Global Bioadhesives Market Size, Share, Growth Analysis Report - Forecast 2034

Bioadhesives Market By Type (Plant-based, Animal-based), By Application (Packaging & Paper, Construction, Woodworking, Personal Care, Medical), By End-user (Healthcare, Construction, Packaging, Automotive, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.26 Billion | USD 25.35 Billion | 8.7% | 2024 |

Bioadhesives Industry Perspective:

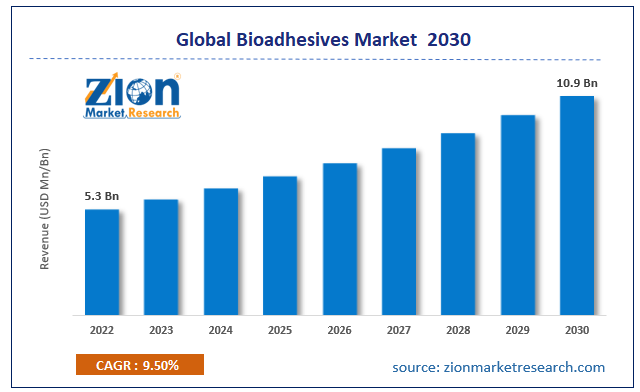

The global Bioadhesives market size was worth around USD 10.26 Billion in 2024 and is predicted to grow to around USD 25.35 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.7% between 2025 and 2034. The report analyzes the global bioadhesives market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the bioadhesives industry.

Bioadhesives Market: Overview

Adhesives made from biologically renewable resources, such as plants and animals, are referred to as bioadhesives. These glues are produced by using biological intermediates in the manufacturing process, such as cellulose, gelatin, or starch. The usage of bioadhesives is expanding across a range of sectors and uses, such as printed sheet lamination, flexible packaging, specialized packaging, cigarette filters, and filters in general. Product developers are launching biologically derived products in response to consumers' increasing interest in buying eco-friendly products. Growing consumer demand for packaging that is helpful to the environment and knowledge of the function that bioadhesives serve in the packaging industry will propel market growth.

Key Insights

- As per the analysis shared by our research analyst, the global bioadhesives market is estimated to grow annually at a CAGR of around 8.7% over the forecast period (2025-2034).

- Regarding revenue, the global bioadhesives market size was valued at around USD 10.26 Billion in 2024 and is projected to reach USD 25.35 Billion by 2034.

- The bioadhesives market is projected to grow at a significant rate due to Increasing demand for eco-friendly, non-toxic adhesives in packaging, medical, and construction sectors fuels growth.

- Based on Type, the Plant-based segment is expected to lead the global market.

- On the basis of Application, the Packaging & Paper segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Healthcare segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Bioadhesives Market: Growth Drivers

Increasing demand for eco-friendly products drives market growth

Research and development into safe adhesives are increasing; a prime instance is Bioadhesives, which are biocompatible adhesives composed of natural polymeric materials including proteins and polysaccharides. However, the production of harmful pollutants is caused by the grinding and machining procedures used in the fabrication of synthetic adhesives derived from petroleum. Government rules about the usage of bio-based goods are becoming more stringent. For example, organizations such as the US Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) support the usage of bio-based ingredients in adhesives, which propels the global bioadhesives market.

Bioadhesives Market: Restraints

Availability of substitutes impedes the bioadhesives market growth

Bioadhesives may create adhesives based on petroleum-based basic materials and are derived from renewable energy sources. Bioadhesives face competition from synthetically produced adhesives, which are easier to make and more affordable. To penetrate significant markets and get over the challenges, producers of bioadhesives must focus on providing bio-based goods at a reasonable cost. The major market segments see this as an opportunity to innovate and create bioadhesives that work exceptionally well at a reasonable cost.

Bioadhesives Market: Opportunities

Growing product launches offer a lucrative opportunity for market growth

The growing product launches by the key players are expected to offer a lucrative opportunity for bioadhesives market growth over the forecast period. For instance, in November 2023, one of the top providers of adhesives worldwide, H.B. Fuller, announced the release of Swift®melt 1515-I, its first biocompatible product approved for use in the India, Middle East, and Africa region. The product is intended for use in stick-to-skin medical tape applications utilizing microporous materials in special climates like the high humidity and temperatures seen in the Indian subcontinent. Swift®melt 1515-I provides shear resistance, high-temperature performance, and a fast, solid connection. The product was put through a rigorous testing process and given ISO 10993-5 certification for cytotoxicity. It exhibits great performance, balancing adhesion, and ease of removal. The adhesive works well in stick-to-skin scenarios for medical applications in hospitals and home care since it is not harmful to human cells.

Bioadhesives Market: Challenges

High investment in R&D poses a major challenge to market growth

Innovative formulation techniques and cutting-edge technology are needed in the production of bioadhesives. Compared to synthetic adhesive formulations, the R&D costs associated with the development of these bioadhesives are relatively greater. Furthermore, significant players are the only ones who can afford to spend heavily on novel enhancements to products. As a result, the major obstacle for smaller competitors in the bioadhesives industry is competing with the products of market leaders that are offering high-quality, up-to-date bioadhesives through innovative technology.

Bioadhesives Market: Segmentation

The global Bioadhesives industry is segmented based on the type, application, and region.

Based on the type, the global market is bifurcated into plant-based and animal-based. The plant-based segment is expected to hold the largest bioadhesives market share over the forecast period. Numerous materials, including starch, soy, lignin, rubber, and others, are used to make plant-based bioadhesives. Synthetic materials are widely used in biomedical applications, although they provide a non-biocompatible risk. As a reliable substitute for synthetic adhesives, plant-based adhesives are also less expensive. Plant-based bioactive components include gums and mucilage, which can be employed as excipients in wound dressing formulations and as a medication delivery mechanism.

Additional uses for plant-based bioadhesives include laminating, paper goods, wallpaper paste, tube winding, and other applications. The bioadhesives business is experiencing a surge in demand owing to its widespread demand across nearly all sectors. Because they are more viscous than other bioadhesives, starch-based bioadhesives are more effective than those derived from plants. The roots, seeds, and stalks of staple crops including maize, rice, and other plants are used to make starch-based bioadhesives. Adhesives based on starch are mostly used in furniture and wood applications. For instance, Scion, a producer of bioadhesives, develops bioadhesives and resins that are entirely composed of natural materials, such as agricultural and forestry waste, and lack of petrochemicals. As a result, they have extremely low formaldehyde emissions, making them more environmentally friendly.

Based on the application, the global bioadhesives industry is bifurcated into paper & packaging, construction, woodworking, personal care, medical, and others. The paper & packaging segment is expected to grow at the highest CAGR over the forecast period. The use of bioadhesives is one aspect of the ongoing innovation that defines the paper and packaging industries. Scientists and producers are looking into methods to improve bioadhesives' performance for a range of packaging uses, making sure they fulfill industrial requirements for reliability, functionality, and longevity. Moreover, consumers are becoming more conscious of environmental concerns, which is driving up demand for environmentally friendly and sustainable packaging. Because they help create packaging materials that are thought to be more ecologically friendly, bioadhesives play a part in satisfying this need. Thereby, driving the segment expansion.

By End-user, the global bioadhesives market is split into Healthcare, Construction, Packaging, Automotive, Others.

Bioadhesives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bioadhesives Market |

| Market Size in 2024 | USD 10.26 Billion |

| Market Forecast in 2034 | USD 25.35 Billion |

| Growth Rate | CAGR of 8.7% |

| Number of Pages | 226 |

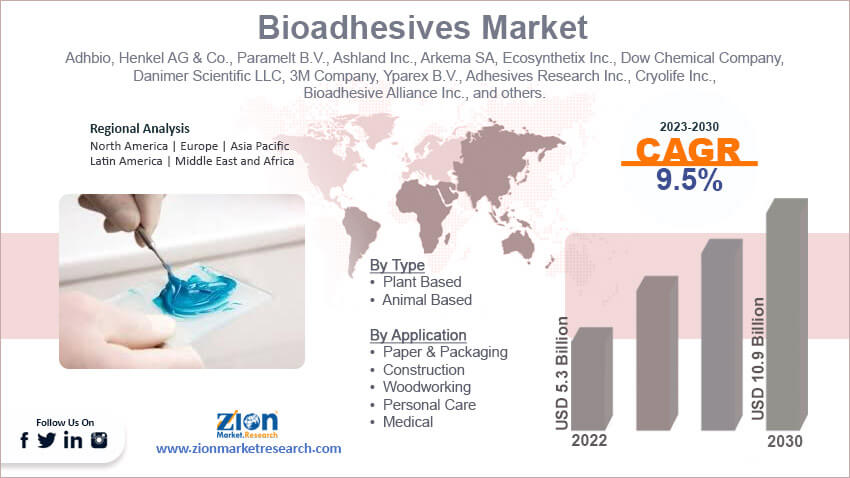

| Key Companies Covered | Adhbio, Henkel AG & Co., Paramelt B.V., Ashland Inc., Arkema SA, Ecosynthetix Inc., Dow Chemical Company, Danimer Scientific LLC, 3M Company, Yparex B.V., Adhesives Research Inc., Cryolife Inc., Bioadhesive Alliance Inc., and others., and others. |

| Segments Covered | By Type, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bioadhesives Market: Regional Analysis

Europe is expected to hold the largest market share over the forecast period

Europe is expected to hold the largest bioadhesives market share over the forecast period. The market growth in the region is attributed to the growth in the construction industry. Although the pandemic had a significant negative influence on the European construction sector, in 2021 it saw a growth of almost 20% due to a surge in residential building activity and a variety of institutional projects. Numerous building applications make substantial use of bioadhesives. For instance, animal- and plant-based bioadhesives—most notably soybean bioadhesives—are widely utilized in wood-based applications such as plywood and wood flooring, among others.

Furthermore, it was discovered that plant-based polyurethane bioadhesives, which create robust connections, had better bonding qualities than bioadhesives that are sold commercially. As a significant manufacturer of natural rubber- and starch-based adhesives worldwide, Germany is the leading user of bio-based adhesives in the European Union. Furthermore, Germany's manufacture of bio-succinic acid has helped to fuel the development of bioadhesives. Architectural coatings employ bioadhesives based on biosuccinium. The substantial increase in building activity will also fuel demand in other European industries, like the plastic, painting, and coasting sectors, and will propel the bioadhesives market even higher.

Bioadhesives Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the bioadhesives market on a global and regional basis.

The global bioadhesives market is dominated by players like:

- Adhbio

- Henkel AG & Co.

- Paramelt B.V.

- Ashland Inc.

- Arkema SA

- Ecosynthetix Inc.

- Dow Chemical Company

- Danimer Scientific LLC

- 3M Company

- Yparex B.V.

- Adhesives Research Inc.

- Cryolife Inc.

- Bioadhesive Alliance Inc.

- and others.

The global bioadhesives market is segmented as follows;

By Type

- Plant-based

- Animal-based

By Application

- Packaging & Paper

- Construction

- Woodworking

- Personal Care

- Medical

By End-user

- Healthcare

- Construction

- Packaging

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Adhesives made from biologically renewable resources, such as plants and animals, are referred to as bioadhesives. These glues are produced by using biological intermediates in the manufacturing process, such as cellulose, gelatin, or starch. The usage of bioadhesives is expanding across a range of sectors and uses, such as printed sheet lamination, flexible packaging, specialized packaging, cigarette filters, and filters in general.

The global bioadhesives market is expected to grow due to Increasing demand for eco-friendly, non-toxic adhesives in packaging, medical, and construction sectors fuels growth.

According to a study, the global bioadhesives market size was worth around USD 10.26 Billion in 2024 and is expected to reach USD 25.35 Billion by 2034.

The global bioadhesives market is expected to grow at a CAGR of 8.7% during the forecast period.

North America is expected to dominate the bioadhesives market over the forecast period.

Leading players in the global bioadhesives market include Adhbio, Henkel AG & Co., Paramelt B.V., Ashland Inc., Arkema SA, Ecosynthetix Inc., Dow Chemical Company, Danimer Scientific LLC, 3M Company, Yparex B.V., Adhesives Research Inc., Cryolife Inc., Bioadhesive Alliance Inc., and others., among others.

The report explores crucial aspects of the bioadhesives market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed