Automotive Hub Bearing Market Size, Share, Trends and Forecast, 2034

Automotive Hub Bearing Market By Type (Gen 1, Gen 2, Gen 3), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (OEM, Aftermarket), By Application (Front Wheel, Rear Wheel), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

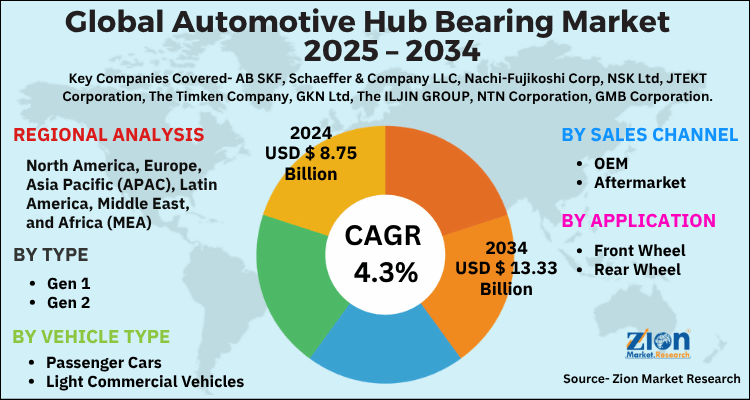

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.75 Billion | USD 13.33 Billion | 4.3% | 2024 |

Automotive Hub Bearing Market: Industry Perspective

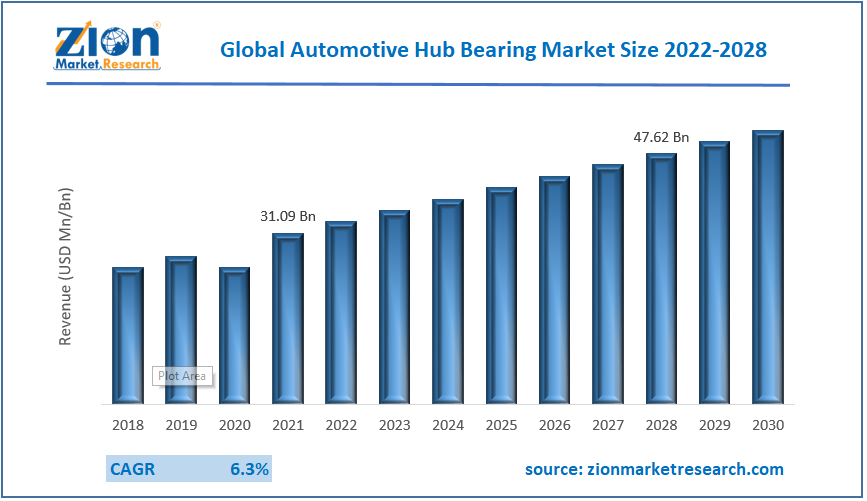

The global Automotive Hub Bearing Market size was worth around USD 8.75 Billion in 2024 and is predicted to grow to around USD 13.33 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.3% between 2025 and 2034. The report analyzes the global automotive hub bearing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive hub bearing industry.

Key Insights

- As per the analysis shared by our research analyst, the global automotive hub bearing market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2025-2034).

- Regarding revenue, the global automotive hub bearing market size was valued at around USD 8.75 Billion in 2024 and is projected to reach USD 13.33 Billion by 2034.

- The automotive hub bearing market is projected to grow at a significant rate due to increasing vehicle production, demand for lightweight and durable components, and growth in electric and connected vehicles.

- Based on Type, the Gen 1 segment is expected to lead the global market.

- On the basis of Vehicle Type, the Passenger Cars segment is growing at a high rate and will continue to dominate the global market.

- Based on the Sales Channel, the OEM segment is projected to swipe the largest market share.

- By Application, the Front Wheel segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Automotive Hub Bearing Market: Outlook

Automotive hub bearing are key components of vehicle braking system, suspension systems, and steering systems. Reportedly, one piece hub assembly situated between drive axle and brake disc encompasses ABS wheel speed sensor, hub, mounting flange, and wheel bearings. Furthermore, it is an automotive part that helps wheel in turning. Moreover, automotive hub bearings are utilized in light commercial vehicles, two wheelers, passenger cars, and heavy commercial vehicles. For the record, automotive hub bearings find slew of applications in transmission tools, wheel hub, engines, and interior of vehicles.

Additionally, automotive hub bearings are mechanical parts used for reducing friction between moving rotating components and aiding rotary parts for achieving a particular kind of motion. These products find massive utilization in vehicles and aviation & defense sectors.

Bearing is a crucial entity in vehicle that supports the two moving object employed in the vehicles. The bearing hubs are mainly used in variety of automotive applications that include wheel hub, interior, engine, and transmission system. Bearing are especially employed to support and basically it reduces the friction between the moving parts of automobile. Therefore, it is one of the important or core entity of automotive industry. Thus, it has wide scope and it is expected to grow at rising CAGR over the forecast period.

Global automotive hub bearing market is mainly driven by increasing demand for vehicles, due to the perpetually growing population across the globe. Secondly, advanced technologies are exercised for automotive industry. New technology helps to provide efficient and comfortable vehicles for the end-users. Therefore, it is expected to drive the market growth over the forecast period. Moreover, increasing cost of raw material used in automotive industry is expected to edge the growth of this industry. Nonetheless, more efficient materials are expected to open new opportunity for the automotive hub bearing industry.

Global Automotive Hub Bearing Market: Growth Drivers

Massive focus on reducing vehicle weight for improving efficiency of automotive will expedite automotive hub bearing industry size growth. In addition to this, there is a lucrative need for automotive hub bearings owing to huge vehicle production & sales, thereby augmenting surge in business expansion. Technological innovations in automotive hub bearings for adding new features to product will open new vistas of growth for automotive hub bearing market. However, oscillating raw material costs can severely impact production & sales of automotive hub rearing, thereby curtailing profits of automotive hub bearing market.

Furthermore, evolution of sensor bearing units and developing of additive manufacturing tools will prop up growth of global automotive hub bearing industry size. Additionally, rise in demand for product across emerging nations will create new growth avenues for automotive hub bearing market. Moreover, rise in commutation of passenger and commercial vehicles on roads has promoted huge demand for manufacture of automotive hub bearings, thereby paving way for progression of automotive hub bearing industry.

The automotive hub bearing market has been segmented into two segments based on technology. These include ball bearing and tapered bearing. The ball bearing segment was the leading segment that leads with over 55% share of market in 2019. As ball bearing can carry and support more load than tapered bearing. Therefore, ball bearing has robust demand and further it is expected to continue this trend throughout the forecast period.

Based on the revenues generated from different application, passenger vehicle application was the dominating segment in 2019. It accounts more than half of the share of the entire market. The ever growing population is a major factor that drives the demand for passenger vehicle. In turn this leads to increase in production of passenger vehicle and further it is also foreseen to remain dominating application segment till 2026. Furthermore, commercial vehicle segment is also augmenting application that will grow with attractive market size during the forecast period.

Europe was the largest market for automotive hub bearing and it accounted for over 25% share of the overall volume consumption in 2019. Asia Pacific is one of the most attractive regions for the market of automotive hub bearing market. Demand for luxury vehicles with advanced safety and comfort features are the major factors fueling demand for automotive hub bearing. In addition, for foreseen period it is expected to have splendid increment for automotive hub bearing especially in Brazil and South Africa region. Moreover, Europe and North America is likely to have moderate market for automotive hub bearing.

Automotive Hub Bearing Market: Segmentation Analysis

The global automotive hub bearing market is segmented based on Type, Vehicle Type, Sales Channel, Application, and region.

Based on Type, the global automotive hub bearing market is divided into Gen 1, Gen 2, Gen 3.

On the basis of Vehicle Type, the global automotive hub bearing market is bifurcated into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles.

By Sales Channel, the global automotive hub bearing market is split into OEM, Aftermarket.

In terms of Application, the global automotive hub bearing market is categorized into Front Wheel, Rear Wheel.

Automotive Hub Bearing Market: Regional Landscape

Asia Pacific Automotive Hub Bearing Market To Register Massive Growth Over 2022-2028

Growth of automotive hub bearing market in Asia Pacific zone in next few years can be credited to rise in manufacture of passenger cars in sub-continent. Apart from this, rise in preference for personal mobility as well as smart mobility has become a major factor of growth for automotive hub bearing industry size in Asia Pacific. Favorable government initiatives in countries such as India and China has enhanced acceptance of electric vehicles in region, thereby increasing product penetration in subcontinent.

Automotive Hub Bearing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Hub Bearing Market |

| Market Size in 2024 | USD 8.75 Billion |

| Market Forecast in 2034 | USD 13.33 Billion |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 110 |

| Key Companies Covered | AB SKF, Schaeffer & Company LLC, Nachi-Fujikoshi Corp, NSK Ltd, JTEKT Corporation, The Timken Company, GKN Ltd, The ILJIN GROUP, NTN Corporation, GMB Corporation, and FKG Bearing Co, Ltd, and others. |

| Segments Covered | By Type, By Vehicle Type, By Sales Channel, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Hub Bearing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the automotive hub bearing market on a global and regional basis.

The global automotive hub bearing market is dominated by players like:

- AB SKF

- Schaeffer & Company LLC

- Nachi-Fujikoshi Corp

- NSK Ltd

- JTEKT Corporation

- The Timken Company

- GKN Ltd

- The ILJIN GROUP

- NTN Corporation

- GMB Corporation

- and FKG Bearing Co Ltd

The global Automotive Hub Bearing Market is segmented as follows:

By Type

- Ball

- Roller

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Application

- Powertrain

- Chassis

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global automotive hub bearing market is expected to grow due to increasing vehicle production, demand for lightweight and durable components, and growth in electric and connected vehicles.

According to a study, the global automotive hub bearing market size was worth around USD 8.75 Billion in 2024 and is expected to reach USD 13.33 Billion by 2034.

The global automotive hub bearing market is expected to grow at a CAGR of 4.3% during the forecast period.

Asia-Pacific is expected to dominate the automotive hub bearing market over the forecast period.

Leading players in the global automotive hub bearing market include AB SKF, Schaeffer & Company LLC, Nachi-Fujikoshi Corp, NSK Ltd, JTEKT Corporation, The Timken Company, GKN Ltd, The ILJIN GROUP, NTN Corporation, GMB Corporation, and FKG Bearing Co, Ltd, among others.

The report explores crucial aspects of the automotive hub bearing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed