Global In Vitro Fertilization (IVF) Market Size, Share, Growth Analysis Report - Forecast 2034

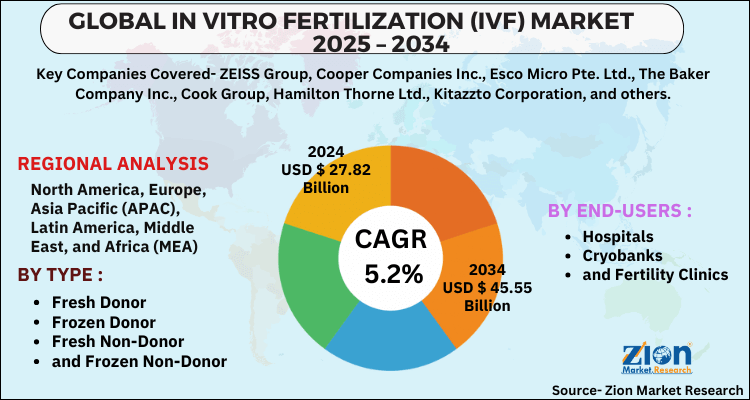

In Vitro Fertilization (IVF) Market By Type (Fresh Donor, Frozen Donor, Fresh Non-Donor, and Frozen Non-Donor), By End-Users (Hospitals, Cryobanks, and Fertility Clinics), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

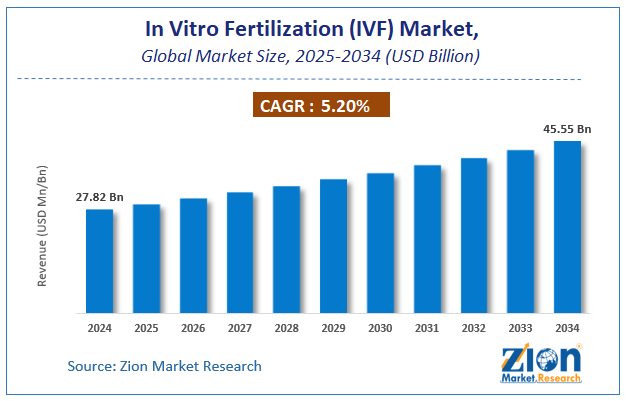

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 27.82 Billion | USD 45.55 Billion | 5.2% | 2024 |

In Vitro Fertilization (IVF) Market Size

The global in vitro fertilization (IVF) market size was worth around USD 27.82 Billion in 2024 and is predicted to grow to around USD 45.55 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.2% between 2025 and 2034.

The report analyzes the global in vitro fertilization (IVF) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the in vitro fertilization (IVF) industry.

In Vitro Fertilization (IVF) Market: Overview

In vitro fertilization (IVF) is a form of assisted reproductive technology (ART) that involves the use of a mix of drugs and surgical procedures. In an infertile couple, IVF therapy aids embryo development and implantation. IVF is a method of fertilization in which eggs are extracted, a sperm sample is obtained, and the egg and sperm are manually combined in a laboratory.

Every year, nearly half a million infants are born through IVF or other artificial insemination treatments as a result of the growing use of technology. As a result, the rising popularity of IVF and ICSI therapy is expected to rise in vitro fertilization (IVF) treatment adoption throughout the projection period.

Key Insights

- As per the analysis shared by our research analyst, the global in vitro fertilization (IVF) market is estimated to grow annually at a CAGR of around 5.2% over the forecast period (2025-2034).

- Regarding revenue, the global in vitro fertilization (IVF) market size was valued at around USD 27.82 Billion in 2024 and is projected to reach USD 45.55 Billion by 2034.

- The in vitro fertilization (IVF) market is projected to grow at a significant rate due to increasing infertility rates, advancements in IVF technologies, rising awareness and acceptance of assisted reproductive technologies, and growing demand for fertility treatments due to delayed pregnancies.

- Based on Type, the Fresh Donor segment is expected to lead the global market.

- On the basis of End-Users, the Hospitals segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

In Vitro Fertilization (IVF) Market: Growth Drivers

The increased average age of first-time mothers drives market growth

In recent decades, it has been observed that women are delaying their pregnancy after the age of 30. Medically it is believed that chances of conceiving post 32 years of age drop by 50% in women, resulting in complications. The median age for first-time mothers has drastically increased, increasing the risk of infertility.

This delay is observed due to late marriages, and couples who focus more on careers rather than extending their families. Given the scenario and the average fertility rate drop by around 2.5%, the global in vitro fertilization (IVF) market is expected to grow.

In Vitro Fertilization (IVF) Market: Restraints

Costly procedures to restrict the market growth

An average in vitro fertilization (IVF) procedure can cost anywhere between USD 13,000 to USD 18,000, excluding medications. Added to the pre and post-care expenses, genetic testing, surgical procedures, and medications, it rises to around USD 24,000 to USD 28,000.

Several potential patients cannot afford such high charges and thus do not opt for IVF treatments. This leaves a huge market unexplored, which has potential for the global in vitro fertilization (IVF) market if the treatment costs are reduced.

In Vitro Fertilization (IVF) Market: Opportunities

Improvement in Cryogenic Technology to provide growth opportunities

In vitro fertilization (IVF) requires cryopreserve technologies to preserve tissues and cell types for assistance in artificial reproductions. The drop in female fertility rate has resulted in increased demand for the preservation of sperm, oocytes, ovarian tissues, embryos as well as egg vitrification.

The developments in cryogenics can be harvested positively to develop more techniques and procedures for IVF treatments, thus providing new opportunities and avenues for the global in vitro fertilization (IVF) market.

In Vitro Fertilization (IVF) Market: Challenges

Lack of awareness and reduced efficiency in elderly patients pose a challenge

Developing countries have a lower awareness regarding in vitro fertilization (IVF) treatments. Given the cultural and social prejudices in some regions, couples or single parents opting for IVF are looked down upon. These social implications affect the global market adversely. Secondly, as the age of patients increases, the success rate of IVF decreases.

Given the fact that people are opting for pregnancy at a later stage, increasing their age, and adding to complications, success cannot be guaranteed. This hinders the growth of the global in vitro fertilization (IVF) market.

In Vitro Fertilization (IVF) Market: Segmentation

The global In vitro fertilization (IVF) market is segmented based on type, end-users, and region.

By Type, the market can be divided into fresh donor, frozen donor, fresh non-donor, and frozen non-donor. The fresh non-donor segment is expected to capture the market share, due to higher success rates, easy process, and also due to improved embryo production. This segment also requires less preservation and thus the charges are less in comparison to the rest.

Based On end-users the market is divided into hospitals, cryobanks, and fertility clinics. The fertility clinical institutions are expected to grow compared to other segments, given the requirement for fertility research. Patients generally opt for IVF treatments in infertility clinics rather than in generalized hospitals. The cryobanks segment is also expected to witness growth during the projection period. Development in cryopreservation will boost the scope for this segment.

In Vitro Fertilization (IVF) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | In Vitro Fertilization (IVF) Market |

| Market Size in 2024 | USD 27.82 Billion |

| Market Forecast in 2034 | USD 45.55 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 185 |

| Key Companies Covered | ZEISS Group, Cooper Companies Inc., Esco Micro Pte. Ltd., The Baker Company Inc., Cook Group, Hamilton Thorne Ltd., Kitazzto Corporation, and others. |

| Segments Covered | By Type, By End-Users, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

In Vitro Fertilization (IVF) Market: Regional Analysis

Europe has a strong position in the in vitro fertilization business. This is due to an increase in the prevalence of infertility in the region, as well as the growing popularity of IVF therapy. On the other hand, due to the high cost of ICSI and IVF treatment in North America, the market will continue to rise steadily. As a result, people in the United States are opting for IVF treatment in other nations due to reduced prices.

Followed by Europe, Asia Pacific sees significant development in the global in vitro fertilization (IVF) market. Significant growth in medical tourism, increased knowledge of in vitro fertilization processes, decreased IVF treatment procedures, expanding fertility clinics in the region, rising healthcare expenditures and growing acceptance of assisted reproductive technologies in emerging countries are fueling the growth in the Asia Pacific region.

Recent Developments

- In 2019, to reduce the risk of miscarriage during in vitro fertilization (IVF) treatments, a new technology for embryo screening was developed by Monash IVF.

- In 2019, Shady Grove Fertility opened a full-service in vitro fertilization (IVF) center in Florida that provides affordable and better quality IVF treatments to regional clients.

In Vitro Fertilization (IVF) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the in vitro fertilization (IVF) market on a global and regional basis.

The global in vitro fertilization (IVF) market is dominated by players like:

- ZEISS Group

- Cooper Companies Inc.

- Esco Micro Pte. Ltd.

- The Baker Company Inc.

- Cook Group

- Hamilton Thorne Ltd.

- Kitazzto Corporation

The global in vitro fertilization (IVF) market is segmented as follows;

By Type

- Fresh Donor

- Frozen Donor

- Fresh Non-Donor

- and Frozen Non-Donor

By End-Users

- Hospitals

- Cryobanks

- and Fertility Clinics

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The Global in vitro fertilization (IVF) market is expected to grow due to rising infertility rates, delayed pregnancies, advancements in assisted reproductive technologies, and increasing awareness and acceptance of IVF treatments.

According to a study, the Global in vitro fertilization (IVF) market size was worth around USD 27.82 Billion in 2024 and is expected to reach USD 45.55 Billion by 2034.

The Global in vitro fertilization (IVF) market is expected to grow at a CAGR of 5.2% during the forecast period.

North America is expected to dominate the in vitro fertilization (IVF) market over the forecast period.

Leading players in the Global in vitro fertilization (IVF) market include ZEISS Group, Cooper Companies Inc., Esco Micro Pte. Ltd., The Baker Company Inc., Cook Group, Hamilton Thorne Ltd., Kitazzto Corporation, among others.

The report explores crucial aspects of the in vitro fertilization (IVF) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed