Genotyping Assay Market Size, Share, Trends, Growth 2032

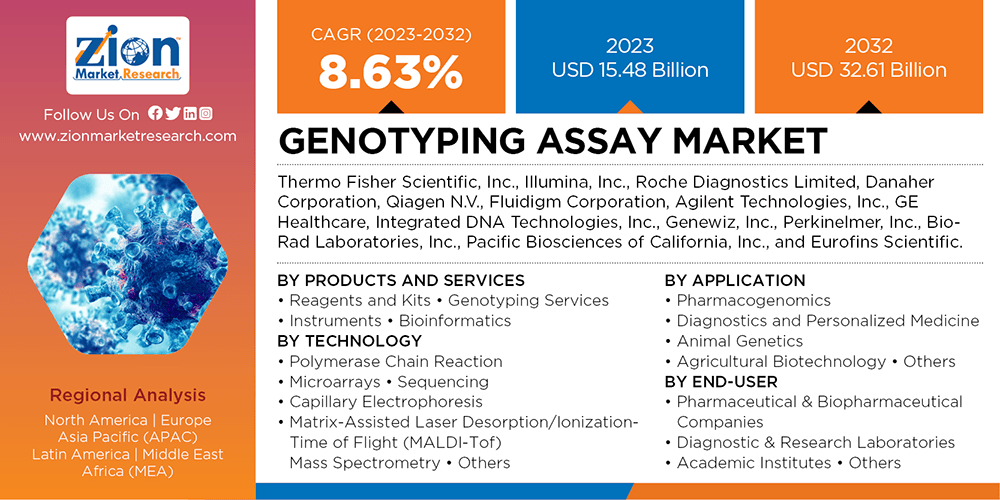

Genotyping Assay Market By Products & Services (Reagents & Kits, Genotyping Services, Instruments, and Bioinformatics), By Technology (PCR, Microarrays, Sequencing, Capillary Electrophoresis, MALDI-Tof MS, and Others), By Application (Pharmacogenomics, Diagnostics & Personalized Medicine, Animal Genetics, Agricultural Biotechnology, and Others), and By End-User (Pharmaceutical & Biopharmaceutical Companies, Diagnostic & Research Laboratories, Academic Institutes, and Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032-

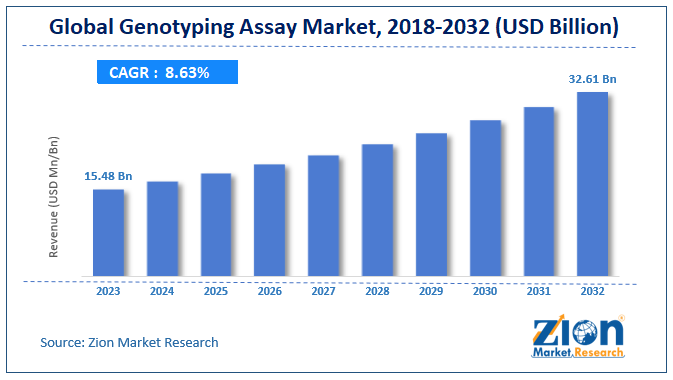

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.48 Billion | USD 32.61 Billion | 8.63% | 2023 |

Genotyping Assay Market: Overview

The global genotyping assay market size was worth around USD 15.48 billion in 2023 and is predicted to grow to around USD 32.61 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.63% between 2024 and 2032.

The report covers a forecast and an analysis of the genotyping assay market on a global and regional level. The study provides historical data from 2018 to 2022 along with forecast from 2024 to 2032 based on revenue (USD Billion).

Genotyping Assay Market: Growth Drivers

Genotyping is a technology used to identify genetic variation in the genomic sequence or allelic genes of an individual by comparing it against the reference sequence. Genotyping helps to explore genetic variants including structural changes in DNA and single nucleotide polymorphism (SNPs).

The increasing prevalence of genetic disorders worldwide, decreasing cost of DNA sequencing, technological advancements in the field of genotyping, and growing use of genotyping for drug development are the major factors contributing toward the genotyping assay market globally. Additionally, the escalating demand for bioinformatics in drug discovery and data analysis, burgeoning popularity of personalized medicine, and increasing awareness about genotyping assay will further propel this market’s growth. Other factors anticipated to fuel the global genotyping assay market are increasing the need for rapid genotyping-based diagnostics tests and the rising number of increasing plant and animal genotyping research activities.

However, the high cost of equipment used in genotyping assays may hamper the market growth in the future. Growing genotyping and sequencing research and development activities and massive demand for plant and animal genome analysis is to generate new growth opportunities for the genotyping assay market over the upcoming years.

The study includes drivers and restraints of the genotyping assay market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the genotyping assay market on a global and regional level.

In order to give the users of this report a comprehensive view of the genotyping assay market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the genotyping assay market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research& development, regional expansion of major participants involved in the genotyping assay market on a global and regional basis.

Genotyping Assay Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Genotyping Assay Market Research Report |

| Market Size in 2023 | USD 15.48 Billion |

| Market Forecast in 2032 | USD 32.61 Billion |

| Growth Rate | CAGR of 8.63% |

| Number of Pages | 215 |

| Key Companies Covered | Thermo Fisher Scientific, Inc., Illumina, Inc., Roche Diagnostics Limited, Danaher Corporation, Qiagen N.V., Fluidigm Corporation, Agilent Technologies, Inc., GE Healthcare, Integrated DNA Technologies, Inc., Genewiz, Inc., Perkinelmer, Inc., Bio-Rad Laboratories, Inc., Pacific Biosciences of California, Inc., and Eurofins Scientific. |

| Segments Covered | By By Products and Services, By Application, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Genotyping Assay Market: Segmentation

The study provides a decisive view of the genotyping assay market by segmenting it based on products and services, technology, application, end-user, and region.

Based on products and services, the market is segmented into genotyping services, reagents and kits, instruments and bioinformatics. Instruments are further segmented into sequencers and amplifiers and analyzers. Bioinformatics segment includes software and services.

By technology, the market is segmented into microarrays, polymerase chain reaction (PCR), sequencing, capillary electrophoresis, matrix-assisted laser desorption/ionization-time of flight (MALDI-Tof) mass spectrometry, and others. Polymerase chain reaction (PCR) is further segmented into real-time PCR and digital PCR. Sequencing segment is further split into next-generation sequencing, pyrosequencing and Sanger sequencing. Capillary electrophoresis technology segment is further split into amplified fragment length polymorphism (AFLP), restriction fragment length polymorphism (RFLP), and single-strand conformation polymorphism.

Based on application, the market is split into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and others. Pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and others form the end-user segment of the market.

Genotyping Assay Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further divided into major countries including the U.S., Canada, Germany, France, UK, China, Japan, India, and Brazil.

North America led the global genotyping assay market in terms of revenue, with about 40% share, in 2018. Growing incidences of genetic disorders, technological advancements, the presence of major players, increasing the need for personalized medicines, and decreasing costs of DNA sequencing are some factors driving the North American genotyping assay market. The second largest region in the global genotyping assay market in 2018 was Europe, due to increasing investments made by private and public companies and the presence of robust healthcare infrastructure.

The Asia Pacific genotyping assay market is estimated to show the highest CAGR over the forecast time period, owing to the flourishing pharmaceutical and biopharmaceutical industry, increasing geriatric population, rising health awareness, and growing research and development activities in developing nations, such as China, India etc.

Genotyping Assay Market: Competitive Analysis

Some of the strong players operating in the global genotyping assay market are:

- Thermo Fisher Scientific, Inc

- Illumina, Inc

- Roche Diagnostics Limited

- Danaher Corporation

- Qiagen N.V.

- Fluidigm Corporation

- Agilent Technologies, Inc

- GE Healthcare

- Integrated DNA Technologies, Inc

- Genewiz, Inc

- Perkinelmer, Inc

- Bio-Rad Laboratories, Inc

- Pacific Biosciences of California, Inc

- Eurofins Scientific

This report segments the global genotyping assay market into:

Global Genotyping Assay Market: By Products and Services

- Reagents and Kits

- Genotyping Services

- Instruments

- Sequencers and Amplifiers

- Analyzers

- Bioinformatics

- Software

- Services

Global Genotyping Assay Market: By Technology

- Polymerase Chain Reaction

- Real-Time PCR

- Digital PCR

- Microarrays

- Sequencing

- Next-Generation Sequencing

- Pyrosequencing

- Sanger Sequencing

- Capillary Electrophoresis

- Amplified Fragment Length Polymorphism

- Restriction Fragment Length Polymorphism

- Single-Strand Conformation Polymorphism

- Matrix-Assisted Laser Desorption/Ionization-Time of Flight (MALDI-Tof) Mass Spectrometry

- Others

Global Genotyping Assay Market: By Application

- Pharmacogenomics

- Diagnostics and Personalized Medicine

- Animal Genetics

- Agricultural Biotechnology

- Others

Global Genotyping Assay Market: By End-User

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic & Research Laboratories

- Academic Institutes

- Others

Global Genotyping Assay Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A genotyping assay is a laboratory procedure utilized to ascertain the genotype, or genetic composition, of a given individual or cohort. Typically, this procedure entails the examination of particular DNA sequences or genetic variations, including but not limited to single nucleotide polymorphisms (SNPs), insertions, deletions, or structural deviations within the DNA.

Market expansion is propelled by ongoing developments in genomic technologies, including but not limited to next-generation sequencing (NGS), microarray analysis, and digital PCR, which facilitate genotyping assays that are more rapid, precise, and economically viable.

The global genotyping assay market size was worth around USD 15.48 billion in 2023 and is predicted to grow to around USD 32.61 billion by 2032.

The global genotyping assay market with a compound annual growth rate (CAGR) of roughly 8.63% between 2024 and 2032.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further divided into major countries including the U.S., Canada, Germany, France, UK, China, Japan, India, and Brazil.

Some key players of the global genotyping assay market include Thermo Fisher Scientific, Inc., Illumina, Inc., Roche Diagnostics Limited, Danaher Corporation, Qiagen N.V., Fluidigm Corporation, Agilent Technologies, Inc., GE Healthcare, Integrated DNA Technologies, Inc., Genewiz, Inc., Perkinelmer, Inc., Bio-Rad Laboratories, Inc., Pacific Biosciences of California, Inc., and Eurofins Scientific.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed