Gas Meter Market Trend, Share, Growth, Size and Forecast 2032

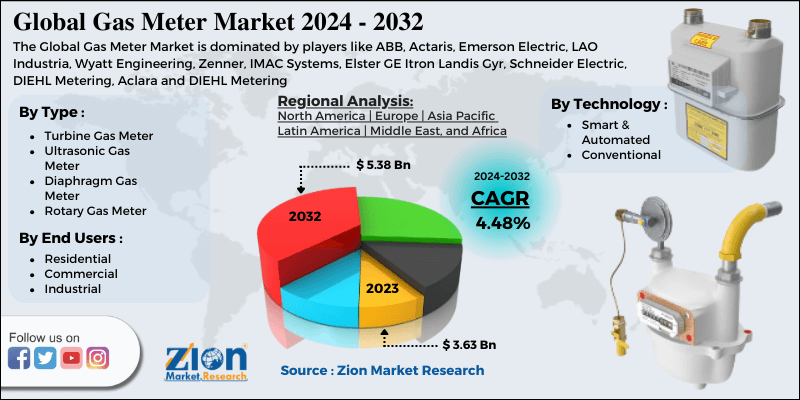

Gas Meter Market By Type (Turbine Gas Meter, Ultrasonic Gas Meter, Diaphragm Gas Meter, and Rotary gas meter), By Technology (Smart & Automated, and Conventional), By End Users (Residential, Commercial, Industrial): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

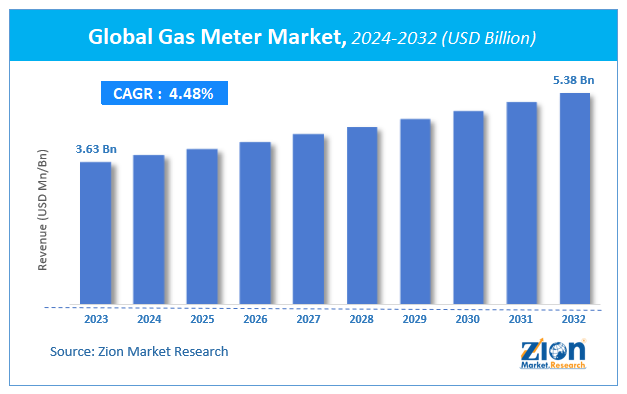

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.63 Billion | USD 5.38 Billion | 4.48% | 2023 |

Gas Meter Market Size

According to Zion Market Research, the global Gas Meter Market was worth USD 3.63 Billion in 2023. The market is forecast to reach USD 5.38 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.48% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Gas Meter Market industry over the next decade.

Gas Meter Market Overview

A gas meter is a device used to measure the volume of gas consumed by residential, commercial, or industrial users. It helps track usage for billing purposes and ensures proper monitoring of gas flow in supply systems.

Global Gas meters market is the devices that measure and record the quantity of gas produced or consumed, regardless of the quality of the gas or pressurized quantity flowing. These meters are essential for ensuring adequate gas pressure from the main supply, keeping track of the usage of gas, and providing accurate bills.

In addition to measuring the definite amount of gas utilized, a gas meter must also be efficient in detecting abnormal conditions and to shut off the gas supply to prevent gas leakage. A gas meter is a specific flow meter utilized to measure the amount of fuel gases such as liquefied petroleum gas and natural gas.

Gas contracts and expands due to heat. Bills are based on a temperature of 15°C. So those meter outside contains profit as compared to those with meter inside. The volume of gas absorbed in cubic meters (m^3) or cubic feet (ft?^3) or still consumers are billed in kilowatt-hours (kWh). The quality of the gas flowing through the meter or pressurized quantity is measured by a described volume by gas meters.

COVID-19 Impact Analysis:

COVID-19 has impacted businesses across the globe. The imposed lockdown and spread of the contagious virus have slowed down the operations in various industries including chemical, metallurgy, Industrial, Mechanical, and many more. Measures such as restriction and lockdown across the globe, have been explicit and unprecedented.

It has further disrupted supply chains, delayed projects in Industrial, and created labor shortages in the plants. The energy industry across the globe is delayed due to the ongoing project due to the slowdown of manufacturing. These factors are likely to hamper the growth of the market in 2020.

Gas Meter Market: Growth Factors

Major driving factors for the growth of the gas meter market are increasing demand for smart equipment to observe the supply of fuel in the energy industry and industry members are investing deeply in R&D drive.

High installation expenses for end users could be restraining factors for the growth of the gas meter market. Growing energy demand and environmental concerns have resulted in a change toward natural gas expenditure owing to its natural characteristics.

The global gas meter market offers new growth opportunities, due to R&D initiatives to develop greater innovative products in line with client specifications and reduce industrialized as well as operating costs. Smart gas meters are not widely established across the end-user industries at present but are expected to observe rapid growth in the future.

Gas Meter Market: Segmentation

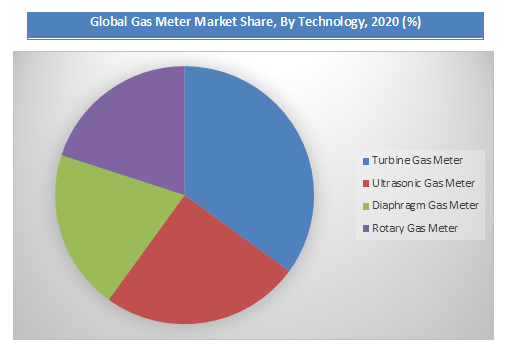

Type Segment Analysis Preview

On the basis of type, the global gas market is segmented into turbine gas meters, ultrasonic gas meters, diaphragm gas meters, and rotary gas meters. The diaphragm gas meter market segment held the largest market share due to huge demand across the globe. The diaphragm gas segment held more than 55% of the overall market in 2020 and is expected to maintain its lead with a greater part share throughout the forecast period. Rotary and turbine gas meters also attract high demand and are expected to continue growing during the next few years.

Technology Segment Analysis Preview

On the basis of Technology, the gas meter market is segmented into smart & automated, and conventional. The conventional segment is estimated to account for the largest gas meter market share among all the technology. Industrial development has resulted in the introduction of smart gas meters. Smart gas meters are ahead of wide acceptance across various end-user industries in the recent past and are expected to continue this development in the future.

End Users Segment Analysis Preview

On the basis of End Users, the gas meter market is segmented into residential, commercial, and industrial. The residential segment held the largest market share due to huge demand across the globe for the growth of the gas meter market. Particularly in developing regions, growth in end-use industries is expected to balance the regional markets. Resulting in higher as well as commercial demand due to rising disposable income, growing standards of living, and urbanization.

Gas Meter Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gas Meter Market |

| Market Size in 2023 | USD 3.63 Billion |

| Market Forecast in 2032 | USD 5.38 Billion |

| Growth Rate | CAGR of 4.48% |

| Number of Pages | 130 |

| Key Companies Covered | ABB, Actaris, Emerson Electric, LAO Industria, Wyatt Engineering, Zenner, IMAC Systems, Elster GE Itron Landis Gyr, Schneider Electric, DIEHL Metering, Aclara and DIEHL Metering |

| Segments Covered | By Type, By Technology, By End Users and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gas Meter Market: Regional Analysis

The Asia Pacific was the most attractive and largest market region that dominates the global industry in the gas meter market. The major consumers of energy fuels are commercial and residential users in North America. In Europe, smart monitoring equipment is fueling immediately and introducing of smart meters in the domestic market.

Gas Meter Market: Competitive Players

The major players operating in the Gas Meter market are:

- ABB

- Actaris

- Emerson Electric

- LAO Industria

- Wyatt Engineering

- Zenner

- IMAC Systems

- Elster GE Itron Landis Gyr

- Schneider Electric

- DIEHL Metering

- Aclara

- DIEHL Metering

The global Gas Meter market is segmented as follows:

By Type

- Turbine Gas Meter

- Ultrasonic Gas Meter

- Diaphragm Gas Meter

- Rotary Gas Meter

By Technology

- Smart & Automated

- Conventional

By End Users

- Residential

- Commercial

- Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A gas meter is a device used to measure the volume of gas consumed by residential, commercial, or industrial users. It helps track usage for billing purposes and ensures proper monitoring of gas flow in supply systems.

According to study, the Gas Meter Market size was worth around USD 3.63 billion in 2023 and is predicted to grow to around USD 5.38 billion by 2032.

The CAGR value of Gas Meter Market is expected to be around 4.48% during 2024-2032.

Asia Pacific has been leading the Gas Meter Market and is anticipated to continue on the dominant position in the years to come.

The Gas Meter Market is led by players like ABB, Actaris, Emerson Electric, LAO Industria, Wyatt Engineering, Zenner, IMAC Systems, Elster GE Itron Landis Gyr, Schneider Electric, DIEHL Metering, Aclara and DIEHL Metering.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed