Molecular Breeding Market Size, Share & Forecast, Growth Report 2032

Molecular Breeding Market by Marker (Simple Sequence Repeats (SSR), Single Nucleotide Polymorphism (SNP), and Others), by Process (Marker-Assisted Selection (MAS), QTL Mapping, Genomic Selection, Marker-Assisted Backcrossing (MABC), and Others), and by Application (Livestock and Crop): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

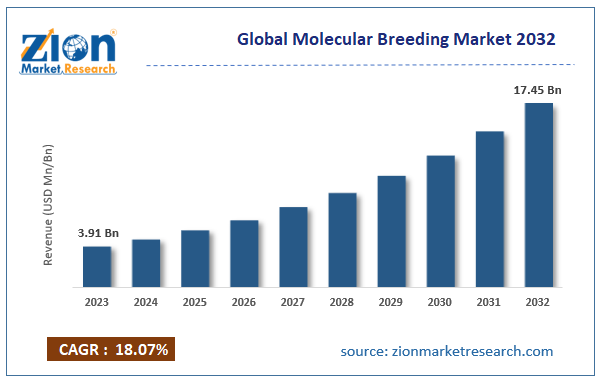

| USD 3.91 Billion | USD 17.45 Billion | 18.07% | 2023 |

Molecular Breeding Industry Perspective:

The global molecular breeding market size was worth around USD 3.91 billion in 2023 and is predicted to grow to around USD 17.45 billion by 2032 with a compound annual growth rate (CAGR) of roughly 18.07% between 2024 and 2032.

The report covers forecasts and analyses for the molecular breeding market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2030 based on revenue (USD Billion). The study includes drivers and restraints for the molecular breeding market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the molecular breeding market on a global as well as regional level.

In order to give the users of this report a comprehensive view of the molecular breeding market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein marker, process and application segments are benchmarked based on their market size, growth rate, and general attractiveness.

Molecular breeding is a breeding technique that uses DNA markers associated with particular phenotypic traits for selecting a particular breeding objective. Breeding aims at improving the genetic makeup in order to improve yield, disease resistance, quality, drought, and frost tolerance in crop plants along with aiming to improve the production of milk, meat, egg, and wool in livestock. Various genetic markers, such as random amplified polymorphic DNA (RAPD), amplified fragment length polymorphism (AFLP), and inter-simple sequence repeats (ISSRs), are important tools for breeding.

Various methods are used in molecular breeding, such as Marker-Assisted Selection (MAS), Quantitative Trait Locus (QTL) Mapping, Genomic Selection, and Marker-Assisted Backcrossing (MABC). MAS process involves marker selection which is linked to a specific trait that needs improvement. QTL mapping refers to quantitative trait deviation in the phenotype of a population. In marker-assisted backcrossing (MABC), agronomically inferior donor gene is incorporated into the breeding line. The resulting breed has a major gene from the donor with remaining genotype from the breeding line.

Molecular Breeding Market Growth:

The report provides a company market share analysis in order to give a broader overview of the key players in the molecular breeding market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the molecular breeding market on a global and regional basis.

The study provides a decisive view of the molecular breeding market by segmenting the market based on marker, process, application, and region. The segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2024. The marker segment is classified into Simple Sequence Repeats (SSR), Single Nucleotide Polymorphism (SNP), and others. Based on the breeding process, the market is segmented into Marker-Assisted Selection (MAS), QTL mapping, genomic selection, Marker-Assisted Backcrossing (MABC), and others. The application segment has been divided into livestock and crops.

Molecular Breeding Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Molecular Breeding Market |

| Market Size in 2023 | USD 3.91 Billion |

| Market Forecast in 2032 | USD 17.45 Billion |

| Growth Rate | CAGR of 18.07% |

| Number of Pages | 220 |

| Key Companies Covered | Illumina, Eurofins, LGC Limited, SGS, Thermo Fisher Scientific, Intertek Group, DanBred, LemnaTec, Slipstream Automation, Charles River, FruitBreedomics, and others. |

| Segments Covered | By Marker, By Process, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Worldwide, the population is growing at a considerable rate and is expected to reach about 8.6 billion by 2030, as per the United Nations. With the population growth, food demand is expected to rise. Crop and livestock yield need to be improved to meet the growing food demand in the near future. The need to improve crop yield is the major factor driving the molecular breeding market. Additionally, crop yield is largely affected by climatic conditions. Biotic and abiotic stress resistant crops can be produced using molecular breeding techniques with improved yield and other traits which, in turn, are predicted to help drive the molecular breeding market growth.

Other factors accelerating the molecular breeding market growth include increased government funding for agrogenomic research, technological advancements in made molecular biology, declining prices of genetic and molecular biology research products, and huge investments made in research and development activities by market players considering the market potential of the molecular breeding products. The expansion of the molecular breeding market is likely to be hampered by the need for huge capital investments and the lack of advanced infrastructure in developing economies. Growing demand for industrial crops, such as wheat and corn, might act as an opportunity for the expansion of the molecular breeding market.

Molecular Breeding Market Segmentation Analysis

The global molecular breeding market is classified based on the marker, process, and application.

By marker, the market categorized into simple sequence repeats (SSR), single nucleotide polymorphism (SNP), and others. The others segment includes a sequence tagged site, expressed sequence tags (EST), and random amplified polymorphic DNA (RAPD).

By breeding process, the market is segmented into Marker-Assisted Selection (MAS), QTL Mapping, Genomic Selection, Marker-Assisted Backcrossing (MABC), and others. The others segment includes position gene cloning, Marker-Assisted Recurrent Selection (MARS), and genetic fingerprinting.

By application, the market is bifurcated into crop and livestock. The crop segment holds the maximum share of the application segment, whereas the livestock segment is projected to grow significantly in the upcoming years. The crop segment is further classified into oilseeds & pulses, cereals & grains, vegetables, and other crops. Cattle, poultry, and others are the sub-segments of the livestock application segment.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further segmentation into major countries including the U.S. Canada, Germany, France, UK, China, Japan, India, and Brazil. This segmentation includes demand for molecular breeding tools based on individual segments and applications in all regions and countries.

The largest regional market for molecular breeding was North America in 2022 and is expected to hold the leading position in the forecast time period. Government funds for agrogenomic R&D, advanced technology, and well-developed infrastructure are the key factors promoting the development of the molecular breeding market in this region. Europe was the second largest market in 2022 and is likely to maintain its position during the forecast time period. Asia Pacific is a rapidly growing region for this market, owing to increasing R&D investments made by the government-owned research institutes. Considerable expansion of the molecular breeding market is likely across the Middle Eastern and African region in the upcoming years. Moderate business growth is expected in the Latin American region during the forecast time period.

Molecular Breeding Market: Competitive Analysis

The global molecular breeding market is led by players like:

- Illumina

- Eurofins

- LGC Limited

- SGS

- Thermo Fisher Scientific

- Intertek Group

- DanBred

- LemnaTec

- Slipstream Automation

- Charles River

- FruitBreedomics

This report segments the global molecular breeding market as follows:

Global Molecular Breeding Market: By Marker

- Simple Sequence Repeats (SSR)

- Single Nucleotide Polymorphism (SNP)

- Others (Sequence Tagged Site, Expressed Sequence Tags (EST), and Random Amplified Polymorphic DNA (RAPD))

Global Molecular Breeding Market: By Process

- Marker-Assisted Selection (MAS)

- QTL Mapping

- Genomic Selection

- Marker-Assisted Backcrossing (MABC)

- Others (Position Gene Cloning, Marker-Assisted Recurrent Selection (MARS), and Genetic Fingerprinting)

Global Molecular Breeding Market: By Application

- Crop

- Oilseeds & Pulses

- Cereals & Grains

- Vegetables

- Other Crops (Fruits, Greenhouse & Nursery Plants, and Ornamentals)

- Livestock

- Cattle

- Poultry

- Others(Equine, Aquaculture, Swine, and Other Avian Livestock)

Global Molecular Breeding Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Molecular breeding deals with genetic manipulation in plants and animals at the DNA level. Molecular breeding aims at improving crop yield and reducing disease resistance, biotic and abiotic stress resistance, etc.

According to the report, the global molecular breeding market size was worth around USD 3.91 billion in 2023 and is expected to reach around USD 17.45 billion by 2032.

The global molecular breeding market is expected to grow at a CAGR of 18.07% during the forecast period.

North America is expected to dominate the molecular breeding market over the forecast period.

The global molecular breeding market is dominated by players like Illumina, Eurofins, LGC Limited, SGS, Thermo Fisher Scientific, Intertek Group, DanBred, LemnaTec, Slipstream Automation, Charles River, and FruitBreedomics, among others.

The molecular breeding market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed