Oil Accumulator Market Size, Share, Trends, Growth & Forecast 2034

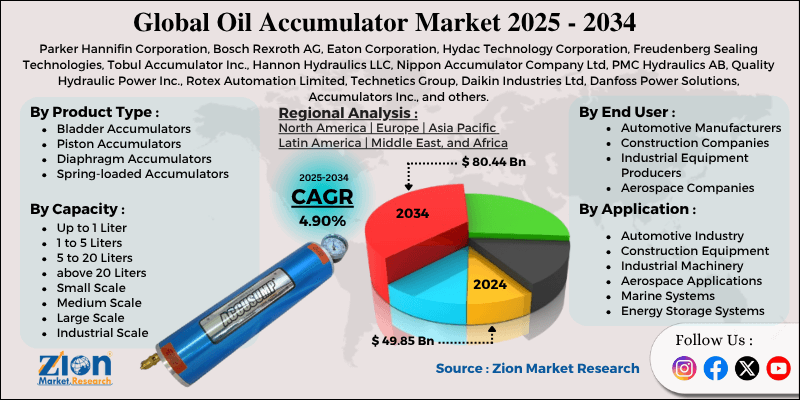

Oil Accumulator Market By Product Type (Bladder Accumulators, Piston Accumulators, Diaphragm Accumulators, and Spring-loaded Accumulators), By Capacity (Up to 1 Liter, 1 to 5 Liters, 5 to 20 Liters, above 20 Liters, Small Scale, Medium Scale, Large Scale, Industrial Scale, and Others), By Application (Automotive Industry, Construction Equipment, Industrial Machinery, Aerospace Applications, Marine Systems, Energy Storage Systems), By End-User (Automotive Manufacturers, Construction Companies, Industrial Equipment Producers, Aerospace Companies, Marine Equipment Suppliers, Energy Storage Providers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

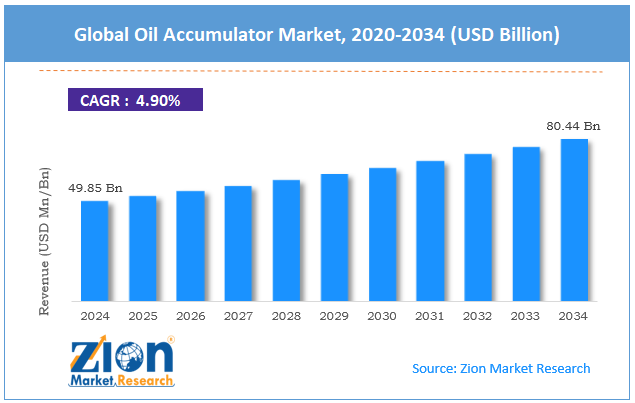

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 49.85 Billion | USD 80.44 Billion | 4.90% | 2024 |

Oil Accumulator Industry Perspective:

The global oil accumulator market size was worth approximately USD 49.85 billion in 2024 and is projected to grow to around USD 80.44 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global oil accumulator market is estimated to grow annually at a CAGR of around 4.90% over the forecast period (2025-2034).

- In terms of revenue, the global oil accumulator market size was valued at approximately USD 49.85 billion in 2024 and is projected to reach USD 80.44 billion by 2034.

- The oil accumulator market is projected to grow significantly due to the expansion of hydraulic system applications across various industries.

- Based on product type, the bladder accumulators segment is expected to lead the oil accumulator market, while the spring-loaded accumulators segment is anticipated to experience significant growth.

- Based on capacity, the 5 to 20 liters segment is expected to lead the oil accumulator market, while the above 20 liters segment is anticipated to witness notable growth.

- Based on application, the industrial machinery segment is the dominating segment, while the aerospace applications segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the industrial equipment producers segment is expected to lead the market compared to the marine equipment suppliers segment.

- Based on region, the Asia Pacific is projected to dominate the global oil accumulator market during the estimated period, followed by North America.

Oil Accumulator Market: Overview

Oil accumulators are hydraulic devices designed to store pressurized fluid and release it when needed to support various industrial operations. These components act as energy storage units that maintain system pressure, manage pressure fluctuations, and provide emergency power if pumps fail. They work by holding hydraulic fluid under pressure using mechanisms like bladders, pistons, or diaphragms that separate the fluid from a gas chamber. Common types include nitrogen-charged accumulators, spring-loaded models, and weighted systems, each tailored for specific operational needs. Oil accumulators are widely used in mobile hydraulic machinery, industrial equipment, automotive suspension systems, and emergency backup applications across manufacturing, construction, and transportation sectors. Manufacturers emphasize precision engineering, durable materials, and rigorous testing to ensure dependable performance under demanding conditions. Following international safety standards enhances operational safety, system efficiency, and reduces maintenance requirements in hydraulic systems worldwide.

The increasing demand for energy-efficient hydraulic systems is expected to drive substantial growth in the oil accumulator market throughout the forecast period.

Oil Accumulator Market Dynamics

Growth Drivers

How is enhanced demand for energy efficiency and system optimization propelling the oil accumulator market growth?

The oil accumulator market is growing fast as industries recognize the energy-saving benefits these components bring to hydraulic systems that need stable pressure. Accumulators act as energy storage devices that reduce power consumption, minimize pump cycles, and improve overall system performance. With businesses focusing on cutting operational costs and conserving energy, many are investing in accumulator solutions that maintain steady hydraulic pressure while lowering electricity use. Trends like industrial automation, equipment upgrades, and sustainable manufacturing are further boosting market demand.

Leading manufacturers rely on accumulators to improve system efficiency and lower operating costs. The rise of renewable energy applications is increasing the use of accumulators for power storage, while industrialization and infrastructure growth are driving demand for high-performance hydraulic systems.

Improvements in accumulator technology and smart system integration

The global oil accumulator market is also driven by smart and advanced solutions that combine intelligent monitoring with strong pressure control. Innovations include pressure sensors, predictive maintenance tools, and IoT-enabled monitoring, which increase reliability without reducing hydraulic performance. Condition-monitoring accumulators and maintenance-free options are gaining popularity in high-end industrial uses. These advancements are used not only in industrial machinery but also in automotive, aerospace, and marine hydraulic systems. Smart technology helps manufacturers stand out in a competitive market while meeting the growing need for predictive maintenance and optimized systems.

Restraints

How are complex installation requirements and high initial investment costs limiting the growth of the oil accumulator market?

A key limitation in the oil accumulator market is the high upfront cost of quality systems, which includes specialized components, installation equipment, and professional setup. These costs make accumulator-equipped systems more expensive than traditional alternatives, which limits their adoption in budget-sensitive segments. Many small operators struggle with proper sizing and system installation, which reduces their acceptance in price-competitive industries.

Ongoing maintenance and periodic inspections add to operational expenses, making long-term investment more challenging. Limited availability of skilled technicians further slows adoption in smaller facilities. Additionally, the rapid pace of technological upgrades can make existing systems feel outdated quickly, discouraging some buyers.

Opportunities

How are technological innovations and performance improvements creating opportunities for the oil accumulator market?

The oil accumulator industry is expanding due to the use of advanced materials and production methods that improve pressure retention while making components smaller for easier integration. New composite materials, better seals, and smart monitoring systems increase performance and reduce maintenance. These innovations make high-performance accumulators more accessible for cost-sensitive industries.

Digital monitoring allows predictive maintenance and real-time optimization, benefiting both large and small facilities by improving hydraulic control, reducing downtime, and enhancing efficiency. Growing demand for automation-ready and maintenance-friendly components is creating opportunities across the manufacturing, construction, and mobile equipment sectors.

Challenges

Safety regulations and maintenance complexity standards

The oil accumulator market is subject to stringent safety regulations and complex maintenance standards worldwide. High-pressure hydraulic components need careful handling, specialized training, and certified maintenance procedures. Some operators avoid accumulators due to safety concerns and compliance challenges, making adoption difficult. Cooperation between manufacturers, safety authorities, and end-users is needed to build trust.

New safety features, such as pressure relief and failure prediction systems, are being developed. Limited technical skills in some regions, combined with the high cost of specialized maintenance equipment, further restrict growth. Differences in safety regulations across countries also create compliance challenges for global manufacturers.

Oil Accumulator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oil Accumulator Market |

| Market Size in 2024 | USD 49.85 Billion |

| Market Forecast in 2034 | USD 80.44 Billion |

| Growth Rate | CAGR of 4.90% |

| Number of Pages | 212 |

| Key Companies Covered | Parker Hannifin Corporation, Bosch Rexroth AG, Eaton Corporation, Hydac Technology Corporation, Freudenberg Sealing Technologies, Tobul Accumulator Inc., Hannon Hydraulics LLC, Nippon Accumulator Company Ltd, PMC Hydraulics AB, Quality Hydraulic Power Inc., Rotex Automation Limited, Technetics Group, Daikin Industries Ltd, Danfoss Power Solutions, Accumulators Inc., and others. |

| Segments Covered | By Product Type, By Capacity, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Oil Accumulator Market: Segmentation

The global oil accumulator market is segmented based on product type, capacity, application, end-user, and region.

Based on product type, the global oil accumulator industry is divided into bladder accumulators, piston accumulators, diaphragm accumulators, and spring-loaded accumulators. Bladder accumulators lead the market due to their versatile pressure regulation capabilities, reliable performance characteristics, and extensive compatibility with various hydraulic applications and system configurations.

Based on capacity, the industry is segregated into up to 1 liter, 1 to 5 liters, 5 to 20 liters, above 20 liters, small scale, medium scale, large scale, industrial scale, and others. 5 to 20 liters lead the market due to their balanced performance capacity, versatility, and cost-effectiveness, making them the preferred choice for industrial machinery, mobile equipment, and automotive applications where moderate storage capacity and reliable operation are equally important.

Based on application, the global oil accumulator market is classified into the automotive industry, construction equipment, industrial machinery, aerospace applications, marine systems, and energy storage systems. Industrial machinery is expected to lead the market during the forecast period due to its high-volume equipment requirements, diverse hydraulic system needs, and strong demand for pressure stability and energy efficiency capabilities.

Based on end-user, the global market is segmented into automotive manufacturers, construction companies, industrial equipment producers, aerospace companies, marine equipment suppliers, and energy storage providers. Industrial equipment producers hold the largest market share due to their extensive hydraulic system volumes, diverse product portfolios, and consistent demand for reliable pressure regulation solutions in manufacturing and processing activities.

Oil Accumulator Market: Regional Analysis

Asia Pacific is experiencing steady growth

Asia Pacific leads the global oil accumulator market because it has strong manufacturing infrastructure, growing industrial equipment production, and fast-expanding construction and automotive industries. About 45% of global oil accumulator use is in this region, with China leading due to its large industrial base and cost-effective production capabilities. Industries in Asia focus on equipment efficiency to improve productivity, reliability, and reduce operational costs. The region benefits from reliable component suppliers, efficient supply chains, and skilled technical workers who maintain quality and drive hydraulic innovation. Rapid industrialization and a growing middle class also increase demand for automated and hydraulic-powered equipment. Economic growth, infrastructure projects, and rising manufacturing investments further support market expansion.

Most innovations in accumulator technology, smart monitoring systems, and cost-effective production come from the Asia Pacific, influencing global trends. Expanding construction projects raise demand for mobile hydraulic equipment, while industrial upgrades encourage the use of energy-efficient accumulators. Strong government backing for automation and Industry 4.0 initiatives also boosts competitiveness. In addition, partnerships between local and international manufacturers are accelerating technology adoption. Rising awareness of energy efficiency in industries is driving wider accumulator usage.

What factors are contributing to North America's rapid growth in the global oil accumulator market?

North America is experiencing steady growth in the oil accumulator market as companies increasingly adopt advanced hydraulic solutions, energy-efficient systems, and specialized pressure control technologies. Industrial firms and equipment manufacturers in the U.S. and Canada are driving this trend with high-performance components and innovative designs. Strong research and development capabilities and modern manufacturing infrastructure support steady market growth by ensuring that products meet safety and performance standards.

Growing awareness of energy efficiency, equipment reliability, and sustainable practices encourages the adoption of smart-monitored, maintenance-free, and improved pressure regulation accumulators. Workplace safety regulations and environmental compliance also promote innovation in high-performance hydraulic systems.

Automation, precision manufacturing, and energy conservation efforts make manufacturers more focused on equipment efficiency and reliability. North American companies collaborate with suppliers to create custom accumulator solutions and advance energy-efficient hydraulic technology. Additionally, government incentives for industrial modernization support market adoption. Rising industrial automation across sectors further increases demand for oil accumulators.

Recent Market Developments:

- In March 2025, Parker Hannifin launched three new high-capacity bladder accumulators, expanding its range of energy-efficient hydraulic solutions without compromising pressure regulation performance or system compatibility.

- In September 2025, Bosch Rexroth partnered with PETRONAS Lubricants International to develop bio-based hydraulic and UTTO fluids, aiming to reduce environmental impact in off-highway and agricultural vehicle industries.

Oil Accumulator Market: Competitive Analysis

The leading players in the global oil accumulator market are:

- Parker Hannifin Corporation

- Bosch Rexroth AG

- Eaton Corporation

- Hydac Technology Corporation

- Freudenberg Sealing Technologies

- Tobul Accumulator Inc.

- Hannon Hydraulics LLC

- Nippon Accumulator Company Ltd

- PMC Hydraulics AB

- Quality Hydraulic Power Inc.

- Rotex Automation Limited

- Technetics Group

- Daikin Industries Ltd

- Danfoss Power Solutions

- Accumulators Inc.

The global oil accumulator market is segmented as follows:

By Product Type

- Bladder Accumulators

- Piston Accumulators

- Diaphragm Accumulators

- Spring-loaded Accumulators

By Capacity

- Up to 1 Liter

- 1 to 5 Liters

- 5 to 20 Liters

- above 20 Liters

- Small Scale

- Medium Scale

- Large Scale

- Industrial Scale

- Others

By Application

- Automotive Industry

- Construction Equipment

- Industrial Machinery

- Aerospace Applications

- Marine Systems

- Energy Storage Systems

By End User

- Automotive Manufacturers

- Construction Companies

- Industrial Equipment Producers

- Aerospace Companies

- Marine Equipment Suppliers

- Energy Storage Providers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Oil accumulators are hydraulic devices designed to store pressurized fluid and release it when needed to support various industrial operations.

The global oil accumulator market is projected to grow due to increasing demand for energy efficiency and system optimization, rising adoption of smart hydraulic technologies, and growing need for reliable pressure regulation in industrial applications.

According to a study, the global oil accumulator market size was worth around USD 49.85 billion in 2024 and is predicted to grow to around USD 80.44 billion by 2034.

The CAGR value of the oil accumulator market is expected to be around 4.90% during 2025-2034.

Asia Pacific is expected to lead the global oil accumulator market during the forecast period.

The major players profiled in the global oil accumulator market include Parker Hannifin Corporation, Bosch Rexroth AG, Eaton Corporation, Hydac Technology Corporation, Freudenberg Sealing Technologies, Tobul Accumulator Inc., Hannon Hydraulics LLC, Nippon Accumulator Company Ltd, PMC Hydraulics AB, Quality Hydraulic Power Inc., Rotex Automation Limited, Technetics Group, Daikin Industries Ltd, Danfoss Power Solutions, and Accumulators Inc.

The report examines key aspects of the oil accumulator market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

Macroeconomic trends like industrial growth, infrastructure investment, manufacturing expansion, and automation adoption boost the oil accumulator market, while economic uncertainty and supply chain disruptions may challenge cost-efficiency and production.

Technological innovations such as smart monitoring systems, advanced materials, IoT integration, predictive maintenance capabilities, and energy-efficient designs drive performance, reliability, and operational efficiency in the oil accumulator market.

The oil accumulator market is moderately concentrated, led by players like Parker Hannifin, Bosch Rexroth, and Eaton, with competition focused on technology innovation, reliability, performance optimization, strategic partnerships, and global market expansion.

The oil accumulator market value chain includes raw material procurement, component manufacturing, assembly and testing, quality assurance, distribution, end-use installation, maintenance services, and equipment lifecycle management.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed