Global B2B Payments Platform Market Size, Share, Growth Analysis Report - Forecast 2034

B2B Payments Platform Market By Payment Type (Domestic Payments, Cross-Border Payments), By Payment Mode (Bank Transfers, Cards, Digital Wallets, Others), Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), Industry Vertical (BFSI, Manufacturing, IT & Telecom, Metals & Mining, Energy & Utilities, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.81 Billion | USD 18.43 Billion | 14.38% | 2024 |

B2B Payments Platform Market: Industry Perspective

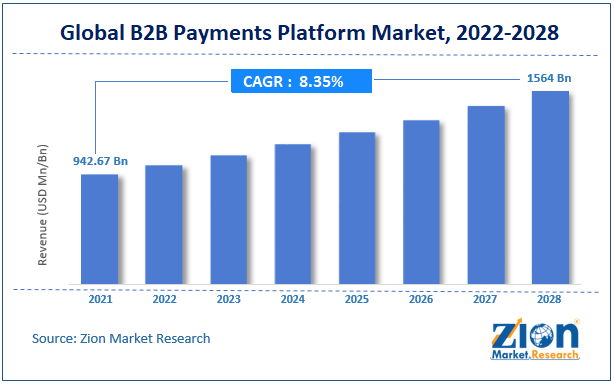

The global B2B payments platform market size was worth around USD 4.81 Billion in 2024 and is predicted to grow to around USD 18.43 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 14.38% between 2025 and 2034.

The report analyzes the global B2B payments platform market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the B2B payments platform industry.

B2B Payments Platform Market: Overview

Business-to-business (B2B) payments refer to the monetary transactions or payments between two organizations for the sales of goods or services. For example, the money-related transactions that would take place between an office and another organization that supplied them with the office equipment. Whenever there is an invoice generated for one company by another, B2B payment systems come into play.

Some of the industries that are the largest consumers of business-to-business payment platforms are; manufacturing covering over 28.8% of the global market share, professional & business service with 21.2% of the share, finance, insurance, leasing, retail, and real estate with 17.8%, mining comprises 5.6% of the market, and wholesale trade covers 5.2% of the global market cap. There are a few key pointers that separate B2B from customer-to-business (C2B) payment models. Some of them include; volume where payments in the B2B model comprise the larger volume of payments as compared to C2B, and frequency of the payment since the frequency is higher in B2B models.

However, deciding on the correct payment model between two organizations for a particular business is not obstacle-free. There are a few questions that organizations struggle to find answers to. Since there are so many payment methods available and each organization has its own requirements, the availability of multiple options like online payments, cryptocurrency, cheques, cash, etc. leads to more confusion.

Key Insights

- As per the analysis shared by our research analyst, the global B2B payments platform market is estimated to grow annually at a CAGR of around 14.38% over the forecast period (2025-2034).

- Regarding revenue, the global B2B payments platform market size was valued at around USD 4.81 Billion in 2024 and is projected to reach USD 18.43 Billion by 2034.

- The B2B payments platform market is projected to grow at a significant rate due to digital transformation of businesses, need for efficient cross-border transactions, increasing adoption of cloud-based payment solutions, and automation in accounts payable/receivable.

- Based on Payment Type, the Domestic Payments segment is expected to lead the global market.

- On the basis of Payment Mode, the Bank Transfers segment is growing at a high rate and will continue to dominate the global market.

- Based on the Enterprise Size, the Small & Medium Enterprises (SMEs) segment is projected to swipe the largest market share.

- By Industry Vertical, the BFSI segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

B2B Payments Platform Market: Growth Drivers

Growth in import and export or trade exchange to propel market growth

The global B2B payments platform market growth may be attributed to the rising transactions taking place between various business models. One of the key aspects that have aided the growth in adoption rate is the increasing international export and import between economies since international trade occurs between organizations that deal with heavy funds. As per the May 2022 report of the US International Trade in Goods & Services, the USA export value was over USD 256 billion.

These numbers are rising owing to the higher demand for goods in the global market assisted by the increasing disposable income of the general population. Some of the other factors that influence the change in export-import value are favorable government policies, the income of the economy, subsidiaries for exporters, import restrictions, etc. There is a growing need for global footprint expansion amongst organizations. This can be achieved with the help of strategic decisions and an increase in trade thus boosting cross-border payments between businesses.

Another factor assisting the rise in B2B payments trends is the exhaustive measures undertaken by small and mid-size firms to increase their profitability index. Multiple tie-ups like outsourcing of information technology (IT) services, HR systems, internet services, and others are a few of the examples that take place between two organizations resulting in global market growth

B2B Payments Platform Market: Restraints

Security concerns related to digital payments may impede the market growth

Data security is a major concern of any organization. Business institutes deal with large sums of money, and they are always under the radar of hackers or security breaches. As per a recent Deloitte study, more than 20% of mid-size companies have faced security breaches at least once. Any transactional platform not only holds data related to money transfers but personal and security details as well. In 2021, payment processors at Amazon and Swiggy faced data breaches where details related to more than 3.5 crore users were compromised. Such concerns are expected to have negative implications on the global market cap unless security systems upgrade so that they can never be compromised.

B2B Payments Platform Market: Opportunities

Time and cost saver benefits of online platforms to provide growth opportunities during the forecast period

In the case of online B2B platforms, repetitive tasks can be avoided thus saving the organization's time and cost since tasks like depositing and reconciling cheques can be completely eliminated. In the case of online transactions, almost all platforms provide timely automated deductions which reduce the risk of faulty payments or missing out deadlines thus saving the company from extra expenses. This provides the employees more time to deal with other critical aspects. In fact, in the case of online payments, data is recorded and kept for safekeeping, unlike offline modes where transaction-related details may get misplaced. These benefits may attract more tech-savvy users to the B2B payments platform during the forecast period

B2B Payments Platform Market: Challenges

Transaction-related fees to challenge global market growth

Many offline and online payment platforms charge companies or account holders for maintenance and transactions completed with the aid of the platform. These extra charges sometimes may not be suitable for small-scale companies who may see this as an extra cost. In case the account maintenance rate is higher, organizations may choose other options to make their payments. There are also certain restrictions related to payment dates like payments raised on bank holidays may take more days for completion which might sometimes not be in the company's favor. These aspects are expected to create challenges for the expansion of the global market size

B2B Payments Platform Market: Segmentation Analysis

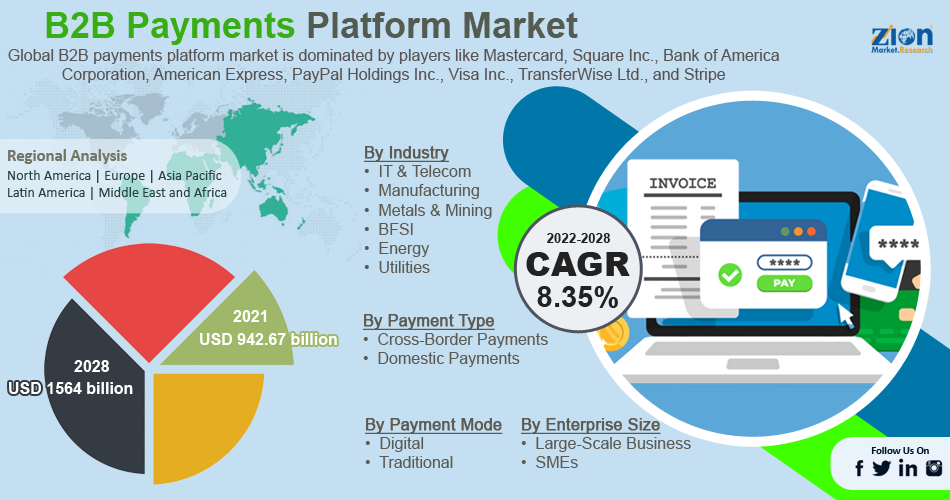

The global B2B payments platform market is segmented based on payment mode, industry, enterprise size, payment type, and region.

Based on payment mode, the global market segments are digital and traditional. The global market is expected to be dominated by digital payment modes since they offer faster transactions, less scope for error, well-organized data, and accurate transaction history. As per official reports, over 71% of businesses prefer digital payments with an increasing number of organizations accepting online transactions.

By industry, the global market is segmented into IT & telecom, manufacturing, metals & mining, BFSI, energy & utilities. Almost all sectors entail at least some form of B2B payments but BFSI leads the global market owing to the heavy transactions conducted under this category.

By enterprise size, large-scale businesses, and SMEs are the two main segments, and the global market is dominated by the large-scale business segment. This can be attributed to the higher adoption rate of B2B trading amongst large-scale organizations especially in international trade in order to expand their global presence. In June 2022, India’s overall export value was around USD 65 billion which is projected to grow further in the coming years.

By payment type, the global market is divided into cross-border payments and domestic payments. Cross-border payments may generate higher revenues since a large sum of money is involved in such payments.

B2B Payments Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | B2B Payments Platform Market |

| Market Size in 2024 | USD 4.81 Billion |

| Market Forecast in 2034 | USD 18.43 Billion |

| Growth Rate | CAGR of 14.38% |

| Number of Pages | 255 |

| Key Companies Covered | PayPal Holdings Inc., Stripe Inc., Square Inc., Adyen N.V., Fiserv Inc., JPMorgan Chase & Co., Mastercard Incorporated, Visa Inc., American Express Company, SAP SE, and others. |

| Segments Covered | By Payment Type, By Payment Mode, By Enterprise Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Development:

- In July 2022, French Fintech Hero, an upcoming B2B payments platform, managed to raise USD 12.49 million within 7 months of its launch. The payment solutions provided are more inclined toward mid-size firms and SMEs. The company aims to create a platform where users can take care of order-to-cash for suppliers and procure-to-pay for clients

- In May 2022, Visa announced that it will explore more opportunities to collaborate with fintech companies in India in order to enhance payment solutions for B2-B suppliers and the entire value chain of corporates. This is regarded as one of the big bets in terms of B2B payments in the corporate and commercial world.

B2B Payments Platform Market: Regional Analysis

North America to lead the global market during the projection period

The global B2B payments platform market is expected to be dominated by North America in the coming years because of increased investment in the field of transaction network security in countries like the USA and Canada. Government spending in the telecom and network industry is expected to boost regional market cap since more companies are being encouraged to adopt technology in as many processes as possible along with advancements towards higher security for online activities like payments.

Asia-Pacific may also register significant growth because of the rise in the number of organizations that deal in B2B trade thus aiding the demand for B2B payments and propelling the global market growth.

B2B Payments Platform Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the B2B payments platform market on a global and regional basis.

The global B2B payments platform market is dominated by players like:

- PayPal Holdings Inc.

- Stripe Inc.

- Square Inc.

- Adyen N.V.

- Fiserv Inc.

- JPMorgan Chase & Co.

- Mastercard Incorporated

- Visa Inc.

- American Express Company

- SAP SE

The global B2B payments platform market is segmented as follows;

By Payment Type

- Domestic Payments

- Cross-Border Payments

By Payment Mode

- Bank Transfers

- Cards

- Digital Wallets

- Others

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- Manufacturing

- IT & Telecom

- Metals & Mining

- Energy & Utilities

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global B2B payments platform market is expected to grow due to digital transformation, demand for faster, secure transactions, and increasing adoption of automation in enterprise payments.

According to a study, the global B2B payments platform market size was worth around USD 4.81 Billion in 2024 and is expected to reach USD 18.43 Billion by 2034.

The global B2B payments platform market is expected to grow at a CAGR of 14.38% during the forecast period.

North America is expected to dominate the B2B payments platform market over the forecast period.

Leading players in the global B2B payments platform market include PayPal Holdings Inc., Stripe Inc., Square Inc., Adyen N.V., Fiserv Inc., JPMorgan Chase & Co., Mastercard Incorporated, Visa Inc., American Express Company, SAP SE, among others.

The report explores crucial aspects of the B2B payments platform market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed