Immunoglobulin Market Size, Share, Growth Report 2032

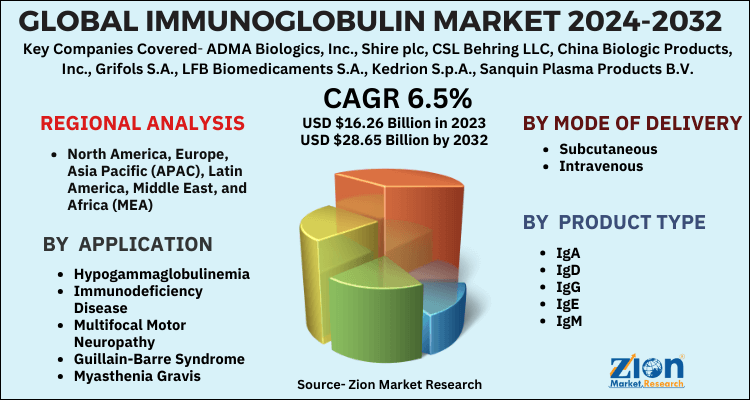

Immunoglobulin Market By Mode Of Delivery (Subcutaneous And Intravenous), By Application (Hypogammaglobulinemia, Immunodeficiency Disease, Multifocal Motor Neuropathy, Guillain-Barre Syndrome, Myasthenia Gravis, Chronic Inflammatory Demyelinating Polyneuropathy, Idiopathic Thrombocytopenic Purpura, Specific Antibody Deficiency, Inflammatory Myopathies, And Others), By Product Type (IgA, IgD, IgG, IgE, And IgM), By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.26 Billion | USD 28.65 Billion | 6.5% | 2023 |

Immunoglobulin Market Size

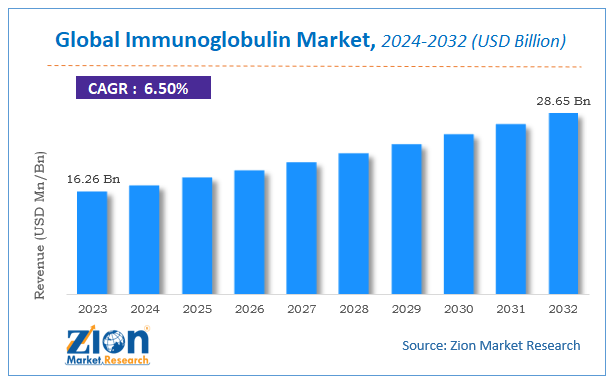

The global immunoglobulin market size was worth around USD 16.26 billion in 2023 and is predicted to grow to around USD 28.65 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.5% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The report covers a forecast and an analysis of the immunoglobulin market on a global and regional level.

Immunoglobulin Market: Overview

Immunoglobulins, also known as antibodies, are glycoprotein molecules produced by plasma cells (a type of white blood cell) in response to foreign antigens, such as bacteria and viruses. They play a critical role in the immune system by identifying and neutralizing pathogens, preventing infections, and supporting immune responses. Immunoglobulins are categorized into several classes, including IgG, IgA, IgM, IgE, and IgD, each with unique functions and roles in immunity. Therapeutically, immunoglobulins are used in various treatments, including intravenous immunoglobulin (IVIG) therapy for immune deficiencies, autoimmune diseases, and certain infections, making them a vital component of modern medicine.

Immunoglobulin Market: Growth Factors

The immunoglobulin market is experiencing significant growth driven by several key factors. The rising prevalence of immune deficiencies and autoimmune diseases, such as primary immunodeficiency disorders (PIDs) and chronic inflammatory demyelinating polyneuropathy (CIDP), has increased the demand for immunoglobulin therapies. Additionally, advancements in diagnostic techniques and a growing understanding of antibody-related disorders are enhancing the identification and treatment of conditions requiring immunoglobulin therapy. Moreover, increasing investment in healthcare infrastructure, coupled with expanding access to advanced medical treatments in emerging markets, is further fueling market growth. As the global population ages and the incidence of age-related diseases rises, the demand for immunoglobulins is expected to continue to grow, making this a dynamic and expanding sector in the healthcare industry.

Immunoglobulin Market: Segmentation

The study provides a decisive view of the immunoglobulin market by segmenting the market based on mode of delivery, application, product type, and region.

By mode of delivery, the immunoglobulin market is segmented into subcutaneous and intravenous. Subcutaneous is further segmented into 16.5% concentration, 20% concentration, and others. Intravenous is further segmented into 5% concentration, 10% concentration, and others.

Based on application, immunoglobulin market is segmented into Hypogammaglobulinemia, Immunodeficiency Disease, Multifocal Motor Neuropathy, Guillain-Barre Syndrome, Myasthenia Gravis, Chronic Inflammatory Demyelinating Polyneuropathy, Idiopathic Thrombocytopenic Purpura, Specific Antibody Deficiency, Inflammatory Myopathies, and others.

By product type, this market includes IgA, IgD, IgG, IgE, and IgM.

Immunoglobulin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Immunoglobulin Market |

| Market Size in 2023 | USD 16.26 Billion |

| Market Forecast in 2032 | USD 28.65 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 110 |

| Key Companies Covered | ADMA Biologics, Inc., Shire plc, CSL Behring LLC, China Biologic Products, Inc., Grifols S.A., LFB Biomedicaments S.A., Kedrion S.p.A., Sanquin Plasma Products B.V., and Octapharma AG, among others |

| Segments Covered | By Mode, By Application, By Product Type and By region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Immunoglobulin Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further classification into major countries including the U.S., Germany, France, UK, China, Japan, India, and Brazil.

Immunoglobulin Market: Competitive Players

Some market players of the global immunoglobulin market are:

- ADMA Biologics Inc.

- Shire plc

- CSL Behring LLC

- China Biologic Products Inc.

- Grifols S.A.

- LFB Biomedicaments S.A.

- Kedrion S.p.A.

- Sanquin Plasma Products B.V.

- Octapharma AG

This report segments the global immunoglobulin market into:

Global Immunoglobulin Market: By Mode of Delivery

- Subcutaneous

- 16.5% Concentration

- 20% Concentration

- Others

- Intravenous

- 5% Concentration

- 10% Concentration

- Others

Global Immunoglobulin Market: By Application

- Hypogammaglobulinemia

- Immunodeficiency Disease

- Multifocal Motor Neuropathy

- Guillain-Barre Syndrome

- Myasthenia Gravis

- Chronic Inflammatory Demyelinating Polyneuropathy

- Idiopathic Thrombocytopenic Purpura

- Specific Antibody Deficiency

- Inflammatory Myopathies

- Others

Global Immunoglobulin Market: By Product Type

- IgA

- IgD

- IgG

- IgE

- IgM

Global Immunoglobulin Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Immunoglobulins, also known as antibodies, are glycoproteins produced by the immune system to recognize and neutralize foreign substances such as bacteria, viruses, and toxins.

According to study, the Immunoglobulin market size was worth around USD 16.26 billion in 2023 and is predicted to grow to around USD 28.65 billion by 2032.

The CAGR value of Immunoglobulin market is expected to be around 6.5% during 2024-2032.

North America has been leading the Immunoglobulin market and is anticipated to continue on the dominant position in the years to come.

The Immunoglobulin market is led by players like ADMA Biologics, Inc., Shire plc, CSL Behring LLC, China Biologic Products, Inc., Grifols S.A., LFB Biomedicaments S.A., Kedrion S.p.A., Sanquin Plasma Products B.V., and Octapharma AG, among others

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed