Medical Device Packaging Market Size, Share, Trends, Growth and Forecast 2032

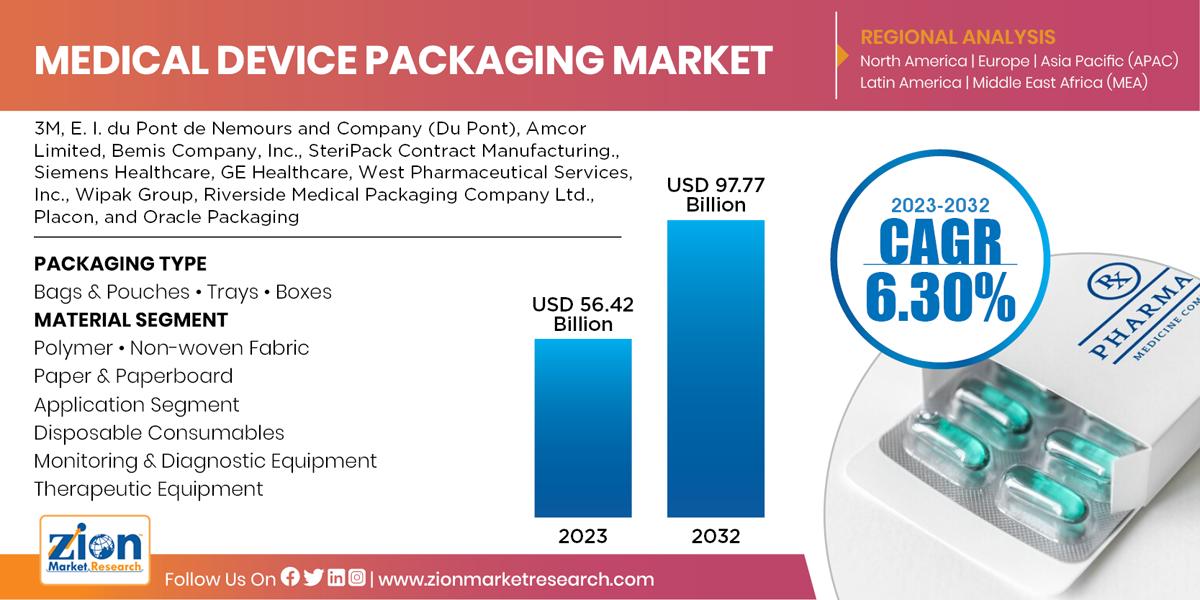

Medical Device Packaging Market by Packaging Type (Bags & Pouches, Trays, and Boxes), by Material (Polymer, Non-woven Fabric, and Paper & Paperboard), and by Application (Disposable Consumables, Monitoring & Diagnostic Equipment, and Therapeutic Equipment): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 56.42 Billion | USD 97.77 Billion | 6.30% | 2023 |

Medical Device Packaging Industry Perspective:

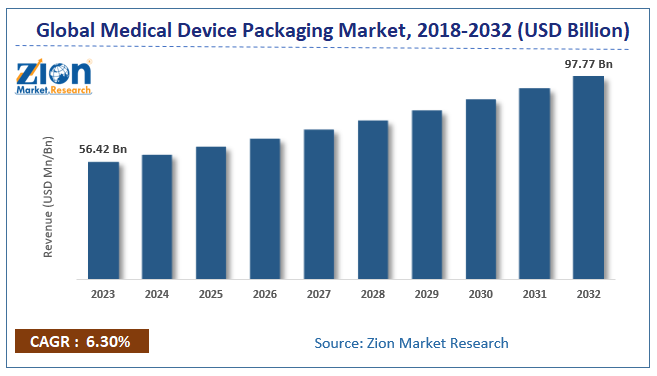

The global Medical Device Packaging Market size was worth around USD 56.42 Billion in 2023 and is predicted to grow to around USD 97.77 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.30% between 2024 and 2032.

Key Insights

- As per the analysis shared by our research analyst, the medical device packaging market is anticipated to grow at a CAGR of 6.30% during the forecast period (2024-2032).

- The global medical device packaging market was estimated to be worth approximately USD 56.42 billion in 2023 and is projected to reach a value of USD 97.77 billion by 2032.

- The growth of the medical device packaging market is being driven by the increasing demand for sterile, safe, and tamper-evident packaging solutions in the healthcare sector.

- Based on the packaging type, the bags & pouches segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the polymer segment is projected to swipe the largest market share.

- In terms of application, the disposable consumables segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Medical device packaging is utilized for storing, transporting, and protecting the medical devices. The packaging must maintain the sterility of the medical device until its usage. Moreover, the packaging includes protection of both rigid and flexible type of products. Manufacturers responsible for packaging system design are required to offer a secured and effective packaging system. The main objective of the packaging is to keep the products free from microbial contamination and maintain sterile condition. Packaging helps the medical devices against tearing, vibration, splitting, damaging, and atmospheric changes. The investments and advancements in the healthcare industry are anticipated to expand the production of medical devices and medical appliances, which in turn contributes to the growth of the market.

The increasing demand for medical devices such as surgical implants and instruments, medical supplies, electro-medical equipment, in-vitro diagnostic equipment and reagents, irradiation apparatuses, and dental goods has been driving the demand for medical device packaging products. Unhealthy lifestyles of people have been resulting in the high prevalence of chronic diseases, such as heart disease, cancer, diabetes, stroke, and arthritis, in recent years, especially in developed economies. These above-mentioned diseases require various medical equipment for diagnosing and treatment and have been contributing to the growth of the medical device market over the past five years.

The report covers forecast and analysis for the medical device packaging market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the medical device packaging market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the medical device packaging market on a global level.

Global Medical Device Packaging Market: Growth Factors

Increasing demand for flexible packaging due to its transparency, chemical resistance, and moldability are expected to positively influence the market growth during the forecast time period. In addition to this, a smart approach to the modern packaging system could be beneficial to the medical device manufacturers which in turn propel the market growth. The rising demand for the product with longer shelf life is also the major factor driving the market. The shelf life of the products can be increased by protecting it from various deteriorating agents such as oxygen, moisture, and microorganisms. Furthermore, due to increased viral infections, most of the medical devices manufacturing factories, hospitals, and diagnostic centers are focusing on disinfecting medical device packaging. However, high cost for maintaining the medical devices is retraining the growth of the market.

In order to give the users of this report a comprehensive view of the medical device packaging market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein the packaging type, material, and application segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology and regional expansion of major participants involved in the market on the global and regional basis. Moreover, the study covers price trend analysis, technology portfolio of various companies according to the region.

Recent Development

- In September 2025, Thermo Fisher Scientific Inc., the world leader in serving science, announced the completion of its acquisition of the Purification & Filtration business of Solventum for approximately $4.0 billion in cash. With the transaction complete, the business, now operating as Thermo Fisher’s Filtration and Separation business, has joined the Life Sciences Solutions segment.

- In May 2025, Packaging Compliance Labs (PCL), an industry leader in sterile packaging solutions for the medical device and life sciences markets, announced the acquisition of Quest Engineering Solutions, an ISO 17025-accredited test lab based in Billerica, MA. This strategic acquisition marks a major milestone in PCL's growth, expanding its footprint to the East Coast and broadening its testing capabilities to include product testing and an array of new test methods.

- In November 2024, Amcor plc entered into a strategic partnership with Siemens Healthineers. The collaboration aimed to develop advanced, sustainable medical device packaging solutions.

- In July 2023, Oliver Healthcare Packaging acquired EK-Pack Folien to strengthen its supply chain and add in-region film and foil production. This acquisition provides greater control over the supply chain and enables innovation of existing products to meet evolving customer needs.

Medical Device Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Device Packaging Market Size Report |

| Market Size in 2023 | USD 56.42 Billion |

| Market Forecast in 2032 | USD 97.77 Billion |

| Growth Rate | CAGR of 6.30% |

| Number of Pages | 195 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | 3M, E. I. du Pont de Nemours and Company (Du Pont), Amcor Limited, Bemis Company, Inc., SteriPack Contract Manufacturing., Siemens Healthcare, GE Healthcare, West Pharmaceutical Services, Inc., Wipak Group, Riverside Medical Packaging Company Ltd., Placon, and Oracle Packaging |

| Segments Covered | By Packaging Type ,By Material, By Application, By end-user, and By region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Medical Device Packaging Market: Segmentation

The study provides a decisive view of the medical device packaging market by segmenting the market based on packaging type, material, and application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

On the basis of the packaging type, medical device packaging market is segmented into bags & pouches, trays, and boxes.

Based on the material, the market is classified into the polymer, non-woven fabric, and paper & paperboard.

Based on the application, the market is classified into disposable consumables, monitoring & diagnostic equipment, and therapeutic equipment.

North America accounted for a considerable revenue share of the medical device packaging market in 2023 and the region is projected to continue with its regional supremacy over the forecast period. The growth of this regional market is attributed due to the technological advancement and high income of consumers. Europe is the leading region followed by North America. Presence of the major manufacturers such as Siemens Healthcare, GE Healthcare, and others also propel the growth of the market in Europe. Asia Pacific medical device packaging market has emerged as the fastest growing market led by China, Japan, and India owing to the growing pharmaceutical industries in the region.

The regional segmentation includes the historic and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. This segmentation includes demand for medical device packaging market based on all segments in all the regions and countries.

The key players in the global Medical Device Packaging Market are -

Major companies are involved in the acquisition of other companies to expand their product portfolio and increase manufacturing capacity. The presence of internationally renowned public players in the market space is likely to lead to the increased instances of mergers & acquisitions over the forecast period, given the inability of smaller and privately held players to compete with the international market participants in terms of revenue generation, regional/global presence, and the establishment of distribution channels. Some prominent players in the global medical device packaging market include:

The major players operating in the medical device packaging market are -

- 3M

- E. I. du Pont de Nemours and Company (Du Pont)

- Amcor Limited

- Bemis Company

- SteriPack Contract Manufacturing.

- Siemens Healthcare

- GE Healthcare

- West Pharmaceutical Services

- Wipak Group

- Riverside Medical Packaging Company Ltd.

- Placon

- Oracle Packaging.

This report segments the global medical device packaging market as follows:

Medical Device Packaging Market: Packaging type Segment Analysis

- Bags & Pouches

- Trays

- Boxes

Medical Device Packaging Market: Material Segment Analysis

- Polymer

- Non-woven Fabric

- Paper & Paperboard

Medical Device Packaging Market: Application Segment Analysis

- Disposable Consumables

- Monitoring & Diagnostic Equipment

- Therapeutic Equipment

Medical Device Packaging Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Medical Device Packaging Market size was worth around USD 56.42 Billion in 2023 and is predicted to grow to around USD 97.77 Billion by 2032

compound annual growth rate (CAGR) of roughly 6.30% between 2024 and 2032.

The largest share of the Medical Device Packaging Market is held by Asia Pacific. Developing countries of Asia Pacific such as China, Japan, and India will be dominating the market scenario mainly due to the rising constructional activities. The growth of Asia-Pacific region is expected to be followed by the Middle East and North America. Also, significant growth is expected from Western Europe owing to the developments taking place in this region especially in countries such as Italy, Germany, the U.K, France, and Spain. However, growth in Africa, Latin America, and Eastern Europe is anticipated to be moderate over the forecast period.

The major players operating in the medical device packaging market are 3M, E. I. du Pont de Nemours and Company (Du Pont), Amcor Limited, Bemis Company, Inc., SteriPack Contract Manufacturing., Siemens Healthcare, GE Healthcare, West Pharmaceutical Services, Inc., Wipak Group, Riverside Medical Packaging Company Ltd., Placon, and Oracle Packaging.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed