Industrial Ethernet Market Size, Share, Revenue Forecast 2032

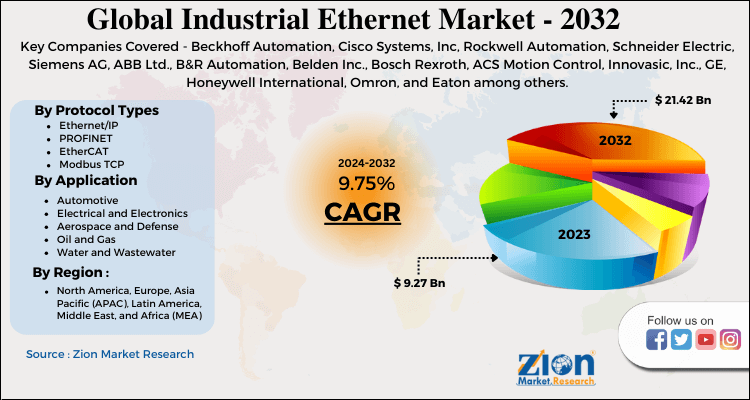

Industrial Ethernet Market by Protocol Type (Ethernet/IP, PROFINET, EtherCAT, Modbus TCP, POWERLINK, Sercos III, CC-Link IE and Others), By Application (Automotive, Electrical and Electronics, Aerospace and Defense, Oil and Gas, Water and Wastewater, Food and Beverages, Pharmaceutical, Engineering/Fabrication, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

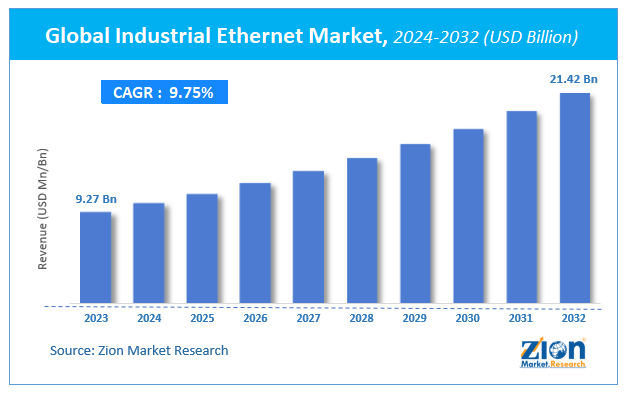

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.27 Billion | USD 21.42 Billion | 9.75% | 2023 |

Industrial Ethernet Market Insights

According to a report from Zion Market Research, the global Industrial Ethernet Market was valued at USD 9.27 Billion in 2023 and is projected to hit USD 21.42 Billion by 2032, with a compound annual growth rate (CAGR) of 9.75% during the forecast period 2024-2032.

This report explores market strengths, weaknesses, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and future prospects that may emerge in the Industrial Ethernet Market industry over the next decade.

Industrial Ethernet Market: Overview

Industrial Ethernet refers to usage of networking solution for industrial purposes. It uses specialized protocols coupled with the Ethernet to improve determinism as well as to provide real-time data. It offers data from range 10 Mbps to 1Gbps. Schneider Electric SE, Honeywell International, Siemens AG, and Rockwell Automation are some of the key vendors of industrial ethernet across the world. These players across the industrial ethernet market are focusing aggressively on innovation, as well as on including advanced technologies in their existing products. Over the coming years, they are also expected to take up partnerships and mergers and acquisitions as their key strategy for business development, states the industrial ethernet market study.

For instance, in August 2018, Antaira Technologies announced the extension of industrial ethernet range through the launching of IMC-C100-XX series. In another breakthrough that can drive the industrial ethernet industry, on August 8th 2018, Omron released a new NX1 series machine automation controller that can help manufacturers increase their output.

COVID-19 Impact Analysis

The global Industrial Ethernet market has witnessed a slight decline in the sales for short term to the lockdown enforcement placed by governments in order to contain COVID spreading. The restrictions imposed by various nations to contain COVID had stopped the production, resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and their's a surge in demand. The market would remain bullish in upcoming year.

The significant decrease in the global Industrial Ethernet market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Industrial Ethernet Market: Dynamics

The advent of innovative technologies such as big data analytics and cloud-based solutions along with its escalated use in data centers is anticipated to impel the industrial ethernet market growth in the ensuing years. Apart from this, the growing implementation of industrial Internet of Things technology across myriad sectors has further fuelled the business scope. Furthermore, the surging acceptance of advanced industrial ethernet protocols in smart firms is anticipated to support the expansion of the industrial ethernet market in the forthcoming years. Reportedly, industrial ethernet finds massive application across automotive, oil & gas, pharmaceutical, electrical & electronics, and aerospace & defense sectors.

Low determinism witnessed across ethernet communication networks, however, is predicted to inhibit the evolution of the industrial ethernet market in the near future. Nevertheless, the untapped market potential of emerging nations along with rise in the ethernet usage across the globe will catapult business expansion in the next few years, thereby normalizing the impact of hindrances on the industrial ethernet market, reports the industrial ethernet market study.

Industrial Ethernet Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Ethernet Market |

| Market Size in 2023 | USD 9.27 Billion |

| Market Forecast in 2032 | USD 21.42 Billion |

| Growth Rate | CAGR of 9.75% |

| Number of Pages | 210 |

| Key Companies Covered | Beckhoff Automation, Cisco Systems, Inc, Rockwell Automation, Schneider Electric, Siemens AG, ABB Ltd., B&R Automation, Belden Inc., Bosch Rexroth, ACS Motion Control, Innovasic, Inc., GE, Honeywell International, Omron, and Eaton among others. |

| Segments Covered | By Protocol Types, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

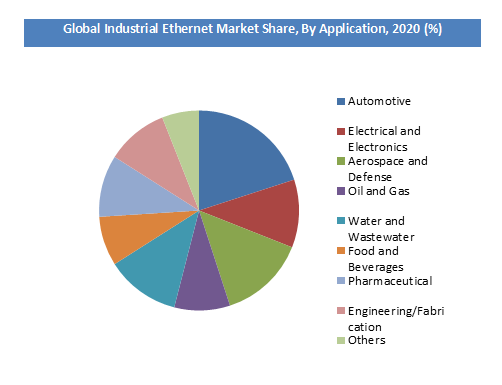

Industrial Ethernet Market: Segmentation Analysis

Automotive, electrical and electronics, aerospace and defense, oil and gas, water and wastewater, food and beverages, pharmaceutical, engineering/fabrication, and others are the key application segments of the global industrial Ethernet market.

The Automotive application segment dominated the market in terms of revenue due to the rising need for advanced automation in automobile manufacturing hubs across the globe. The aerospace and defense segment is likely to have significant growth within the forecast period and is projected as the fastest-growing segment.

Request Free Sample

Request Free Sample

Industrial Ethernet Market: Regional Analysis

Regionally, Asia Pacific has been leading the worldwide industrial ethernet market in 2023 and is anticipated to continue on the dominant position in the years to come, states the industrial ethernet market study. The immense popularity of industrial ethernet across consumer electronics as well as automotive sectors in countries such as China, South Korea, Japan, and India is the main factor behind the dominance of the Asia Pacific industrial ethernet market.

Industrial Ethernet Market: Competitive Analysis

Some of the major players in the global Industrial Ethernet market include:

- Beckhoff Automation

- Cisco Systems, Inc

- Rockwell Automation

- Schneider Electric

- Siemens AG

- ABB Ltd.

- B&R Automation

- Belden Inc.

- Bosch Rexroth

- ACS Motion Control

- Innovasic, Inc.

- GE

- Honeywell International

- Omron

- Eaton

The global Industrial Ethernet Market is segmented as follows:

By Protocol Types

- Ethernet/IP

- PROFINET

- EtherCAT

- Modbus TCP

- POWERLINK

- Sercos III

- CC-Link IE

- Others

By Applications

- Automotive

- Electrical and Electronics

- Aerospace and Defense

- Oil and Gas

- Water and Wastewater

- Food and Beverages

- Pharmaceutical

- Engineering/Fabrication

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Industrial Ethernet market size was worth around USD 9.27 billion in 2023 and is expected to reach USD 21.42 billion by 2032.

The global Industrial Ethernet market is expected to grow at a CAGR of 9.75% during the forecast period.

Some of the key factors driving the global Industrial Ethernet Market growth is growing aging population and prevalence of target diseases such as diabetic retinopathy and chronic diseases.

North America is expected to dominate the Industrial Ethernet market over the forecast period.

Some of the major players of global Industrial Ethernet market Beckoff Automation., Medtronic Inc, Boston Scientific Corporation, Arrow International, Theragenics, Varian Medical Systems, Allergan Inc, Merck, Bayer Healthcare, Abbott laboratories among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed