Molding Compounds Market Size, Share, Trends, Growth 2034

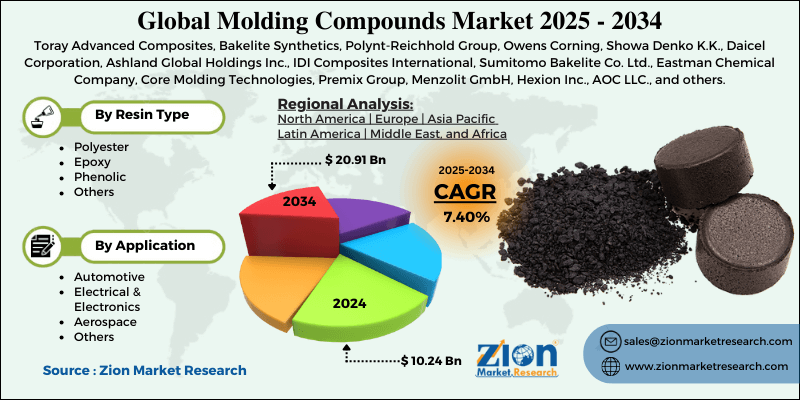

Molding Compounds Market By Resin Type (Polyester, Epoxy, Phenolic, and Others), By Application (Automotive, Electrical & Electronics, Aerospace, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

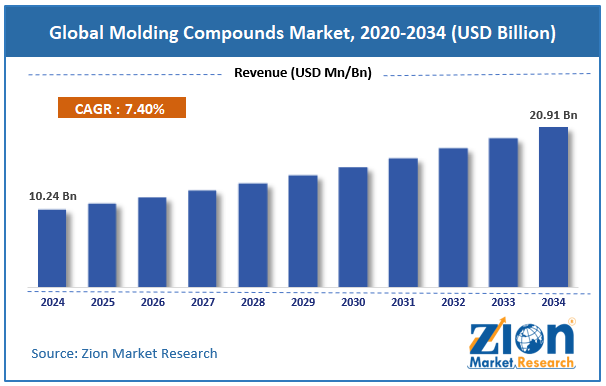

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.24 Billion | USD 20.91 Billion | 7.40% | 2024 |

Molding Compounds Industry Perspective:

The global molding compounds market size was worth around USD 10.24 billion in 2024 and is predicted to grow to around USD 20.91 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.40% between 2025 and 2034.

Molding Compounds Market: Overview

Molding compounds are essential thermosetting plastics. They showcase exceptional electrical and mechanical insulation and also offer higher temperature resistance properties. Molding compounds are used across various applications, depending on factors such as their chemistry, additives, hardeners, filler & filler cut size, and other parameters. These specialized materials are available for further processing in granular or pellet form. They are subject to a molding process to create different products. The industry is currently dominated by three main types of molding compounds: semiconductor molding compound, bulk molding compound (BMC), and sheet molding compound (SMC).

Furthermore, the use of molding compounds can be witnessed in growing industries such as construction, automotive, electrical & electronics, and aerospace sectors, among others. During the forecast period, demand for molding compounds is expected to grow due to multiple factors. For instance, increased demand in the electric vehicle industry will propel the application of specialized molding compounds during the forecast period. In addition to this, growing investments in the semiconductor sector and the rise in the use of consumer electronics will further propel the industry demand rate in the future. Market growth may be affected by the intensifying geopolitical tension worldwide.

Key Insights:

- As per the analysis shared by our research analyst, the global molding compounds market is estimated to grow annually at a CAGR of around 7.40% over the forecast period (2025-2034)

- In terms of revenue, the global molding compounds market size was valued at around USD 10.24 billion in 2024 and is projected to reach USD 20.91 billion by 2034.

- The molding compounds market is projected to grow at a significant rate due to the rising advancements in the electric vehicle (EV) sector.

- Based on the resin type, the phenolic segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the electrical & electronics segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Molding Compounds Market: Growth Drivers

Will rising advancements in the electric vehicle (EV) sector push the molding compounds market demand in the coming years?

The global molding compounds market is expected to be driven by the growing advancements in the electric vehicle sector of the automotive industry. EV investments in recent times have escalated at an unprecedented level due to increased demand from end consumers. Moreover, the increasing adoption of electric vehicles in public transport systems has further fueled the use of EVs across the globe. As end-user demand continues to rise, regional governments have opened new avenues for further market expansion.

Government support can be registered in the form of the availability of tax subsidies for businesses investing in electric vehicle technology and consumers buying EVs for personal use. For instance, the Government of India provides tax subsidies to companies investing in setting up required charging infrastructure or providing financial assistance for research & development (R&D) in the regional EV sector.

Molding compounds are used for producing several automotive parts such as electrical & electronic components, under-the-hood equipment, and interior parts. The increasing launch of new molding compounds suitable for applications in the electric vehicle sector will be critical to the industry’s final growth rate in the future.

Evolving requirements in terms of building materials in the construction sector to propel market revenue

The building & construction industry is witnessing rapid evolution in terms of material requirements. Industry players are increasingly investing in construction solutions that can withstand the changing climate conditions while continuing to offer superior structural support and deliver higher safety to the occupants. For instance, in February 2025, Avient Corporation, a leading provider of materials solutions, launched Hammerhead™ FR Flame Retardant Composite Panels along with other advanced composite technologies. It is the first-of-its-kind thermoplastic composite sandwich structure offering flame retardance and can be used for modular construction, flooring, or walls.

The new offering eliminates the need to use additional Fire-Resistant (FR) sheets or coating. The global molding compounds market is expected to benefit from increasing investments in technologies and solutions that can simplify the procedures in the construction industry worldwide.

Molding Compounds Market: Restraints

How do environmental impact and raw material price volatility impede the molding compounds market growth?

The global molding compounds industry is expected to be restricted due to the growing concerns over environmental damage caused during the production process. These procedures are energy-intensive, and market players must adhere to strict regulatory policies. In addition to this, raw materials such as epoxy and resin are subject to price volatility due to several external factors. The intensifying rate of geopolitical tension worldwide and changes in global trading partnerships may create growth limitations for the industry players in the future.

Molding Compounds Market: Opportunities

Does the expansion of the semiconductor industry generate growth opportunities for molding compounds market players?

The global molding compounds market is anticipated to generate growth opportunities due to the rising expansion of the semiconductor industry. According to recent trends, global economies are seeking ways to reduce dependence on Southeast Asian countries for the supply of advanced semiconductors and chips powering next-generation technologies. Regional governments are investing in setting up domestic semiconductor manufacturing facilities and supporting industries to reduce the impact on business operations in the backdrop of escalating political tensions. An increase in regional investments will emerge as a critical catalyst for higher opportunities for molding compound producers, according to research.

In June 2024, Röhm, a leading German chemical company, announced the expansion of its specialty molding compounds production capacity at the Wallingford plant in the US. The company aims to strengthen its foothold in the molding compounds sector with the new move. In September 2024, MPACT Plastic Containers, a South African producer of reusable plastic packaging solutions, announced an investment of R354 million as the company plans to extend its capabilities with the launch of a new injection molding factory.

Molding Compounds Market: Challenges

Raw material quality-related issues remain a primary challenge for industry players

The global molding compounds industry faces challenges in ensuring the consistent quality of raw materials used for molding compound production. Inconsistent quality can directly affect the performance of the final product manufactured using poor-grade molding compounds. Moreover, the higher cost of producing specialized molding compounds may further restrict the overall revenue generated by the industry players.

Molding Compounds Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Molding Compounds Market |

| Market Size in 2024 | USD 10.24 Billion |

| Market Forecast in 2034 | USD 20.91 Billion |

| Growth Rate | CAGR of 7.40% |

| Number of Pages | 213 |

| Key Companies Covered | Toray Advanced Composites, Bakelite Synthetics, Polynt-Reichhold Group, Owens Corning, Showa Denko K.K., Daicel Corporation, Ashland Global Holdings Inc., IDI Composites International, Sumitomo Bakelite Co. Ltd., Eastman Chemical Company, Core Molding Technologies, Premix Group, Menzolit GmbH, Hexion Inc., AOC LLC., and others. |

| Segments Covered | By Resin Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Molding Compounds Market: Segmentation

The global molding compounds market is segmented based on resin type, application, and region.

Based on the resin type, the global market segments are polyester, epoxy, phenolic, and others. In 2024, the phenolic segment achieved the highest growth, accounting for nearly 38.9% of the total revenue. The increasing demand for consumer electronics & electrical devices is one of the major segmental growth propellants. Phenolic-based molding compounds are used for insulating circuit boards and electronic components used across modern devices since the compound delivers improved heat resistance.

Based on the application, the global market is fragmented into automotive, electrical & electronics, aerospace, and others. In 2024, the highest revenue-generating segment was electrical & electronics, with prominence over 30.05% of the final revenue. Molding compounds are highly efficient in protecting critical electrical & electronic components of modern machines and devices, contributing to higher segmental revenue. The automotive industry is expected to emerge as the second-highest revenue generator during the forecast period.

Molding Compounds Market: Regional Analysis

What factors help Asia-Pacific dominate the molding compounds market during the forecast period?

The global molding compounds market will be led by Asia-Pacific. In 2024, the region accounted for nearly 41% of global revenue, with India, China, and Japan acting as the major revenue generators. The presence of a robust and thriving chemicals & manufacturing industry in the Asia-Pacific helps the region dominate among other territories.

Moreover, the Asia-Pacific has a high production volume of semiconductors, including the most advanced versions. Taiwan and China are the world’s largest suppliers of semiconductors used for powering consumer electronics, aircraft, Artificial Intelligence (AI) machines, and other cutting-edge equipment. The region’s automotive industry and growing investments in the EV sector across China and India will further facilitate higher regional revenue.

Europe is another prominent region in the molding compounds industry, and it is expected to continue contributing significantly to the global revenue. The existence of several critical players across countries such as Germany, Spain, and others leads European industry.

Moreover, increasing demand for sustainable and eco-friendly molding compounds may further create a higher growth scope for regional players. In April 2025, Ingenia Polymers, a leading provider of thermoplastic compounds, masterbatches, and additive solutions from Luxembourg, launched its first European plant in Germany in a bid to expand its global footprint.

Molding Compounds Market: Competitive Analysis

The global molding compounds market is led by players like:

- Toray Advanced Composites

- Bakelite Synthetics

- Polynt-Reichhold Group

- Owens Corning

- Showa Denko K.K.

- Daicel Corporation

- Ashland Global Holdings Inc.

- IDI Composites International

- Sumitomo Bakelite Co. Ltd.

- Eastman Chemical Company

- Core Molding Technologies

- Premix Group

- Menzolit GmbH

- Hexion Inc.

- AOC LLC.

The global molding compounds market is segmented as follows:

By Resin Type

- Polyester

- Epoxy

- Phenolic

- Others

By Application

- Automotive

- Electrical & Electronics

- Aerospace

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Molding compounds are essential thermosetting plastics. They showcase exceptional electrical and mechanical insulation and also offer higher temperature resistance properties.

The global molding compounds market is expected to be driven by the growing advancements in the electric vehicle sector of the automotive industry.

According to study, the global molding compounds market size was worth around USD 10.24 billion in 2024 and is predicted to grow to around USD 20.91 billion by 2034.

The CAGR value of the molding compounds market is expected to be around 7.40% during 2025-2034.

The global molding compounds market will be led by Asia-Pacific. In 2024, the region accounted for nearly 41% of global revenue, with India, China, and Japan acting as the major revenue generators.

The global molding compounds market is led by players like Toray Advanced Composites, Bakelite Synthetics, Polynt-Reichhold Group, Owens Corning, Showa Denko K.K., Daicel Corporation, Ashland Global Holdings Inc., IDI Composites International, Sumitomo Bakelite Co., Ltd., Eastman Chemical Company, Core Molding Technologies, Premix Group, Menzolit GmbH, Hexion Inc., and AOC, LLC.

The report explores crucial aspects of the molding compounds market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed