Global Industrial Robotics Market Size, Share, Growth Analysis Report - Forecast 2034

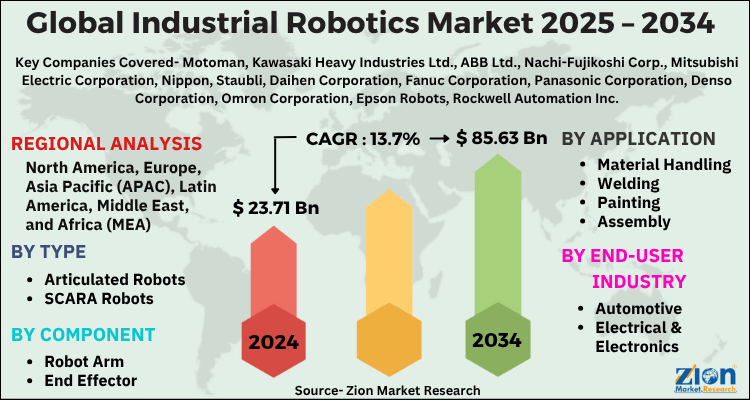

Industrial Robotics Market By Type (Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Parallel Robots, Collaborative Robots), By Component (Robot Arm, End Effector, Controller, Drive, Sensor), By Application (Material Handling, Welding, Painting, Assembly, Inspection, Dispensing, Others), By End-user Industry (Automotive, Electrical & Electronics, Metals & Machinery, Food & Beverage, Pharmaceuticals, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.71 Billion | USD 85.63 Billion | 13.7% | 2024 |

Industrial Robotics Market: Industry Perspective

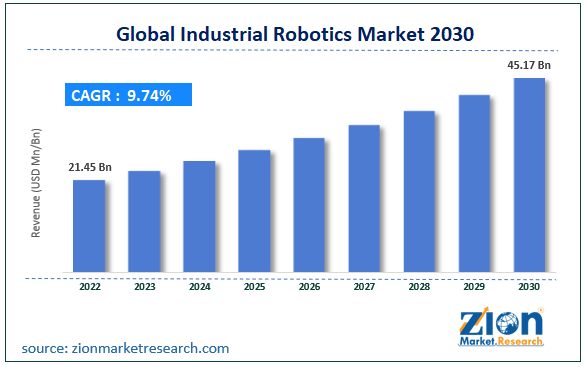

The global industrial robotics market size was worth around USD 23.71 Billion in 2024 and is predicted to grow to around USD 85.63 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 13.7% between 2025 and 2034.

The report analyzes the global industrial robotics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the industrial robotics industry.

Industrial Robotics Market: Overview

An industrial robot is an automated equipment that is fed with data and programmed for executing events related to production in manufacturing units in an automated manner. Reportedly, the product is developed for automating and increasing production like those needed by a consistently moving assembly line. The industrial robots are programmed as well as reprogrammed as per the requirements of the factories and production units. For the record, industrial robots help in enhancing output while reducing operating costs and producing high-quality products in an automated way. There are various kinds of robots used in the industry including SCARA, Cartesian, Collaborative, Cylindrical, and Articulated robots.

Key Insights

- As per the analysis shared by our research analyst, the global industrial robotics market is estimated to grow annually at a CAGR of around 13.7% over the forecast period (2025-2034).

- Regarding revenue, the global industrial robotics market size was valued at around USD 23.71 Billion in 2024 and is projected to reach USD 85.63 Billion by 2034.

- The industrial robotics market is projected to grow at a significant rate due to Increased automation in manufacturing, labor shortages, and demand for precision drive market expansion. Growth in electronics and automotive sectors also contributes.

- Based on Type, the Articulated Robots segment is expected to lead the global market.

- On the basis of Component, the Robot Arm segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Material Handling segment is projected to swipe the largest market share.

- By End-user Industry, the Automotive segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Industrial Robotics Market: Growth Factors

High wages of labor can prompt the expansion of the market across the globe

Shortage of labor and high labor costs in the production sector will prop up the expansion of the global industrial robotics market in the coming years. An industry 4.0 revolution has culminated in massive demand for robotics and smart manufacturing activities, thereby driving global market trends. Furthermore, industry players have set up new units for manufacturing industrial robots, thereby paving the way for the expansion of the market space. For instance, in the last quarter of 2022, ABB Limited, a key tech firm providing apt solutions to utilities, transport, and infrastructure sectors globally, established a new industrial robotics unit in China.

In addition to this, new product launches will further steer the expansion of the global market in the coming years. Citing an instance, in March 2022, Mitsubishi Electric Corporation, a Japan-based firm manufacturing electronics & electrical devices, announced its plans to launch industrial robots in 2023 for performing industrial tasks in food-processing units. Apart from this, in May 2023, Schaeffer, a key tech firm specializing in industrial & automotive solutions, demonstrated a slew of innovations for industrial automation & robotics industries under a theme at the Automate 2023 trade show held in Detroit, the U.S.

Industrial Robotics Market: Restraints

High installation costs can restrict the global industry expansion over 2023-2030

Huge costs of initially deploying the product along with a rise in the maintenance charges can put brakes on the global industrial robotics industry expansion. Low penetration of products in small & medium-sized firms owing to fewer returns on investments can further hinder global industry growth.

Industrial Robotics Market: Opportunities

Massive product penetration in the electrical & electronics sector to help the global market explore new growth facets

Rise in the automation in the electrical & electronics sector will open new growth opportunities for the global industrial robotics market. Furthermore, the inclusion of artificial intelligence and machine learning systems in industrial robots will lucratively impact the expansion of the global market. The launching of 5G systems will proliferate the application of robotics in the manufacturing sector and this will open new vistas of growth for the global market.

Industrial Robotics Market: Challenges

Less availability of skilled persons can be challenging for the global industry expansion

Low interoperability and lack of expertise can put up a big challenge for the global industrial robotics industry. Reportedly, making use of industrial robots needs a skilled workforce that possesses good programming skills along with experience in the effective maintenance of robots. Moreover, such a workforce incurs huge costs to the firm, thereby posing a huge challenge for global industry expansion.

Industrial Robotics Market: Segmentation

The global industrial robotics market is segmented based on Type, Component, Application, End-user Industry, and region.

Based on Type, the global industrial robotics market is divided into Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Parallel Robots, Collaborative Robots.

On the basis of Component, the global industrial robotics market is bifurcated into Robot Arm, End Effector, Controller, Drive, Sensor.

In application terms, the global industrial robotics market is segregated into handling, processing, welding & soldering, assembling & disassembling, and dispensing segments. Moreover, the processing segment, which garnered nearly 55% of the global market share in 2022, is projected to record the fastest CAGR in the ensuing years. The growth of the segment in the next few years can be subject to fewer errors incurred by industrial robots while performing painting and cutting processes.

Based on the end-use, the global industrial robotics industry is bifurcated into automotive, chemical rubber & plastics, food & beverages, electrical & electronics, machinery, and others segments. In addition to this, the electrical & electronics segment, which contributed majorly towards the global industry share in 2022, is set to establish segmental domination in the forecasting years.

The segmental elevation over the assessment timeline can be subject to the massive use of industrial robots for performing repetitive tasks such as dispensing, labeling, screw driving, and insertion in the electrical & electronics segment. Apart from this, the use of industrial robots in the electrical & electronics segment helps in improving output and reducing costs along with minimizing production overhead costs. Technological disruptions have also contributed significantly towards the segmental surge in recent years.

Industrial Robotics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Robotics Market |

| Market Size in 2024 | USD 23.71 Billion |

| Market Forecast in 2034 | USD 85.63 Billion |

| Growth Rate | CAGR of 13.7% |

| Number of Pages | 224 |

| Key Companies Covered | Motoman, Kawasaki Heavy Industries Ltd., ABB Ltd., Nachi-Fujikoshi Corp., Mitsubishi Electric Corporation, Nippon, Staubli, Daihen Corporation, Fanuc Corporation, Panasonic Corporation, Denso Corporation, Omron Corporation, Epson Robots, Rockwell Automation Inc., KUKA AG, Yaskawa Electric Corporation, Siemens AG, Dixon Automatic Tool Inc., Seiko Epson Corporation, and Comau SpA., and others. |

| Segments Covered | By Type, By Component, By Application, By End-user Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Robotics Market: Regional Analysis

Asia-Pacific is likely to retain its dominant status in the global market over the assessment period

Asia-Pacific region, which accounted for 49% of the global industrial robotics market share in 2022, will be a leading region during the analysis timeline. Moreover, the expansion of the market in the Asia-Pacific zone over the forecast period can be attributed to the presence of a large number of factories in the countries such as Taiwan, South Korea, Japan, and China. Apart from this, the rising adoption of automation and AI in various sectors in the region has proliferated the expansion of the size of the market in the region.

The thriving electronics and automotive sector in the sub-continent will propel the expansion of the market space in the region. The government of these countries has supported the use of industrial robots by providing tax subsidies and funding to the manufacturers and such initiatives have promoted the expansion of the market in the region. Additionally, the presence of key players in the Asia-Pacific region will further embellish the regional market growth trends.

The Middle East & Africa industrial robotics industry is set to register the highest CAGR over the forecast timeline owing to favorable government schemes encouraging the use of industrial robots in oil & gas exploration and drilling as well as food processing activities in the countries of the Middle East region. In addition to this, use of the industrial robotics in the logistics sector will spearhead the expansion of the industry in the region. For instance, in the second half of 2020, the Prince of Dubai introduced The Dubai Robotics & Automation project in which nearly 2, 00,000 robots were to be provided to various logistics & industrial sectors to increase their production.

Industrial Robotics Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the industrial robotics market on a global and regional basis.

The global industrial robotics market is dominated by players like:

- Motoman

- Kawasaki Heavy Industries Ltd.

- ABB Ltd.

- Nachi-Fujikoshi Corp.

- Mitsubishi Electric Corporation

- Nippon

- Staubli

- Daihen Corporation

- Fanuc Corporation

- Panasonic Corporation

- Denso Corporation

- Omron Corporation

- Epson Robots

- Rockwell Automation Inc.

- KUKA AG

- Yaskawa Electric Corporation

- Siemens AG

- Dixon Automatic Tool Inc.

- Seiko Epson Corporation

- and Comau SpA.

The global industrial robotics market is segmented as follows;

By Type

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Cylindrical Robots

- Parallel Robots

- Collaborative Robots

By Component

- Robot Arm

- End Effector

- Controller

- Drive

- Sensor

By Application

- Material Handling

- Welding

- Painting

- Assembly

- Inspection

- Dispensing

- Others

By End-user Industry

- Automotive

- Electrical & Electronics

- Metals & Machinery

- Food & Beverage

- Pharmaceuticals

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global industrial robotics market is expected to grow due to Increased automation in manufacturing, labor shortages, and demand for precision drive market expansion. Growth in electronics and automotive sectors also contributes.

According to a study, the global industrial robotics market size was worth around USD 23.71 Billion in 2024 and is expected to reach USD 85.63 Billion by 2034.

The global industrial robotics market is expected to grow at a CAGR of 13.7% during the forecast period.

Asia-Pacific is expected to dominate the industrial robotics market over the forecast period.

Leading players in the global industrial robotics market include Motoman, Kawasaki Heavy Industries Ltd., ABB Ltd., Nachi-Fujikoshi Corp., Mitsubishi Electric Corporation, Nippon, Staubli, Daihen Corporation, Fanuc Corporation, Panasonic Corporation, Denso Corporation, Omron Corporation, Epson Robots, Rockwell Automation Inc., KUKA AG, Yaskawa Electric Corporation, Siemens AG, Dixon Automatic Tool Inc., Seiko Epson Corporation, and Comau SpA., among others.

The report explores crucial aspects of the industrial robotics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed