Marine Electronics Market Size, Share, Growth, Forecast 2034

Marine Electronics Market By Component Type (Hardware, Software), By Vessel Type (Merchant Vessels, Fishing Vessels, Vessels, Recreational Boats, Others), Application (Navigation, Communication, Automation, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.77 Billion | USD 13.10 Billion | 6.82% | 2024 |

Marine Electronics Industry Perspective:

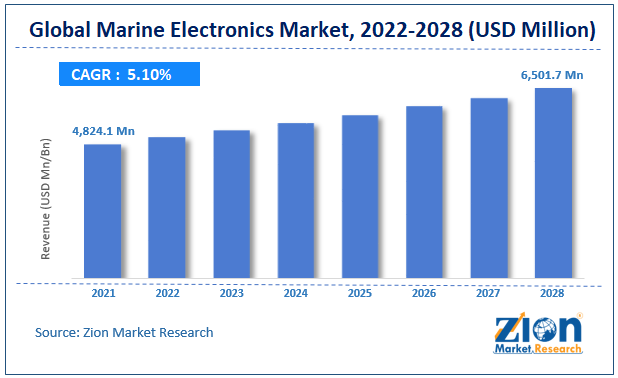

The global marine electronics market size was worth around USD 6.77 Billion in 2024 and is predicted to grow to around USD 13.10 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.82% between 2025 and 2034. The report analyzes the global marine electronics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the marine electronics industry.

The report analyzes the marine electronics market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the marine electronics market.

Marine Electronics Market: Overview

Marine electronics refers to the electronics gear created or intended for use on yachts and ships that is used in a marine environment. These electronic items are typically water-resistant or waterproof. The market is expanding as a result of the global marine and industrial electronics products market, which is expanding quickly. A rise in the market for marine transportation, a surge in the adoption of sonar & radar systems for search and rescue operations, and rapid uptake of marine safety protocols are expected to boost global marine electronics market growth during the forecast period. The marine electronics industry is also expected to see increasing applications of navigation, safety, marine communication, and fishing electronics. The market is also expanding due to the increasing adoption of different vessel management systems like vessel traffic management. The high cost of marine electronics devices and occasionally occurring technical issues with hardware or software are significant restraints on the market's growth.

Key Insights

- As per the analysis shared by our research analyst, the global marine electronics market is estimated to grow annually at a CAGR of around 6.82% over the forecast period (2025-2034).

- Regarding revenue, the global marine electronics market size was valued at around USD 6.77 Billion in 2024 and is projected to reach USD 13.10 Billion by 2034.

- The marine electronics market is projected to grow at a significant rate due to increasing maritime trade and transportation, rapid advancements in navigation technology, rising demand for enhanced safety and security systems, growing adoption of automation and digitalization in the maritime sector, and stringent regulatory requirements for maritime safety and environmental protection.

- Based on Component Type, the Hardware segment is expected to lead the global market.

- On the basis of Vessel Type, the Merchant Vessels segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Navigation segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Marine Electronics Market: Growth Drivers

Rising use of sophisticated marine electronics for military purposes to drive market growth

The growing desire for electronics on marine tours and other sea life by a sizable portion of the public are the main factors that are fueling significant and widespread demand for the industry. The rising use of sophisticated marine electronics for military purposes along with globalization of maritime trade and transportation, is expected to fuel the growth of the marine electronics market during the forecast period. Additionally, the large increase in earnings that individuals have seen as a result of the establishment of higher work positions has improved their situation, which is fueling demand for the military electronics. The need for maritime electronic equipment is influenced by the growing use of contemporary digital navigation, sonars, and radars for proximity sensing and other applications.

Marine Electronics Market: Restraints

Lack of investment is likely to restrain the market expansion to a certain extent

A significant investment gap has been one of the market's biggest obstacles, and this is further complicating matters if the manufacturers want to increase the size of the worldwide market and the range of goods they can offer the intended customer base. Additionally, the target audience's lack of awareness about the subject is likely to prevent the worldwide marine electronics industry from reaching its ideal sales level.

Marine Electronics Market: Segmentation

The global marine electronics market is segregated on the basis of components, applications, and region.

By component, the market is divided into hardware and software. With the growing use of GPS and sonar technologies by merchant navy and marine forces, the hardware sector of the market is anticipated to hold the biggest market share during the forecast period, which ends in 2028. The market segment is expanding as a result of the growing naval footprint of the armed forces brought on by the acquisition of new ships and submarines as well as upgrading initiatives for current naval vessels. Additionally, increased marine trade, oil & gas development, dredging, and fishing operations are also credited with the market's expansion. During the projected period, there is anticipated to be a significant increase in demand for improved sonar systems from the nations that depend on basic fish finders. Technology developments may prompt nations to buy cutting-edge sonar systems for their naval fleets, which is anticipated to fuel the market's expansion shortly.

By application, the global marine electronics market is divided into merchant marine electronics, fishing vessel electronics, yacht/recreation boat electronics, military naval electronics, autonomous shipping electronics, smart boat electronics, and underwater drone electronics. In 2021, the merchant marine held a 41.2 percent share of the global market. The maritime sector has seen a tremendous increase in digital momentum, with increased autonomy being the ultimate goal. Modern maritime communication and navigation systems' technological advancements continue to drive developments in marine electronics. The risk of accidents is rising due to increased usage of the sea or the air for the transportation of people or goods, which is driving the market for marine electronics, particularly marine electrical screeners. The global marine electronics market is anticipated to grow as a result of the increasing use of unmanned underwater vehicles (UUVs) and anti-submarine warfare (ASW) systems, as well as increased emphasis on enhancing marine transportation safety.

Recent Developments

- In July 2020, Furuno, a Japanese electronics manufacturer, purchased EMRI A/S, a Danish company that specializes in autopilots, steering control, joystick dynamic positioning, and maneuvering systems. More than 1000 cruise and ship owner’s vessels have steering control systems from EMRI, an original equipment manufacturer.

- In November 2021, Wärtsilä SAM Electronics GmbH's marine electrical systems division, situated in Hamburg, has been contracted to supply electrical system integration (eSI) solutions for the German Navy's F126 project. The business finalized the agreement with Dutch shipbuilder Damen, which was given the job of building the F126 frigates last month after a protracted tendering and coordination process.

Marine Electronics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Marine Electronics Market |

| Market Size in 2024 | USD 6.77 Billion |

| Market Forecast in 2034 | USD 13.10 Billion |

| Growth Rate | CAGR of 6.82% |

| Number of Pages | 230 |

| Key Companies Covered | FLIR Systems Inc.

|

| Segments Covered | By Component Type, By Vessel Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Marine Electronics Market: Regional Landscape

North America is projected to dominate global marine electronics market during projection period

In North America, the rising use of marine GPS systems and marine chart plotters is propelling market expansion. The market growth in North America is being driven by a significant presence of numerous marine electronics device manufacturing businesses and rising sales of GPS systems. Growing investment in GPS and autonomous underwater vehicle systems, together with advancements in the marine industry, are factors boosting the market's overall growth. Large logistical operations in the United States require ongoing monitoring and communication.

Consequently, it is anticipated that in the years to come, demand for water transportation would rise. Over the projected period, the marine electronics market is anticipated to increase in line with the growth in demand for maritime transportation as a result of the expansion of ocean logistics activities.

Marine Electronics Market: Competitive Space

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the marine electronics market on a global and regional basis.

The global Marine Electronics market profiles key players such as:

- Navico

- FLIR Systems

- Furuno Electric

- Wärtsilä SAM Electronics

- Raytheon Company

- Icom Inc

- SRT Marine Systems

- Thales Group

- Ultra Electronics

- Kongsberg Gruppen ASA

- Northrop Grumman Corporation

Global Marine Electronics Market is segmented as follows:

By Component

- Hardware

- Software

By Application

- Merchant Marine Electronics

- Fishing Vessel Electronics

- Yacht/Recreation Boat Electronics

- Military Naval Electronics

- Autonomous Shipping Electronics

- Smart Boat Electronics

- Underwater Drone Electronics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global marine electronics market is expected to grow due to rising demand for advanced navigation systems, growth in maritime trade, increasing adoption of smart fishing technologies, and stricter government regulations on vessel safety and efficiency.

According to a study, the global marine electronics market size was worth around USD 6.77 Billion in 2024 and is expected to reach USD 13.10 Billion by 2034.

The global marine electronics market is expected to grow at a CAGR of 6.82% during the forecast period.

North America is expected to dominate the marine electronics market over the forecast period.

Leading players in the global marine electronics market include FLIR Systems Inc.

- Garmin Ltd.

- Transas

- Icom Inc.

- Furuno Electric Co.Ltd.

- Kongsberg Maritime

- SRT Marine Systems plc

- Navico

- Northrop Grumman Sperry Marine B.V.

- Japan Radio Co.Ltd., among others.

The report explores crucial aspects of the marine electronics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed