Forklift Collision Avoidance System Market Size, Share, Trends, Growth 2034

Forklift Collision Avoidance System Market By Technology (Ultra-Wideband Technology, RFID, AI Vision Technology, Laser Technology, and Others), By Component (Proximity Sensors, Collision Detection Software, Forklift Telematics and Communication Systems, Cameras, Forklift Safety Lights, and Others), By Application (Manufacturing, Construction, Logistics, Mining, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

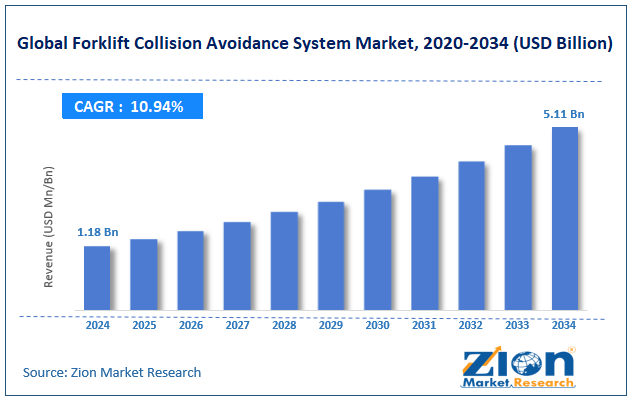

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.18 Billion | USD 5.11 Billion | 10.94% | 2024 |

Forklift Collision Avoidance System Industry Perspective:

What will be the size of the global forklift collision avoidance system market during the forecast period?

The global forklift collision avoidance system market size was approximately USD 1.18 billion in 2024 and is projected to reach USD 5.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.94% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global forklift collision avoidance system market is estimated to grow annually at a CAGR of around 10.94% over the forecast period (2025-2034)

- In terms of revenue, the global forklift collision avoidance system market was valued at around USD 1.18 billion in 2024 and is projected to reach USD 5.11 billion by 2034.

- The forklift collision avoidance system market is projected to grow significantly, driven by rising workplace safety regulations, demand for smart industrial equipment, and reduced operational downtime costs.

- Based on technology, the ultra-wideband technology segment is expected to lead the market, while the AI vision technology segment is expected to grow considerably.

- Based on the component, the proximity sensors segment is the dominating segment, while the cameras segment is projected to witness sizeable revenue over the forecast period.

- Based on the application, the manufacturing segment is expected to lead the market, followed by the logistics segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Forklift Collision Avoidance System Market: Overview

A forklift collision avoidance system is a safety technology designed to reduce accidents on industrial sites and in warehouses by detecting vehicles, people, or obstacles near a moving forklift. The system monitors the surroundings in real time. It signals the operator with audible or visual warnings when a collision threat is detected using sensors such as radar, LiDAR, cameras, or RFID. The global forklift collision avoidance system market is poised to expand rapidly, driven by growing workplace safety focus, expanding warehouse automation, and rising costs associated with forklift accidents. Organizations are prioritizing employee safety to reduce fatalities and injuries in material handling operations. Collision avoidance systems help reduce unsafe forklift interactions and human error. This fuels adoption in manufacturing facilities and warehouses.

Moreover, automation has intensified traffic between forklifts, workers, and robots. Collision avoidance systems promise safe operations in high-density, complex environments. They are becoming a standard component of smart warehouses. Forklift-associated accidents lead to expensive downtime, legal liabilities, and equipment damage. Preventive safety systems majorly reduce these operational risks. Companies view them as long-term cost-saving investments.

Despite the growth, the global market is impeded by factors such as retrofitting challenges in older forklifts and operational and environmental limitations. Installing systems on legacy forklifts may be time-consuming and complex. Compatibility issues increase implementation prices. This slows down penetration in facilities with aging machinery. Similarly, vibration, dust, poor lighting, and extreme temperatures impact sensor performance. False alerts ma reduces operator trust. These factors limit system efficiency in harsh environments.

Nonetheless, the global forklift collision-avoidance system industry stands to benefit from several key opportunities, including integration with automation and semi-autonomous vehicles and the development of cost-effective solutions. Surging use of autonomous forklifts and AMRs raises safety requirements. Collision avoidance systems allow safe human-machine interaction, thus creating strong future demand. Additionally, affordable and modular systems can expand adoption among small businesses. advanced in low-cost sensors support this trend. Price accessibility is a key growth opportunity.

Forklift Collision Avoidance System Market: Dynamics

Growth Drivers

How is the forklift collision avoidance system market augmented by the explosion of warehouse automation and e-commerce fulfillment growth?

The rapid growth of e-commerce has significantly expanded warehouse operations, increasing the complexity of material movement and the number of forklifts. Facilities now have human operators, automated systems, and autonomous vehicles operating in the same space, increasing the risk of collisions and operational bottlenecks. Collision-avoidance technologies are increasingly essential for protecting equipment and workers without compromising throughput. Also, several businesses are now integrating these systems during facility design rather than adding them as retrofits. This expansion ultimately fuels the global forklift collision avoidance system market.

How do rising operational costs and accident-related expenses affect the forklift collision avoidance system market?

A forklift collision may result in significant financial losses from equipment damage, downtime, and injury claims. Businesses recognize that preventing collisions with collision-avoidance systems is more cost-effective than incurring the costs of collisions. Reduced incidents translate into lower insurance premiums and greater operational stability. Companies increasingly view safety technology as a financial risk mitigator. Economic incentives are the key driver of adoption decisions.

Restraints

Safety culture gaps and limited awareness unfavorably impact the market progress

In some industries and markets, awareness of the full capabilities and benefits of collision avoidance systems is low. Organizations with entrenched safety practices may be reluctant to adopt new technology, relying instead on traditional training and supervision. Without strong leadership support or internal safety culture, these systems can be deprioritized. This gap in awareness and cultural readiness limits broader deployment, mainly among small businesses. Educating stakeholders on long-term value remains a continual challenge.

Opportunities

How does customization for vertical‑specific needs offer advantageous conditions for the forklift collision avoidance system market development?

Different industries, such as automotive manufacturing, cold storage, retail distribution, and chemicals, have unique operational hazards and safety needs. Developing customizable collision avoidance solutions tailored to specific vertical challenges creates a competitive advantage. Characteristics such as temperature-resilient sensors, specialized detection zones, or hazardous-area compliance cater to niche requirements. Vertical specialization can command premium pricing and deep customer loyalty. Targeted advancement will help providers hold diverse segments of the forklift collision avoidance system industry.

Challenges

Training and change management requirements limit the market growth

Deploying mature collision-avoidance technology requires effective training and change management for supervisors and operators. Without buy-in and proper education, staff may bypass alerts, disable features, or misinterpret signals out of frustration. Ensuring that users understand the system's capabilities and limitations is important for maximizing the system's safety impact. Ongoing support and training programs contribute to implementation costs and resource needs. Overcoming human resistance and fostering positive adoption habits remain key challenges.

Forklift Collision Avoidance System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Forklift Collision Avoidance System Market |

| Market Size in 2024 | USD 1.18 Billion |

| Market Forecast in 2034 | USD 5.11 Billion |

| Growth Rate | CAGR of 10.94% |

| Number of Pages | 214 |

| Key Companies Covered | ELOKON, Litum Technologies, Trio Mobil, Siera, Safe Drive Systems, Olea Systems, ARIN Technologies, Continental AG, Omron Corporation, Clark Material Handling Company, Jungheinrich, AisleMaster, Linde Material Handling, Mitsubishi Logisnext, Honeywell International, and others. |

| Segments Covered | By Technology, By Component, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Forklift Collision Avoidance System Market: Segmentation

The global forklift collision avoidance system market is segmented based on technology, component, application, and region.

Why is the Ultra-Wideband Technology segment projected to dominate the forklift collision avoidance system market?

Based on technology, the global forklift collision avoidance system industry is divided into ultra-wideband, RFID, AI vision, laser, and other technologies. Ultra-wideband technology is the leading segment, accounting for 40% of the total market. This is backed by its reliable obstacle detection and high-precision real-time positioning. UWB performs well in busy, complex industrial environments and enhances safety by accurately identifying equipment and people. Its strong scalability and performance make it the most broadly adopted technology.

Conversely, AI vision technology ranks second, with a 36% market share, as facilities deploy camera-based systems with advanced image processing to detect hazards and pedestrians. It complements tag-based systems by providing rich visual context and analytics to support better safety decisions. Growth in machine vision adoption ranks it just after UWB in industry share.

What factors help the Proximity Sensors segment lead the forklift collision avoidance system market?

Based on component, the global forklift collision avoidance system market is segmented into proximity sensors, collision detection software, forklift telematics and communication systems, cameras, forklift safety lights, and others. The proximity sensors segment accounts for over 50% of the market, as they provide vital real-time detection of personnel and obstacles. These sensors form the core of most collision avoidance systems due to their cost-efficiency and reliability. Their broader use in industrial settings fuels their deployment.

However, the camera segment dominates with 30% market share, as visual detection becomes increasingly crucial for advanced hazard recognition and AI-based analysis. Cameras improve system capabilities by visually confirming objects and enabling smart image processing. Their adoption grows as facilities upgrade to more mature safety solutions.

What are the key reasons for the leadership of the Manufacturing segment in the forklift collision avoidance system market?

Based on application, the global market is segmented into manufacturing, construction, logistics, mining, and others. The manufacturing segment leads the market, accounting for 40% of the market share. This market share is attributed to the industrial plants and factories that use forklifts, where safety is essential. These systems reduce workplace accidents and maintain smooth production. Manufacturing’s high forklift use and regulatory safety focus drive its dominant position.

Nonetheless, the logistics segment registers second-leading position with 35% market share. This is backed by e-commerce growth and elevated distribution center activity. High volumes of material movement and dense forklift operations drive demand for advanced collision avoidance solutions. Safety systems in logistics enhance personnel protection and operational reliability.

Forklift Collision Avoidance System Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Forklift Collision Avoidance System Market?

Asia-Pacific is expected to retain its leading role, with a 15.6% CAGR in the global forklift collision avoidance system market, driven by rapid industrialization and manufacturing growth, the expansion of logistics and e-commerce infrastructure, and government initiatives and a focus on safety. APAC’s rising manufacturing base makes it a leading hub for safety systems and forklifts. In 2024, Asia accounted for nearly 39% of the global market, driven by adoption in India, China, Southeast Asia, and Japan. This scale drives demand for collision avoidance solutions.

Moreover, the e-commerce boom and the growth of new warehouses are increasing forklift traffic and driving the adoption of safety systems. APSC is anticipated to grow at approximately a 15% CAGR, reflecting increasing warehouse development and automation investments. Furthermore, governments in the region are promoting workplace safety and industrial automation, thereby stimulating the adoption of collision-avoidance systems. Safety-focused policies and smart manufacturing further accelerate industry growth and adoption.

What factors make North America rank second in the global Forklift Collision Avoidance System Market?

North America ranks as the second-largest region, with a 6.5% CAGR in the global forklift collision avoidance system industry, driven by developed markets with a significant share, strict safety regulations and compliance, and high levels of automation and technology integration. North America accounts for nearly 29% of the global market, ranking second after APAC. Strong adoption in warehouses, distribution centers, and manufacturing plants fuels this share. Well-developed industrial operations in Canada, the U.S., and Mexico also back this.

Moreover, stringent occupational health and safety norms push companies to adopt advanced collision-avoidance systems. Regulatory focus motivates proactive investment in forklift safety, thereby strengthening sustained adoption across sectors. Additionally, digital supply chain and high automation adoption increase demand for AI- and IoT-enabled safety solutions. Advanced technology ecosystems support continuous advancements, sustaining North America’s strong market rank after APAC.

Forklift Collision Avoidance System Market: Competitive Analysis

The leading players in the global forklift collision avoidance system market are:

- ELOKON

- Litum Technologies

- Trio Mobil

- Siera

- Safe Drive Systems

- Olea Systems

- ARIN Technologies

- Continental AG

- Omron Corporation

- Clark Material Handling Company

- Jungheinrich

- AisleMaster

- Linde Material Handling

- Mitsubishi Logisnext

- Honeywell International

What are the key trends in the global Forklift Collision Avoidance System Market?

Multi‑sensor and hybrid systems:

Manufacturers are integrating UWB, LiDAR, cameras, and radar into a hybrid solution to enable more accurate decision-making. These systems offer 360° awareness in complex environments. The multi-sensor approach raises reliability and reduces collision risks.

OEM and technology partnerships:

Collaboration between forklift manufacturers and technology providers integrates advanced safety features into vehicles. Associations facilitate the development of sensor fusion, AI, and automation solutions. This trend augments innovation and widens market reach worldwide.

The global forklift collision avoidance system market is segmented as follows:

By Technology

- Ultra Wideband Technology

- RFID

- AI Vision Technology

- Laser Technology

- Others

By Component

- Proximity Sensors

- Collision Detection Software

- Forklift Telematics and Communication Systems

- Cameras

- Forklift Safety Lights

- Others

By Application

- Manufacturing

- Construction

- Logistics

- Mining

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed