Luxury Furniture Market Growth, Size, Share, Trends, and Forecast 2032

Luxury Furniture Market by Material Type (Glass, Metal, Plastic, Leather, Wood and Others), by Distribution Channel (Departmental Stores, Online Sales, Independent Furniture Retailers, Factory Outlets and Others) and by End Users (Domestic and Commercial): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

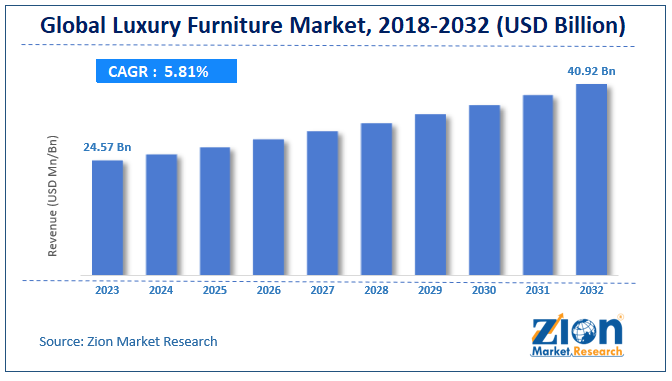

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.57 Billion | USD 40.92 Billion | 5.81% | 2023 |

Luxury Furniture Industry Perspective:

The global luxury furniture market size accrued earnings worth approximately USD 24.57 Billion in 2023 and is predicted to gain revenue of about USD 40.92 Billion by 2032, is set to record a CAGR of nearly 5.81% over the period from 2024 to 2032. The study includes drivers and restraints for the luxury furniture market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the luxury furniture market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the global luxury furniture market is estimated to grow annually at a CAGR of around 5.81% over the forecast period (2024-2032).

- The global luxury furniture market size was valued at around USD 24.57 Billion in 2023 and is projected to reach USD 40.92 Billion by 2032.

- The growth of the luxury furniture market is being driven by the increasing demand for premium, stylish, and durable home and commercial furnishings among high-income consumers and hospitality sectors.

- Based on material type, the glass segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the departmental stores segment is projected to swipe the largest market share.

- In terms of end-user, the domestic segment is expected to dominate the market.

- By region, the North America is expected to dominate the global market during the forecast period.

Luxury furniture enhances the artistic value of homes, offices, restaurants, and hotels in addition to various outdoor and indoor spaces. Over the past few years, the significant growth in real estate industry has fostered the growth of luxury furniture market. Movement of people from rural to urban areas, globalization, and inclination in the personal disposable income is strengthening the growth of the global luxury furniture market.

Luxury Furniture Market Growth Analysis

Rising environmental consciousness among people is also leading to rising demand for eco-friendly luxury furniture all over the world. Besides this, rising penetration of online retailing all across the world is expected to further stimulate the global luxury furniture market. In the coming years, growing number of commercial spaces such as restaurants, luxury hotels, and clubs are also likely to be key end users of luxury furniture items as they persistently try to create a luxurious experience for the customer. Entry of various designers, focusing on providing an opulent lifestyle choice to the end user, and a higher awareness about the artistic value of the luxury furniture has also been identified as the important growth drivers for the global luxury furniture market.

In order to give the users of this report a comprehensive view on the luxury furniture market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein material type segment, distribution channel segment, and end-user segments are benchmarked based on their market size, growth rate, and general attractiveness.

Luxury Furniture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Luxury Furniture Market |

| Market Size in 2023 | USD 24.57 Billion |

| Market Forecast in 2032 | USD 40.92 Billion |

| Growth Rate | CAGR of 5.81% |

| Number of Pages | 212 |

| Key Companies Covered | Muebles Pico, Nella Vetrina, Laura Ashley Folding PLC, VALDERAMOBILI srl, Scavolini S.p.A., Henredon Furniture Industries, Inc., Giovanni Visentin srl, Iola Furniture Ltd., Turri S.r.l, Herman Miller, Inc., Heritage Home Group LLC and others. |

| Segments Covered | By Material Type, By Distribution Channel, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology and regional expansion of major participants involved in the market on the global and regional basis. Moreover, the study covers price trend analysis, the product portfolio of various companies according to the region.

Luxury Furniture Market Segmentation

The study provides a decisive view on the luxury furniture market by segmenting the market based on material type, distribution channel, end user, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the material type the market is segmented into glass, metal, plastic, leather, wood, and others.

On the basis of the distribution channel, the market is segmented into departmental stores, online sales, independent furniture retailers, factory outlets, and others.

Based on end users the market is segmented into domestic and commercial. The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America and the Middle East & Africa with its further bifurcation into major countries.

The global luxury furniture market is segmented into major regions which include North America, Europe, Asia-Pacific, Latin America and the Middle East and Africa. Amongst all these regions, Europe captured the highest share in the global luxury furniture market in 2023. China is expected to be the biggest and rapidly growing furniture market in future which will drive the overall Asia luxury furniture market. Latin America region is also anticipated to showcase fast growth in the forecast period. The requirement of luxury furniture, especially in the hospitality sector in Middle East region and African region, is expected to drive the market in this region in future.

The report also includes detailed profiles of end players such as

- Muebles Pico

- Nella Vetrina

- Laura Ashley Folding PLC

- VALDERAMOBILI srl

- Scavolini S.p.A.

- Henredon Furniture Industries, Inc.

- Giovanni Visentin srl

- Iola Furniture Ltd.

- Turri S.r.l

- Herman Miller, Inc.

- Heritage Home Group LLC and others.

This report segments the global luxury furniture market as follows:

By Material Type Segments

- Glass

- Metal

- Plastic

- Leather

- Wood

- Others

By Distribution Channel Segments

- Departmental Stores

- Online Sales

- Independent Furniture Retailers

- Factory Outlets

- Others

By End-User Segments

- Domestic

- Commercial

By Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed