Orthodontic Supplies Market Size, Share, Growth Analysis, 2032

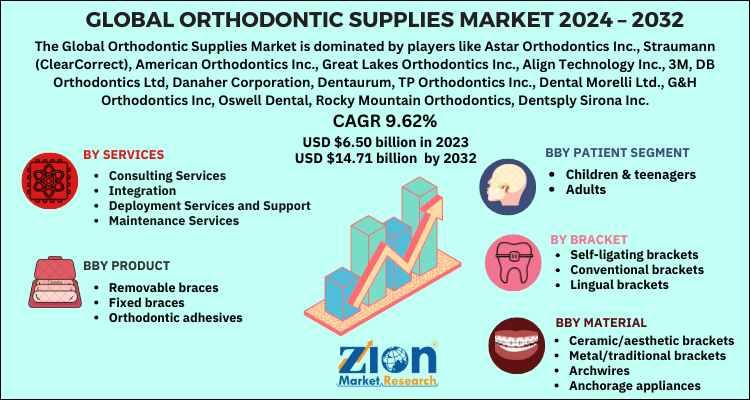

Orthodontic Supplies Market - By Products (Removable Braces, Fixed Braces, And Orthodontic Adhesives), By Patient (Children & Teenagers and Adults), By Bracket Type (Self-Ligating Brackets, Conventional Brackets, And Lingual Brackets), By Material (Ceramic/Aesthetic Brackets, Metal/Traditional Brackets, Archwires, Anchorage Appliances, And Ligatures), And By Region - Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024 - 2032

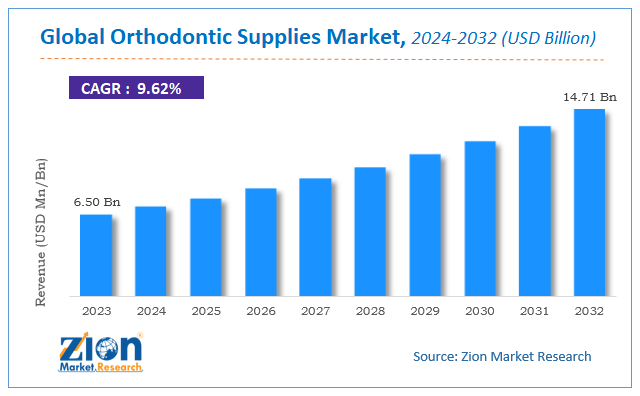

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.50 Billion | USD 14.71 Billion | 9.62% | 2023 |

Orthodontic Supplies Market: Industry Perspective

The global orthodontic supplies market size was worth around USD 6.50 billion in 2023 and is predicted to grow to around USD 14.71 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.62% between 2024 and 2032. The report offers a valuation and analysis of the Orthodontic Supplies market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data.

Orthodontic Supplies Market: Introduction

Orthodontic supplies include materials utilized in braces including orthodontic adhesives, archwires, anchorage supplies, brackets, and ligatures. In addition to this, these products are utilized for treating teeth or jaw misalignment. Products like orthodontic braces are used by orthodontists for treating teeth malocclusion that weakens face muscles and leads to chewing issues, thereby culminating in digestive problems and low self-esteem due to loss of good appearance with crooked & protruding teeth. Additionally, orthodontic supplies like invisible braces are most popular among adults as well as adolescents who are looking for straight teeth.

Orthodontic Supplies Market: Growth Drivers

The surge in the incidence of malocclusions and a rise in the proportion of untreated orthodontic cases in Asia Pacific will unravel new growth opportunities for the market over the ensuing years. Additionally, a prominent rise in oral disorders and the availability of new orthodontic supplies will spearhead the market expansion over the years ahead. Apart from this, the bulge in the per capita income of consumers and awareness about orthodontic treatment & oral care across the globe will trigger the orthodontic supplies market trends. Moreover, supportive compensation and health insurance policies for dental treatments are likely to sketch a profitable growth chart for the orthodontic supplies industry over the years to come.

Furthermore, thriving medical tourism activities in emerging economies due to enhanced as well as cost-effective dental treatment facilities will prop up the market progression over the forecasting years. Low production costs of oral devices in developing countries and high compliance of orthodontic supplies as well as the availability of high-quality orthodontic supplies in these economies will propel the industry landscape.

Orthodontic Supplies Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Orthodontic Supplies Market |

| Market Size in 2023 | USD 6.50 Billion |

| Market Forecast in 2032 | USD 14.71 Billion |

| Growth Rate | CAGR of 9.62% |

| Number of Pages | 238 |

| Key Companies Covered | Astar Orthodontics Inc., Straumann (ClearCorrect), American Orthodontics Inc., Great Lakes Orthodontics Inc., Align Technology Inc., 3M, DB Orthodontics Ltd, Danaher Corporation, Dentaurum, TP Orthodontics Inc., Dental Morelli Ltd., G&H Orthodontics Inc, Oswell Dental, Rocky Mountain Orthodontics, Dentsply Sirona Inc., Orthodontic Supply & Equipment Company, Ultradent Products Inc., and others. |

| Segments Covered | By Product, By Patient, By Bracket Type, By Material, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America To Contribute Sizably Towards Global Market Share By 2032

The growth of the market in North America over the estimated timespan is due to a rise in the frequency of oral disorders and a trend among the youth, adults, and old persons in countries like the U.S. to look good & healthy. In addition to this, a prominent surge in the disposable income among the middle-income group population in countries like Canada and the U.S. will further augment the business growth in the sub-continent over the projected timespan.

Orthodontic Supplies Market: Competitive Analysis

The global orthodontic supplies market is dominated by players like:

- Astar Orthodontics Inc.

- Straumann (ClearCorrect)

- American Orthodontics Inc.

- Great Lakes Orthodontics Inc.

- Align Technology Inc.

- 3M

- DB Orthodontics Ltd

- Danaher Corporation

- Dentaurum

- TP Orthodontics Inc

- Dental Morelli Ltd.

- G&H Orthodontics Inc

- Oswell Dental

- Rocky Mountain Orthodontics

- Dentsply Sirona Inc.

- Orthodontic Supply & Equipment Company

- Ultradent Products Inc.

The global orthodontic supplies market is segmented as follows:

By Product Segment Analysis

- Removable braces

- Fixed braces

- Orthodontic adhesives

By Patient Segment Analysis

- Children & teenagers

- Adults

By Bracket Type Segment Analysis

- Self-ligating brackets

- Conventional brackets

- Lingual brackets

By Material Segment Analysis

- Ceramic/aesthetic brackets

- Metal/traditional brackets

- Archwires

- Nickel titanium

- Beta titanium

- Stainless steel

- Anchorage appliances

- Mini-screws

- Bands and buccal tubes

- Ligatures

- Elastomeric ligatures

- Wire ligatures

By Region Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Orthodontic supplies are specialized materials and tools used by dentists and orthodontists to diagnose, treat, and correct misaligned teeth and jaws.

According to a study, the global orthodontic supplies market size was worth around USD 6.50 billion in 2023 and is expected to reach USD 14.71 billion by 2032.

The global orthodontic supplies market is expected to grow at a CAGR of 9.62% during the forecast period.

North America is expected to dominate the orthodontic supplies market over the forecast period.

Leading players in the global orthodontic supplies market include Astar Orthodontics Inc., Straumann (ClearCorrect), American Orthodontics Inc., Great Lakes Orthodontics Inc., Align Technology Inc., 3M, DB Orthodontics Ltd, Danaher Corporation, Dentaurum, TP Orthodontics Inc, Dental Morelli Ltd., G&H Orthodontics Inc, Oswell Dental, Rocky Mountain Orthodontics, Dentsply Sirona Inc., Orthodontic Supply & Equipment Company, and Ultradent Products Inc., among others.

The orthodontic supplies market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed