Foot And Ankle Devices Market Size, Share, Growth Report 2032

Foot And Ankle Devices Market By Product (Orthopedic Implants, Prostheses, and Bracing And Supporting Devices), By Cause Of Injury (Diabetes, Neurological Disorders, Trauma, And Others), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

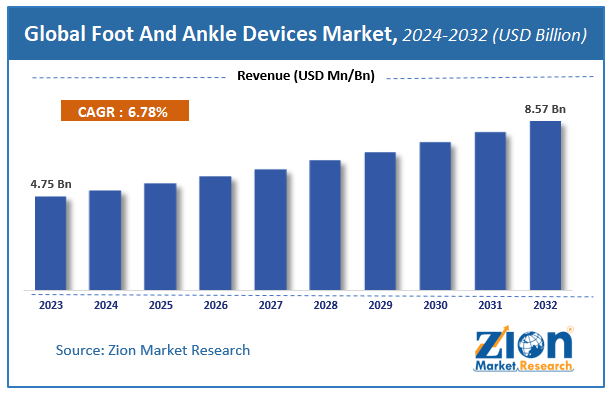

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.75 Billion | USD 8.57 Billion | 6.78% | 2023 |

Foot And Ankle Devices Market Insights

According to a report from Zion Market Research, the global Foot And Ankle Devices Market was valued at USD 4.75 Billion in 2023 and is projected to hit USD 8.57 Billion by 2032, with a compound annual growth rate (CAGR) of 6.78% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Foot And Ankle Devices Market industry over the next decade.

Foot And Ankle Devices Market: Overview

Foot and ankle devices are used to treat injuries and problems in the foot and ankle region, either surgically or non-surgically. Diabetic foot, arthritis, bunions, hammertoes, and other orthopaedic diseases can cause injuries which can be cured by using foot and ankle devices. These devices can also be utilised to replace a foot that has been lost due to a congenital abnormality, trauma, amputation, or any other type of injury. Accidents can also cause injuries or wounds near the foot and ankle region.

Increasing road accidents and growing number of diabetic patients is expected to drive the global market further. Increased knowledge of such machines, improved healthcare infrastructure, and an increase in the frequency of sports-related injuries are all contributing to the growth of the foot and ankle device market.

Foot And Ankle Devices Market: Growth Factors

Rising sports involvement, the frequency of road accidents, and more healthcare awareness are all driving the worldwide Foot and Ankle Devices market forward. The rising prevalence of diabetes, along with the need for important operations that result in the removal of foot-ankle with significant sores, is expected to drive demand for these devices, boosting the foot and ankle device market. Increased knowledge of such machines, improved healthcare infrastructure, and an increase in the frequency of sports-related injuries are all contributing to the growth of the foot and ankle device market.

In the coming years, the worldwide Foot and Ankle Devices market is expected to rise due to the strong expansion of healthcare infrastructure and increased government funding. The market's growth is expected to be hampered by high product costs and a lack of customer understanding.

Foot And Ankle Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Foot And Ankle Devices Market |

| Market Size in 2023 | USD 4.75 Billion |

| Market Forecast in 2032 | USD 8.57 Billion |

| Growth Rate | CAGR of 6.78% |

| Number of Pages | 120 |

| Key Companies Covered | Stryker Corporation, Smith & Nephew PLC., Arthrex, Inc., Zimmer Biomet Holdings, Inc., Integra Lifesciences Holdings Corporation, Wright Medical Technology, Inc., Ossur, Tornier N.V., OrthoHelix and BioPro amongst others |

| Segments Covered | By Product, By Cause of Injury, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Foot And Ankle Devices Market: Segment Analysis

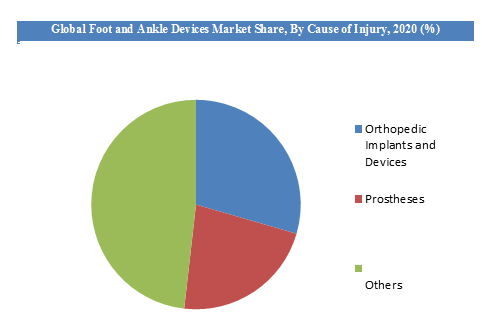

The foot and ankle devices market can be segmented on the basis of product, cause of injury, and region.

By Product Segment Analysis

Based on product, the foot and ankle devices market is divided into prostheses, orthopedic implants, and bracing & supporting gadgets. Fixation devices, joint implants, and soft-tissue orthopedic machines are the three types of orthopedic implants. Orthopedic implants are predicted to dominate this section of the foot and ankle devices market in the coming years, as well as develop at the fastest rate.

By Cause of Injury Segment Analysis

Based on the cause of injury the foot and ankle devices market is segmented into trauma, neurological disorders, diabetes and others. The largest market share of this segment is expected to be captured by the other types of injuries which include; osteoporosis, rheumatoid arthritis, and osteoarthritis owing to the increasing prevalence of these kinds of injuries. Trauma is expected to grow at a high CAGR during the forecast period.

Foot And Ankle Devices Market: Regional Analysis

North America is expected to account for the largest share of this market in the coming five years. Growth in this region for this market is attributed to a large number of sports injuries. For example, As per The American Journal Of Orthopedics, foot and ankle injuries are common in American football, with injury rates significantly increasing over the past decade. Epidemiologic studies of collegiate football players have shown an annual incidence of foot and ankle injuries ranging from 9% to 39% with as many as 72% of all collegiate players presenting to the National Football League (NFL) Combined with a history of a foot or ankle injury and 13% undergoing surgical treatment. In addition, high per capita healthcare expenditure and well-developed healthcare infrastructure are also expected to fuel the market growth for foot and ankle devices within the forecast period. Europe is expected to be followed by North America and is expected to gain the second-largest share in this market within the forecast period.

Asia Pacific is expected to witness the fastest growth in this market in the next five years. Growth in this region is expected to accelerate by increasing healthcare spending and increasing the aging population. In addition, the increasing number of podiatrists in this region is also expected to make this region a lucrative market for foot and ankle devices in the coming five years. Latin America and the Middle East & South Africa are also expected to show positive growth in the coming five years.

Request Free SampleFoot And Ankle Devices Market: Competitive Landscape

Request Free SampleFoot And Ankle Devices Market: Competitive Landscape

Some of the major players in the global foot and ankle devices market include:

- Stryker Corporation

- Smith & Nephew PLC.

- Arthrex, Inc.

- Zimmer Biomet Holdings, Inc.

- Integra Lifesciences Holdings Corporation

- Wright Medical Technology, Inc.

- Ossur

- Tornier N.V.

- OrthoHelix

- BioPro amongst others

The global Foot and Ankle Devices Market is segmented as follows:

By Product

- Orthopedic Implants and Devices

- Joint Implants

- Fixation Devices

- Soft-Tissue Orthopedic Devices

- Prostheses

- Bracing and Supporting Devices

By Cause of Injury

- Trauma

- Neurological Disorders

- Diabetes

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Foot and Ankle Devices Market was valued at USD 4.75 Billion in 2023.

Foot And Ankle Devices Market size worth at USD 4.75 Billion in 2023 and projected to USD 8.57 Billion by 2032, with a CAGR of around 6.78% between 2024-2032.

The global Foot and Ankle Devices Market is expected to reach USD 8.57 Billion by 2032, with a CAGR of around 6.78% between 2024-2032.

Rising sports involvement, the frequency of road accidents, and more healthcare awareness are all driving the worldwide Foot and Ankle Devicess market forward. The expansion of the Foot and Ankle Devicess market is being fueled by technical advancements in fixation products as well as increased government funding and grants in the sector.

In 2020, North America accounted towards a major share of Foot and Ankle Devices market and will continue to dominate the market over the next few years. However, Foot and Ankle Devices will see a significant growth in Asia Pacific region because of increasing in population.

Some of the major players of global Foot and Ankle Devices market includesStryker Corporation, Smith & Nephew PLC., Arthrex, Inc., Zimmer Biomet Holdings, Inc., Integra Lifesciences Holdings Corporation, Wright Medical Technology, Inc., Ossur, Tornier N.V., OrthoHelix and BioPro among others

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed