IoT Medical Devices Market Size, Share, Analysis, Trends, Growth, Forecasts 2032

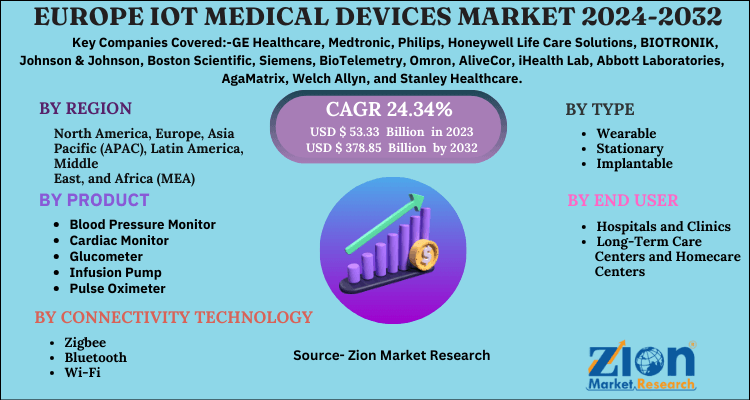

IoT Medical Devices Market by Product (Blood Pressure Monitor, Cardiac Monitor, Glucometer, Infusion Pump, and Pulse Oximeter), by Type (Wearable, Stationary, and Implantable), by Connectivity Technology (Zigbee, Bluetooth, and Wi-Fi), and by End-User (Hospitals and Clinics, Long-Term Care Centers & Homecare Centers, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

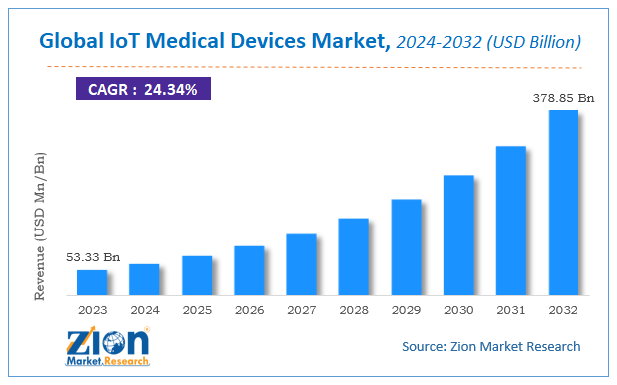

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 53.33 Billion | USD 378.85 Billion | 24.34% | 2023 |

IoT Medical Devices Industry Perspective:

The IoT medical devices market size was worth around USD 53.33 Billion in 2023 and is predicted to grow to around USD 378.85 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 24.34% between 2024 and 2032.

The report covers a forecast and an analysis of the IoT medical devices market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Million). The study includes drivers and restraints of the IoT medical devices market along with their have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the IoT medical devices market on a global and regional level.

In order to give the users of this report a comprehensive view of the IoT medical devices market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

IoT Medical Devices Market: Overview

IoT medical devices or smart healthcare devices are connected through actuators, sensors, and network communication technologies to interconnect doctors, patients, and clinicians. These devices modernize clinical operations and information flow along with permitting real-time patient monitoring and bridges the gap between physical and digital data sources. These devices comprise intermediary components, such as electronic system, network connectivity, software, and devices, which help in transmitting data signals between them in the absence of human interference.

With the introduction of IoT medical devices, the operational burden on healthcare providers has reduced along with helping in the delivery of better healthcare facilities, through improved communication, to patients. Availability of advanced technology has replaced the traditional diagnosis and treatment procedures with IoT medical devices. These devices are majorly used for taking readings, patient monitoring, and notifying inconsistent patterns. These devices also offer various benefits to patients and healthcare service providers, such as continuous transfer of EHR, improved patient safety, reduced medical errors, enable patient involvement, and aid in patient-centric care delivery. The growing digitalization in the healthcare sector is driving the demand for IoT medical devices.

The report provides company market share analysis to give a broader overview of the key players in the IoT medical devices market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

IoT Medical Devices Market: Growth Factors

There are various factors propelling the global IoT medical devices market, such as increasing government participation for endorsing digital health, rising penetration of tablets, smartphones, and other mobile platforms in the healthcare sector, innovations in technology, growing focus on patient safety, and evolution of high-speed networking technologies. Furthermore, increasing focus on patient-centric care delivery and active patient engagement and rising need for cost-effective services in healthcare and medical sectors are also propelling the IoT medical devices market globally. In addition, the growing demand for uninterrupted dataflow, decreasing sensor technology prices, and availability of customer-friendly devices are some other factors fuelling the market. However, the distribution of connected medical devices, high IoT infrastructural development costs, data privacy and security issues, and the lack of technical knowledge among personnel may hamper this market’s growth. Alternatively, the low doctor-to-patient ratio is leading to an increased dependency on self-operated e-Health platforms and increasing R&D spending will offer new growth opportunities in the market.

IoT Medical Devices Market: Segmentation

The study provides a decisive view of the IoT medical devices market by segmenting it based on the product, connectivity technology, type, end-user, and region. The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Based on Product, the market includes blood pressure monitor, cardiac monitor, glucometer, infusion pump, and pulse oximeter. Glucometers are expected to dominate the global market in the future. This can be due to the increasing adoption of smartphones, the introduction of innovative technology, and changing lifestyles.

By Type, the market includes wearable, implantable, and stationary. The wearable segment accounted for the largest market share in 2023 and is expected to register the highest CAGR in the future. This can be attributed to the rising preference for preventive care, increasing chronic diseases occurrences, growing health awareness, and escalating need for long-term home patient monitoring, especially the elderly population.

The Connectivity Technology segment is categorized into Zigbee, Bluetooth, and Wi-Fi. The Wi-Fi segment is dominating the market with the highest revenue share, as Wi-Fi offers greater flexibility to healthcare providers in terms of sharing EMRs and inpatient monitoring and device management. The Bluetooth segment will grow notably over the forecast period, due to its low cost and low-power consumption. Furthermore, rising developments related to Bluetooth-enabled medical devices is likely to further propel this segment’s growth over the estimated timeframe.

On the basis of End-user, the market includes hospitals and clinics, long-term care centers and homecare centers, and others. Long-term care centers and homecare centers hold the largest market share and are expected to show substantial growth in the future. This can be the growing need for continued treatment for certain chronic diseases, high cost of hospital stays, and increasing preference for participatory and preventive care by patients.

IoT Medical Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IoT Medical Devices Market |

| Market Size in 2023 | USD 53.33 Billion |

| Market Forecast in 2032 | USD 378.85 Billion |

| Growth Rate | CAGR of 24.34% |

| Number of Pages | 110 |

| Key Companies Covered | GE Healthcare, Medtronic, Philips, Honeywell Life Care Solutions, BIOTRONIK, Johnson & Johnson, Boston Scientific, Siemens, BioTelemetry, Omron, AliveCor, iHealth Lab, Abbott Laboratories, AgaMatrix, Welch Allyn, and Stanley Healthcare |

| Segments Covered | By product, By connectivity technology, By type, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IoT Medical Devices Market: Regional Insights

North America contributed the largest revenue share to the global IoT medical devices market in 2023. The U.S. holds the major position in this regional market and is expected to dominate in the forecasted period. This can be due to technological advancements and innovations and various government initiatives encouraging the adoption of digital platforms in the life sciences industry. In addition, various measures are also being undertaken for developing clinical interoperability and e-Health to boost up the demand in this region. Europe held the second largest share for IoT medical devices market due to the rise in government funding and increasing focus on innovation through R&D activity in this region.

The Asia Pacific IoT medical devices market is likely to be the fastest growing region and register the highest CAGR over the forecast time period. The key growth factors for this region are the rising initiatives for promoting connected health services, improving health IT infrastructure, accelerating implementation of government initiatives for e-Health promotion, increasing medical tourism, and growing patient alertness about self-health management. The Middle Eastern and African market shows productive growth for IoT medical devices, due to the growing government initiatives for the promotion of e-Health, increasing demand for superior healthcare, rising chronic disorders prevalence, escalating adoption of smartphones, increasing per capita income, and rising penetration of advanced connectivity and networks.

IoT Medical Devices Market: Competitive Space

Some major players of the global IoT medical devices market are

- GE Healthcare

- Medtronic

- Philips

- Honeywell Life Care Solutions

- BIOTRONIK

- Johnson & Johnson

- Boston Scientific

- Siemens

- BioTelemetry

- Omron

- AliveCor

- iHealth Lab

- Abbott Laboratories

- AgaMatrix

- Welch Allyn

- Stanley Healthcare.

- And Others

This report segments the global IoT medical devices market into:

Global IoT Medical Devices Market: By Product

- Blood Pressure Monitor

- Cardiac Monitor

- Glucometer

- Infusion Pump

- Pulse Oximeter

Global IoT Medical Devices Market: By Connectivity Technology

- Zigbee

- Bluetooth

- Wi-Fi

Global IoT Medical Devices Market: By Type

- Wearable

- Stationary

- Implantable

Global IoT Medical Devices Market: By End-User

- Hospitals and Clinics

- Long-Term Care Centers and Homecare Centers

- Others

Global IoT Medical Devices Market: By Region

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

IoT medical devices or smart healthcare devices are connected through actuators, sensors, and network communication technologies to interconnect doctors, patients, and clinicians.

There are various factors propelling the global IoT medical devices market, such as increasing government participation for endorsing digital health, rising penetration of tablets, smartphones, and other mobile platforms in the healthcare sector, innovations in technology, growing focus on patient safety, and evolution of high-speed networking technologies.

According to a study, the global IoT medical devices Industry size was $53.33 Billion in 2023 and is projected to reach $378.85 Billion by the end of 2032.

The global IoT medical devices market is expected to grow at a CAGR of 24.34% during the forecast period.

North America contributed the largest revenue share to the global IoT medical devices market in 2023.

Some major players of the global IoT medical devices market are GE Healthcare, Medtronic, Philips, Honeywell Life Care Solutions, BIOTRONIK, Johnson & Johnson, Boston Scientific, Siemens, BioTelemetry, Omron, AliveCor, iHealth Lab, Abbott Laboratories, AgaMatrix, Welch Allyn, and Stanley Healthcare.

The global IoT medical devices market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed