North America Third Party Logistics Market Size, Share, Trends, Growth 2034

North America Third Party Logistics Market By Solution (Dedicated Contract Carriage (DCC), Dedicated Transportation Management (DTM), International Transportation Management (ITM), Warehousing & Distribution, and Logistics Software), By Mode (Air, Sea, and Rail & Road), By Application (Food & Beverages, Healthcare, Retail, Automotive, Manufacturing, and Others), By Service (Transportation Services, Warehousing and Distribution Services, Freight Forwarding Services, and Others), By End-Use (Large Enterprises and Small and Medium Enterprises (SME)), and By Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

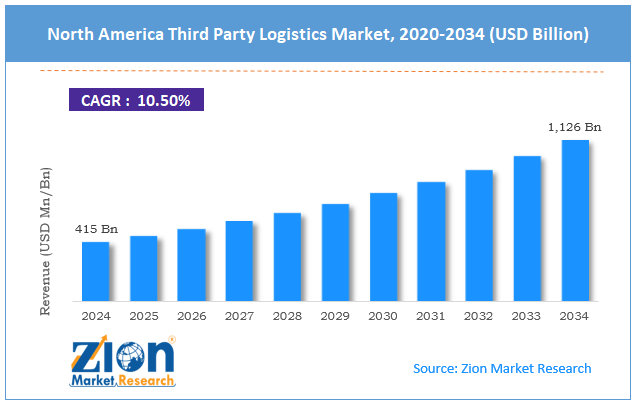

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 415 Billion | USD 1,126 Billion | 10.50% | 2024 |

North America Third Party Logistics Industry Perspective:

North America third party logistics market size was worth around USD 415 billion in 2024 and is predicted to grow to around USD 1126 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the North America third party logistics market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2025-2034).

- In terms of revenue, North America third party logistics market size was valued at around USD 415 billion in 2024 and is projected to reach USD 1126 billion by 2034.

- The increasing e-commerce boom drives the North America third party logistics industry over the forecast period.

- Based on the solution, the Dedicated Transportation Management (DTM) segment is expected to hold the largest market share over the forecast period.

- Based on the mode, the rail & road segment is expected to dominate the market over the projected period.

- Based on the application, the retail segment is expected to capture a significant revenue share during the anticipated period.

- Based on the service, the transportation services segment is expected to capture a significant revenue share during the anticipated period.

- Based on the end use, the large enterprises segment is expected to capture a significant revenue share during the anticipated period.

- Based on region, the U.S. is expected to dominate the market during the forecast period.

North America Third Party Logistics Market: Overview

Third party logistics, or 3PL, are businesses that focus on specific components of a company's supply chain or perhaps the whole thing. This can include managing inventory, warehousing, processing orders, reverse logistics, shipping and receiving services, and managing a distribution center 3PL. It can also include other logistical support and technology, such as warehouse management software, a 3PL system, a 3PL warehouse system, or a fulfilment service. Logistics experts work at 3PLs and offer contract logistics services. One common type of 3PL service is when an online store works with a fulfillment center to handle inventory storage and order processing. The 3PL company not only provides warehouse space for the warehousing business, but it also manages the process of choosing specific items for each customer's order and packing them for shipping.

The North American third party logistics market is flourishing due to several variables, including growing e-commerce, demand for last-mile capacity & fulfillment flexibility, automation, robotics, and warehouse technology adoption, cold chain & healthcare logistics growth, and others. However, the regulatory and trade policy complexity poses a major challenge to the industry's expansion.

North America Third Party Logistics Market: Growth Drivers

Why does growing e-commerce drive the expansion of North American third party logistics industry?

The North American third party logistics (3PL) sector is developing significantly, largely because more people are buying things online. Some of the main reasons for growth are the presence of big global retail and e-commerce companies like Amazon and Walmart, the growing need for fast and reliable delivery services (like Amazon's one-day delivery), rising exports to developing economies, government efforts to improve supply chain infrastructure, and the fact that supply chains are getting more complicated and need specialized 3PL services.

As e-commerce grows, so does the need for storage, last-mile delivery, and inventory management services. 3PL firms are good at all of these things. New technologies like blockchain, automation, robots, artificial intelligence, and real-time tracking are also helping regional 3PL suppliers get more done and work more efficiently. UPS, FedEx, XPO Logistics, and C.H. Robinson are just a few of the big corporations that offer full logistics services in North America. The market is still competitive.

North America Third Party Logistics Market: Restraints

How is regulatory and trade policy complexity hindering North American third party logistics market growth?

The North American Third Party Logistics (3PL) industry is very complex because of legislation and trade policies that govern how 3PL providers can do business. Important rules include safety laws for transportation, environmental standards, customs compliance, and licensing requirements specific to certain businesses, such as those involved in the pharmaceutical industry. 3PL companies must invest a significant amount of time and money to ensure compliance with all the requirements in the locations where they conduct business, particularly when operating across borders with the US, Canada, and Mexico.

Trade policy is very complicated, and trade wars like the one between the US and China and tariff issues with the EU, Canada, and Mexico make 3PL operations less predictable and more risky. Tariffs and retaliatory measures can make trade less common, which could make logistics less important, especially for enterprises that rely on worldwide supply networks. Following free trade agreements and export restrictions makes things considerably harder for 3PLs that operate with the manufacturing and export industries.

North America Third Party Logistics Market: Opportunities

How does the collaboration among 3PL and technology giants offer a potential opportunity for North American third party logistics market growth?

The partnership between 3PL providers and major digital companies is a big trend in the North American Third Party Logistics (3PL) industry that is making the market develop and change. The best 3PL firms are teaming up with digital startups that focus on AI, blockchain, the Internet of Things (IoT), sophisticated analytics, and automation to make the supply chain easier to see, more efficient, and less expensive.

For instance, in August 2024, DB Schenker, a global leader in logistics and supply chain management, teamed up with Dexory to deliver the latest robotics and AI technologies to the US market. This partnership's goal was to make the optimum use of resources across all of DB Schenker's operations while also solving the daily difficulties of tracking occupancy and stock in real time.

North America Third Party Logistics Market: Challenges

How do technology and integration issues pose a major challenge to market expansion??

The North American Third Party Logistics (3PL) sector has an array of important technological and integration issues that affect the quality of service and the efficiency of operations. One major issue is that 3PL suppliers and their clients don't have data ecosystems that are linked together. This makes it impossible to observe what's going on and slows down real-time shipment tracking. When data is spread across multiple platforms, it can be challenging to coordinate effectively and make decisions quickly, especially in networks with different carriers and modes of transit.

Another issue is that old systems and APIs don't operate together. This happens when some 3PLs or clients employ obsolete technology platforms that don't work well with new transportation management systems (TMS) that are based on APIs. This means that exceptions must be fixed manually, which slows down logistics operations and makes it more challenging to integrate real-time management and automation.

North America Third Party Logistics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | North America Third Party Logistics Market |

| Market Size in 2024 | 415 Bn |

| Market Forecast in 2034 | 1,126 Bn |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 212 |

| Key Companies Covered | JB Hunt Transport Services Inc, Burris Logistics, Yusen Logistics, CEVA Logistics, Nippon Express Holdings Inc, DSV AS, DB Schenker, Kuehne + Nagel International AG, C.H. Robinson Worldwide Inc, FedEx Corp, United Parcel Service Inc, Amazon, GXO Logistics, J.B. Hunt, Ryder System, Total Quality Logistics, DHL Supply Chain, Echo Global Logistics, Americold, Knight-Swift Transportation, Arrive Logistics, Universal Logistics Holdings, and others. |

| Segments Covered | By Solution, By Mode, By Application, By Service, By End Use, and By Region |

| Regions Covered in North America | The U.S., Canada, Mexico, and Rest of North America |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America Third Party Logistics Market: Segmentation

North America third party logistics industry is segmented based on solution, mode, application, service, end-use, and region.

Based on the solution, the North America third party logistics market is bifurcated into Dedicated Contract Carriage (DCC), Dedicated Transportation Management (DTM), International Transportation Management (ITM), Warehousing & Distribution, and Logistics Software. The Dedicated Transportation Management (DTM) is expected to dominate the market over the forecast period. The main reasons for the substantial increase in revenue are that supply chains have grown more digital, demand for better order and freight management is rising, and transportation networks are becoming more complicated, mostly because of the advent of e-commerce.

Government spending on transportation infrastructure, stricter rules for following the law, and more efforts to be environmentally friendly all encourage firms to employ dedicated TMS systems to boost efficiency, cut costs, and make the supply chain more visible.

Based on the mode, the North America third party logistics industry is bifurcated into air, sea, and rail & road. The rail & road segment captures the largest revenue share in the market. The thriving e-commerce sector in North America drives demand for fast, reliable, and adaptable delivery services, which are often supported by road and rail networks. This boosts warehouse capacity and freight volume, which benefits road and rail logistics.

Based on the application, the North America third party logistics market is bifurcated into food & beverages, healthcare, retail, automotive, manufacturing, and others. The retail segment is expected to hold a strong market share over the analysis period. Consumers are increasingly demanding rapid, reliable delivery, same-day or next-day shipment, and real-time tracking, prompting merchants to collaborate with qualified 3PL providers.

Based on the service, the North America third party logistics industry is bifurcated into transportation services, warehousing and distribution services, freight forwarding services, and others. The transportation services segment holds a prominent market share over the projected period. The growing rise of e-commerce has raised demand for efficient transportation services, such as last-mile delivery, in order to match consumer expectations for fast and reliable shipment.

Based on the end-use, the North America third party logistics market is divided into large enterprises and Small and Medium Enterprises (SME). The large enterprises segment is expected to hold the prominent market share over the forecast period. Large corporations are increasingly outsourcing logistical operations to third-party logistics companies to reduce costs, increase efficiency, and focus on core business activities. This choice creates a demand for comprehensive 3PL services such as warehousing, shipping, and inventory management.

North American Third Party Logistics Market: Regional Analysis

Why does the U.S. dominate the North American third party logistics market over the projected period??

The United States is the largest and most mature region of North America's third party logistics market, driven by varied industries such as manufacturing, retail, life sciences, and e-commerce. Manufacturing accounts for a substantial portion of logistics outsourcing, owing to sophisticated freight scheduling, customs compliance, and distribution requirements, particularly in the automobile, industrial equipment, and semiconductor industries. Furthermore, the sustained launching program propels the North American third-party logistics industry.

For instance, in June 2024, GXO Logistics launched its Sustainable Logistics Professional Program, which includes hands-on workshops and case studies for warehouse technicians and supply chain managers. The program promotes energy-efficient automation, smart inventory management, and green warehouse architecture throughout North America.

North America Third Party Logistics Market: Competitive Analysis

North America third party logistics market is dominated by players like:

- JB Hunt Transport Services Inc

- Burris Logistics

- Yusen Logistics

- CEVA Logistics

- Nippon Express Holdings Inc

- DSV AS

- DB Schenker

- Kuehne + Nagel International AG

- C.H. Robinson Worldwide Inc

- FedEx Corp

- United Parcel Service Inc

- Amazon

- GXO Logistics

- J.B. Hunt

- Ryder System

- Total Quality Logistics

- DHL Supply Chain

- Echo Global Logistics

- Americold

- Knight-Swift Transportation

- Arrive Logistics

- Universal Logistics Holdings

North America third party logistics market is segmented as follows:

By Solution

- Dedicated Contract Carriage (DCC)

- Dedicated Transportation Management (DTM)

- International Transportation Management (ITM)

- Warehousing & Distribution

- Logistics Software

By Mode

- Air

- Sea

- Rail & Road

By Application

- Food & Beverages

- Healthcare

- Retail

- Automotive

- Manufacturing

- Others

By Service

- Transportation Services

- Warehousing and Distribution Services

- Freight Forwarding Services

- Others

By End Use

- Large Enterprises

- Small and Medium Enterprises (SME)

By Region

- The U.S.

- Canada

- Mexico

- Rest of North America

Table Of Content

Methodology

FrequentlyAsked Questions

Third party logistics, or 3PL, are businesses that focus on specific components of a company's supply chain or perhaps the whole thing. This can include managing inventory, warehousing, processing orders, reverse logistics, shipping and receiving services, and managing a distribution center 3PL.

The North American third party logistics market is flourishing by several variables, including growing e-commerce, demand for last-mile capacity & fulfillment flexibility, automation, robotics, and warehouse technology adoption, cold chain & healthcare logistics growth, and others.

The regulatory and trade policy complexity poses a major challenge to industry expansion.

Based on the application, the retail segment is expected to dominate the industry growth during the projected period.

The increasing investment in advanced technology and the growing cold chain and healthcare logistics growth are impacting the industry growth over the projected period.

According to the report, North America third party logistics market size was worth around USD 415 billion in 2024 and is predicted to grow to around USD 1126 billion by 2034.

North America third party logistics market is expected to grow at a CAGR of 10.5% during the forecast period.

North America third party logistics industry growth is expected to be driven by the US region. It is currently the world’s highest revenue-generating market due to the growing e-commerce and presence of major players.

North America third party logistics market is dominated by players like JB Hunt Transport Services Inc, Burris Logistics, Yusen Logistics, CEVA Logistics, Nippon Express Holdings Inc, DSV AS, DB Schenker, Kuehne + Nagel International AG, C.H. Robinson Worldwide Inc, FedEx Corp, United Parcel Service Inc, Amazon, GXO Logistics, J.B. Hunt, Ryder System, Total Quality Logistics, DHL Supply Chain, Echo Global Logistics, Americold, Knight-Swift Transportation, Arrive Logistics and Universal Logistics Holdings, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed