Household Cleaners Market Size, Share, Trends and Outlook 2032

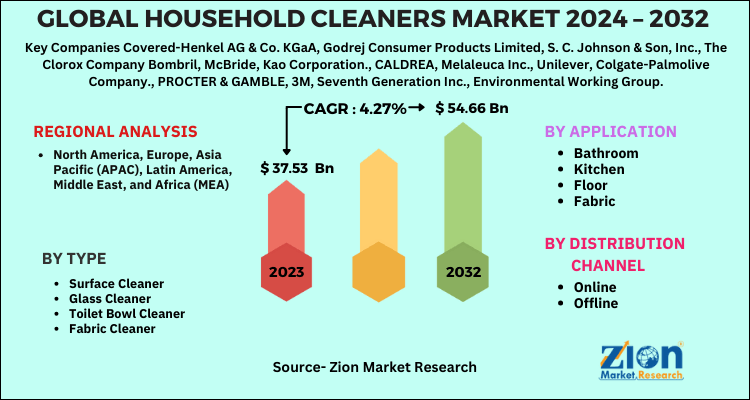

Household Cleaners Market By Product Type (Surface Cleaner, Glass Cleaner, Toilet Bowl Cleaner, Fabric Cleaner, and Others), By Application (Bathroom, Kitchen, Floor, Fabric, and Others), By Distribution Channel (Online and Offline): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

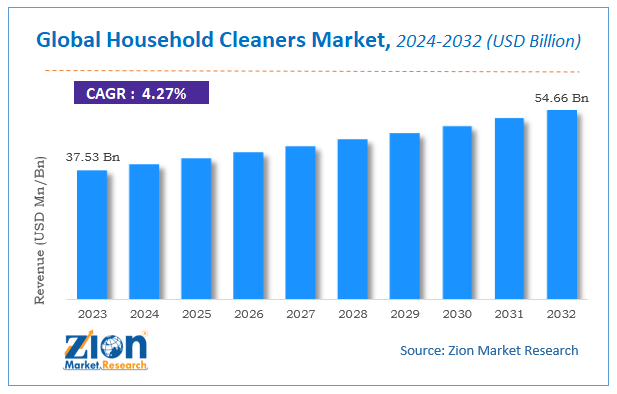

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 37.53 Billion | USD 54.66 Billion | 4.27% | 2023 |

Household Cleaners Market Insights

Zion Market Research has published a report on the global Household Cleaners Market, estimating its value at USD 37.53 Billion in 2023, with projections indicating that it will reach USD 54.66 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.27% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Household Cleaners Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Household Cleaners Market: Overview

Household cleaners refers to the type of products are particularly made so that they can remove stains, dust and other bad smells in the house. These products are used against clay, dust, oil, soap scum, grease, limescale, hard water marks, mold and mildew. They come in the market with packaging of aerosol cans, triggered sprays and in-pump actuated bottles and can aid in maintaining hygiene in the household. Scouring pad, Surface cleaners, toiler cleaners and some others are of common type household cleaners. The main purpose of the usage is to keep house fresh and clean.

Household Cleaners Market: Growth Factors

The hike in demand for sustainable and environment-friendly household products and rapid rise in the demand for eco- friendly household products are expected to come up with various opportunities that will lead to the growth in market demand of household cleaners in the above mentioned forecast period. As the rate of urbanization is increasing and changing lifestyle, rise in disposable incomes boosted by sanitation standards, are likely to positively impact the market’s growth in the coming years.

With this, the ease of availability of the substitute in market and rise in awareness about the unsafe and toxic chemicals in these cleaners are about to act as a major problem for household cleaners market. The competition among local companies can challenge the growth of the household cleaners market in the forecast period.

Household Cleaners Market: Segment Analysis Preview

Surface cleaners represented as growing segment driven by increased household spending and consumers’ focusing on more hygienic lifestyle. Surfaces like mirrored, stainless, glass and wood are now can be cleaned with the new smart drop technology that are developed to preserve specific surfaces. Liquid cleaners that are solid suspension abrasive particles in thickened liquid matrix are available in different formats such as aerosol cans, trigger sprays and pump-actuated bottles. Market players are in introducing surface cleaners and innovative toilet in terms of quality, pricing, packaging and fragrance. In current scenario, consumers also prefer eco-friendly care products with natural and refreshing fragrances. For example, Clorox Professional Product Company is offering a ‘Green Works Natural Toilet Bowl Cleaner’ which is made up of natural ingredients.

In current situation the online channels are really doing well with this market as consumers are also feeling safe purchasing cleaning products. The online channel is expected to cover the market in coming years. Online distribution on household cleaning makes it more easy and time economic.

Household Cleaners Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Household Cleaners Market |

| Market Size in 2023 | USD 37.53 Billion |

| Market Forecast in 2032 | USD 54.66 Billion |

| Growth Rate | CAGR of 4.27% |

| Number of Pages | 140 |

| Key Companies Covered | Henkel AG & Co. KGaA, Godrej Consumer Products Limited, S. C. Johnson & Son, Inc., The Clorox Company Bombril, McBride, Kao Corporation., CALDREA, Melaleuca Inc., Unilever, Colgate-Palmolive Company., PROCTER & GAMBLE, 3M, Seventh Generation Inc., Environmental Working Group., Eastman Chemical Company, Amway, and Balthazar & Brisco LLC, among others |

| Segments Covered | By Type, By Application, By Distribution Channel and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Household Cleaners Market: Regional Analysis Preview

The market in North America is expected to rise tremendously and have it dominance in forecast period. The growth of the region is complimenting the presence of major players in the region. The rising demand of cleaning products with Research & Development by companies to enrich the product's ingredients, packaging, content and others will further improve the prospects of the market during the forecast period.

Asia Pacific is also expected to witness a substantial growth rate during the forecast period because of rising population in the Asia Pacific region. The increasing disposable incomes of consumers will further bring the growth in the market. The rising demand for natural cleaning products in China, Japan, and India is expected to increase.

Key Market Players & Competitive Landscape

The major players Household Cleaners Market are

- Henkel AG & Co

- KGaA

- Godrej Consumer Products Limited

- S. C. Johnson & Son, Inc

- The Clorox Company Bombril

- McBride

- Kao Corporation

- CALDREA

- Melaleuca Inc

- Unilever

- Colgate-Palmolive Company

- PROCTER & GAMBLE

- 3M

- Seventh Generation Inc

- Environmental Working Group

- Eastman Chemical Company

- Amway

- Balthazar & Brisco LLC

The household cleaners market is segmented as follows:

By Type

- Surface Cleaner

- Glass Cleaner

- Toilet Bowl Cleaner

- Fabric Cleaner

- Others

By Application

- Bathroom

- Kitchen

- Floor

- Fabric

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed