, the average insurance cost for dogs is more than for cats. Some insurance includes routine care, general exams, preventative treatment, teeth cleaning & de-worming, and immunizations.

Growing pet adoption and the increasing prevalence of feline and dog-related disorders are important drivers in this industry. Innovative insurance policies that cover pets of all ages, as well as multi-pet insurance policies that comprise numerous pets in a single plan, attract many consumers. By taking such measures, private firms might increase their market share in the pet health insurance industry.

Demand for pet insurance to assist in minimizing out-of-pocket expenses on important medical problems, including cancer & accidental injuries, is expected to drive development. However, concerns such as a lack of standardized pet health categories for reimbursement, risks for pet insurance businesses, a barrier to entrance, significant competition, and a lack of understanding regarding pet insurance are all factors that constrict the market growth.

Key Insights

- As per the analysis shared by our research analyst, the global pet insurance market is estimated to grow annually at a CAGR of around 18.1% over the forecast period (2025-2034).

- Regarding revenue, the global pet insurance market size was valued at around USD 18.40 Billion in 2024 and is projected to reach USD 97.12 Billion by 2034.

- The pet insurance market is projected to grow at a significant rate due to increasing pet ownership, rising veterinary costs, growing awareness of pet health, and expansion of coverage options by insurers.

- Based on Coverage, the Accident & Illness segment is expected to lead the global market.

- On the basis of Animal, the Dogs segment is growing at a high rate and will continue to dominate the global market.

- Based on the Provider, the Public segment is projected to swipe the largest market share.

- By Sales Channel, the Direct segment is expected to dominate the global market.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

Pet Insurance Market: Growth Drivers

An increasing number of pet adoption is likely to pave the way for global market growth

Increased pet adoption for companionship is anticipated to promote industry expansion. The market for pet insurance is expanding as people become more concerned about the health of animals. As the trend has changed from being pet owners to pet parents, pets are increasingly adopted for companionship and are frequently thought of as family members.

Adopting a pet is also thought to help with sadness, loneliness, and low blood pressure, among other things. Additionally, the industry landscape is anticipated to be much improved by the growing awareness around pet insurance programs as a result of a substantial effort by insurance providers.

Pet Insurance Market: Restraints

Lack of awareness about pet insurance policies may hamper the global market growth

The growth of the global pet insurance market may be hampered by the developing regions' low level of awareness about pet insurance plans and services. Compared to their industrialized counterparts, the income per capita in developing countries is comparatively low.

An additional element hindering the market data is a lack of knowledge about numerous infectious and zoonotic diseases. Additionally, there are fewer private veterinarians and veterinary facilities in poorer nations, thus, pet insurance is not seen as a top priority.

Pet Insurance Market: Opportunities

Key players offering novel pet insurance policies and concessions to bring up several growth opportunities

Another significant element boosting the global pet insurance market expansion is the rise in the number of businesses operating in the sector. New policy schemes for pets have been introduced as a result of increased player competition to establish a firm presence in the market.

For instance, several businesses provide multi-pet insurance policies, which allow for the enrollment of numerous pets under a single policy. Various other providers are also providing discounts and deals in their pet insurance plans to keep customers and boost the market growth.

Pet Insurance Market: Segmentation Analysis

The global pet insurance market is segregated on the basis of policy coverage, animal type, sales channel, and region.

By policy coverage, the market is segmented into accident & illness, accident only, and others. Among these, the accident & illness segment dominates the market and accounted for the revenue share of 84.0% in 2021. High veterinarian treatment & diagnostic expenses, an increase in the number of companion animals, and more knowledge of pet insurance are the main drivers of this expansion. Pet insurance providers most frequently provide accident and illness coverage. This offers coverage for a range of issues, including drugs, diagnostic procedures, acute & chronic illnesses, and more. The segment is anticipated to develop at the quickest rate in the coming years since accident and illness policies offer comprehensive coverage to pet owners.

Based on sales channels, the market is divided into brokers, agencies and others. Over the forecast period, the agency segment is expected to develop at the fastest rate.

By animal type, the market is divided into dogs, cats, and others. Among these, the dog's segment dominates the market and accounted for a revenue share of 50% in 2021. Growing pet adoption, the development of insurance companies' service offerings, and rising disposable income in important areas are the main drivers of this share. In addition, the future market expansion is anticipated to be fueled by the rising number of pet dogs in the area as well as the availability of different insurance policies to accommodate varied pet demands. Therefore, it is anticipated that the expansion of the pet insurance market will benefit the nations where the dog population is higher than that of other companion animals.

Pet Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pet Insurance Market |

| Market Size in 2024 | USD 18.40 Billion |

| Market Forecast in 2034 | USD 97.12 Billion |

| Growth Rate | CAGR of 18.1% |

| Number of Pages | 206 |

| Key Companies Covered | Trupanion Inc., Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Jab Holding Company, Direct Line, Lassie, Getsafe GmbH, Waggel Limited, Feather Insurance, Napo Limited, and others. |

| Segments Covered | By Coverage, By Animal, By Provider, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In February 2021, Nationwide Pet Rx Express will be developed in conjunction with Walmart, an American multinational retailer. Due to the strategic relationship, customers of Nationwide will be able to complete their pet's prescriptions at Walmart's 4,700 pharmacies.

- In 2021, the Pet Insurance Guide will be published by PetDesk. Pet parents may quickly request and buy pet insurance plans thanks to a feature of the PetDesk app. Users of the app may now access the pet insurance guide, which offers a new option for pet owners to quickly find and compare pet insurance policies.

Pet Insurance Market: Regional Landscape

Rising pet adoption is likely to help North America dominate the global market

North America is expected to dominate the global pet insurance market during the forecast period. The market is expected to thrive as pet insurance penetration rates rise in the United States and Canada. However, the subscriber base of pet insurance in the United States is less than 2%, but with the recent surge in pet adoption, the United States is expected to hold substantial shares during the forecast period. Furthermore, key players in the pet insurance sector have a strong presence in the North American market, which boosts revenue growth. Another important factor driving the North American market is the growing trend of adopting exotic pets such as bearded dragons, fennec foxes, and wallabies in the United States and Canada.

Over the forecast period, the Asia Pacific regional market is expected to grow significantly in the pet insurance market Owing to increased growth resulting from owners' growing care for the well-being of their pets. Additionally, there has been a change in how people respect their pets as family members worldwide. As a result, the market in the Asia Pacific is primarily driven by rising concerns along with rising disposable income in these nations. Furthermore, the increasing number of large companies entering the undeveloped market in the Asia Pacific region will fuel the expansion of the pet insurance market.

Pet Insurance Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the pet insurance market on a global and regional basis.

The global pet insurance market is dominated by players like:

- Trupanion Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Jab Holding Company

- Direct Line

- Lassie

- Getsafe GmbH

- Waggel Limited

- Feather Insurance

- Napo Limited

The global pet insurance market is segmented as follows;

By Coverage

- Accident & Illness

- Accident Only

- Chronic Conditions

- Other Policies

By Animal

- Dogs

- Cats

- Other Animals

By Provider

- Public

- Private

By Sales Channel

- Direct

- Agency

- Broker

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global pet insurance market is expected to grow due to rising pet ownership, increasing veterinary costs, and growing awareness of pet healthcare coverage.

According to a study, the global pet insurance market size was worth around USD 18.40 Billion in 2024 and is expected to reach USD 97.12 Billion by 2034.

The global pet insurance market is expected to grow at a CAGR of 18.1% during the forecast period.

Europe is expected to dominate the pet insurance market over the forecast period.

Leading players in the global pet insurance market include Trupanion Inc., Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Jab Holding Company, Direct Line, Lassie, Getsafe GmbH, Waggel Limited, Feather Insurance, Napo Limited, among others.

The report explores crucial aspects of the pet insurance market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed