Global Grain Oriented Electrical Steel Market Size, Share, Growth Analysis Report - Forecast 2034

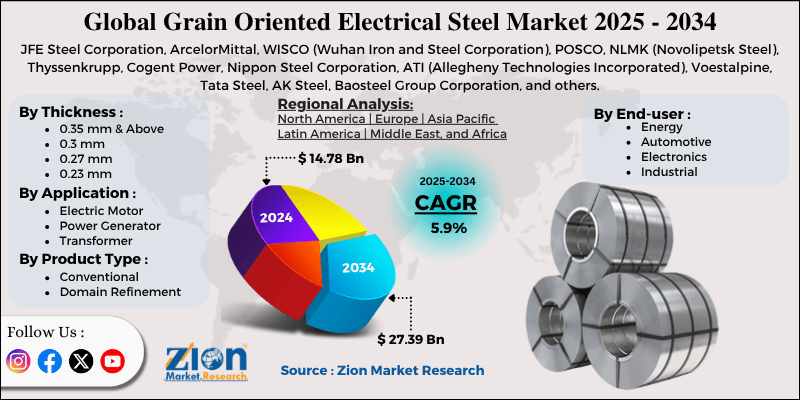

Grain Oriented Electrical Steel Market By Type (High Magnetic Strength, Conventional), By Application (Transformers, Motors, Inductors), By End-user (Energy, Automotive, Electronics, Industrial), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.78 Billion | USD 27.39 Billion | 5.9% | 2024 |

Grain Oriented Electrical Steel Market: Industry Perspective

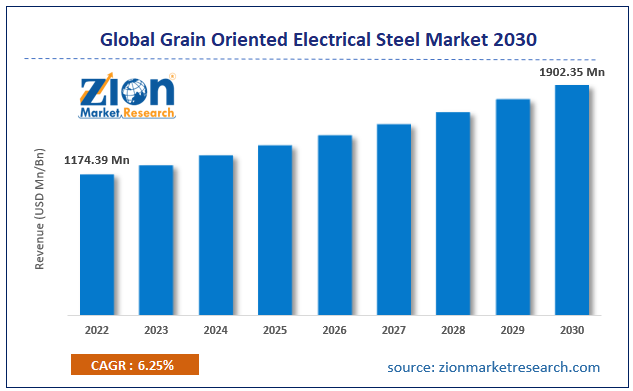

The global grain oriented electrical steel market size was worth around USD 14.78 Billion in 2024 and is predicted to grow to around USD 27.39 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.9% between 2025 and 2034.

The report analyzes the global grain oriented electrical steel market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the grain oriented electrical steel industry.

Grain Oriented Electrical Steel Market: Overview

An electrical steel is a modified steel type exhibiting magnetic properties. The primary difference between grain and non-grain electrical steel is the direction of magnetization. Electrical steel, the main component of which the non-grain variant is a derivative, has small hysteresis areas that promote reduced power loss during each cycle along with high permeability and low core loss. Grain-oriented electrical steel has applications in the construction of high-performance and large generators. At present times, laminated grain oriented electrical steel is the core and essential material required for constructing power transformers, distribution transformers, and small transformers. The grain variant shows an optimal magnetic behavior in only one direction, unlike the non-grain-oriented electrical steel version. This behavioral aspect makes it highly suitable for transformers since these units require one preferred magnetization direction since they exhibit unidirectional magnetization within the limbs, unlike rotating machines such as generators and engines.

Key Insights

- As per the analysis shared by our research analyst, the global grain oriented electrical steel market is estimated to grow annually at a CAGR of around 5.9% over the forecast period (2025-2034).

- Regarding revenue, the global grain oriented electrical steel market size was valued at around USD 14.78 Billion in 2024 and is projected to reach USD 27.39 Billion by 2034.

- The grain oriented electrical steel market is projected to grow at a significant rate due to Growing need for efficient transformers and power distribution systems drives demand. Expansion of smart grids and renewable energy infrastructure supports growth.

- Based on Type, the High Magnetic Strength segment is expected to lead the global market.

- On the basis of Application, the Transformers segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Energy segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Grain Oriented Electrical Steel Market: Growth Drivers

Growing need for high-performance transformers for power generation to drive market growth

The global grain oriented electrical steel market is projected to grow owing to the increasing need for transformers with high capacity to generate and distribute power. The increasing rate of industrialization along with surging urbanization and commercialization has resulted in a greater need for energy supply. Small transformer units are unable to meet the growing need for electrical energy. As per the latest research, the US is facing delays in the completion of various projects across industries including residential applications, electric vehicle manufacturing, and infrastructure assignments due to a shortage of power grid transformers. In addition to this, the increasing number of natural disasters such as hurricanes, cyclones, floods, and other disasters has created problems for power grid operators.

An August 2023 report by the Australian Energy Market Operator (AEMO) has warned Australian citizens of power shortages in the states of South Australia and Victoria due to dry and hot summers during the end of the year. Statistics projected by Our World In Data indicate that more than 940 million worldwide do not have access to electricity. These numbers indicate the growing need for installing large-scale transformers resulting in a higher demand for grain oriented electrical steel.

Increasing demand for electric vehicles to push market revenue

During the forecast period, the grain oriented electrical steel market players can expect higher consumption owing to the thriving electric vehicle (EV) sectors. Factors such as growing awareness about the environmental impact of fuel consumption, rising number of EV providers, increasing prices of non-renewable fuel, reducing prices of EVs, and surging investments by the government sector in state-owned EVs for public transport are some of the major growth propellers for the EV sector. Tata Motors, India's leading automaker, witnessed a jump of 150% in its EV segment revenue in 2022 as compared to 2021. Grain oriented electrical steel is used in the production of inductors and transformers used in electric vehicles. These units, in turn, are responsible for powering other parts of EVs.

Grain Oriented Electrical Steel Market: Restraints

Fluctuating prices of steel and varying availability rates to restrict market growth

The global grain oriented electrical steel market growth is projected to come across several growth restrictions and the primary concern will be the fluctuating prices of steel, the essential raw material required for producing grain oriented electrical steel. Some factors linked to surging prices are growing production costs, supply chain disruptions, and increased global demand with restricted production volume. In addition to this, a constant supply of steel poses an additional problem for grain oriented electrical steel suppliers. External geopolitical factors and changing trading partnerships between global economies have resulted in severe fluctuations in steel supply.

Grain Oriented Electrical Steel Market: Opportunities

Rising global collaboration between market players to create growth opportunities

The grain oriented electrical steel industry will witness new growth avenues due to the increasing rate of international and domestic strategic partnerships between steel manufacturers, suppliers, and end-consumers. In May 2023, JSW Steel, India and Japan’s JFE Steel announced their decision to invest in a 50:50 joint venture (JV) for manufacturing cold-pressed grain-oriented electrical steel. The production will take place at facilities located in Karnataka, India. The JV will be the first of its kind in India to produce cold-pressed versions of grain oriented electrical steel with a complete manufacturing process. On the other hand, Beijing Shougang, a subsidiary of China’s sixth-largest steelmaker Shougang Group, announced its investment toward the construction of a new grain-oriented (GO) electrical steel production line which is also claimed as the world’s first production line specializing in the production of 100% high magnetic induction and thin gauge grain-oriented electrical steel.

Growing infrastructure development projects in rural areas to create expansion possibilities

The growing efforts by local and regional governments to improve remote infrastructure with the aim to enhance the quality of life of the general population may lead to additional demand for grain oriented electrical steel. The August 2023 program launched in the US to provide electricity in more Native American homes is one such example among many others.

Grain Oriented Electrical Steel Market: Challenges

Growing investments in development of alternate materials to challenge market expansion

The rising investments and interest in the development of alternate materials could create challenges for the grain-oriented electrical steel industry growth trend. The other materials gaining more traction are nanocrystalline and amorphous electrical steels. For instance, in October 2022, Cogent Power, a Tata Steel subsidiary launched several new sophisticated electric steel products with reduced electricity losses by 20 to 30% as compared to conventionally used grain oriented electrical steel.

Grain Oriented Electrical Steel Market: Segmentation

The global grain oriented electrical steel market is segmented based on thickness, application, product type, End-user and region.

Based on thickness, the global market segments are 0.35 mm & above, 0.3 mm, 0.27 mm, 0.23 mm, and 0.2 mm & below. In 2022, the highest growth was registered in the 0.23 mm segment since the thickness is ideal for applications in several electromagnetic and electrical applications. However, the specific size selected depends on the exact requirements of the end-user. In addition to this, the 0.35 mm variant is also highly popular.

Based on application, the global market segments are electric motor, power generator, transformer, and others.

Based on product type, the grain oriented electrical steel industry is divided into high magnetic strength steels, conventional, and domain refinement. In 2022, the conventional segment was the leading revenue generator driven by an existing ecosystem for the production of conventional grain oriented electrical steels. Most material providers operate in the segment since it enjoys a large consumer base as the high-magnetic version is relatively new and needs more time to establish as a dominant segment. The melting point of electrical steel is around 1,500 °C.

By End-user, the global grain oriented electrical steel market is split into Energy, Automotive, Electronics, Industrial.

Grain Oriented Electrical Steel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Grain Oriented Electrical Steel Market |

| Market Size in 2024 | USD 14.78 Billion |

| Market Forecast in 2034 | USD 27.39 Billion |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 229 |

| Key Companies Covered | JFE Steel Corporation, ArcelorMittal, WISCO (Wuhan Iron and Steel Corporation), POSCO, NLMK (Novolipetsk Steel), Thyssenkrupp, Cogent Power, Nippon Steel Corporation, ATI (Allegheny Technologies Incorporated), Voestalpine, Tata Steel, AK Steel, Baosteel Group Corporation, and others., and others. |

| Segments Covered | By Type, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Grain Oriented Electrical Steel Market: Regional Analysis

Asia-Pacific to register the highest growth rate during the coming period

The global grain oriented electrical steel market will be dominated by Asia-Pacific during the forecast period. Asia is home to some of the largest steel-producing countries including South Korea, India, and China. In fiscal year 2023, India produced over 125 million tonnes of steel. The Indian government is planning to upscale steel production to 300 million tons by the end of 2030. In addition to this, the regional steel players are experimenting and investing in the development of advanced steel products including grain oriented electrical steel. For instance, in February 2023, Thyssenkrupp announced that it will be expanding its cold rolled grain oriented electrical steel production capacity at its Nashik plant in India. The current production capacity is at 50,000 tonnes. The announcement is influenced by India’s growing take on Make In India ideology. Moreover, China and India are emerging economies and the growing rate of foreign investment along with rising regional demand for power has created higher requirements for installing large transformers to satisfy electricity demands resulting in higher usage of grain oriented electrical steel.

Grain Oriented Electrical Steel Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the grain oriented electrical steel market on a global and regional basis.

The global grain oriented electrical steel market is dominated by players like:

- JFE Steel Corporation

- ArcelorMittal

- WISCO (Wuhan Iron and Steel Corporation)

- POSCO

- NLMK (Novolipetsk Steel)

- Thyssenkrupp

- Cogent Power

- Nippon Steel Corporation

- ATI (Allegheny Technologies Incorporated)

- Voestalpine

- Tata Steel

- AK Steel

- Baosteel Group Corporation

- and others.

The global grain oriented electrical steel market is segmented as follows:

By Thickness

- 0.35 mm & Above

- 0.3 mm

- 0.27 mm

- 0.23 mm

- 0.2 mm & Below

By Application

- Electric Motor

- Power Generator

- Transformer

- Others

By Product Type

- High Magnetic Strength Steels

- Conventional

- Domain Refinement

By End-user

- Energy

- Automotive

- Electronics

- Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global grain oriented electrical steel market is expected to grow due to Growing need for efficient transformers and power distribution systems drives demand. Expansion of smart grids and renewable energy infrastructure supports growth.

According to a study, the global grain oriented electrical steel market size was worth around USD 14.78 Billion in 2024 and is expected to reach USD 27.39 Billion by 2034.

The global grain oriented electrical steel market is expected to grow at a CAGR of 5.9% during the forecast period.

Asia-Pacific is expected to dominate the grain oriented electrical steel market over the forecast period.

Leading players in the global grain oriented electrical steel market include JFE Steel Corporation, ArcelorMittal, WISCO (Wuhan Iron and Steel Corporation), POSCO, NLMK (Novolipetsk Steel), Thyssenkrupp, Cogent Power, Nippon Steel Corporation, ATI (Allegheny Technologies Incorporated), Voestalpine, Tata Steel, AK Steel, Baosteel Group Corporation, and others., among others.

The report explores crucial aspects of the grain oriented electrical steel market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed