Global Large Appliances Market Size, Share, Growth Analysis Report - Forecast 2034

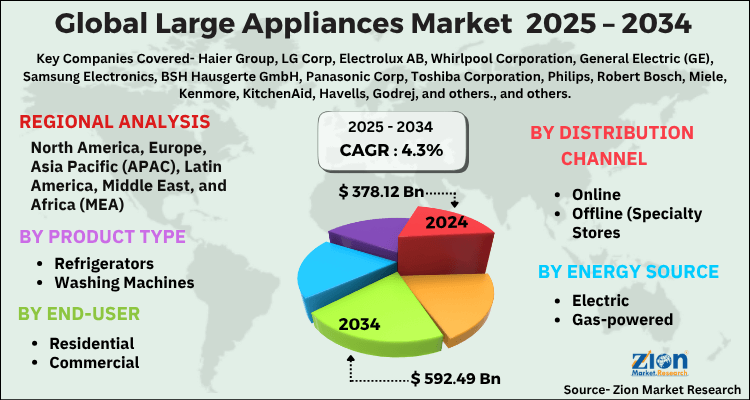

Large Appliances Market By Product Type (Refrigerators, Washing Machines, Air Conditioners, Microwave Ovens, Dishwashers, Freezers, Others), By End-user (Residential, Commercial), By Distribution Channel (Online, Offline (Specialty Stores, Supermarkets, Brand Stores)), By Energy Source (Electric, Gas-powered), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 378.12 Billion | USD 592.49 Billion | 4.3% | 2024 |

Large Appliances Industry Perspective:

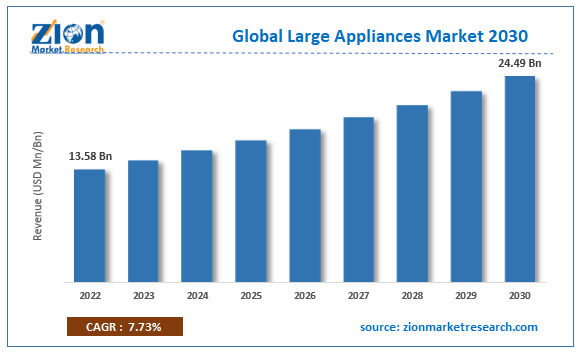

The global Large Appliances market size was worth around USD 378.12 Billion in 2024 and is predicted to grow to around USD 592.49 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.3% between 2025 and 2034. The report analyzes the global large appliances market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the large appliances industry.

Large Appliances Market: Overview

A large appliance is a non-portable or semi-portable device used for typical household duties like cooking, washing clothing, or food preservation. It is often referred to as a major domestic appliance, a large electric appliance, or simply a major appliance. Since these appliances have often been white, while other colors are available, they are frequently referred to as "white goods." Because an appliance consumes fuel or electricity, it differs from a plumbing fixture. Due to their size and lack of portability, large appliances are different from small appliances. They are frequently provided to tenants as part of otherwise unfurnished rental homes since they are frequently thought of as fixtures and parts of real estate. Major appliances could be permanently connected to particular plumbing and ventilation systems, connections to gas suppliers, or unique electrical and electrical connections. This restricts the places that they may be used in a home.

Key Insights

- As per the analysis shared by our research analyst, the global large appliances market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2025-2034).

- Regarding revenue, the global large appliances market size was valued at around USD 378.12 Billion in 2024 and is projected to reach USD 592.49 Billion by 2034.

- The large appliances market is projected to grow at a significant rate due to rising disposable income, urbanization, smart home trends, and innovations in energy-efficient and connected appliances like refrigerators, washing machines, and air conditioners.

- Based on Product Type, the Refrigerators segment is expected to lead the global market.

- On the basis of End-user, the Residential segment is growing at a high rate and will continue to dominate the global market.

- Based on the Distribution Channel, the Online segment is projected to swipe the largest market share.

- By Energy Source, the Electric segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Large Appliances Market: Growth Drivers

Increasing government initiatives for electronic products drive market growth

The increasing government initiatives for electronic products are expected to drive global large appliances market growth over the forecast period. The Indian government has given the automatic route approval for 100% of FDI in the consumer electronics and home appliance manufacturing industry and 51% of FDI in multi-brand retail. Nowadays, this is a magnet for foreign investors. The growth and upscaling of India's consumer electronics and home appliance sectors depend heavily on the National Policy on Electronics (NPE), which was established in 2011 to boost the Electronic System Design and Manufacturing (ESDM) industry. With the help of the Make in India program, India is also progressing toward becoming a high-tech center for the manufacture of electronic goods. A substantial step toward reaching the Sustainable Development Goal was also taken by the Indian government by powering 99.9% of Indian houses, which will propel the market growth over the forecast period.

Large Appliances Market: Restraints

Shifting consumer preferences hamper market growth

The demand for large appliances may be impacted by changing consumer preferences, such as a move toward minimalism and smaller living areas. A change in lifestyle, such as a preference for eating out rather than cooking at home, might also have an impact on purchasing appliances. Thus, the shifting consumer preference is expected to hamper the large appliances industry growth over the forecast period.

Large Appliances Market: Opportunities

Increasing product launches offers an attractive opportunity for market revenue growth

The increasing product launches in the sector are expected to offer an attractive opportunity for large appliances industry growth during the forecast period. For instance, in June 2023, with its subsequent dishwasher, which will cost Rs 10,000 Elista, a maker of electronics, home appliances, IT, and mobile accessories, hopes to revolutionize the home appliance market. This will be a six-plate rack desktop dishwasher for young couples that is intended for working professionals, small families, young couples, and even students. Moreover, in February 2023, Beko Home Appliances, the U.S. division of Arcelik, is launching a record-breaking 40 new cooking, cooling, and cleaning products at the 2023 Kitchen & Bath Industry Show (KBIS) in Las Vegas to further solidify its position as the world's most environmentally conscious appliance brand. Beko Home Appliances is committed to providing the industry's healthiest, most sustainable kitchen and home appliances. Thereby, driving the market growth.

Large Appliances Market: Challenges

Cost sensitive consumer poses a major challenge to market growth

The high cost of appliances for low- and middle-income consumer groups will be a key factor limiting the worldwide large appliances market for big appliances throughout the projected period. A key obstacle to the market's expansion is the large labor force or maid presence in low-income countries as well as in semi-urban and rural parts of emerging economies, where people feel they help with many household duties. Additionally, the market development is hampered by the lower adoption of big appliances in the lower-income population due to frequent repair and maintenance.

Large Appliances Market: Segmentation

The global Large Appliances industry is segmented based on product type, end-user, distribution channel, and region.

Based on the type, the global market is bifurcated into refrigeration equipment, cooking, washing & drying equipment, heating & cooling, and others. The refrigeration equipment is expected to dominate the market during the forecast period. The refrigeration appliances category accounts for a sizeable revenue market share among the key appliances. Companies like Samsung, GE, and LG have opened the path for others to enter the market for smart connected refrigerators by developing devices with unique features like touchscreens and adaptable user-controlled cooling choices. The developed markets are where these items are mostly marketed. In January 2023, the top-of-the-line, premium Side-by-Side Refrigerator collection from Samsung, the leading consumer electronics company in India, will be released in 2024.

This new line is entirely made in India and has various features designed specifically for India based on customer insights that will improve and make it easier for people to live their lives. This brand-new, Internet of Things (IoT)-enabled line-up has been carefully created to meet the unique refrigeration demands of modern Indian customers, including adjustable storage, glitzy exteriors, connected Living convenience, never-ending entertainment, energy efficiency, and more. Convertible 5-in-1 mode, Samsung's Twin Cooling PlusTM technology, and Curd MaestroTM, which enables customers to manufacture curd at home healthily and hygienically, are all included in this device. Customers may now disconnect the curd-making chamber while it's not in use, allowing for improved space usage. Thus, this type of product launch is expected to propel the segment expansion during the forecast period.

Based on the end-user, the large appliances industry is bifurcated into residential, commercial, industrial, and others.

Based on the distribution channel, the large appliances industry is bifurcated into online and offline. The online segment is expected to grow at the highest CAGR over the forecast period due to the convenience, wide product selection, and ease of comparison shopping that online platforms offer to consumers. For instance, according to secondary sources, from 209 million in 2016 to 230 million in 2021, more people will be shopping online. Thus, this is expected to drive the segment growth during the analysis period.

In terms of Energy Source, the global large appliances market is categorized into Electric, Gas-powered.

Large Appliances Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Large Appliances Market |

| Market Size in 2024 | USD 378.12 Billion |

| Market Forecast in 2034 | USD 592.49 Billion |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 215 |

| Key Companies Covered | Haier Group, LG Corp, Electrolux AB, Whirlpool Corporation, General Electric (GE), Samsung Electronics, BSH Hausgerte GmbH, Panasonic Corp, Toshiba Corporation, Philips, Robert Bosch, Miele, Kenmore, KitchenAid, Havells, Godrej, and others., and others. |

| Segments Covered | By Product Type, By End-user, By Distribution Channel, By Energy Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Large Appliances Market: Regional Analysis

Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific is expected to dominate the global large appliances market during the forecast period. The market growth in the region is attributed to the increasing disposable income of the population and the growing urban population. For instance, according to the Ministry of Statistics and Programme Implementation (MOSPI), in India, disposable personal income climbed from USD 2,886,935.76 million in 2021 to USD 3,303,465.13 million in 2022. Moreover, the e-commerce growth in the region is expected to fuel the market growth during the forecast period.

For Instance, as per Invest India, the Indian e-commerce market has experienced steady expansion. In terms of Gross Merchandise Value, the Indian e-commerce sector is anticipated to reach around $55 billion in 2021. It is anticipated to reach a gross merchandise value of $350 billion annually by 2030. Therefore, the aforementioned stats drive the market growth during the forecast period.

Large Appliances Market: Competitive Analysis

The global Large Appliances market is dominated by players like:

- Haier Group

- LG Corp

- Electrolux AB

- Whirlpool Corporation

- General Electric (GE)

- Samsung Electronics

- BSH Hausgerte GmbH

- Panasonic Corp

- Toshiba Corporation

- Philips

- Robert Bosch

- Miele

- Kenmore

- KitchenAid

- Havells

- Godrej

The global Large Appliances market is segmented as follows:

By Type

- Refrigeration Equipment

- Freezer

- Refrigerator

- Water Cooler

- Ice Maker

- Cooking

- Wall Oven

- Steamer Oven

- Microwave Oven

- Washing and Drying Equipment

- Washing Machines

- Clothes Dryer

- Drying Cabinet

- Dishwasher

- Heating and Cooling

- Air Conditioner

- Furnace

- Water Heater

- Others

By End User

- Residential

- Commercial

- Industrial

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A large appliance is a non-portable or semi-portable device used for typical household duties like cooking, washing clothing, or food preservation. It is often referred to as a major domestic appliance, a large electric appliance, or simply a major appliance. Since these appliances have often been white, while other colors are available, they are frequently referred to as "white goods." Because an appliance consumes fuel or electricity, it differs from a plumbing fixture. Due to their size and lack of portability, large appliances are different from small appliances.

The global large appliances market is expected to grow due to rising disposable income, urbanization, smart home trends, and innovations in energy-efficient and connected appliances like refrigerators, washing machines, and air conditioners.

According to a study, the global large appliances market size was worth around USD 378.12 Billion in 2024 and is expected to reach USD 592.49 Billion by 2034.

The global large appliances market is expected to grow at a CAGR of 4.3% during the forecast period.

Asia-Pacific is expected to dominate the large appliances market over the forecast period.

Leading players in the global large appliances market include Haier Group, LG Corp, Electrolux AB, Whirlpool Corporation, General Electric (GE), Samsung Electronics, BSH Hausgerte GmbH, Panasonic Corp, Toshiba Corporation, Philips, Robert Bosch, Miele, Kenmore, KitchenAid, Havells, Godrej, and others., among others.

The report explores crucial aspects of the large appliances market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed