Global In Vitro Cancer Diagnostics (IVD) Market Size, Share, Growth Analysis Report - Forecast 2034

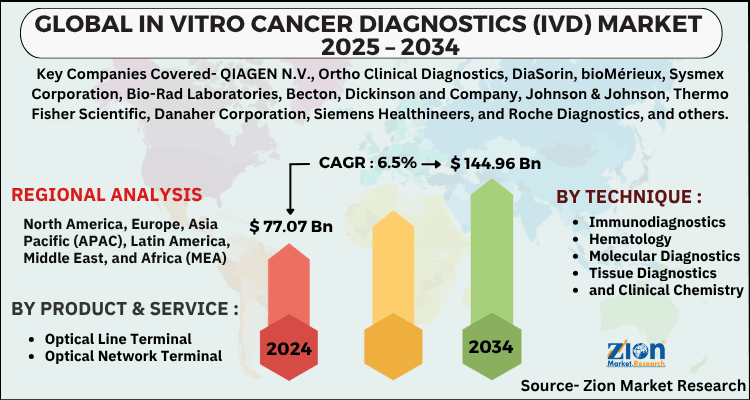

In Vitro Cancer Diagnostics (IVD) Market By Product & Service (Reagents, Instruments, and Software & Services), By Technique (Immunodiagnostics, Hematology, Molecular Diagnostics, Tissue Diagnostics, and Clinical Chemistry), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

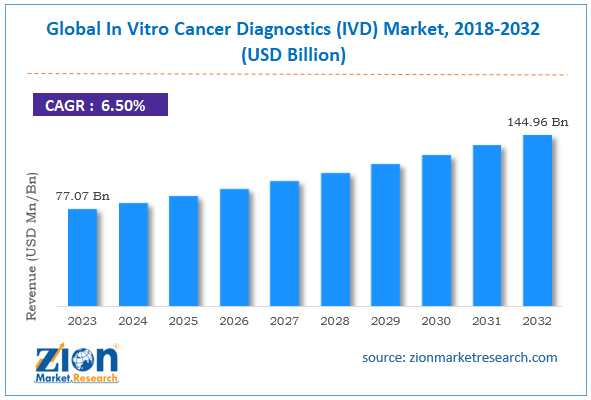

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 77.07 Billion | USD 144.96 Billion | 6.5% | 2024 |

In Vitro Cancer Diagnostics (IVD) Market Size

The global in vitro cancer diagnostics (IVD) market size was worth around USD 77.07 Billion in 2024 and is predicted to grow to around USD 144.96 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034. The report analyzes the global in vitro cancer diagnostics (IVD) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the in vitro cancer diagnostics (IVD) industry.

In Vitro Cancer Diagnostics (IVD) Market: Overview

In vitro cancer diagnostic refers to the medical devices that need the help of reagents and assays to diagnose a medical condition. However, these instruments analyze the tissue samples and body fluids collected from patients. These diagnostic systems are widely adopted to execute different in-vitro tests on targeted samples. These are used to diagnose different health conditions like cancer and diabetes. They also monitor different infectious and autoimmune diseases.

Key Insights

- As per the analysis shared by our research analyst, the global in vitro cancer diagnostics (IVD) market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034).

- Regarding revenue, the global in vitro cancer diagnostics (IVD) market size was valued at around USD 77.07 Billion in 2024 and is projected to reach USD 144.96 Billion by 2034.

- The in vitro cancer diagnostics (IVD) market is projected to grow at a significant rate due to rising incidence of cancer, advancements in diagnostic technologies, and the growing emphasis on early detection and personalized medicine.

- Based on Product & Service, the Reagents segment is expected to lead the global market.

- On the basis of Technique, the Immunodiagnostics segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

In Vitro Cancer Diagnostics Market: Growth Drivers

Rapid shift to point-of-care testing is likely to boost the growth of the global market.

The traditional model of laboratory testing all across the globe was a centralized laboratory that utilized automatic analytical testing techniques to detect the target. However, this one was well established in metallurgy discipline & clinical chemistry and is now extending to other spaces also. Point-of-care devices over conventional procedures offer ease of use affordability and yield rapid results that are high in demand for initiating quick decision making. However, the high adoption rate of POC devices is largely impacted by the need to make the healthcare system more patient-centric. Centralized testing does not offer a convenient process in respect of patients as the testing process is not connected with consultations calls.

However, it poses a huge drawback for patients with chronic diseases like diabetes that need constant monitoring. Apart from this, the world is witnessing growing incidences of chronic diseases. Parallelly, there is a rise in awareness among people regarding the early diagnosis and proper treatment, which in turn is further expanding the scope of the global in vitro cancer diagnostics (IVD) market. People became more aware of the availability of advanced novel IVD products.

In Vitro Cancer Diagnostics (IVD) Market: Restraints

High cost of IVD instruments is likely to hamper the growth of the global market.

In-vitro diagnostics are quite expensive when compared to other available technology. It also requires constant maintenance of instruments which is further likely to hamper the growth of the global market. Additionally, such instruments also need skilled professionals to operate, thereby limiting its growth.

In Vitro Cancer Diagnostics (IVD) Market: Opportunities

The high adoption rate of point of care testing devices is likely to create several lucrative growth opportunities in the global market.

Medical device companies are constantly increasing their research and development capabilities to innovate technologically advanced diagnostic devices. Hospitals and laboratories have shown high interest in the point of care testing devices to collect precise real-time data. Such an increase in interest in point-of-care testing devices is due to the constantly growing burden of diseases on healthcare infrastructure, which requires advanced results in a short period of time. Therefore, such a landscape is likely to offer ample impetus to the growth of the global market in the forthcoming years.

In Vitro Cancer Diagnostics (IVD) Market: Challenges

Unfavorable reimbursement landscape is a huge challenge in the global market.

The lack of a proper financing system will hamper the growth of the global market. Advanced treatment is quite expensive, and therefore it restricts people from undergoing treatment through in vitro cancer diagnostics, thereby posing a huge challenge in the global market.

In Vitro Cancer Diagnostics (IVD) Market: Segmentation

The global in vitro cancer diagnostics (IVD) market can be segmented into product & service, technique, and region.

By product & service, the market can be segmented into software & services, instruments, and reagents.

By technique, the market can be segmented into clinical chemistry, tissue diagnostics, molecular diagnostics, hematology, and immunodiagnostics.

In Vitro Cancer Diagnostics (IVD) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | In Vitro Cancer Diagnostics (IVD) Market |

| Market Size in 2024 | USD 77.07 Billion |

| Market Forecast in 2034 | USD 144.96 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 150 |

| Key Companies Covered | QIAGEN N.V., Ortho Clinical Diagnostics, DiaSorin, bioMérieux, Sysmex Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Johnson & Johnson, Thermo Fisher Scientific, Danaher Corporation, Siemens Healthineers, and Roche Diagnostics, and others. |

| Segments Covered | By Product & Service, By Technique, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- Sysmex Corporation, in January 2021, partnered with Roche Diagnostics (Switzerland) to optimize its strengths like competitive products, extensive sales, and service networks.

- Abbott Laboratories in September 2021 got US FDA has clearance for the Freestyle libre 2 iOS application for its utilization with compatible iPhones.

In Vitro Cancer Diagnostics (IVD) Market: Regional Landscape

North America accounts for the largest share in the global in vitro cancer diagnostics (IVD) market due to the presence of a robust healthcare system in the region. Furthermore, the high awareness among people in the region regarding the presence of such advanced novel technology is likely to boost the growth of the regional market. Additionally, the efficient reimbursement policies implemented by the government will further encourage people to adopt such advanced technology to undergo a complete treatment for different diseases, which in turn will accentuate the growth of the regional market.

In Vitro Cancer Diagnostics (IVD) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the in vitro cancer diagnostics (IVD) market on a global and regional basis.

The global in vitro cancer diagnostics (IVD) market is dominated by players like:

- QIAGEN N.V.

- Ortho Clinical Diagnostics

- DiaSorin

- bioMérieux

- Sysmex Corporation

- Bio-Rad Laboratories

- Becton

- Dickinson and Company

- Johnson & Johnson

- Thermo Fisher Scientific

- Danaher Corporation

- Siemens Healthineers

- and Roche Diagnostics

The global in vitro cancer diagnostics (IVD) market is segmented as follows;

By Product & Service

- Reagents

- Instruments

- and Software & Services

By Technique

- Immunodiagnostics

- Hematology

- Molecular Diagnostics

- Tissue Diagnostics

- and Clinical Chemistry

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global in vitro cancer diagnostics (IVD) market is expected to grow due to increasing demand for early cancer detection, rising cancer prevalence, advancements in diagnostic technologies, growing awareness about personalized medicine, and the expansion of healthcare infrastructure.

According to a study, the global in vitro cancer diagnostics (IVD) market size was worth around USD 77.07 Billion in 2024 and is expected to reach USD 144.96 Billion by 2034.

The global in vitro cancer diagnostics (IVD) market is expected to grow at a CAGR of 6.5% during the forecast period.

North America is expected to dominate the in vitro cancer diagnostics (IVD) market over the forecast period.

Leading players in the global in vitro cancer diagnostics (IVD) market include QIAGEN N.V., Ortho Clinical Diagnostics, DiaSorin, bioMérieux, Sysmex Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Johnson & Johnson, Thermo Fisher Scientific, Danaher Corporation, Siemens Healthineers, and Roche Diagnostics, among others.

The report explores crucial aspects of the in vitro cancer diagnostics (IVD) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed