Gas Mixers Market Size, Growth, Global Trends, Forecast 2034

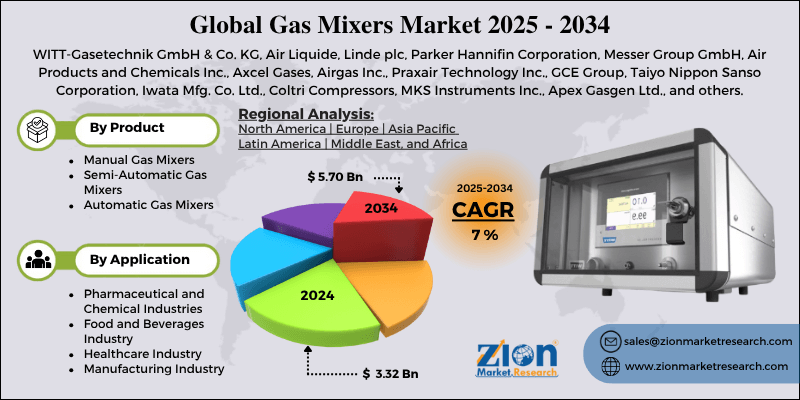

Gas Mixers Market By Product (Manual Gas Mixers, Semi-Automatic Gas Mixers, Automatic Gas Mixers), By Application (Pharmaceutical and Chemical Industries, Food and Beverages Industry, Healthcare Industry, Manufacturing Industry, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

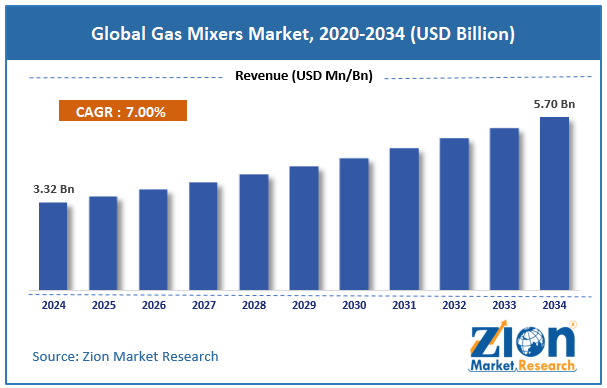

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.32 Billion | USD 5.70 Billion | 7.0% | 2024 |

Gas Mixers Industry Perspective:

The global gas mixers market size was worth around USD 3.32 billion in 2024 and is predicted to grow to around USD 5.70 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global gas mixers market is estimated to grow annually at a CAGR of around 7% over the forecast period (2025-2034)

- In terms of revenue, the global gas mixers market size was valued at around USD 3.32 billion in 2024 and is projected to reach USD 5.70 billion by 2034.

- The gas mixers market is projected to grow significantly due to the expansion of the healthcare and medical gas supply sector, increasing use in chemical and pharmaceutical manufacturing, and technological advancements in gas mixing and control systems.

- Based on product, the automatic gas mixers segment is expected to lead the market, while the semi-automatic gas mixers segment is expected to grow considerably.

- Based on application, the healthcare industry segment is the dominating segment, while the pharmaceutical and chemical industries segment is projected to witness sizeable revenue over the forecast period.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Gas Mixers Market: Overview

Gas mixers are precision devices, specially designed to blend two or more gases in controlled, accurate proportions for medical, industrial, and laboratory applications. They assure consistent gas quality, improve safety, and enhance process efficiency by removing manual gas mixing inaccuracies. The global gas mixers market is likely to expand rapidly, driven by increasing demand in healthcare applications, the growth of industrial manufacturing processes, and food & beverage processing. Gas mixers play a key role in medical fields like respiratory care, anesthesia delivery, and incubator systems. The rising cases of surgical procedures and chronic respiratory diseases augment the demand for reliable medical gas supply systems. Hospitals prefer automated gas mixers for accurate oxygen-nitrous oxide and oxygen-air blending to improve patient safety.

Moreover, industries like chemical processing, glass manufacturing, and metal fabrication majorly depend on controlled gas mixtures. Gas mixers assure welding efficiency and optimal combustion by maintaining the right hydrogen, oxygen, and nitrogen ratios. The rising adoption of advanced welding solutions worldwide is fueling the market growth. Furthermore, modified atmosphere packaging in the food industry uses gas mixers to increase shelf life and maintain product freshness. Growing worldwide demand for packaged and processed foods has resulted in the rise in carbon dioxide and nitrogen-based gas mixing solutions. This trend is majorly strong in the developing economies with progressing retail sectors.

Despite the growth, the global market is impeded by factors such as high initial investment costs and complex calibration and maintenance needs. Advanced gas mixing systems with monitoring and automation technologies need significant capital. Medium and small-sized businesses usually hesitate to invest because of budget constraints. This slows industry penetration in cost-sensitive regions.

Likewise, gas mixers need regular calibration and maintenance for the best accuracy. Improper handling or infrequent servicing may result in performance deviations. This technical complexity restricts adoption among users lacking expertise. Nonetheless, the global gas mixers industry stands to gain from a few key opportunities, like the growing adoption of IoT-enabled mixers and the rising focus on green technologies and renewable energy. The move towards Industry 4.0 is boosting the adoption of IoT-based monitoring systems. Smart mixers can predict maintenance needs and optimize performance through real-time analytics. This advancement opens fresh growth prospects for manufacturers.

Additionally, gas mixers are vital in hydrogen fuel cells, carbon capture systems, and biogas upgrading. The worldwide push for sustainable energy creates new application areas. Government incentives for green solutions further boost adoption.

Gas Mixers Market Dynamics

Growth Drivers

How are expanding industrial gas applications in manufacturing and metal processing fueling the gas mixers market?

Industries like chemical processing, automotive manufacturing, and metallurgy depend on gas mixers for precise blending of nitrogen, hydrogen, and argon. In 2024, the World Steel Association reported a 1.8% rise in worldwide steel production, driving the use of controlled gas mixtures for heat and welding treatment. Gas mixers enhance combustion quality and fuel efficiency, reducing emissions and operational costs. Companies like Messer Group and Linde plc are expanding their portfolios with sensor-based and smart mixers, as the industrial gas segment is expected to contribute nearly 35% of the overall industry revenue by 2028.

How is automation in gas mixing systems and technological improvements driving the gas mixers market?

The incorporation of IoT-based monitoring, automated calibration, and AI-driven controls is transforming the gas mixers market. Modern systems offer real-time adjustments and accurate control, reducing human error and enhancing process efficiency. Companies like WITT and Air Products are investing in cloud-connected mixers with predictive maintenance, promoting broader adoption in high-tech industries like energy, semiconductor, and biotechnology.

Restraints

Dependence on a stable energy supply hinders market progress

Several gas mixing systems, especially automated and digital ones, largely depend on a continuous supply of compressed gas and electricity. Power interruptions or pressure variations may disturb gas blending, impacting product safety and quality. For instance, APAC manufacturing industries experienced over 120 hours of downtime in 2024 due to regional power variabilities, which affected gas mixer expenditure. This reliance on energy reliability constrains the adoption of renewable energy in developing economies with poor gas or electricity infrastructure.

Opportunities

How does the adoption in the food & beverage and pharmaceutical industries present favorable prospects for the gas mixers industry expansion?

Modified atmosphere packaging and controlled gas environments in beverage, food, and pharmaceutical production are primarily dependent on gas mixers. In 2024, the worldwide MAP industry experienced a growth rate of 28% Year-on-Year, underscoring the growing demand for quality-preserving solutions. Pharmaceutical companies need precise oxygen-nitrogen blends for manufacturing and laboratory processes. Companies like WITT and Praxair are offering cost-effective and small-scale mixers for these domains. Growing applications in storage, packaging, and lab operations continue to fuel opportunities in the gas mixers industry.

Challenges

Competition from conventional gas blending methods limits the market progress

Fixed-ratio regulators, manual gas blending, and other simpler systems continue to dominate in cost-sensitive regions. A 2024 survey found that nearly 35% of small-scale industries still use non-automated techniques because of low upfront costs. Convincing these users to move to automated or digital mixers requires substantial education, cost justification, and incentives. This competitive presence of conventional systems slows the penetration of advanced gas mixers in the developing regions.

Gas Mixers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gas Mixers Market |

| Market Size in 2024 | USD 3.32 Billion |

| Market Forecast in 2034 | USD 5.70 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 215 |

| Key Companies Covered | WITT-Gasetechnik GmbH & Co. KG, Air Liquide, Linde plc, Parker Hannifin Corporation, Messer Group GmbH, Air Products and Chemicals Inc., Axcel Gases, Airgas Inc., Praxair Technology Inc., GCE Group, Taiyo Nippon Sanso Corporation, Iwata Mfg. Co. Ltd., Coltri Compressors, MKS Instruments Inc., Apex Gasgen Ltd., and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gas Mixers Market: Segmentation

The global gas mixers market is segmented based on product, application, and region.

Based on product, the global gas mixers industry is divided into manual gas mixers, semi-automatic gas mixers, and automatic gas mixers. The automatic gas mixers segment dominates the worldwide market due to their better precision, integration with advanced control technologies, and efficiency. They automatically adjust gas ratios with mass flow controllers and digital sensors, reducing human error and promising reliable quality. The rising automation trends and strict safety norms fuel their broader use in semiconductor, healthcare, and chemical industries.

On the other hand, the semi-automatic gas mixers segment held a second rank since they offer a balance between affordability and automation. These mixers provide partial digital control with manual adjustments, making them suitable for mid-scale manufacturing and laboratory setups. Their prominence is growing in the developing regions where industries are steadily transitioning to automatic systems.

Based on application, the global gas mixers market is segmented into pharmaceutical and chemical industries, food and beverages industry, healthcare industry, manufacturing industry, and others. The healthcare industry holds a dominating share of the market because of the crucial need for precise medical gas delivery. Gas mixers are extensively used in respiratory therapy, incubators, and anesthesia to assure patient safety and treatment precision. Growing healthcare infrastructure, mounting surgical procedures, and chronic respiratory diseases fuel continuous demand for reliable and automated gas mixing systems.

Conversely, the pharmaceutical and chemical industries segment holds a second-leading position in the market since it majorly depends on gas mixers for fermentation, controlled reactions, and laboratory processes. Accurate gas blending promises product quality, compliance with strict industry norms, and consistency. Rising investments in biotech research, pharmaceuticals, and chemical manufacturing in the developing economies support the steady growth of the segment.

Gas Mixers Market: Regional Analysis

What gives Europe a competitive edge in the global Gas Mixers Market?

Europe is anticipated to retain its leading role in the global gas mixers market due to strong healthcare infrastructure, well-developed chemical and pharmaceutical industries, and high adoption of smart technologies and automation. Europe leads the worldwide market because of its advanced healthcare infrastructure, comprising a high number of hospitals and specialized medical facilities. Automated gas mixers are widely used in anesthesia delivery, neonatal incubators, and respiratory care to enhance patient safety.

The region also houses the leading chemical and pharmaceutical companies, creating continuous demand for precise gas mixing systems. Gas mixers are vital for fermentation, controlled chemical reactions, and laboratory research. The region accounts for nearly 30% of the global gas mixer consumption in chemical and pharma applications, underscoring its industry dominance.

Moreover, European industries prioritize digital monitoring, automation, and Industry 4.0 integration, driving the demand for semi-automatic and automatic gas mixers. Companies prefer IoT-enabled mixers for real-time monitoring and predictive maintenance.

Asia Pacific ranks as the second-leading region in the global gas mixers industry due to rapid industrialization, manufacturing growth, advancing healthcare infrastructure, and the expansion of chemical and pharmaceutical industries. APAC registers a considerable share of the market after Europe because of speedy industrialization in economies like Japan, China, and India. Growing manufacturing industries like electronics, chemical processing, and metal fabrication need precise gas blending for quality and efficiency.

According to the reports, the region registers for nearly 30% of the worldwide gas mixer demand in industrial applications. The growing number of clinics, hospitals, and surgical centers in APAC fuels the demand for medical gas mixers. Semi-automatic and automatic gas mixers are progressively used in respiratory therapy, neonatal care, and anesthesia. The healthcare domain in APAC is anticipated to progress at an 8% CAGR, majorly adding to the regional gas mixer adoption.

Additionally, APAC's chemical and pharmaceutical sectors are speedily growing, impacted by biotechnology, chemical production, and generics. Gas mixers are vital for controlled reactions, laboratory processes, and fermentation. The region now accounts for nearly 25% of the global gas mixer usage in chemical and pharma applications, indicating strong industrial adoption.

Gas Mixers Market: Competitive Analysis

The leading players in the global gas mixers market are:

- WITT-Gasetechnik GmbH & Co. KG

- Air Liquide

- Linde plc

- Parker Hannifin Corporation

- Messer Group GmbH

- Air Products and Chemicals Inc.

- Axcel Gases

- Airgas Inc.

- Praxair Technology Inc.

- GCE Group

- Taiyo Nippon Sanso Corporation

- Iwata Mfg. Co. Ltd.

- Coltri Compressors

- MKS Instruments Inc.

- Apex Gasgen Ltd.

Gas Mixers Market: Key Market Trends

Demand for customizable and modular systems:

End-users are seeking gas mixers that can be modified for specific gas composition and easily integrated into current setups. Modular designs allow flexibility and scalability in multiple applications. This trend is fueling innovations among manufacturers to offer tailored solutions for different industrial needs.

Integration with digitalization and Industry 4.0:

Gas mixers are being incorporated into smart factory ecosystems with cloud-based monitoring and digital sensors. This enables remote control, optimization of gas use, and data analytics. Companies are leveraging these digital solutions to enhance compliance with safety regulations and operational efficiency.

The global gas mixers market is segmented as follows:

By Product

- Manual Gas Mixers

- Semi-Automatic Gas Mixers

- Automatic Gas Mixers

By Application

- Pharmaceutical and Chemical Industries

- Food and Beverages Industry

- Healthcare Industry

- Manufacturing Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Gas mixers are precision devices, specially designed to blend two or more gases in controlled, accurate proportions for medical, industrial, and laboratory applications. They assure consistent gas quality, improve safety, and enhance process efficiency by removing manual gas mixing inaccuracies.

The global gas mixers market is projected to grow due to the surging demand for precision gas blending in industrial applications, the rise of the semiconductor and electronics manufacturing industry, and the increasing automation and digitalization in gas supply systems.

According to study, the global gas mixers market size was worth around USD 3.32 billion in 2024 and is predicted to grow to around USD 5.70 billion by 2034.

The CAGR value of the gas mixers market is expected to be around 7% during 2025-2034.

The gas mixers market is shaped by smart sensors, IoT-enabled automation, predictive maintenance, modular designs, and integration with Industry 4.0 systems.

Europe is expected to lead the global gas mixers market during the forecast period.

The key players profiled in the global gas mixers market include WITT-Gasetechnik GmbH & Co. KG, Air Liquide, Linde plc, Parker Hannifin Corporation, Messer Group GmbH, Air Products and Chemicals, Inc., Axcel Gases, Airgas, Inc., Praxair Technology, Inc., GCE Group, Taiyo Nippon Sanso Corporation, Iwata Mfg. Co., Ltd., Coltri Compressors, MKS Instruments, Inc., and Apex Gasgen Ltd.

Stakeholders should focus on product customization, technological innovation, digital integration, strategic partnerships, and expansion into emerging markets to stay competitive.

Pricing trends in the gas mixers market show a shift toward premium pricing for smart and automated systems. At the same time, cost-effective options remain for the developing regions and small-scale applications.

The report examines key aspects of the gas mixers market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed