Global IQF Vegetable Market Size, Share, Growth Analysis Report - Forecast 2034

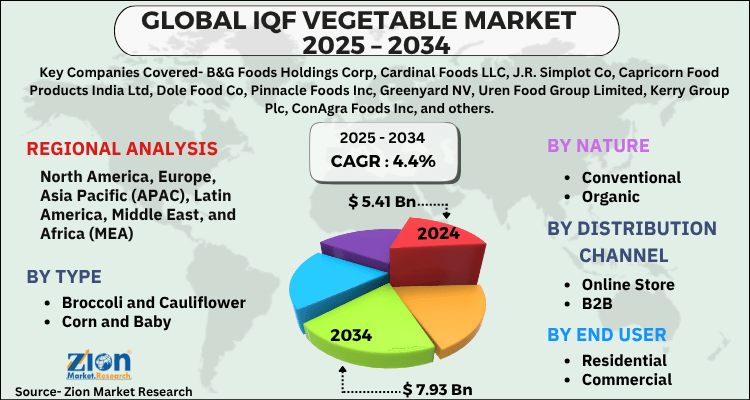

IQF Vegetable Market By Type (Broccoli & Cauliflower, Corn & Baby Corn, Peas, Beans, Carrot, Tomato, Onion, Potato, and Others), By Nature (Conventional and Organic), Distribution Channel (Online Store, B2B, Supermarket/Hypermarket, and Others), End-User (Residential and Commercial), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.41 Billion | USD 7.93 Billion | 4.4% | 2024 |

IQF Vegetable Industry Perspective:

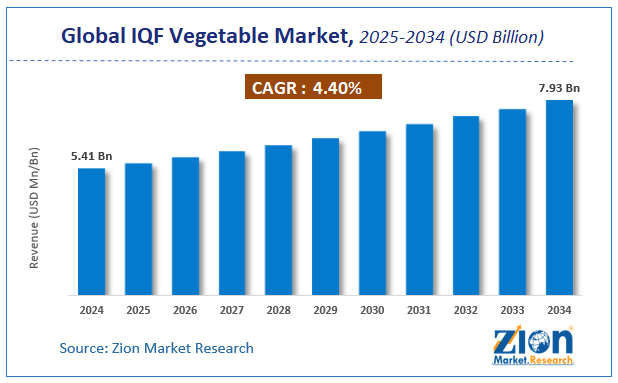

The global IQF vegetable market size was worth around USD 5.41 Billion in 2024 and is predicted to grow to around USD 7.93 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.4% between 2025 and 2034. The report analyzes the global IQF vegetable market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the IQF vegetable industry.

IQF Vegetable Market: Overview

Individually Quick Frozen vegetables, or IQF vegetables, are fresh vegetables that are been frozen one at a time. This process of fast freezing helps to maintain the final product’s freshness and quality. IQF is a strong food preservation technique that offers several benefits over traditional methods of freezing. Individual quick freezing not only speeds up the procedure, but also ensures that an IQF vegetable retains its form, color, and flavor longer than traditional freezing. Traditional frozen veggies lose their nutritional value faster than IQF vegetables. For individuals who prefer the convenience of frozen vegetables without sacrificing quality or taste, IQF vegetables are a perfect choice.

Key Insights

- As per the analysis shared by our research analyst, the global IQF vegetable market is estimated to grow annually at a CAGR of around 4.4% over the forecast period (2025-2034).

- Regarding revenue, the global IQF vegetable market size was valued at around USD 5.41 Billion in 2024 and is projected to reach USD 7.93 Billion by 2034.

- The IQF vegetable market is projected to grow at a significant rate due to rising consumer demand for convenience food, longer shelf life, and nutritional retention is fueling the market for individually quick-frozen (iqf) vegetables.

- Based on Type, the Broccoli & Cauliflower segment is expected to lead the global market.

- On the basis of Nature, the Conventional segment is growing at a high rate and will continue to dominate the global market.

- Based on the Distribution Channel, the Online Store segment is projected to swipe the largest market share.

- By End-User, the Residential segment is expected to dominate the global market.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

IQF Vegetable Market: Growth Drivers

IQF vegetables’ longer shelf life is expected to expand the market growth

Due to the technology utilized in the manufacture, processing, and storage of frozen food, it has seen an increase in demand. The capacity to securely keep vegetables and fruits for extended periods of time when kept at particular temperatures has been enhanced by IQF technology. IQF technique employs nitrogen to freeze every single vegetable unit, whereas cold storage methods regulate moisture. IQF vegetables have a shelf life of a few weeks to months, based on the source, enabling storage without fear of deterioration.

Fast freezing, which transforms all liquid to a frozen form without destroying vegetable cells, is used in IQF techniques to provide vegetables with an extended shelf life. Thus, the longer shelf life of IQF vegetables is propelling the growth of the market. In addition to this, growing preference for frozen food, rise in disposable income, and easy availability of IQF vegetables in hypermarkets/supermarkets, as well as online platforms, are some of the factors that are fostering the growth of the global IQF vegetable market.

IQF Vegetable Market: Restraints

Pathogen risk in IQF vegetables is likely to restrain the growth of the market

Bacteria and viruses have been found in frozen vegetables and fruits in Japan and certain countries in North America. The Listeria monocytogenes bacterium made headlines throughout the globe after IQF vegetable items were recalled. Bacterial contamination is a problem in the United States and China as a result of high pollution levels.

Every year, most manufacturers in the United States recall IQF vegetable goods owing to a Listeria monocytogenes epidemic. Listeria monocytogenes is a pathogenic bacterium that causes listeriosis, a disease that kills an estimated 300 people per year throughout the world. Thus, growing concerns of the consumer regarding the risk of pathogens in IQF vegetables may hamper the growth of the market.

IQF Vegetable Market: Opportunities

Advancement in technologies is predicted to boost the market during the forecast period.

A rise in demand for IQF vegetables is been witnessed in the food and beverage industry as they can be stored for a longer duration and used as raw material in the final food products. Thus, key players in the market are investing majorly in the technologies used for instant quick freezing and upgrading the current features. Additionally, the wide adoption of IQF over water injection freezing technology to reduce the cost of logistics may also create ample growth opportunities for the market during the forecast period.

Furthermore, the growing emphasis on the development of novel packaging & promotions, the rapidly growing retail industry, and the busy lifestyle of the people are also some of the key aspects that are likely to drive the global IQF vegetable market during the forecast period.

IQF Vegetable Market: Challenges

The volatilized nature of the moisture in the food may be a major challenge for market expansion

Food must be divided and frozen while using IQF, therefore the surface area vulnerable to freezing rises proportionately. It has the potential to dehydrate the meal and acidify the fat. When food that was moist before freezing turns dry after freezing, water vapor in the air adheres to the frozen food, leading to frosting on the food surface.

Because the freshness of the food impacts the taste and flavor at this time, more care should be taken before freezing. Thus, the volatilized nature of the moisture in the food is estimated to act as a challenge to the expansion of the market.

IQF Vegetable Market: Segmentation Analysis

The global IQF vegetable market is segmented based on Type, Nature, Distribution Channel, End-User, and region.

Based on Type, the global IQF vegetable market is divided into Broccoli & Cauliflower, Corn & Baby Corn, Peas, Beans, Carrot, Tomato, Onion, Potato, and Others.

On the basis of Nature, the global IQF vegetable market is bifurcated into Conventional and Organic.

By Distribution Channel, the global IQF vegetable market is split into Online Store, B2B, Supermarket/Hypermarket, and Others.

In terms of End-User, the global IQF vegetable market is categorized into Residential and Commercial.

IQF Vegetable Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IQF Vegetable Market |

| Market Size in 2024 | USD 5.41 Billion |

| Market Forecast in 2034 | USD 7.93 Billion |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 188 |

| Key Companies Covered | B&G Foods Holdings Corp, Cardinal Foods LLC, J.R. Simplot Co, Capricorn Food Products India Ltd, Dole Food Co, Pinnacle Foods Inc, Greenyard NV, Uren Food Group Limited, Kerry Group Plc, ConAgra Foods Inc, and others. |

| Segments Covered | By Type, By Nature, By Distribution Channel, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IQF Vegetable Market: Regional Landscape

North America is expected to hold a major share in the global market

Among the regions, North America is likely to hold the largest share in the global IQF vegetable market during the forecast period. Major factors such as strong supply and distribution channels of vegetables in Canada & the US, rapid adoption of advanced technologies, and expansion of the frozen food market are contributing to the market growth in this region.

Europe is estimated to hold the second-most position in the market and this is majorly attributed to the growing demand for IQF vegetables, an increase in demand for food products with longer shelf life, and an increase in demand from food manufacturers. On the other hand, the market in the Asia Pacific is likely to grow at the fastest CAGR value during the forecast period.

Recent Developments

- In April 2021, food and beverage industry professionals established REMS Frozen Foods intending to be the "supplier of choice for all major UK and Irish food producers." REMS will import frozen food products from all over the world, with a focus on individually quick frozen (IQF) herbs, spices, vegetables, and fruit for further processing by Irish and UK food producers.

- In January 2022, SimpliFine, a Kenyan integrated food company that distributes locally sourced and produced food across East Africa, launched its Individual Quick Freezing (IQF) processing line. simplify is extending its manufacture of fresh French fries to provide frozen French fries as a result of its investment in IQF technology, improving supply and prolonging the shelf life of locally grown potatoes. SimpliFine's technology will help Kenyan potato growers increase their market and minimize their dependency on imported French fries.

IQF Vegetable Market: Competitive Landscape

Some of the prominent players that are operating in the global IQF vegetable market include;

- B&G Foods Holdings Corp

- Cardinal Foods LLC

- J.R. Simplot Co.

- Capricorn Food Products India Ltd

- Dole Food Co.

- Pinnacle Foods, Inc.

- Greenyard NV

- Uren Food Group Limited

- Kerry Group Plc.

- ConAgra Foods, Inc

The global IQF vegetable market is segmented as follows:

By Type

- Broccoli and Cauliflower

- Corn and Baby

- Corn

- Peas

- Beans

- Carrot

- Tomato

- Onion

- Potato

- Others

By Nature

- Conventional

- Organic

By Distribution Channel

- Online Store

- B2B

- Supermarket/Hypermarket

- Others

By End User

- Residential

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Individually Quick Frozen vegetables, or IQF vegetables, are fresh vegetables that are been frozen one at a time.

The global IQF vegetable market is expected to grow due to growing demand for frozen foods, increasing consumer preference for convenience, and advancements in quick-freezing technology.

According to a study, the global IQF vegetable market size was worth around USD 5.41 Billion in 2024 and is expected to reach USD 7.93 Billion by 2034.

The global IQF vegetable market is expected to grow at a CAGR of 4.4% during the forecast period.

Europe is expected to dominate the IQF vegetable market over the forecast period.

Leading players in the global IQF vegetable market include B&G Foods Holdings Corp, Cardinal Foods LLC, J.R. Simplot Co, Capricorn Food Products India Ltd, Dole Food Co, Pinnacle Foods Inc, Greenyard NV, Uren Food Group Limited, Kerry Group Plc, ConAgra Foods Inc, among others.

The report explores crucial aspects of the IQF vegetable market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed