Paddy Rice Market Size, Growth, Global Trends, Forecast 2034

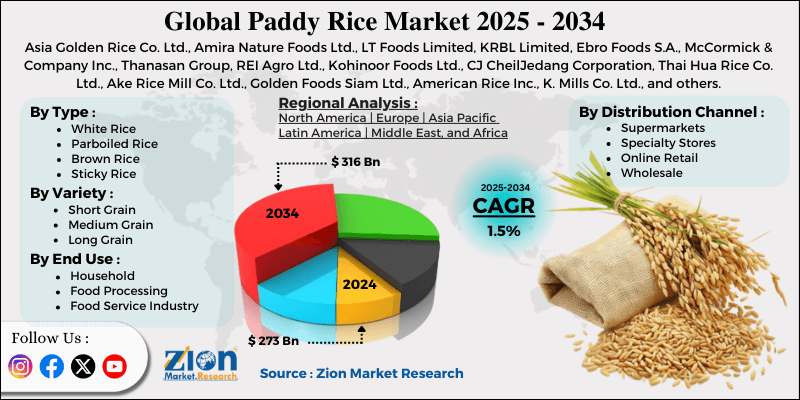

Paddy Rice Market By Type (White Rice, Parboiled Rice, Brown Rice, and Sticky Rice), By Variety (Short Grain, Medium Grain, and Long Grain), By End-Use (Household, Food Processing, and Food Service Industry), By Distribution Channel (Supermarkets, Specialty Stores, Online Retail, and Wholesale), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

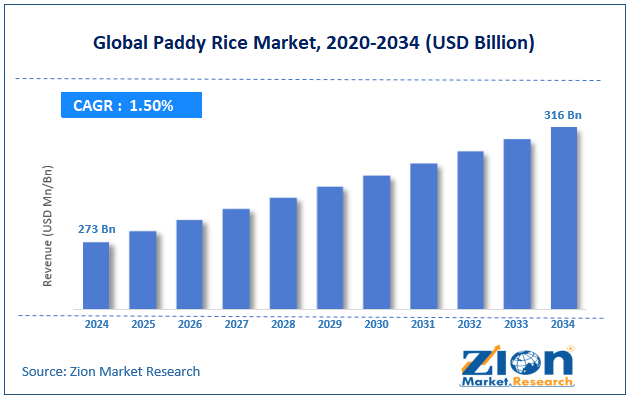

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 273 Billion | USD 316 Billion | 1.5% | 2024 |

Paddy Rice Industry Perspective:

What will be the size of the global paddy rice market during the projected period?

The global paddy rice market size was worth around USD 273 billion in 2024 and is predicted to grow to around USD 316 billion by 2034, with a compound annual growth rate (CAGR) of roughly 1.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global paddy rice market is estimated to grow annually at a CAGR of around 1.5% over the forecast period (2025-2034).

- In terms of revenue, the global paddy rice market size was valued at around USD 273 billion in 2024 and is projected to reach USD 316 billion by 2034.

- Rising global population along with growing food demand is expected to drive the paddy rice market over the forecast period.

- Based on the type, the white rice segment is expected to dominate the market over the projected period.

- Based on the variety, the long grain segment is expected to capture the largest market share over the projected period.

- Based on the application, the household segment is expected to capture the largest market share over the projected period.

- Based on the end-use, the supermarkets segment is expected to capture the largest market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Paddy Rice Market: Overview

Paddy rice is defined as the rice that has been harvested from the paddies and is still with its outer husk or hull. It is the unprocessed, raw form of rice gained from the first steps of harvesting and threshing, before any milling, polishing, or parboiling. Paddy rice is not meant for direct consumption; in some instances, the husk and bran layers are removed, and the resulting brown or white rice becomes the edible form that rice must undergo to be processed. It is a major agricultural product in the rice supply chain, and its production is extensive across tropical and subtropical regions worldwide, particularly in areas with flooding or irrigation. Hence, paddy rice is considered a very durable and marketable product, with the added advantage of being a major player in food security, as it is the first product in the commercial rice chain to be transported for both human and industrial use.

Paddy Rice Market Dynamics

Growth Drivers

Why does the growing global demand for rice as a staple food propel the growth of the paddy rice market?

Rice consumption worldwide as a staple food is increasing, which is the main reason the paddy rice industry is flourishing. Rice is indubitably the mainstay of diets in the Asia-Pacific, Africa, and parts of Latin America, which together account for over 50% of the world population. The combination of population growth and urbanization in these areas increases total food consumption, thereby directly raising rice demand due to its low price, long storage life, and its role as a staple in daily culture. Unlike luxury foods, rice, as a basic food commodity, will always have a constant demand even during economic hardships. This means that market volume will be stable and that revenue flows across the value chain will be predictable.

Moreover, rising incomes in developing countries are driving a shift in consumption from loose, unbranded grains to processed, packaged, and premium rice varieties, which not only adds to volume growth but also market value. Governments also play a crucial role in promoting this demand by implementing food security measures, establishing public distribution systems, and setting up buffer stock programs that prioritize rice availability, thereby driving continuous procurement from farmers and traders. International trade is also a factor here, as rice-deficient countries depend on imports to meet domestic demand; this creates stronger global supply chains and encourages higher production. Together, these elements sustain the long-term growth in demand for staples, and the same holds for the global rice and paddy grain industry, which benefits from sustained investment in cultivation, processing, and distribution.

Restraints

Water scarcity and irrigation pressures impede the industry’s growth

Water scarcity and irrigation pressures are major obstacles to market growth because rice farming uses a lot of water and has always depended on flooding. Groundwater levels are dropping, rainfall patterns are changing, and urban and industrial areas are competing more for water. All of these things make it hard to get reliable irrigation, especially in areas where rice is grown. When there is insufficient water, farmers often have to reduce the amount of paddy they grow, switch to crops that don't require as much water, or use alternative irrigation methods. These changes can lower yields and increase the risk of production at first.

Additionally, rising costs of irrigation infrastructure, energy for pumping water, and compliance with water-use regulations increase the overall cost of production, reducing farmers' profits and making it harder for them to expand their businesses. In rain-dependent regions, greater reliance on monsoon unpredictability reduces yield predictability, undermining supply stability and market trust. Even though water-saving methods like alternate soaking and drying are becoming more popular, they aren't very effective in the short term because they aren't used consistently and take a long time to learn. As a result, the ongoing lack of water and stress on irrigation continue to limit productivity, raise costs, and be a major barrier to long-term growth in the paddy rice market.

Opportunities

Will the rising innovative product launches offer a potential opportunity for the paddy rice?

The increasing number of innovative product launches is expected to present an opportunity for the paddy rice market over the analysis period. For instance, in December 2025 in China, BASF and Anhui Winall High-Tech Seed Co., Ltd. (hereinafter, "Winall") worked together to launch the Provisia® Herbicide-Tolerant Rice System. The main components of this system are the herbicide Provisia (300 g/L quizalofop-p-ethyl), produced by BASF, and two rice varieties tolerant of quizalofop-p-ethyl, Quanyou 822 and Huiliangyou 898, bred by Winall.

In China, BASF's Provisia is the first quizalofop-p-ethyl herbicide to be registered for use on rice varieties resistant to herbicides. This scientific combination is just what farmers need to address weed control challenges in direct-seeded rice. The Provisia rice system will significantly reduce labor costs and give large-scale wet paddy rice farmers a new reason to consider dry-direct-seeded rice farming, which is more efficient and better for the environment.

Challenges

How do labor shortages and mechanization barriers pose a major challenge to paddy rice market expansion?

Growing rice typically requires substantial labor, particularly during transplanting, weeding, and harvesting. Because of this, a shortage of workers and technological limitations make it hard for the paddy rice market to grow. The number of seasonal farm laborers has declined significantly due to rapid rural-to-urban migration, the retirement of older farmers, and a reduced interest among younger workers in farm work. Farmers have to wait longer to plant and harvest, which can lower yields and grain quality and, in the end, limit the overall supply of grains on the market. At the same time, mechanization, which could help with labor shortages, is sometimes held back by high capital costs, limited access to credit, and landholdings that are too small to be useful, especially for smallholder farmers.

Many rice fields are too small or poorly constructed to accommodate large machines effectively, and adoption is further hindered by a lack of technical training and inadequate repair and after-sales service. These limits make farmers more dependent on scarce labor and raise production costs, lowering their profits and making it harder for paddy farming to spread. Because of this, a shortage of workers and slow adoption of machinery make it hard for productivity and supply to grow, which is a major barrier to the long-term growth of the paddy rice market.

Paddy Rice Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Paddy Rice Market |

| Market Size in 2024 | USD 273 Billion |

| Market Forecast in 2034 | USD 316 Billion |

| Growth Rate | CAGR of 1.5% |

| Number of Pages | 212 |

| Key Companies Covered | Asia Golden Rice Co. Ltd., Amira Nature Foods Ltd., LT Foods Limited, KRBL Limited, Ebro Foods S.A., McCormick & Company Inc., Thanasan Group, REI Agro Ltd., Kohinoor Foods Ltd., CJ CheilJedang Corporation, Thai Hua Rice Co. Ltd., Ake Rice Mill Co. Ltd., Golden Foods Siam Ltd., American Rice Inc., K. Mills Co. Ltd., and others. |

| Segments Covered | By Type, By Variety, By End Use, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Paddy Rice Market: Segmentation

Type Insights

The white rice segment is expected to dominate the market over the projected period. The main reason for its rise is that many people eat it because it tastes good and can be used in many ways. Brown rice is growing at a rapid rate over the analysis period because health-conscious buyers seek more nutritious options. Parboiled and sticky rice come next, though they are only available at a small market catering to certain tastes and preferences.

Variety Insights

The long grain segment held the largest market share of over 55% in 2025. High consumer demand and changing global buying habits are also helping the expansion. Long-grain rice types like basmati, jasmine, and other slender, long-grain varieties make up a large share of the rice market and consistently bring in the most money. This is because they are popular in regions where rice is widely consumed, as they are fluffy, aromatic, and versatile in cooking.

End-Use Insights

The household segment is expected to grow substantially over the forecast period. Rice remains the primary staple for millions of families worldwide and is a central part of the daily meals of many cultures. As the world's population rises and more households, especially in Asia-Pacific, Africa, and parts of Latin America, depend on rice as a staple, families' steady and rising consumption directly increases demand for both raw paddy and milled rice. This constant need keeps sales steady year to year, encouraging farmers, millers, and merchants to boost supply and offer more options to meet changing needs. Emerging economies have higher disposable income and larger household budgets, enabling households to transition to higher-quality, branded rice varieties, such as premium white rice. These varieties of rice cost more and help the business thrive by generating more revenue.

Distribution Channel Insights

The supermarkets segment is expected to grow substantially over the forecast period. Supermarkets offer a wide range of rice, from basic staples to premium and specialty grains, all in one place. This facilitates customer comparison, selection, and purchase of different types of rice, thereby increasing overall spending. The rise in the number of supermarkets and hypermarkets, especially in cities and suburbs, makes it easier for manufacturers and brands to reach more customers and get their products in front of more people. This helps them sell more and get a bigger share of household demand.

Regional Insights

What factors enable the Asia Pacific to dominate the paddy rice market?

The Asia Pacific is expected to hold the largest market share over the projected period. High consumption rates and abundant production capacity help the region grow. Countries like China and India dominate the market, accounting for more than 75% of the total. The area has great weather and government policies that aim to boost agricultural productivity, which is necessary to meet expanding demand. India and China are not only the world's largest rice producers but also major players in the global rice trade. It is important for companies such as Kohinoor Foods and Vietnam Southern Food Corporation to enhance market competition. Focusing on new technologies in farming is expected to strengthen the region's position in the global market.

Paddy Rice Market: Competitive Analysis

The global paddy rice market is dominated by players like:

- Asia Golden Rice Co. Ltd.

- Amira Nature Foods Ltd.

- LT Foods Limited

- KRBL Limited

- Ebro Foods S.A.

- McCormick & Company Inc.

- Thanasan Group

- REI Agro Ltd.

- Kohinoor Foods Ltd.

- CJ CheilJedang Corporation

- Thai Hua Rice Co. Ltd.

- Ake Rice Mill Co. Ltd.

- Golden Foods Siam Ltd.

- American Rice Inc.

- K. Mills Co. Ltd.

The global paddy rice market is segmented as follows:

By Type

- White Rice

- Parboiled Rice

- Brown Rice

- Sticky Rice

By Variety

- Short Grain

- Medium Grain

- Long Grain

By End Use

- Household

- Food Processing

- Food Service Industry

By Distribution Channel

- Supermarkets

- Specialty Stores

- Online Retail

- Wholesale

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed