Molybdenum Market Size, Share, Trends, Growth & Forecast 2034

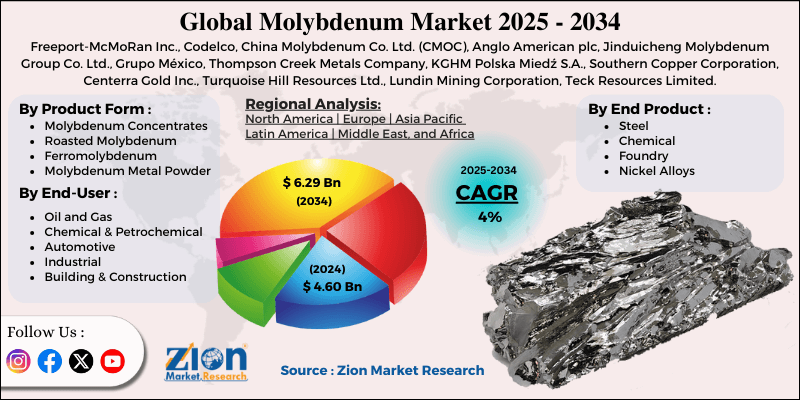

Molybdenum Market By End Product (Steel, Chemical, Foundry, Molybdenum Metal, Nickel Alloys), By Product Form (Molybdenum Concentrates, Roasted Molybdenum [Technical Oxide], Ferromolybdenum, Molybdenum Metal Powder, Molybdenum Chemicals), By End-User Industry (Oil and Gas, Chemical and Petrochemical, Automotive, Industrial, Building and Construction, Aerospace and Defense, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

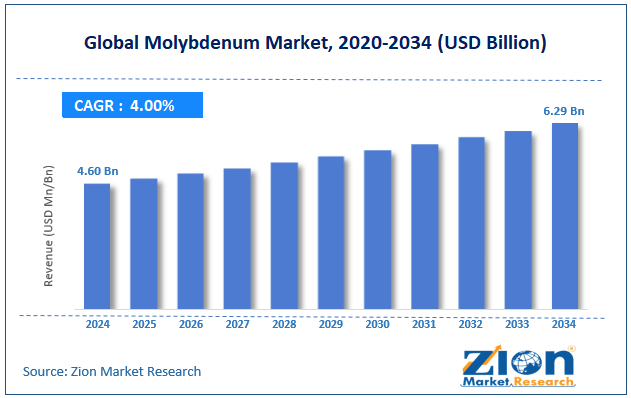

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.60 Billion | USD 6.29 Billion | 4% | 2024 |

Molybdenum Industry Perspective:

The global molybdenum market size was worth around USD 4.60 billion in 2024 and is predicted to grow to around USD 6.29 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4% between 2025 and 2034.

Molybdenum Market: Overview

Molybdenum is a silvery-white transition metal, prominent for its resistance to corrosion, strength, and high melting point. It is mainly used as an alloying agent in superalloys and steel, where it remarkably improves toughness, hardness, and heat resistance, increasing its suitability in industries like aerospace, automotive, construction, and energy. The global molybdenum market is likely to expand rapidly, driven by the growth of power and energy infrastructure, adoption in renewable energy technologies, and increasing demand for chemical catalysts. High-performing molybdenum alloys hold applications in offshore drilling equipment, turbines, and pipelines. As global investments in power infrastructure and oil & gas rise, mainly in the Middle East, China, and India, molybdenum demand witnesses notable growth.

Molybdenum is primarily used in wind turbines, solar panels, and hydrogen production catalysts. The move towards net-zero targets by 2050 is increasing molybdenum's role in clean energy solutions, mainly in fuel cell development and green hydrogen. In the chemical industry, molybdenum catalysts are used in the hydrocracking process and desulfurization in oil refineries. With stringent ecological norms on sulfur emissions, refineries are largely adopting these catalysts.

Despite the growth, the global market is impeded by factors such as price volatility, environmental regulations, and concerns. The molybdenum sector is highly cyclical, with costs varying because of demand from mining and steelmaking output fluctuations. Sharp price changes affect profitability for industries and producers with stable input costs.

Furthermore, the molybdenum refining and mining process generates emissions and waste that are under rising scrutiny. Stringent environmental regulations and ESG needs may restrict mining growth. Nonetheless, the global molybdenum industry stands to gain from a few key opportunities, such as growth in the hydrogen and clean energy economy, growing use in EVs, and advanced defense and aerospace applications.

Molybdenum's role in catalysts for hydrogen storage and production offers fresh growth opportunities, with the global hydrogen economy anticipated to surpass $400 billion by 2030. With the growing EV sales crossing 14 million units in 2023, molybdenum demand in EV batteries and durable and lightweight auto components is expected to rise, backing long-term growth. Additionally, emerging hypersonic technology, defense, and spacecraft projects require molybdenum alloys with enhanced durability, thereby generating high-value niche markets.

Key Insights:

- As per the analysis shared by our research analyst, the global molybdenum market is estimated to grow annually at a CAGR of around 4% over the forecast period (2025-2034)

- In terms of revenue, the global molybdenum market size was valued at around USD 4.60 billion in 2024 and is projected to reach USD 6.29 billion by 2034.

- The molybdenum market is projected to grow significantly owing to the rise in oil and gas exploration activities, rising demand for renewable energy technologies, and urbanization and infrastructure development.

- Based on the end product, the steel segment is expected to lead the market, while the chemical segment is expected to grow considerably.

- Based on product form, the ferromolybdenum segment is the dominating segment, while the roasted molybdenum (technical oxide) segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user industry, the oil and gas segment is expected to lead the market compared to the building and construction segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Molybdenum Market: Growth Drivers

How is the global molybdenum market driven by industrial & infrastructure upgrades in India and emerging Asia?

Manufacturing and speedy urbanization in ASEAN/India are boosting alloy steel intensity in metro/rail, chemical parks, bridges, food-pharma plants, and refineries. Where uptime and life-cycle cost matter, owners are switching to 316/duplex from 304 and to low-alloy Mo steels from carbon steel to reduce corrosion downtime, mainly in high-chloride water systems and industrial/coastal atmospheres.

Stainless steel and Indian EPCs referenced healthy demand for duplex and 316L in water, process, and metro segments. Policy-associated capex underpinned order visibility for stainless and alloy fabricators.

How are price & supply dynamics considerably fueling the molybdenum market?

A majority of molybdenum comes as a by-product of copper mining, which makes the supply sensitive to copper grades/throughput and inelastic to Mo-price. When copper mines reduce output or experience grade declines, Mo supply tightens; however, higher throughput or new copper projects may loosen the molybdenum market. These periods have generated multi-year Mo spikes, which strengthen substitution towards Mo in crucial service and simulate mine-capacity investments.

Molybdenum Market: Restraints

Substitution risk from alternative materials hampers the market progress

While molybdenum offers unique properties like high-corrosion strength and corrosion at higher temperatures, price-sensitive sectors substitute it with low-Mo or Mo-free options during a price rise. Chromium, vanadium, niobium steels, and nickel usually replace molybdenum in some applications, mainly in construction-grade stainless steel and automotive components.

During the 2023 price hike, the worldwide demand for 316 stainless steel dropped by approximately 7% YoY, with some consumers switching back to 304 stainless steel to control prices. This substitution risk reduces the demand for molybdenum during high-price periods.

Molybdenum Market: Opportunities

How do energy storage systems & hydrogen economy present lucrative opportunities for advancing the molybdenum market?

Hydrogen pipelines, electrolyzers, and storage tanks need Mo-bearing steels to resist hydrogen embrittlement. As hydrogen infrastructure grows, molybdenum's role in promising longevity and safety is becoming paramount.

Germany and Japan have declared significant hydrogen import terminal projects, both of which stipulate high-performance Mo-alloyed steels in their designs. The United States DOE also listed molybdenum as an essential material for hydrogen-ready pipelines, impacting the development of the worldwide molybdenum industry.

Molybdenum Market: Challenges

High processing and energy costs limit the market growth

Molybdenum refining and smelting are energy-intensive, mainly depending on electricity and natural gas. Growing energy costs raise operating expenses, mainly in China and Europe. Several European smelters cut back production because of soaring energy costs after the Russia-Ukraine conflict in 2023. Chinese refiners also mentioned energy volatility as a reason for the drop in operating rates.

Molybdenum Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Molybdenum Market |

| Market Size in 2024 | USD 4.60 Billion |

| Market Forecast in 2034 | USD 6.29 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 213 |

| Key Companies Covered | Freeport-McMoRan Inc., Codelco, China Molybdenum Co. Ltd. (CMOC), Anglo American plc, Jinduicheng Molybdenum Group Co. Ltd., Grupo México, Thompson Creek Metals Company, KGHM Polska Miedź S.A., Southern Copper Corporation, Centerra Gold Inc., Turquoise Hill Resources Ltd., Lundin Mining Corporation, Teck Resources Limited, Zijin Mining Group Co. Ltd., BHP Group Limited, and others. |

| Segments Covered | By End Product, By Product Form, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Molybdenum Market: Segmentation

The global molybdenum market is segmented based on end product, product form, end-user industry, and region.

Based on end product, the global molybdenum industry is divided into steel, chemical, foundry, molybdenum metal, and nickel alloys. The steel segment registers more than 60% of worldwide molybdenum production. The metal is mainly used in structural steel, stainless steel, and tool steels, where it improves weldability, tensile strength, and corrosion resistance. Industrialization and rapid urbanization in developing economies have increased the demand for molybdenum-alloyed steels in infrastructure and construction projects. Moreover, applications in automotive parts, oil & gas pipelines, and energy infrastructure promise steady growth in this domain, increasing the significance of steel in these markets.

Based on product form, the global molybdenum market is segmented as molybdenum concentrates, roasted molybdenum (technical oxide), ferromolybdenum, molybdenum metal powder, and molybdenum chemicals. The ferromolybdenum holds the leading share of use across the globe. It is the highly preferred product form because it is the main additive in steelmaking, particularly in alloy and stainless steels. Ferromolybdenum is highly favored due to its efficacy in enhancing steel's hardness, corrosion resistance, and high-temperature strength, thereby increasing its significance in automotive, construction, oil & gas pipelines, and energy applications.

Based on end-user industry, the global market is segmented as oil and gas, chemical and petrochemical, automotive, industrial, building and construction, aerospace and defense, and others. The oil & gas is the dominating segment, accounting for the highest share of molybdenum. It is broadly used in offshore drilling equipment, pipelines, and refining catalysts due to its ability to tolerate heat, high pressure, and corrosive environments. With the increasing global energy demand along with investments in exploration projects, the said end-use industry continues to dominate the market.

Molybdenum Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Molybdenum Market?

Asia Pacific is anticipated to retain its leading role in the global molybdenum market as a result of a strong steel production base, construction growth, speedy urbanization, and expanding energy and oil & gas infrastructure. Asia Pacific holds leadership in the global market because of its massive steelmaking sector, since molybdenum is a primary alloying material in structural and stainless steels.

In 2023, China alone generated more than 1.02 billion metric tons of crude steel, accounting for approximately 54% of the worldwide output, which fuels primary molybdenum consumption. This makes the region the leading consumer of ferromolybdenum used in automotive, construction, and industrial sectors. APAC's speedy urbanization propels steel consumption in construction, a leading end-use domain for molybdenum. The region needs USD 1.7 trillion yearly in infrastructure investment until 2030 to sustain development, according to the Asian Development Bank. Bridges, skyscrapers, and smart city projects in India, China, and Southeast Asia demand structural and stainless steel strengthened with molybdenum.

Furthermore, the region is heavily investing in energy infrastructure, comprising refineries, pipelines, and power plants, where molybdenum-alloyed steels are vital. For instance, in 2023, India's oil refining capacity hit 256 MTPA, ranking it second in Asia and China. Such massive energy projects surge the demand for catalysts and molybdenum-based steels used in hydrodesulfurization processes.

North America ranks as the second-leading region in the global molybdenum industry as a result of advanced automotive and industrial applications, construction and infrastructure growth, and robust oil & gas industry demand. North America holds a well-developed industrial and automotive base, with molybdenum used in heavy machinery, EV technologies, and engine components. In 2023, the United States auto industry generated more than 10 million vehicles, with the growing adoption of EVs amplifying battery-associated molybdenum and alloy demand. Construction equipment and industrial machinery further contribute to North America’s significant molybdenum use.

Additionally, North America continues to invest in infrastructure advancement, driving the demand for molybdenum-alloyed steels in transport networks, bridges, and urban projects. The United States Infrastructure Investment and Jobs Act allocates over $1.2 trillion through 2030, with a significant portion dedicated to steel-intensive construction projects. These large projects guarantee steady molybdenum consumption in structural and stainless steels. The region's large oil & gas industry fuels primary consumption of molybdenum, mainly in refining catalysts, pipelines, and offshore drilling machinery. The United States generated nearly 12.9 million oil barrels each day in 2023, registering as the leading producer worldwide. This energy prominence assures sustained demand for molybdenum in corrosion-resistant steel pipelines and hydrodesulfurization catalysts.

Molybdenum Market: Competitive Analysis

The leading players in the global molybdenum market are:

- Freeport-McMoRan Inc.

- Codelco

- China Molybdenum Co. Ltd. (CMOC)

- Anglo American plc

- Jinduicheng Molybdenum Group Co. Ltd.

- Grupo México

- Thompson Creek Metals Company

- KGHM Polska Miedź S.A.

- Southern Copper Corporation

- Centerra Gold Inc.

- Turquoise Hill Resources Ltd.

- Lundin Mining Corporation

- Teck Resources Limited

- Zijin Mining Group Co. Ltd.

- BHP Group Limited

Molybdenum Market: Key Market Trends

Rising demand from the hydrogen economy and clean energy:

Molybdenum is largely used in catalysts for the production of hydrogen, solar panels, and wind turbines, complying with the worldwide decarbonization efforts. With the green hydrogen industry anticipated to surpass USD 400 billion by 2030, molybdenum’s role in fuel cell technologies and electrolysis is becoming a leading driver.

Technological shifts in the automotive and steel industries:

The growth of high-strength lightweight steels and electric vehicles is fueling molybdenum use in construction and automotive appliances. In 2023, the worldwide EV sales progressed by 35%, generating fresh alloying prospects for molybdenum in chassis, drivetrain systems, and batteries. This shift assures continued demand from modernized mobility solutions.

The global molybdenum market is segmented as follows:

By End Product

- Steel

- Chemical

- Foundry

- Molybdenum Metal

- Nickel Alloys

By Product Form

- Molybdenum Concentrates

- Roasted Molybdenum (Technical Oxide)

- Ferromolybdenum

- Molybdenum Metal Powder

- Molybdenum Chemicals

By End-User Industry

- Oil and Gas

- Chemical and Petrochemical

- Automotive

- Industrial

- Building and Construction

- Aerospace and Defense

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Molybdenum is a silvery-white transition metal, prominent for its resistance to corrosion, strength, and high melting point. It is mainly used as an alloying agent in superalloys and steel, where it remarkably improves toughness, hardness, and heat resistance, increasing its suitability in industries like aerospace, automotive, construction, and energy.

The global molybdenum market is projected to grow due to increasing use in petrochemical and chemical applications, growing use in automotive manufacturing, and surging production capacity and global mining activities.

According to study, the global molybdenum market size was worth around USD 4.60 billion in 2024 and is predicted to grow to around USD 6.29 billion by 2034.

The CAGR value of the molybdenum market is expected to be around 4% during 2025-2034.

Asia Pacific is expected to lead the global molybdenum market during the forecast period.

Emerging trends in the molybdenum market include its use in hydrogen infrastructure, rising use in renewable energy, advanced catalysts, and aerospace superalloys supported by the rising demand for high-performance materials. Innovations focus on low-carbon mining, recycling technologies, and alloy development to improve sustainability and reduce costs.

Molybdenum chemicals and catalysts are expected to offer significant growth opportunities, driven by rising demand in petrochemicals, refining, and environmental applications. Additionally, ferromolybdenum will experience steady growth as alloy and stainless steel production expands worldwide.

The molybdenum value chain includes concentration, mining, refining/conversion, roasting, and alloy fabrication, before reaching end-use industries. Final applications span aerospace, stainless steel, catalysts, electronics, and energy.

The key players profiled in the global molybdenum market include Freeport-McMoRan Inc., Codelco, China Molybdenum Co., Ltd. (CMOC), Anglo American plc, Jinduicheng Molybdenum Group Co., Ltd., Grupo México, Thompson Creek Metals Company, KGHM Polska Miedź S.A., Southern Copper Corporation, Centerra Gold Inc., Turquoise Hill Resources Ltd., Lundin Mining Corporation, Teck Resources Limited, Zijin Mining Group Co., Ltd., and BHP Group Limited.

The report examines key aspects of the molybdenum market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed