Marine Propellers Market Trend, Share, Size Analysis, and Forecast 2032

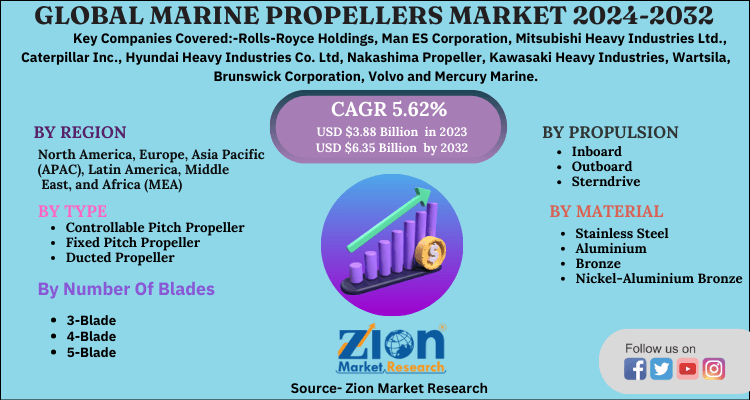

Marine Propellers Market By Type (Controllable Pitch Propeller, Fixed Pitch Propeller , Ducted Propeller And Others) By Number Of Blades (3-Blade, 4-Blade, 5-Blade And Others), By Propulsion (Inboard, Outboard, Sterndrive And Others) By Material (Stainless Steel, Aluminum, Bronze, Nickel, Aluminum Bronze And Others) By Application (Merchant Ships, Naval Ships, Recreational Boats, Cargo Or Container Ships, Bulk Carrier, Offshore Vessel, Passenger Ship And Others), By End User (OEM And Aftermarket) And By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

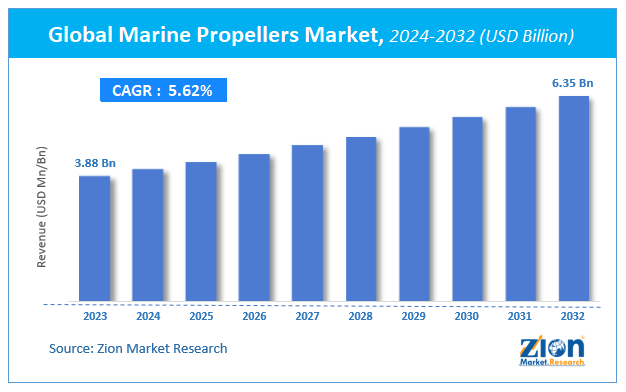

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.88 Billion | USD 6.35 Billion | 5.62% | 2023 |

Marine Propellers Market Size

Zion Market Research has published a report on the global Marine Propellers Market, estimating its value at USD 3.88 Billion in 2023, with projections indicating that it will reach USD 6.35 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.62% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Marine Propellers Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Marine Propellers Market: Overview

A propellers is fan-like rotating ship equipment used to propel the ship in forward direction in water by utilizing power from ship engine. The marine propellers are usually made from alloy of stainless steel and aluminum to resist corrosive action caused by sea water. In addition to alloys materials like bronze, nickel, and aluminum bronze and copper are used for manufacturing propellers. The propellers are vital for the movement of ship and the number of blades in the propeller determines the speed of the ship.

The marine propellers are increasingly witnessing product development due to emerging need for the high efficiency and less fuel consuming propellers by the end users. The market is witnessing upsurge in demand due to rising invests in seashore developments and seaborne trading across the globe.

COVID-19 Impact Analysis

The COVID-19 outbreak has significantly impacted the manufacturing sector and the international trade. The nationwide lockdown implementation had halted the manufacturing processes resulting loss of revenue. The supply and distribution chain for components of marine propellers manufacturers got disrupted resulting in even supply of raw materials and delayed delivery of finished products. Lockdown implementation affected the human resource required for production and manufacturing.

The COVID-19 pandemic have caused significant decline in global trade to strict government regulations to restrict the spread of COVID-19 infections. The manufacturing industry halted due to spread of COVID-19, leading to reduction in marine trading across the globe. The pandemic has hampered the growth of global economies and caused economic recession leading to the decline in international trade. The economic recession also affected the demand for the marine propellers. The marine propellers have witnessed significant decline due to covid-19 outbreak. The market is slowly recovering after the regulations for COVID-19 are loosened up.

Marine Propellers Market: Growth Factors

The factors primarily driving the market demand are upsurge in international marine trade and water-based activities. The rise in international trade is attributed to the low cost associated with transport of raw material via marine mode of transport. The rising demand for materials like coal, ore and iron are boosting the international trade leading to growth in marine propellers market. The increasing interest of dealers towards marine transport is also contributing to the demand of marine propellers.

The technological advancements and increasing investments in R&D for the development of the hybrid marine population system to minimize fuel consumption and optimize the efficiency is leading to the demand for advance marine propellers. The growth of shipping industry owing to rise in manufacturing activities is fueling the marine propellers market. The rising investments in development of seashore development and marine shipment by the leading economies are boosting the marine propellers market.

Marine Propellers Market: Segmentation

Type Segment Analysis Preview

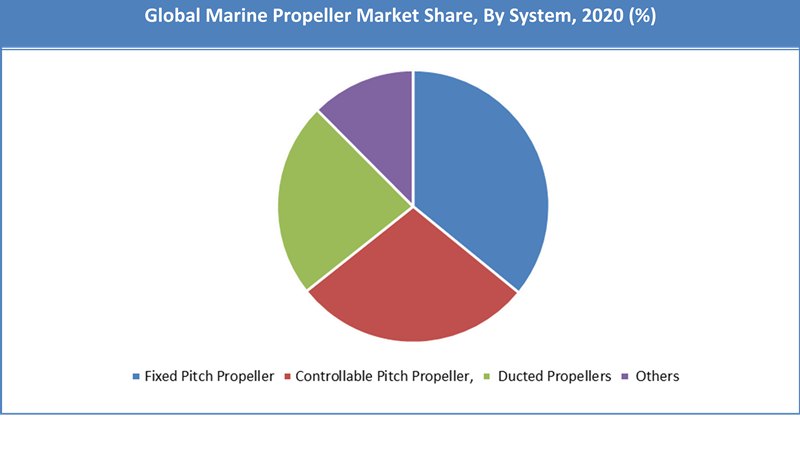

Fixed pitch propeller segment held a share of around 35.89% in 2020. This is attributable to low cost associated with the manufacturing and installation of fixed pitch propellers. These are simple type of propellers mostly used in ships with requirement of low maneuverability. These propellers are directly attached to the hub and their position is permanently fixed and cannot be moved during operations. These propellers are considered robust and reliable because they do not incorporate any hydraulic and mechanical connections. These propellers are functions with maximum efficiency, minimum noise and minimum vibrations. Fixed pitch propellers are used in ships like Container vessels, Tankers, Bulk carriers, Dry cargo vessels and Passenger liners. The lower maintenance cost of the fixed pitch propellers is estimated to drive the market demand in the forecast period.

Number of Blades Segment Analysis Preview

5 blades propellers segment will grow at a CAGR of over 3.4% from 2024 to 2032. This is attributable to high propulation efficiency of the blades. The Merchant Ships, Naval Ships, Recreational Boat and Cargo ships are having rising demand for 5-blade propellers due to fewer vibrations caused by the 5-blade propeller as compared to other propellers. The higher demand for 5-blade by marine defense industry is contributing to the of 5 blade propeller segment. The features of 5-blade propellers like more water displacement capacity, better holding power in rough seas, increased lift, better bite and grip as compared to other propellers is driving the market demand. These propellers provide improved acceleration and higher speed due to additional blades than other propellers. The increasing adoption of recreational boats owing to rise in COVID-19 pandemic has contributed to growth of 3-blade propellers.

Marine Propellers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Marine Propellers Market |

| Market Size in 2023 | USD 3.88 Billion |

| Market Forecast in 2032 | USD 6.35 Billion |

| Growth Rate | CAGR of 5.62% |

| Number of Pages | 154 |

| Key Companies Covered | Rolls-Royce Holdings, Man ES Corporation, Mitsubishi Heavy Industries Ltd., Caterpillar Inc., Hyundai Heavy Industries Co. Ltd, Nakashima Propeller, Kawasaki Heavy Industries, Wartsila, Brunswick Corporation, Volvo and Mercury Marine |

| Segments Covered | By Product Type, By Application, and By End Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Marine Propellers Market: Regional Analysis

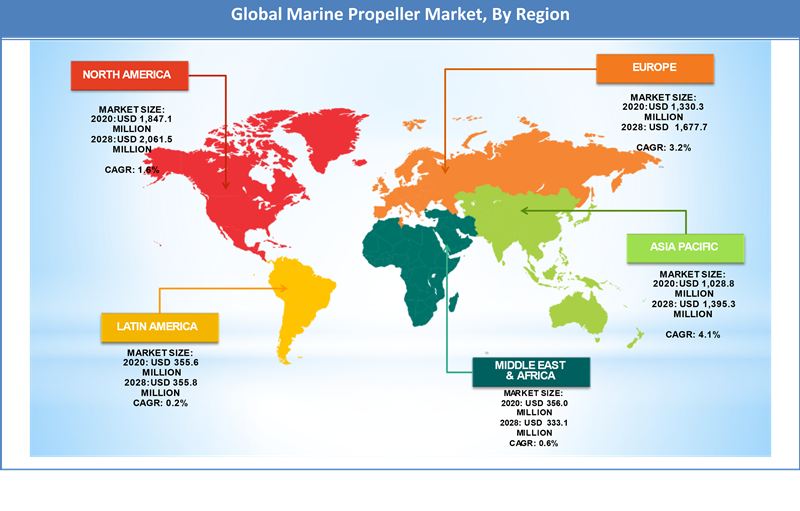

The Asia-Pacific region held a share of 20.92% in 2020. This is attributable to the growth of shipbuilding industries in countries like China and South Korea. The international brand in these countries is forming joint ventures for development of shipbuilding industry. The rise in marine trading owing to development of manufacturing industry is fueling the market demand. The growth manufacturing industry is leading intensive need for cost effective transport of raw material. The increase in marine trade of crude oil from Middle East countries to Asia-Pacific is contributing to rise in Asia-Pacific trade. The marine equipment industry in the APAC region offers variety of marine equipment’s. China is dominating player in the APAC region owing to the rising developments in ship building industry and extensive capacity of marine equipment manufacturing. The major companies in China are implementing strategies like mergers and acquisitions to fulfill the market demand for marine propellers.

The North America region is projected to grow at a CAGR of 1.6% over the forecast period. This surge is due to the rising investments in research and development in marine equipment manufacturing is boosting the market growth in APAC region. The growing demand for high efficiency, low cost and eco-friendly propellers is contributing to the technologically advance marine propellers. The upsurge in international trade due to cost effective transport manufactured goods and raw materials are driving the growth of the North America region. There are significant investments by the leading manufacturers in the region for the development of electric propellers.

U.S. is the leading manufacturer of marine propellers in the North America region. The leading manufacturers in U.S. are focusing on premium boat segment. Canada is the second largest manufacturer in the North-America region followed by U.S. The manufacturers in Canada are focusing on manufacturing fishing boat equipment’s. The growing demand for eco-friendly is estimated to bolster the growth of the region in the forecast period.

Marine Propellers Market: Competitive Players

Some of key players in marine propellers market are:

- Rolls-Royce Holdings

- Man ES Corporation

- Mitsubishi Heavy Industries Ltd.

- Caterpillar Inc.

- Hyundai Heavy Industries Co. Ltd

- Nakashima Propeller

- Kawasaki Heavy Industries

- Wartsila

- Brunswick Corporation

- Volvo and Mercury Marine

The leading market players are focusing on product development and investing in R&D for the development of ecofriendly propellers. Some market players are implementing strategies like mergers and acquisitions, partnerships and collaboration to increase their production potential to satisfy the market demand. The acquisitions are intended to strengthen the regional footprint of the companies.

For Instance, In April 2021, Nakashima Propeller Co Ltd had announced acquisition of Becker Marine Systems. This acquisition will aid optimization of propulsive performance and maneuvering performance of the propellers.

James Marine Acquires Big River Propeller

In July 2021, James Marine had acquired Big River Propellers. This acquisition will aid James’s marine to provide improved propeller repairing services and to conduct product innovation.

The global marine propellers market is segmented as follows:

By Type

- Controllable Pitch Propeller

- Fixed Pitch Propeller

- Ducted Propeller

- Others

By Number Of Blades

- 3-Blade

- 4-Blade

- 5-Blade

- Others

By Propulsion

- Inboard

- Outboard

- Sterndrive

- Others

By Material

- Stainless Steel

- Aluminium

- Bronze

- Nickel-Aluminium Bronze

- Others

By Application

- Merchant Ships

- Naval Ships

- Recreational Boats

- Cargo Or Container Ships

- Bulk Carrier

- Offshore Vessel

- Passenger Ship

- Others (Tugs & Service Ships)

By End User

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed