Packaging Laminates Market Size, Share, Trends, Growth & Forecast 2034

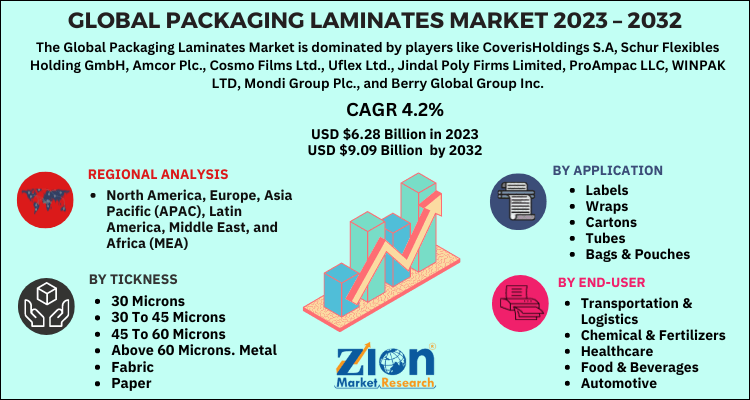

Packaging Laminates Market By Product Type (Paper-based Laminates, Plastic-based Laminates, Metal-based Laminates, and Biodegradable Laminates), By Thickness (30 Microns, 30 to 45 Microns, 45 to 60 Microns, above 60 Microns, Metal, Fabric, Paper, Plastic, and Others), By Application (Food and Beverage Packaging, Pharmaceutical Packaging, Cosmetic and Personal Care, Industrial Applications, Consumer Electronics, Agricultural Products), By End User (Food Manufacturers, Pharmaceutical Companies, Cosmetic Brands, Electronics Manufacturers, Industrial Producers, Agricultural Suppliers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.58 Billion | USD 9.93 Billion | 4.20% | 2024 |

Packaging Laminates Industry Perspective:

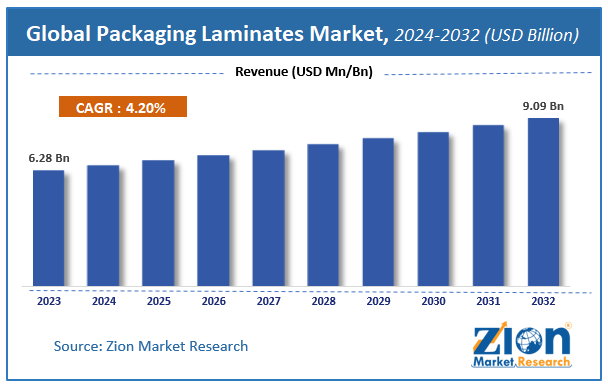

The global packaging laminates market size was worth approximately USD 6.58 billion in 2024 and is projected to grow to around USD 9.93 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global packaging laminates market is estimated to grow annually at a CAGR of around 4.20% over the forecast period (2025-2034).

- In terms of revenue, the global packaging laminates market size was valued at approximately USD 6.58 billion in 2024 and is projected to reach USD 9.93 billion by 2034.

- The packaging laminates market is projected to grow significantly due to the expansion of flexible packaging applications.

- Based on product type, the plastic-based laminates segment is expected to lead the packaging laminates market, while the biodegradable laminates segment is anticipated to experience significant growth.

- Based on thickness, the 30 to 45 microns segment is expected to lead the packaging laminates market, while the above 60 microns segment is anticipated to witness notable growth.

- Based on application, the food and beverage packaging segment is the dominating segment, while the pharmaceutical packaging segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the food manufacturers segment is expected to lead the market compared to the electronics manufacturers segment.

- Based on region, Asia Pacific is projected to dominate the global packaging laminates market during the estimated period, followed by North America.

Packaging Laminates Market: Overview

Packaging laminates are multi-layer materials designed by combining substrates such as plastic, aluminum foil, paper, or coatings to improve product protection and packaging performance. They provide strong barriers against moisture, oxygen, and contaminants while adding strength and visual appeal. Common laminate types include polyethylene-aluminum blends, paper-plastic hybrids, and specialized barrier films for extended shelf life. These materials are widely used in flexible packaging formats, such as stand-up pouches, retort pouches, blister packs, and wrap-around labels across the food, beverage, pharmaceutical, and personal care industries. Manufacturers rely on precision coating, advanced adhesives, and strict quality control to ensure durability and safety. Compliance with regulatory standards supports environmental responsibility, product safety, and reduced material waste in global packaging applications.

The growing emphasis on sustainable packaging solutions is expected to drive growth in the packaging laminates market throughout the forecast period.

Packaging Laminates Market Dynamics

Growth Drivers

Increased demand for barrier protection and shelf life extension

The packaging laminates market is expanding as companies realize the strong protective benefits these materials provide to sensitive products that need longer storage. Laminates act as powerful barriers against moisture, oxygen, light, and contaminants that can reduce product quality. With rising consumer demand for fresh products and longer shelf life, businesses are investing in laminate solutions that help maintain nutrition, flavor, and pharmaceutical safety.

Food trends, social media influence, and attractive packaging styles are boosting demand further. Leading brands rely on laminates to preserve freshness and justify premium pricing. Growth in e-commerce is increasing laminate use for protective shipping, while busy lifestyles and on-the-go eating are raising demand for high-performance flexible packaging.

How are developments in sustainable laminate technologies and eco-friendly material innovations propelling the packaging laminates market growth?

The global packaging laminates market is being driven by manufacturers developing environmentally responsible solutions that maintain performance while reducing environmental impact. These innovations include biodegradable adhesives, recyclable substrate combinations, and the integration of renewable raw materials, which enhance sustainability without compromising barrier effectiveness.

A key trend is the development of mono-material laminates and compostable alternatives in premium packaging applications. These sustainable practices are gaining popularity not only in food packaging but also in pharmaceutical, cosmetic, and industrial packaging manufacturers. This growing appreciation for sustainability also allows brands to differentiate themselves in a competitive marketplace while meeting regulatory requirements.

Restraints

High material costs and complex manufacturing processes

A major constraint for the packaging laminates industry is the elevated cost of raw materials, which includes specialized films, adhesives, and advanced coating technologies. These expenses often make laminated packaging solutions expensive than single-layer alternatives, limiting adoption among price-sensitive manufacturers. These factors prevent potential users in cost-sensitive market segments from regularly utilizing advanced laminate packaging solutions.

Supply chain complexity also affects the market. This makes it challenging for packaging laminates to gain widespread acceptance in price-competitive markets where material costs and production efficiency matter most. Additionally, the technical expertise required for multi-layer processing further restricts adoption among smaller converters with limited resources.

Opportunities

How are technological innovations and performance enhancements creating opportunities for the packaging laminates market?

The packaging laminates market is expanding due to coating technologies that improve barrier performance while reducing material thickness for enhanced sustainability. Advanced deposition techniques, nano-barrier coatings, and smart packaging integration help achieve superior protection with minimal material usage. These innovations make high-performance laminates more accessible to cost-sensitive applications and emerging market segments.

Digital printing is now compatible with laminates, making customization and shorter runs easier. This helps both big manufacturers and smaller brands create flexible packaging with reduced inventory and quicker supply chains. Rising demand for eco-friendly and value-added packaging is opening new opportunities across the food, pharmaceutical, and personal care industries.

Challenges

How are recyclability concerns and regulatory compliance standards limiting the growth of the packaging laminates market?

The packaging laminates industry faces challenges with recycling and strict global regulations. Multi-layer packaging is hard to recycle, causing waste management issues and lower sustainability ratings. Some consumers avoid laminates due to environmental concerns, while retailers face difficulties in meeting green goals without clear recycling rules or systems. This highlights the need for industry-wide recycling solutions and better recovery programs.

Stronger cooperation among laminate makers, recyclers, and regulators is needed to alleviate concerns and foster trust. New methods like chemical recycling and advanced sorting are being developed to address end-of-life issues. Limited infrastructure in developing regions and the high cost of sustainable processing technologies further restrict market growth, making it harder for manufacturers to adopt eco-friendly solutions at scale. Additionally, inconsistent regulations across countries create compliance challenges for global packaging companies.

Packaging Laminates Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaging Laminates Market |

| Market Size in 2024 | USD 6.58 Billion |

| Market Forecast in 2034 | USD 9.93 Billion |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 213 |

| Key Companies Covered | Mondi Group, Amcor Limited, Berry Global Inc., Sealed Air Corporation, Constantia Flexibles, Sonoco Products Company, Winpak Ltd, Coveris Holdings SA, Schott AG, Clondalkin Group, Huhtamaki Oyj, CCL Industries Inc., Multi-Color Corporation, Toray Plastics America, Jindal Poly Films Limited, and others. |

| Segments Covered | By Product Type, By Thickness, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaging Laminates Market: Segmentation

The global packaging laminates market is segmented based on product type, thickness, application, end-user, and region.

Based on product type, the global packaging laminates industry is divided into paper-based laminates, plastic-based laminates, metal-based laminates, and biodegradable laminates. Plastic-based laminates lead the market due to their versatile barrier properties, cost-effective manufacturing processes, and extensive compatibility with various packaging applications and production technologies.

Based on thickness, the industry is segregated into 30 microns, 30 to 45 microns, 45 to 60 microns, above 60 microns, metal, fabric, paper, plastic, and others. 30 to 45 microns lead the market due to their balanced strength, flexibility, and cost-effectiveness, making them the preferred choice for food packaging, consumer goods, and pharmaceutical applications where durability and lightweight properties are equally important.

Based on application, the global packaging laminates market is classified into food and beverage packaging, pharmaceutical packaging, cosmetic and personal care, industrial applications, consumer electronics, and agricultural products. Food and beverage packaging is expected to lead the market during the forecast period due to its high-volume consumption, diverse product requirements, and strong demand for barrier protection and shelf life extension capabilities.

Based on end-user, the global market is segmented into food manufacturers, pharmaceutical companies, cosmetic brands, electronics manufacturers, industrial producers, and agricultural suppliers. Food manufacturers hold the largest market share due to their extensive packaging volumes, diverse product portfolios, and consistent demand for flexible packaging solutions in processing and distribution activities.

Packaging Laminates Market: Regional Analysis

What factors are contributing to the Asia Pacific’s rapid growth in the global packaging laminates market?

Asia Pacific leads the global packaging laminates market due to its strong manufacturing base, growing consumer goods production, and rapidly expanding food processing industries. Around 50% of global packaging laminate use occurs in this region, with China leading because of its large-scale production and cost-efficient processes. Consumers in Asia increasingly value product freshness for quality, safety, and longer shelf life. The region benefits from established chemical suppliers, efficient logistics, and a skilled workforce that ensures consistent quality and innovative packaging solutions.

Rising middle-class populations and urbanization also drive strong demand for packaged and convenience products. Economic growth, infrastructure development, and higher disposable incomes further support market expansion. Most innovations in barrier technologies, sustainable materials, and cost-efficient production come from the Asia Pacific, shaping global trends. The growing e-commerce sector is increasing demand for protective packaging, while environmental awareness is encouraging the adoption of sustainable laminates. Strong government support for smart manufacturing and Industry 4.0 initiatives is also boosting production efficiency and market competitiveness.

North America is seeing strong growth

North America is seeing strong growth in the packaging laminates market as manufacturers increasingly look for premium packaging, sustainable materials, and specialized barrier technologies. Advanced packaging companies and consumer goods producers across the U.S. and Canada are driving this trend with high-performance materials and innovative packaging designs. The region’s robust research and development infrastructure, along with modern manufacturing systems, supports rapid market growth by ensuring that products meet both performance and environmental standards.

Rising awareness of food safety, product protection, and sustainable packaging has encouraged companies to adopt advanced laminates, including bio-based materials, recyclable structures, and improved barrier films. Regulatory focus on food contact safety and environmental compliance provides a solid foundation for innovation in high-performance packaging. Growth in e-commerce, premium branding, and sustainability initiatives is making manufacturers more aware of packaging quality and environmental responsibility. To meet demand, North American companies are partnering with material suppliers to create custom laminates and advance eco-friendly packaging solutions.

Recent Market Developments:

- In February 2025, TIPA® launched four new high-barrier compostable laminates, expanding its range of eco-friendly flexible packaging solutions without compromising barrier performance or machine compatibility.

- In September 2025, Amcor expanded its sustainable packaging portfolio, focusing on recyclable and compostable laminates to meet increasing consumer demand for eco-friendly materials.

Packaging Laminates Market: Competitive Analysis

The leading players in the global packaging laminates market are:

- Mondi Group

- Amcor Limited

- Berry Global Inc.

- Sealed Air Corporation

- Constantia Flexibles

- Sonoco Products Company

- Winpak Ltd

- Coveris Holdings SA

- Schott AG

- Clondalkin Group

- Huhtamaki Oyj

- CCL Industries Inc.

- Multi-Color Corporation

- Toray Plastics America

- Jindal Poly Films Limited

The global packaging laminates market is segmented as follows:

By Product Type

- Paper-based Laminates

- Plastic-based Laminates

- Metal-based Laminates

- Biodegradable Laminates

By Thickness

- 30 microns

- 30 to 45 microns

- 45 to 60 microns

- above 60 microns

- Metal

- Fabric

- Paper

- Plastic and Others

By Application

- Food and Beverage Packaging

- Pharmaceutical Packaging

- Cosmetic and Personal Care

- Industrial Applications

- Consumer Electronics

- Agricultural Products

By End User

- Food Manufacturers

- Pharmaceutical Companies

- Cosmetic Brands

- Electronics Manufacturers

- Industrial Producers

- Agricultural Suppliers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Packaging laminates are multi-layer materials designed by combining substrates such as plastic, aluminum foil, paper, or coatings to improve product protection and packaging performance.

The global packaging laminates market is projected to grow due to increasing demand for barrier protection and shelf life extension, rising adoption of sustainable packaging solutions, and growing need for flexible packaging applications.

According to a study, the global packaging laminates market size was worth around USD 6.58 billion in 2024 and is predicted to grow to around USD 9.93 billion by 2034.

The CAGR value of the packaging laminates market is expected to be around 4.20% during 2025-2034.

Asia Pacific is expected to lead the global packaging laminates market during the forecast period.

The major players profiled in the global packaging laminates market include Mondi Group, Amcor Limited, Berry Global Inc., Sealed Air Corporation, Constantia Flexibles, Sonoco Products Company, Winpak Ltd, Coveris Holdings SA, Schott AG, Clondalkin Group, Huhtamaki Oyj, CCL Industries Inc., Multi-Color Corporation, Toray Plastics America, and Jindal Poly Films Limited.

The report examines key aspects of the packaging laminates market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

Macroeconomic trends like economic growth, rising incomes, urbanization, and e-commerce expansion boost the packaging laminates market, while inflation and supply chain disruptions may challenge cost-efficiency and production.

Technological innovations such as advanced coatings, nano-barrier films, smart packaging, digital printing, and sustainable materials drive efficiency, customization, and eco-friendliness in the packaging laminates market.

The packaging laminates market is fragmented, led by players like Mondi, Amcor, and Berry Global, with competition focused on innovation, sustainability, performance, partnerships, and regional expansion.

The packaging laminates market value chain includes raw material sourcing, substrate preparation, lamination/coating, printing/finishing, production, distribution, end-use, and recycling or sustainable disposal.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed