Payday Loan Market Size, Share, Growth, Industry Analysis 2034

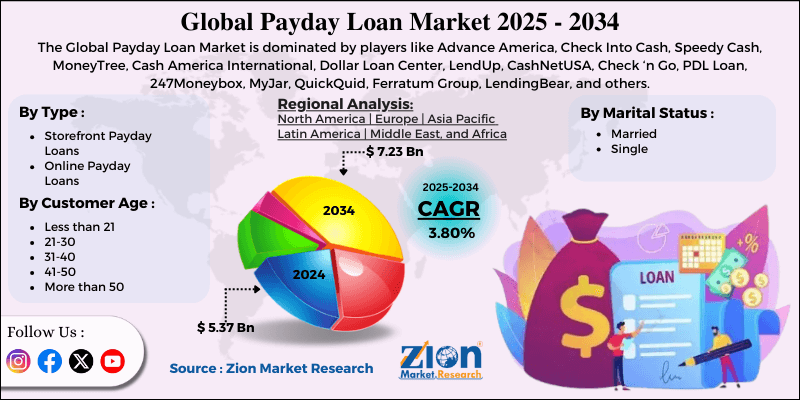

Payday Loan Market By Type (Storefront Payday Loans, Online Payday Loans), By Marital Status (Married, Single), By Customer Age (Less than 21, 21-30, 31-40, 41-50, More than 50), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

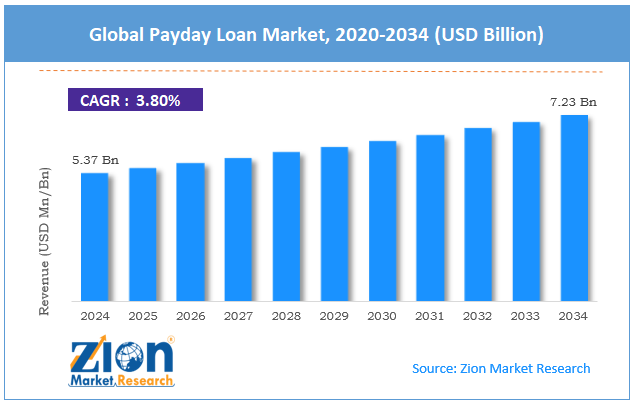

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.37 Billion | USD 7.23 Billion | 3.80% | 2024 |

Payday Loan Industry Perspective:

The global payday loan market size was worth around USD 5.37 billion in 2024 and is predicted to grow to around USD 7.23 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.80% between 2025 and 2034.

Payday Loan Market: Overview

The payday loan offers short-term and high-interest credit, usually intended for borrowers requiring immediate cash before their upcoming paycheck. These loans are generally small in amount but carry higher interest rates than customary credit, making them overpriced if not promptly paid. The global payday loan market is poised for notable growth owing to the growing financial emergencies, the development of online lending platforms, and the rising number of underbanked and unbanked populations. Unexpected expenditures, such as utility payments, vehicle repairs, and medical bills, are driving consumers toward payday loans for quick cash. Several households lack emergency savings, resulting in surging dependency on these services. The speed and convenience of approval further propel this demand.

Moreover, the digitalization of financial services has made payday loans 24/7 accessible via websites and mobile applications. Instant transfers and an automated verification process attract the tech-savvy consumers. This convenience is increasing the consumer base, mainly among the younger demographics. Furthermore, millions of users still lack access to traditional banking facilities, especially in emerging regions. Payday lenders fill this gap by offering credit without exhaustive documentation. This trend is particularly pronounced in markets with a weak banking ecosystem.

Nevertheless, the global market faces limitations due to factors such as high interest rates and stringent government norms. Payday loans generally carry APRs surpassing 300%, building a heavy repayment pressure. This leads to a debt cycle for several borrowers who need re-borrowing services to cover their past loans. These costs drive criticism and regulatory restrictions.

Also, several economies have imposed caps on interest rates, borrowing frequency, and repayment limits. While these protect borrowers, they also reduce lender profitability. Regulatory uncertainty increases risk for industry expansion. Still, the global payday loan industry benefits from several favorable factors, including the integration of ML and AI, as well as associations with fintech platforms. Advanced credit scoring models with artificial intelligence can better assess borrowers' risks, decreasing defaults. Automation also reduces operational costs, aiding more competitive loan offerings.

In addition, associating with mobile wallet providers, BNPL platforms, and e-commerce companies can create fresh borrower channels. These alliances improve trust and visibility. Launching more flexible repayment timelines can attract users who fear lump-sum repayment. This may also enhance customer loyalty and repayment rates.

Key Insights:

- As per the analysis shared by our research analyst, the global payday loan market is estimated to grow annually at a CAGR of around 3.80% over the forecast period (2025-2034)

- In terms of revenue, the global payday loan market size was valued at around USD 5.37 billion in 2024 and is projected to reach USD 7.23 billion by 2034.

- The payday loan market is projected to grow significantly due to increasing emergency expenses, faster loan disbursement, and flexible approval requirements.

- Based on type, the storefront payday loans segment is expected to lead the market, while the online payday loans segment is expected to grow considerably.

- Based on marital status, the single segment is the dominating segment, while the married segment is projected to witness sizeable revenue over the forecast period.

- Based on customer age, the 21-30 segment is expected to lead the market compared to the 31-40 segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Payday Loan Market: Growth Drivers

How is digitization remarkably driving the global payday loan market?

The payday loan market’s inclination has reduced acquisition costs and increased geographic reach. Several new applications in different developed markets are now initiated on smartphones, with same-day funding and instant decisioning becoming table stakes. This UX parity with BNPL and fintech wallets preserves relevance among younger and mobile-first borrowers.

Alternative data, including bank transaction analytics, utility/telecom histories, and payroll/shift data histories, enables lenders to underwrite below the conventional FICO frontier. While outcomes differ by model quality, lenders report better risk sorting and higher approval rates when assimilating bank-connect data with income volatility metrics, which materially benefits short-term loans.

How does distribution scale fuel the worldwide payday loan market?

In the UK and the U.S., entrenched brands with large storefront networks will experience steady walk-in traffic from repeat borrowers who favor in-person service, money services, or cash pickup. Storefront density correlates with originations in permission states, and post-pandemic re-openings restored a channel that had shifted online, temporarily.

Concurrently, national online leaders have scaled repeat-borrower programs and effective marketing funnels, increasing (LTV) lifetime value through cross-sell (lines of credit, check cashing, transfers, and installment loans). The interplay of national digital reach and local presence creates resilience; when one channel softens, the other usually cushions volume.

Payday Loan Market: Restraints

How do credit risk volatility and high default rates hamper the payday loan market's progress?

The payday loan segment operates in the high-risk borrower domain, where default rates can be nearly four times higher than prime credit products for consumers. Economic shocks, such as inflationary cost spikes, job loss, or unexpected medical expenses, can lead to a rapid decline in repayment performance.

Payday lenders price risk into high fees, but competitive pressures or caps may crush margins without decreasing inherent borrower volatility. Growing defaults elevate charge-off rates and collection costs, thus undermining profitability.

Payday Loan Market: Opportunities

Product diversification beyond traditional payday loans offers favorable prospects for market growth

With APR caps and growing competition, payday lenders are expanding their operations to comply with local regulations while still serving quick cash needs. Common pivots comprise small investment loans, rotating credit lines, and hybrid earned-wage-access models. This diversification reduces dependency on one high-margin but high-risk product and creates cross-selling prospects, impacting the global payday loan industry.

For instance, hybrid products can allow repayment in multiple installments instead of a single lump sum, reducing default risk and enhancing affordability. In jurisdictions with stringent cost caps, spreading the cost over a longer term makes a loan a feasible option while still offering quick funding and approval.

Payday Loan Market: Challenges

Growing competition from fintech alternatives limits the market growth

Payday lenders are now facing intense competition from BNPL services, earned wage access platforms, and low-cost credit union microloans. BNPL has become highly prominent in retail transactions, with a worldwide transaction volume surpassing USD 300 billion in 2023, appealing to the younger demographics who may otherwise switch to payday loans for smaller expenses.

EWA platforms, offered via gig apps and employers, offer access to earned wages without the stigma of payday borrowing and with fewer fees. These alternate options are increasing rapidly, backed by corporate associations that payday lenders find challenging to match.

Payday Loan Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Payday Loan Market |

| Market Size in 2024 | USD 5.37 Billion |

| Market Forecast in 2034 | USD 7.23 Billion |

| Growth Rate | CAGR of 3.80% |

| Number of Pages | 215 |

| Key Companies Covered | Advance America, Check Into Cash, Speedy Cash, MoneyTree, Cash America International, Dollar Loan Center, LendUp, CashNetUSA, Check ‘n Go, PDL Loan, 247Moneybox, MyJar, QuickQuid, Ferratum Group, LendingBear, and others. |

| Segments Covered | By Type, By Marital Status, By Customer Age, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Payday Loan Market: Segmentation

The global payday loan market is segmented based on type, marital status, customer age, and region.

Based on type, the global payday loan industry is divided into storefront payday loans and online payday loans. By type, the storefront payday loans segment accounted for a larger market share due to its mature presence in the rural and urban areas. Several borrowers still choose face-to-face transactions for transparency, trust, and instant cash disbursement. Storefronts also satisfy customers without reliable internet access, which is still a key barrier in many regions. Their local marketing and physical viability further strengthen retention rates and customer acquisition.

Based on marital status, the global payday loan market is segmented into married and single individuals. The single segment dominates the market, primarily due to their reliance on a single income source, which leaves them highly vulnerable financially. Without the financial support of a partner, single borrowers are more likely to choose payday loans to bridge income gaps and unexpected expenses. This group also tends to have lesser savings or shared access, increasing the preference towards payday loans. Additionally, lifestyle factors such as managing all expenses alone or living alone can increase dependency on such loans.

Based on customer age, the global market is segmented into the following categories: less than 21, 21-30, 31-40, 41-50, and more than 50. The 21-30 segment holds a dominating share because of their entry-level incomes, limited savings, and high propensity for lifestyle-related spending. A majority of this group are early in their careers or recent graduates experiencing student loans, daily living costs, or rent without central financial reserves. They are also more digitally engaged, increasing the preference for online payday lending platforms. This age segment's openness to alternative finance solutions with quick borrowing fuels its leadership in the industry.

Payday Loan Market: Regional Analysis

Why does North America hold a dominant position in the global Payday Loan Market?

North America is projected to maintain its dominant position in the global payday loan market due to high demand driven by financial instability, developed lending ecosystems, and intense penetration of online payday lending. A significant share of the North American population lives paycheck-to-paycheck, creating robust demand for short-term credit. In the United States, nearly 61% of adults reported in 2023 that they could not manage a USD 1,000 emergency expense without borrowing. This financial vulnerability propels the payday loan sector as a quick solution for emergency needs. North America holds a sophisticated payday lending infrastructure, with abundant licensed and well-established online platforms. The United States alone has more than 20,000 payday loan outlets, promising easy accessibility.

The integration of digital and physical channels expands consumer reach across various demographics. High smartphone adoption and internet penetration have amplified online payday loan transactions. In 2024, more than 92% of the United States households had internet access, allowing a faster approval process and application. The tech-savvy population is highly inclined to use websites and mobile apps for instant liquidity needs.

Europe maintains its position as the second-leading region in the global payday loan industry due to the growing short-term credit demand, growth of digital payday lending, and presence of a strong alternative finance infrastructure. Several European households experience monthly budget gaps because of high rent, inflation, and energy prices. In 2023, more than 30% of EU households complained about making ends meet before salary day. This consistent cash-flow strain continues strong demand for payday and several short-term loans.

Furthermore, Europe has witnessed the speedy adoption of online payday loan platforms, mainly in the United Kingdom, Nordic countries, and Poland. The region's 91% average internet saturation rate allows paperless and fast loan applications. Younger consumers, mainly, are fueling this digital shift. The region boasts a striking alternative finance industry, with payday loans capturing a significant portion of it. In the United Kingdom alone, the short-term market issued more than Euro 1.3 billion in payday loans in the past years. This developed infrastructure creates service innovation and healthy competition.

Payday Loan Market: Competitive Analysis

The leading players in the global payday loan market are:

- Advance America

- Check Into Cash

- Speedy Cash

- MoneyTree

- Cash America International

- Dollar Loan Center

- LendUp

- CashNetUSA

- Check ‘n Go

- PDL Loan

- 247Moneybox

- MyJar

- QuickQuid

- Ferratum Group

- LendingBear

Payday Loan Market: Key Market Trends

Rapid move toward online lending platforms:

The payday loan sector is progressing from traditional storefronts to digital platforms, offering speedy approvals and 24/7 accessibility. In 2024, more than 60% of payday loan applications were submitted online worldwide. This inclination is fueled by enhanced fintech infrastructure, consumer preferences for convenience, and smartphone adoption.

Growing compliance focus and regulatory scrutiny:

Governments across the globe are tightening payday lending norms to prevent predatory practices, including interest rate caps and strict affordability checks. For example, the United Kingdom’s FCA imposes total cost caps to protect users. This trend is forcing lenders to adopt more ethical and transparent business models.

The global payday loan market is segmented as follows:

By Type

- Storefront Payday Loans

- Online Payday Loans

By Marital Status

- Married

- Single

By Customer Age

- Less than 21

- 21-30

- 31-40

- 41-50

- More than 50

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The payday loan offers short-term and high-interest credit, usually intended for borrowers requiring immediate cash before their upcoming paycheck. These loans are generally small in amount but carry higher interest rates than customary credit, making them overpriced if not promptly paid.

The global payday loan market is projected to grow due to the rising cost of living and inflation, the increasing number of underbanked and unbanked populations, and the growth of digital lending platforms.

According to study, the global payday loan market size was worth around USD 5.37 billion in 2024 and is predicted to grow to around USD 7.23 billion by 2034.

The CAGR value of the payday loan market is expected to be around 3.80% during 2025-2034.

North America is expected to lead the global payday loan market during the forecast period.

The key players profiled in the global payday loan market include Advance America, Check Into Cash, Speedy Cash, MoneyTree, Cash America International, Dollar Loan Center, LendUp, CashNetUSA, Check ‘n Go, PDL Loan, 247Moneybox, MyJar, QuickQuid, Ferratum Group, and LendingBear.

The payday loan value chain includes loan origination, customer acquisition, fund disbursement, regulatory compliance, and repayment collection.

Key factors include affordability checks, strict interest rate caps, and licensing requirements that limit profitability, alongside public scrutiny and advocacy pressures pushing for tighter controls. Environmental influences, such as consumer protection policies and digital transformation, also transform market dynamics.

Macroeconomic pressures like rising living costs, persistent inflation, and income volatility will likely sustain demand for short-term credit. However, higher defaults, economic slowdowns, and tighter monetary policies may challenge lender risk management and profitability.

The report examines key aspects of the payday loan market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed