Horse-Riding Apparel Market Size, Share, Trends, Growth & Forecast 2034

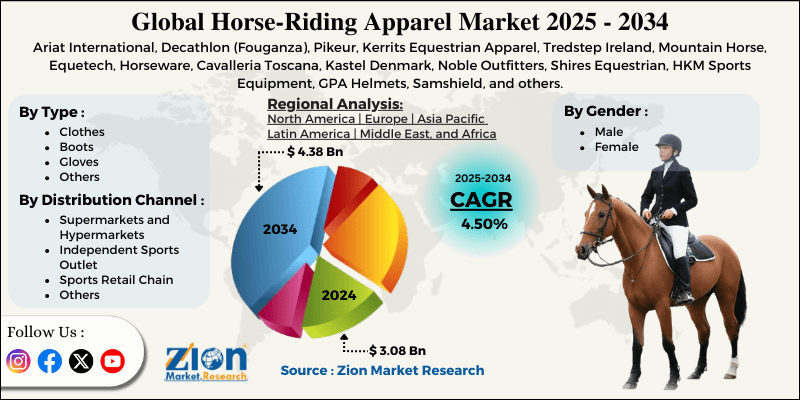

Horse-Riding Apparel Market By Type (Clothes, Boots, Gloves, and Others), By Gender (Male, Female), By Distribution Channel (Supermarkets and Hypermarkets, Independent Sports Outlet, Sports Retail Chain, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

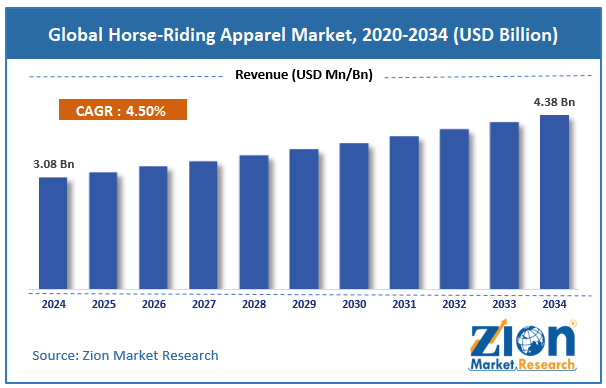

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.08 Billion | USD 4.38 Billion | 4.50% | 2024 |

Horse-Riding Apparel Industry Perspective:

The global horse-riding apparel market size was approximately USD 3.08 billion in 2024 and is projected to reach around USD 4.38 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global horse-riding apparel market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034)

- In terms of revenue, the global horse-riding apparel market size was valued at around USD 3.08 billion in 2024 and is projected to reach USD 4.38 billion by 2034.

- The horse-riding apparel market is projected to grow significantly due to the increasing participation in recreational horse riding, the expansion of horse-riding training schools and academies, and technological advancements in performance apparel.

- Based on type, the clothes segment is expected to lead the market, while the boots segment is expected to grow considerably.

- Based on gender, the female segment is the dominant segment, while the male segment is projected to witness sizable revenue growth over the forecast period.

- Based on the distribution channel, the sports retail chain segment is expected to lead the market compared to the independent sports outlet segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Horse-Riding Apparel Market: Overview

The horse-riding apparel covers specialized gear and clothing designed for performance, safety, and comfort while riding. Items such as boots, helmets, jackets, gloves, and breeches are custom-made to meet both fashion preferences and functional needs. The global horse-riding apparel market is projected to experience substantial growth, driven by increasing participation in equestrian sports, heightened awareness of rider safety, and advancements in design and fabric technology. The growing prominence of equestrian sports, including show jumping, dressage, and racing, is driving demand for apparel. According to the FEI, millions of people participate in organized horse-riding events worldwide, driving the need for specialized safety gear and clothing.

Moreover, awareness campaigns and safety regulations are driving riders to invest in certified helmets, boots, and protective vests. This move promises long-term demand for high-class, protective apparel in the industry. Additionally, the use of advanced fabrics, such as moisture-wicking, stretchable, and breathable textiles, improves performance and comfort. Smart clothing with embedded sensors for rider monitoring is also advancing, appealing to tech-savvy consumers.

Although drivers exist, the global market is challenged by factors like the high cost of premium apparel, regional and seasonal demand variations, and low awareness in developing regions. Specialized fabrics, brand exclusivity, and safety certifications make equestrian apparel costly, limiting affordability for low-income and casual riders. Furthermore, horse riding is seasonal in colder regions, with participation peaking only in certain months, creating inconsistent demand for horse riding clothing. In several developing nations, equestrian sports are underdeveloped and niche, resulting in reduced demand for professional apparel and limited awareness.

Even so, the global horse-riding apparel industry is well-positioned due to the incorporation of eco-friendly and sustainable apparel, personalization and customization, and the use of smart wearables. The growing demand for sustainable products presents fresh opportunities for environmentally friendly horse-riding apparel made from organic cotton, vegan leather, and recycled materials. Offering monogrammed apparel, tailored designs, and customized safety gear attracts premium users who prefer exclusive products. Smart apparel integrated with sensors to track posture, performance, or body temperature can appeal to professionals and tech-savvy riders.

Horse-Riding Apparel Market: Growth Drivers

How is premiumization driving growth in the horse-riding apparel market?

Apparel makers are actively focusing on high-performance fabrics, such as anti-abrasion materials, moisture-wicking properties, and four-way stretch, that enhance rider safety and comfort. These advancements not only justify premium pricing but also differentiate brands that prioritize innovation, research & development. Competition riders primarily demand advanced gear that is embedded with ventilation, features an ergonomic design, and offers durability for optimal performance in events. Premium product lines enable brands to achieve high profit margins and strengthen their brand visibility among aspirational and elite consumers. Hence, the horse-riding apparel market is shifting from basic to technologically advanced and specialized gear.

Lifestyle branding and fashion crossover, expanding consumer reach, spur the market growth

Equestrian-inspired apparel is essentially merging with mainstream fashion, offering new user segments beyond professional riders. Riding boots, tailored breeches, and quilted jackets are now largely bought products in urban and luxury fashion. Associations between luxury fashion houses and brands are augmenting this trend, appealing to hopeful buyers. This crossover creates a dual-purpose equestrian apparel product that is both functional for riders and fashionable for non-riders. This blend of utility and functionality broadens reach in new retail channels and increases market visibility.

Horse-Riding Apparel Market: Restraints

How does limited awareness and accessibility in the developing regions hamper the development of the horse-riding apparel market?

While equestrian sports are gaining prominence in regions such as Latin America and the Asia Pacific, awareness of specialized apparel remains low. A majority of casual riders in these regions typically rely on general sportswear rather than investing in technical apparel. Statistics show that equestrian penetration in Brazil and India is still under 15% among enthusiast riders, compared to more than 70% in Europe. Recent reports in 2024 stated that restricted retail presence and substantial import costs limit the adoption in these regions. Low awareness and restricted distribution networks continue to hamper the worldwide adoption.

Horse-Riding Apparel Market: Opportunities

How does the adoption of ethical and sustainable materials offer advantageous conditions for the horse-riding apparel market growth?

The growing awareness of animal welfare and environmental impact presents opportunities for nature-friendly apparel, influencing the development of the horse-riding apparel industry. Vegan leather substitutes, bio-based fabrics, and recycled synthetics are gaining acceptance by consumers. According to a European survey (2023), nearly 42% of riders aged 18-35 prefer environmentally friendly apparel, indicating a shift in buying behavior. Companies that implement sustainability measures may distinguish themselves and gain loyalty from young people. Sustainability programs also allow collaborations with eco-conscious organizations and stables.

Horse-Riding Apparel Market: Challenges

Regulatory and safety compliance challenge the market growth

The current updates to safety standards for vests, helmets, and other protective apparel need a continuous certification process and product redesign. Compliance cost may surge the product price by 15%, impacting affordability. High-profile accidents and stringent norms in 2023 in North America and Europe underscored the need for mandatory certification of competitive gear. Compared to larger manufacturers, small manufacturers face challenges in meeting updated standards, and delayed compliance may result in legal risks. Navigating complex and varied regulations is a persistent challenge for global industry players.

Horse-Riding Apparel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Horse-Riding Apparel Market |

| Market Size in 2024 | USD 3.08 Billion |

| Market Forecast in 2034 | USD 4.38 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 216 |

| Key Companies Covered | Ariat International, Decathlon (Fouganza), Pikeur, Kerrits Equestrian Apparel, Tredstep Ireland, Mountain Horse, Equetech, Horseware, Cavalleria Toscana, Kastel Denmark, Noble Outfitters, Shires Equestrian, HKM Sports Equipment, GPA Helmets, Samshield, and others. |

| Segments Covered | By Type, By Gender, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Horse-Riding Apparel Market: Segmentation

The global horse-riding apparel market is segmented based on product type, material type, end-user industry, and region.

Based on type, the global horse-riding apparel industry is categorized into clothing, boots, gloves, and other accessories. The clothing segment dominated the global market, as jackets, breeches, show coats, and shirts are essential for professionals and casual riders. They are purchased more often than other products because they are prone to wear and tear due to friction, weather exposure, and sweat. Beyond functionality, riders are actively seeking stylish designs, fueling steady demand for fashion-oriented collections. With advancements in stretchable and breathable fabrics, enhancing performance and comfort, clothes are still dominating the industry share.

Based on gender, the global horse-riding apparel market is segmented into male and female. The female segment has held a leading share of the market, as women make up a substantial portion of the worldwide equestrian category, particularly in North America and Europe, where female participation in sports such as show jumping, dressage, and recreational riding is higher. Leading companies are actively customizing apparel for women with more stylish designs, better fits, and performance-based fabrics, thereby propelling segmental dominance.

Based on distribution channel, the global market is segmented into supermarkets and hypermarkets, independent sports outlets, sports retail chains, and others. The sports retail chain segment has held a leadership position in the market, as it offers a broader variety of dedicated equestrian apparel in one place, often collaborating with prominent brands. Their ability to provide expert guidance, loyalty programs, and premium collections increases their preference for recreational and professional riders.

Horse-Riding Apparel Market: Regional Analysis

Why does Europe hold a dominant position in the global Horse-Riding Apparel Market?

Europe is likely to maintain its leadership in the horse-riding apparel market due to its strong equestrian tradition and participation, high disposable income, and luxury market, as well as the presence of leading retailers and brands. Europe holds the leading equestrian traditions worldwide, with economies such as France, Germany, and the United Kingdom leading the way in horse-riding culture. There are more than 6 million active riders in the region, according to the European Equestrian Federation. This makes the area the leading region in the said sport. This extensive participation creates consistent demand for horse-riding apparel in leisure and professional categories. Furthermore, European users spend actively on luxury sports and lifestyle, with horse-riding apparel usually viewed as fashionable and functional.

In 2023, Western Europe reported an average spending power of over USD 30,000, enabling more expenses on premium equestrian wear. The rising preference for stylish, branded apparel surges sales of high-end clothing, accessories, and boots. Europe is home to well-established equestrian apparel brands, including Cavallo, Pikeur, Equiline, and Samshield, which hold leading positions in the global industry. Their advancements in fabric technology, safety standards, and design contribute to their regional dominance. Moreover, well-developed e-commerce infrastructure and retail networks promise access to affordable and luxury apparel.

North America continues to hold the second-highest share in the horse-riding apparel industry, owing to the strong presence of competitive sports, high spending power, and premium industry demand, as well as the growth of e-commerce and retail. The region hosts leading equestrian competitions, including the American Gold Cup, the Kentucky Derby, and the Winter Equestrian Festival, which attract thousands of riders every year. The United States Equestrian Federation reports that more than 30,000 riders participate in these prominent events, driving increased demand for performance-based riding apparel.

Likewise, with a per capita spending power exceeding $ 55,000 in 2023, North American users possess a strong purchasing power for luxury and premium apparel. Riders in Canada and the United States often prefer high-quality boots, helmets, and show apparel, making North America a lucrative region for global brands. Canada and the United States boast a robust equestrian retail infrastructure, featuring key distributors, specialized online platforms, and outlets such as Dover Saddlery and SmartPak. E-commerce in the United States accounted for 15.6% of the overall retail sales in 2023, according to Statista. Equestrian brands benefit from this progressing digital penetration.

Horse-Riding Apparel Market: Competitive Analysis

The leading players in the global horse-riding apparel market are:

- Ariat International

- Decathlon (Fouganza)

- Pikeur

- Kerrits Equestrian Apparel

- Tredstep Ireland

- Mountain Horse

- Equetech

- Horseware

- Cavalleria Toscana

- Kastel Denmark

- Noble Outfitters

- Shires Equestrian

- HKM Sports Equipment

- GPA Helmets

- Samshield

Horse-Riding Apparel Market: Key Market Trends

Integration of smart fabrics and technology:

The use of moisture-wicking, breathable, and stretchable fabrics is becoming standard in premium riding apparel, improving rider performance and safety. Some companies are experimenting with smart wearables, such as clothing that helps monitor body temperature and posture. These advancements attract the tech-savvy riders and professionals who admire performance optimization. The push for advancement is transforming equestrian wear from completely functional to performance-based gear.

Increasing focus on lifestyle and fashion appeal:

Horse-riding apparel is progressing beyond functionality into a lifestyle and fashion segment, with riders preferring modern and stylish designs. Premium brands are collaborating with fashion houses to create collections that enhance performance while blending seamlessly with luxury aesthetics. Riders, primarily youth and women, prefer clothing that can be worn both on and off the field. This trend-based move is helping equestrian apparel enter the mainstream sports fashion industry.

The global horse-riding apparel market is segmented as follows:

By Type

- Clothes

- Boots

- Gloves

- Others

By Gender

- Male

- Female

By Distribution Channel

- Supermarkets and Hypermarkets

- Independent Sports Outlet

- Sports Retail Chain

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The horse-riding apparel covers specialized gear and clothing designed for performance, safety, and comfort while riding. Items such as boots, helmets, jackets, gloves, and breeches are custom-made to meet both fashion preferences and functional needs.

The global horse-riding apparel market is projected to grow due to the rising popularity of equestrian sports, increasing demand for safety-focused riding gear, and expanding online retail penetration.

According to study, the global horse-riding apparel market size was worth around USD 3.08 billion in 2024 and is predicted to grow to around USD 4.38 billion by 2034.

The CAGR value of the horse-riding apparel market is expected to be approximately 4.50% from 2025 to 2034.

By 2034, the sports retail chain segment is expected to dominate the horse-riding apparel market, driven by brand partnerships, a broad product range, and a robust omnichannel presence.

Technological advancements are enhancing horse-riding apparel with moisture-wicking materials, smart fabrics, and wearable sensors, improving rider comfort, performance, and safety.

Regulatory and environmental factors influencing the horse-riding apparel market include import/export regulations, safety standards for protective gear and helmets, as well as the growing demand for sustainable and eco-friendly materials.

Europe is expected to lead the global horse-riding apparel market during the forecast period.

The key players profiled in the global horse-riding apparel market include Ariat International, Decathlon (Fouganza), Pikeur, Kerrits Equestrian Apparel, Tredstep Ireland, Mountain Horse, Equetech, Horseware, Cavalleria Toscana, Kastel Denmark, Noble Outfitters, Shires Equestrian, HKM Sports Equipment, GPA Helmets, and Samshield.

The report examines key aspects of the horse-riding apparel market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed