Graphic Films Market Size, Share Report, Analysis, Trends, Growth 2032

Graphic Films Market by type of film (opaque, transparent, translucent, and reflective and other films), type of material, (PVC, polypropylene (PP), and polyethylene (PE) and other materials), end use, (automotive, promotion, advertising, and branding, and industrial and other end-use sectors), by Region (North America, Europe, Asia Pacific, Latin America and Middle East and Africa): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

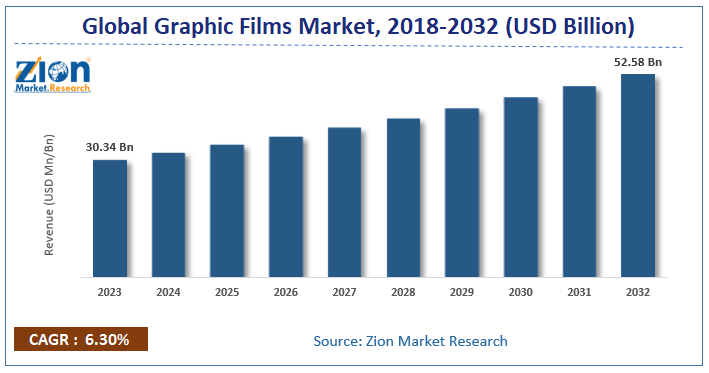

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.34 Billion | USD 52.58 Billion | 6.30% | 2023 |

Graphic films Market: Industry Perspective

The global Graphic Films market size accrued earnings worth approximately USD 30.34 Billion in 2023 and is predicted to gain revenue of about USD 52.58 Billion by 2032, is set to record a CAGR of nearly 6.30% over the period from 2024 to 2032.

Graphic films Market Overview

Graphic Films is mainly used as a premier custom coater of pressure sensitive materials for the offset, screen, industrial & specialty, and digital markets. Graphic films have wild applications such as in an anti-graffiti, advertisement, promotional banners, and pamphlets applications. Moreover, graphic films could be progressively used for developing promotional banners and vehicle wraps. When compared to traditional films, graphic films are expected to be the most cost-effective option. In addition, compared to conventional types of films, graphic films are expected to be a cost-effective substitute. The lifestyle of consumers as a result of improving purchase power and technological developments is anticipated to be responsible for the further growth of the market.

Graphic films Market Growth Dynamics

Rising promotional trends observed in the e-commerce sector boost the demand of graphic films market. However, industry players could find favorable growth in future and also other sectors such as automotive, promotion and branding, retail and construction. While this possibly will help the market to strike with its growth, there are certain other forecasts projected to take shape with the growing application of opaque films. Such types of films can be significantly demanded because of their high durability, excellent printability, lightweight, and ease of use.

This report offers comprehensive coverage on global graphic films market along with, market trends, drivers, and restraints of the graphic films market. This report included a detailed competitive scenario and the product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the graphic films market has also been included. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate, and general attractiveness. This report is prepared using data sourced from in-house databases, secondary and primary research team of industry experts.

Graphic films Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Graphic films Market |

| Market Size in 2023 | USD 30.34 Billion |

| Market Forecast in 2032 | USD 52.58 Billion |

| Growth Rate | CAGR of 6.30% |

| Number of Pages | 204 |

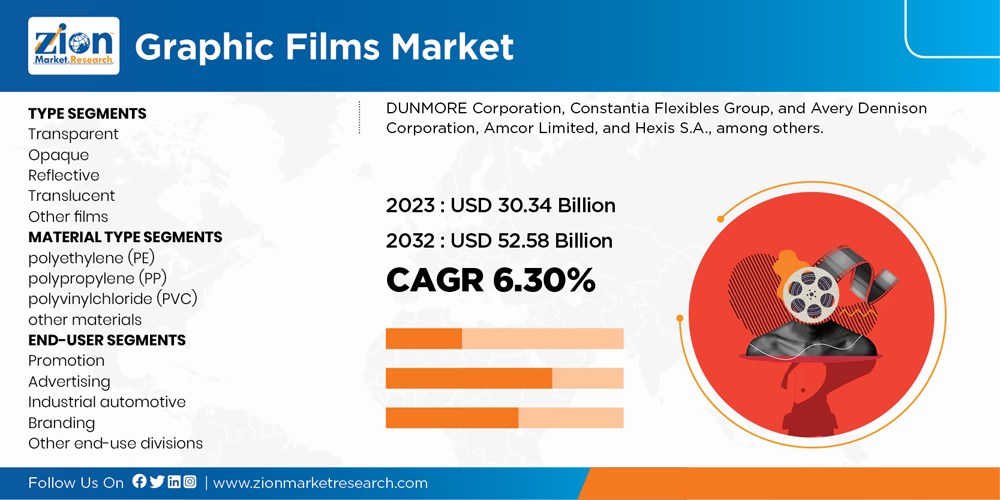

| Key Companies Covered |

DUNMORE Corporation, Constantia Flexibles Group, and Avery Dennison Corporation, Amcor Limited, and Hexis S.A., among others |

| Segments Covered | By type of film, By type of material, By end use, and by Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Graphic films Market Segmentation Analysis

The study provides a decisive view on the graphic films market by segmenting the market based on type, material type, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on type of film, the market is devided into opaque, transparent, translucent, and reflective and other films

Based on material types, the market is devided into polyvinylchloride (PVC), polypropylene (PP), and polyethylene (PE) and other material.

By end user, the market is devided into automotive, promotion, advertising, and branding, and industrial and other end-use sectors,

Graphic films Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

The Asia Pacific accounted for most of the global market share and is expected to grow in light of the increase in disposable, increasing population, rapid urbanization, and income capability of constituent nations like India, China, and Japan. In 2016, International Monetary Fund (IMF) acknowledged that the economy of Asia Pacific grew by more than 5% and is anticipated to grow further during the forecast period, thus graphical film business is lucrative in Asia-Pacific market.

North America is expected to witness strong growth over the forecast period for graphic films from the automotive industry. Due to exposure of sun for a long duration of time vehicle starts heating resulting in reduces fuel efficiency. Application of graphic films provides with sufficient protection from UV rays.

Graphic films Market: Key Players Analysis

The major players operating in the graphic films market are

- DUNMORE Corporation

- Constantia Flexibles Group

- and Avery Dennison Corporation

- Amcor Limited

- and Hexis S.A., among others.

The report segments the global graphic films market as follows:

Graphic films Market: Type Segments

- Transparent

- Opaque

- Reflective

- Translucent

- Other films

Graphic films Market: Material Type Segments

- polyethylene (PE)

- polypropylene (PP)

- polyvinylchloride (PVC)

- other materials

Graphic films Market: End-User Segments

- Promotion

- Advertising

- Industrial automotive

- Branding

- Other end-use divisions.

Graphic films Market: Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Graphic Films is mainly used as a premier custom coater of pressure sensitive materials for the offset, screen, industrial & specialty, and digital markets.

According to study, the global Graphic Films Market size was worth around USD 30.34 billion in 2023 and is predicted to grow to around USD 52.58 billion by 2032.

The CAGR value of Graphic Films Market is expected to be around 6.30% during 2024-2032.

Asia Pacific has been leading the global Graphic Films Market and is anticipated to continue on the dominant position in the years to come.

The global Graphic Films Market is led by players like DUNMORE Corporation, Constantia Flexibles Group, and Avery Dennison Corporation, Amcor Limited, and Hexis S.A., among others

List of Contents

Graphic films Industry PerspectiveGraphic films Market OverviewGraphic films Market Growth DynamicsGraphic films Report ScopeGraphic films Market Segmentation AnalysisGraphic films Regional AnalysisGraphic films Key Players AnalysisThe report segments the global graphic films market as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed