Medical Gas Market Size Report, Industry Share, Analysis, Growth 2032

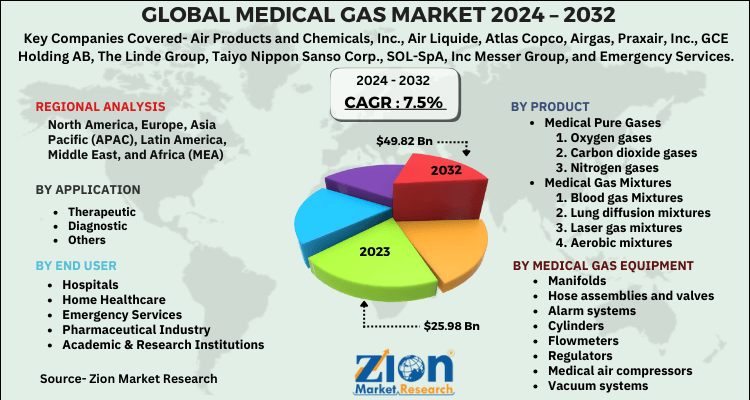

Medical Gas Market By Product (Medical Gases, Medical Pure Gases, Oxygen Gases, Carbon Dioxide Gases, Nitrogen Gases, , Helium Gases, Medical Gas Mixtures, Blood Gas Mixtures, Carbon Dioxide-Oxygen Mixtures, Laser Gas Mixture, Aerobic Mixture, Ethylene Oxide, Helium Oxygen Mixtures), By Medical Gas Equipment (Manifolds, Outlets, Hose Assemblies And Valves, Alarm Systems, Cylinders, Flowmeters, Regulators, Medical Air Compressors, Vacuum Systems, Masks), By Application (Therapeutic, Diagnostic, Others), By End User (Hospitals, Home Healthcare, Emergency Services, Pharmaceutical Industry, Academic & Research Institutions), And By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.98 Billion | USD 49.82 Billion | 7.5% | 2023 |

Global Medical Gas Market Insights

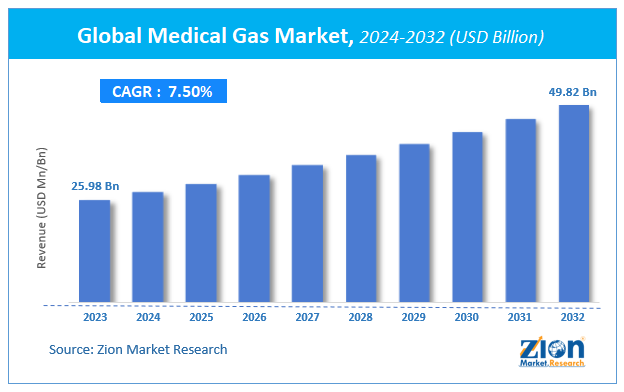

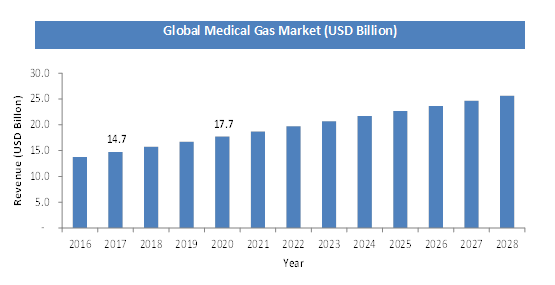

Zion Market Research has published a report on the global Medical Gas Market, estimating its value at USD 25.98 Billion in 2023, with projections indicating that it will reach USD 49.82 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.5% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Medical Gas Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Medical Gas Market Overview

Rising incidence of chronic diseases, a growing number of industry-friendly safety initiatives undertaken by the government, implementation of the U.S. FDA safety and innovation act, growing base of geriatric population, and increasing demand for home healthcare and point of care products are a number of the main factors propelling the expansion of the medical gases market. Medical gases are labeled as medical products and subsequently, the related equipment is termed as medical devices.

They're frequently employed by healthcare professionals for diagnostic and treatment purposes. Additionally, it's varied usage in the pharmaceutical and biotechnology industry, such as pharmaceutical manufacturing, cell culture studies, and drug discovery and development.

Medical gas systems in hospitals are, in a word, lifesaving. These assemblies supply piped oxygen, nitrous oxide, nitrogen, carbon dioxide, and medical air to hospital areas such as patient rooms, recovery areas, operating rooms, and more. In hospitals, there are computerized alarm systems to monitor gas flow and alert hospital staff to any abnormalities. Medical gases are disposed of via vacuum equipment, generally supplied by various vacuum pump systems that exhaust to the atmosphere. It is necessary to establish a monitoring system to maintain a stable supply of medical gases.

Medical Air can be referred to as a clean supply of compressed air which is used in hospitals and healthcare facilities to distribute medical gas. As it is free from contamination and particles, has no oil or odors, and is dry to prevent water buildup in your facility's pipeline. Many surgeons rely on the medical air compressor to keep the patient comfortable and breathing.

Enhancing home healthcare market is major drivers of Medical Gas Market. Additionally, increasing prevalence of respiratory diseases, the high prevalence of tobacco smoking, rising aging population and rapid urbanization are some of the other driver factors. According to World Health Organization (WHO), around 235 million people are suffering from asthma, and 383,000 deaths caused in 2015.

The strongest risk factors for causing asthma are a combination of genetic tendency and environmental exposure to inhaled substances & particles which may provoke allergic reactions or irritate the airways. Substances including allergens like house dust mites in bedding, carpets and stuffed furniture, pollution and pet dander, pollens and molds, tobacco smoke, chemical irritants in the workplace and air pollution.

In addition to enhancing home healthcare market, changing eating habits and execution of the U.S. Food and Drug Administration (FDA) Safety and Innovation Act leads to increased demand for the medical gas market. However, changes in medical gas calibration standards may restrain the market growth. Also, a worldwide shortage of helium and declining reimbursements policies for respiratory therapies may restrain the medical gas market. However, technological advancement in the medical gas market and market expansion strategy adopted by emerging countries creating opportunities in the medical gas market in the coming years.

The Medical Gas Market is classified based on product, medical gas equipment, application, end user, and region. On the basis of product, the market is divided medical pure gases and medical gas mixtures. Medical pure gases are further classified into nitrogen gas, medical air, carbon dioxide gas, helium gas, nitrous oxide gas and oxygen gas. Medical gas mixtures are further classified into blood gas mixtures, lung diffusion mixtures, nitrous oxide-oxygen mixtures, carbon dioxide-oxygen mixtures,laser gas mixtures, aerobic mixtures, anaerobic mixtures, ethylene oxide, helium oxygen mixtures.

Medical pure gases segment accounted for the largest share of the medical gases market. This is a major reason for the increasing use of medical gases for the diagnosis and treatment of various respiratory diseases. The growing incidences of chronic obstructive pulmonary disease (COPD), asthma, and other medical conditions such as cardiovascular and lifestyle diseases are further expected to drive the demand of medical gases and equipment during the forecast period.

Growth Factors

The increasing geriatric population vulnerable to chronic conditions is additionally expected to spice up demand for technologically advanced equipment that aid in the management and treatment of varied such conditions. Adulthood heightens the necessity for healthcare by making individuals more vulnerable to diseases especially concerning the respiratory system thus triggering patient hospitalization rates. Statistics suggest that 55% to 60% of patients admitted to hospitals are administered with medical gases. Thus, with a rise in the geriatric population globally, the demand for medical gases is expected to rise considerably.

Medical Gas Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Gas Market |

| Market Size in 2023 | USD 25.98 Billion |

| Market Forecast in 2032 | USD 49.82 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 155 |

| Key Companies Covered | Air Products and Chemicals, Inc., Air Liquide, Atlas Copco, Airgas, Praxair, Inc., GCE Holding AB, The Linde Group, Taiyo Nippon Sanso Corp., SOL-SpA, Inc Messer Group, and Emergency Services. |

| Segments Covered | By Product, By Medical Gas Equipment, By Application, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Medical Gas Market: Segmentation

Product Segment Analysis Preview

Based on type, the lung diffusion mixtures segment accounted for the largest share of the medical gas mixtures market in 2020. This can be attributed to the increase in the number of chronic diseases, the high proportion of untreated patients, and the rising aging population.

Application Segment Analysis Preview

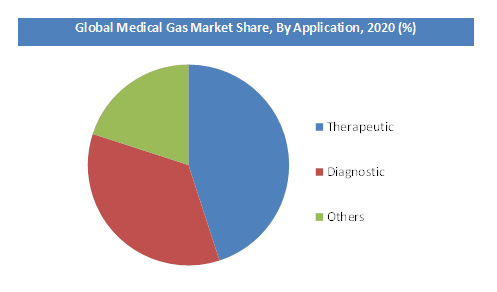

Based on applications, the therapeutic applications segment accounted for the highest share of the medical gases and equipment market in 2020. This is due to the high prevalence of cardiovascular diseases and respiratory, which has resulted in increased consumption of medical gases and equipment.

End-User Segment Analysis Preview

Based on end-users, the hospital's segment accounted for the largest share of the medical gases and equipment market in 2023. This is mainly due to the high consumption of medical gases and equipment by hospitals due to the large patient pool during this COVID-19 pandemic.

Equipment Segment Analysis Preview

The pure gases in high-pressure cylinders are expected to dominate the market in the coming years. This is owing to the widespread use of these devices in home healthcare setups and hospitals. Many of the major players in the medical gases and equipment market also offer products in high-pressure cylinders.

Regional Analysis Preview

Regionally, North America is dominated to carry the most important market size within the medical gases and equipment market during the forecast period, followed by the European region. On the opposite hand, the Asia Pacific market is dominated to witness the very best growth during the forecast period. The rapid climb within the developing healthcare industry across China and India is dominated to supply significant growth opportunities for players operating during this market during the forecast period.

On the basis of medical gas equipment market is segmented as manifolds, alarm systems, outlets, hose assemblies and valves, cylinders, regulators, flowmeters, medical air compressors, vacuum systems, masks. On the basis of the application, the market is divided into therapeutic, diagnostic and pharmaceutical manufacturing & research. On the basis of the end, user market is divided into hospitals, emergency services, the pharmaceutical industry, home health care and academic & research institutions.

By geography, North America dominates the medical gas market owing to the growing elderly population base and the rising prevalence of chronic diseases is expected to propel the sector growth in the region. In addition to growing elderly population base and the rising prevalence of chronic diseases, improved access to healthcare infrastructure, escalating demand for minimally invasive medical interventions and favorable industry initiatives such as the implementation of U.S. FDA Safety and Innovation Act will drive business growth. Owing to large population base countries such as India and china in the Asia Pacific region medical gas market is growing at fastest growth rate. Latin America is another key regional market and is expected to moderate growth in the coming years owing to rising healthcare infrastructure and raising awareness among the people. The Middle East and Africa are anticipated to witness significant growth during the forecast period.

Key Market Players & Competitive Landscape

Some of the key players in Medical Gas Market include Air Products and Chemicals, Inc., Air Liquide, Atlas Copco, Airgas, Praxair, Inc., GCE Holding AB, The Linde Group, Taiyo Nippon Sanso Corp., SOL-SpA, Inc Messer Group, and others.

Some of the major players in Medical Gas market are: -

- Air Products and Chemicals Inc

- Air Liquide

- Atlas Copco

- Airgas

- Praxair Inc

- GCE Holding AB

- The Linde Group

The global Medical Gas market is segmented as follows:

By Product

- Medical Pure Gases

- Oxygen gases

- Carbon dioxide gases

- Nitrogen gases

- Nitrous oxide gases

- Medical air gases

- Helium gases

- Medical Gas Mixtures

- Blood gas Mixtures

- Lung diffusion mixtures

- Nitrous oxide-oxygen mixtures

- Carbon dioxide-oxygen mixtures

- Laser gas mixtures

- Aerobic mixtures

- Anaerobic Mixtures

- Ethylene oxide

- Helium-oxygen mixtures

By Medical Gas Equipment

- Manifolds

- Outlets

- Hose assemblies and valves

- Alarm systems

- Cylinders

- Flowmeters

- Regulators

- Medical air compressors

- Vacuum systems

- Masks

By Application

- Therapeutic

- Diagnostic

- Others

By End User

- Hospitals

- Home Healthcare

- Emergency Services

- Pharmaceutical Industry

- Academic & Research Institutions

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Medical Gas market was valued at USD 25.98 Billion in 2023.

The global Medical Gas market is expected to reach USD 49.82 Billion by 2032, growing at a CAGR of 7.5% between 2024 to 2032.

The increasing geriatric population susceptible to chronic conditions is also expected to boost demand for technologically advanced equipment that aid in the management and treatment of various such conditions.

Regionally, North America has been leading the worldwide Medical Gas market and is anticipated to continue in the dominant position in the years to come.

Some of the major players in Medical Gas market are Air Products and Chemicals, Inc., Air Liquide, Atlas Copco, Airgas, Praxair, Inc., GCE Holding AB, The Linde Group, Taiyo Nippon Sanso Corp., SOL-SpA, Inc Messer Group, and Emergency Services.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed