Global Copper Market Size, Share, Growth Analysis Report - Forecast 2034

Copper Market By Type (Primary Copper, Secondary Copper), By Product (Wire Rod, Plates, Sheets & Strips, Tubes, Bars & Sections, Others), By Application (Electrical & Electronics, Construction, Transportation, Industrial Machinery, Consumer Goods), By End-user (Building & Construction, Electricals, Industrial, Transportation, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

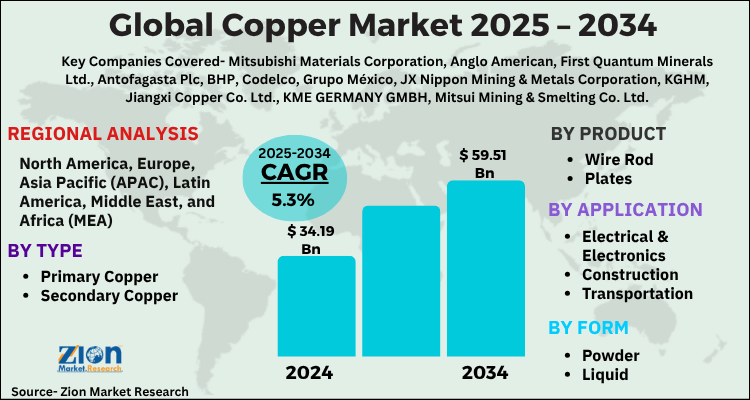

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.19 Billion | USD 59.51 Billion | 5.3% | 2024 |

Copper Market: Industry Perspective

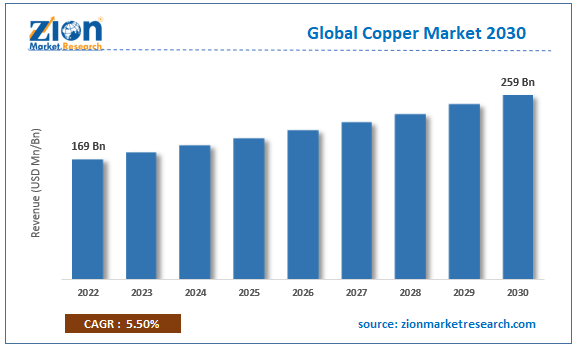

The global copper market size was worth around USD 34.19 Billion in 2024 and is predicted to grow to around USD 59.51 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.3% between 2025 and 2034. The report analyzes the global copper market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the copper industry.

Copper Market: Overview

Metals like copper are frequently alloyed with other metals. It is made by rolling copper sheets or depositing copper electrodes. It is a favored option for industrial objects because of its superior mechanical strength, durability, and electrical conductivity when compared to other metals. Excellent electrical and thermal conductivity characterizes this ductile, malleable metal. The hue of a newly exposed pure copper surface is pinkish-orange. Copper finds applications as a heat & electricity conductor, construction material, and constituent of many metal alloys, such as constantan for strain gauges, sterling silver for jewelry, and cupronickel for naval gear and coins.

Key Insights

- As per the analysis shared by our research analyst, the global copper market is estimated to grow annually at a CAGR of around 5.3% over the forecast period (2025-2034).

- Regarding revenue, the global copper market size was valued at around USD 34.19 Billion in 2024 and is projected to reach USD 59.51 Billion by 2034.

- The copper market is projected to grow at a significant rate due to Growing demand from construction, electronics, and renewable energy sectors fuels market growth. Electric vehicle and infrastructure investments also boost copper usage.

- Based on Type, the Primary Copper segment is expected to lead the global market.

- On the basis of Product, the Wire Rod segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Electrical & Electronics segment is projected to swipe the largest market share.

- By End-user, the Building & Construction segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Copper Market: Growth Drivers

The growth in the construction industry drives market growth

The growth in the construction industry is expected to drive the global copper market growth over the forecast period. Copper's exceptional qualities, including its high electrical conductivity, resistance to corrosion, and durability, make it an indispensable material in the building sector. It enhances the efficiency, usefulness, and safety of infrastructure and buildings through a variety of construction-related uses. For instance, in January 2022, the Indian government gave its approval for the construction of 21 new airports. The Gautam Buddha Nagar region of Uttar Pradesh will host the nation's biggest airport. In the upcoming years, the Ministry of Civil Aviation plans to construct 21 more airports throughout India. At an estimated cost of USD 338 million, the Airports Authority of India (AAI) intends to build new airports as well as extend and renovate several existing airports over the next four to five years. This includes building new terminals, enlarging and modifying existing ones, and bolstering or expanding runways, technical blocks, aprons, and control towers for airport navigation services. Furthermore, three Public-Private Partnership (PPP) airports—in Hyderabad, Bengaluru, and Delhi—will have spent INR 30,000 crore in development plans by the year 2025.

Copper Market: Restraints

Environmental concerns hamper the market growth

The environmental effects of copper mining and extraction procedures may cause local populations and environmental groups to raise concerns. Tighter environmental laws have the potential to raise production costs and impede the opening of new mines. For instance, according to the International Energy Agency, the production of copper accounts for 0.21% of all metals' greenhouse gas emissions and uses around 600 million Gj of energy yearly. Thus, the aforementioned stats are expected to hamper the copper industry growth during the forecast period.

Copper Market: Opportunities

Growing collaboration among key players offers a lucrative opportunity for market growth

The growing collaboration among the key market players is expected to offer a lucrative opportunity for copper market growth during the forecast period. For instance, in October 2023, a memorandum of understanding was recently signed by Anglo American and Mitsubishi Materials Corporation to work together on developing a copper product offering that meets the increasing demand for metals with provenance credentials that can be verified. To identify and quantify sustainability indicators that end users and industry stakeholders feel are most important and useful, the partnership will concentrate on advancing traceability throughout the fragmented value chain of copper. The two businesses will collaborate to give these stakeholders safe access to pertinent product provenance data through technology-driven traceability solutions. To lower the overall carbon footprint of the metal supplied to clients, they also look into decarbonization options.

Copper Market: Challenges

Modern technology and the ease of finding alternatives pose a challenge to market growth

In some applications, substitute materials might pose a challenge to copper's market share. For example, the telecommunications infrastructure built on copper has been gradually degraded due to the progress made in fiber optic technology. The demand for copper may also be impacted by technical developments in energy transmission and storage systems that introduce substitute materials or lower the copper content.

Copper Market: Segmentation Analysis

The global copper market is segmented based on Type, Product, Application, End-user, and region.

Based on Type, the global copper market is divided into Primary Copper, Secondary Copper.

On the basis of Product, the global copper market is bifurcated into Wire Rod, Plates, Sheets & Strips, Tubes, Bars & Sections, Others.

By Application, the global copper market is split into Electrical & Electronics, Construction, Transportation, Industrial Machinery, Consumer Goods.

In terms of End-user, the global copper market is categorized into Building & Construction, Electricals, Industrial, Transportation, Others.

Copper Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Copper Market |

| Market Size in 2024 | USD 34.19 Billion |

| Market Forecast in 2034 | USD 59.51 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 221 |

| Key Companies Covered | Mitsubishi Materials Corporation, Anglo American, First Quantum Minerals Ltd., Antofagasta Plc, BHP, Codelco, Grupo México, JX Nippon Mining & Metals Corporation, KGHM, Jiangxi Copper Co. Ltd., KME GERMANY GMBH, Mitsui Mining & Smelting Co. Ltd., Norilsk Nickel, Rio Tinto, UMMC Holding Corp., OM Group Inc., Sumitomo Metal Mining Co. Ltd., Teck Resources Limited, Vale, and others., and others. |

| Segments Covered | By Type, By Product, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Copper Market: Regional Analysis

Asia Pacific is expected to hold the largest market share over the forecast period

The Asia Pacific is expected to hold the largest copper market share over the forecast period. The market growth in the region is owing to the presence of major producing countries such as China. The world's top producer of copper is China. Due to its extensive mining activities, smelting capabilities, and refining capacity, the nation contributes significantly to the world's supply of copper. Important participants in the market include Chinese enterprises Jiangxi Copper, Tongling Nonferrous Metals Group, and Zijin Mining.

In addition, China is the world's largest consumer of copper as well as the biggest producer. The enormous demand for copper is driven by its growing urbanization, infrastructural expansion, and growth in the electronics & automotive sectors. The nation's consumption patterns have a significant impact on world copper prices. For instance, according to secondary analysis, China's copper consumption is set to increase by between 110,000 tonnes and 120,000 tonnes compared with an expected rise of between 50,000 tonnes and 70,000 tonnes in 2023. Moreover, the copper demand from the auto sector is set to rise by as much as 160,000 tonnes. Thus, the aforementioned facts are expected to drive market growth in the region during the forecast period.

Copper Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the copper market on a global and regional basis.

The global copper market is dominated by players like:

- Mitsubishi Materials Corporation

- Anglo American

- First Quantum Minerals Ltd.

- Antofagasta Plc

- BHP

- Codelco

- Grupo México

- JX Nippon Mining & Metals Corporation

- KGHM

- Jiangxi Copper Co. Ltd.

- KME GERMANY GMBH

- Mitsui Mining & Smelting Co. Ltd.

- Norilsk Nickel

- Rio Tinto

- UMMC Holding Corp.

- OM Group Inc.

- Sumitomo Metal Mining Co. Ltd.

- Teck Resources Limited

- Vale

- and others.

The global copper market is segmented as follows;

By Type

- Primary Copper

- Secondary Copper

By Product

- Wire Rod

- Plates

- Sheets & Strips

- Tubes

- Bars & Sections

- Others

By Application

- Electrical & Electronics

- Construction

- Transportation

- Industrial Machinery

- Consumer Goods

By End-user

- Building & Construction

- Electricals

- Industrial

- Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Metals like copper are frequently alloyed with other metals.

The global copper market is expected to grow due to Growing demand from construction, electronics, and renewable energy sectors fuels market growth. Electric vehicle and infrastructure investments also boost copper usage.

According to a study, the global copper market size was worth around USD 34.19 Billion in 2024 and is expected to reach USD 59.51 Billion by 2034.

The global copper market is expected to grow at a CAGR of 5.3% during the forecast period.

Asia-Pacific is expected to dominate the copper market over the forecast period.

Leading players in the global copper market include Mitsubishi Materials Corporation, Anglo American, First Quantum Minerals Ltd., Antofagasta Plc, BHP, Codelco, Grupo México, JX Nippon Mining & Metals Corporation, KGHM, Jiangxi Copper Co. Ltd., KME GERMANY GMBH, Mitsui Mining & Smelting Co. Ltd., Norilsk Nickel, Rio Tinto, UMMC Holding Corp., OM Group Inc., Sumitomo Metal Mining Co. Ltd., Teck Resources Limited, Vale, and others., among others.

The report explores crucial aspects of the copper market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed